[ad_1]

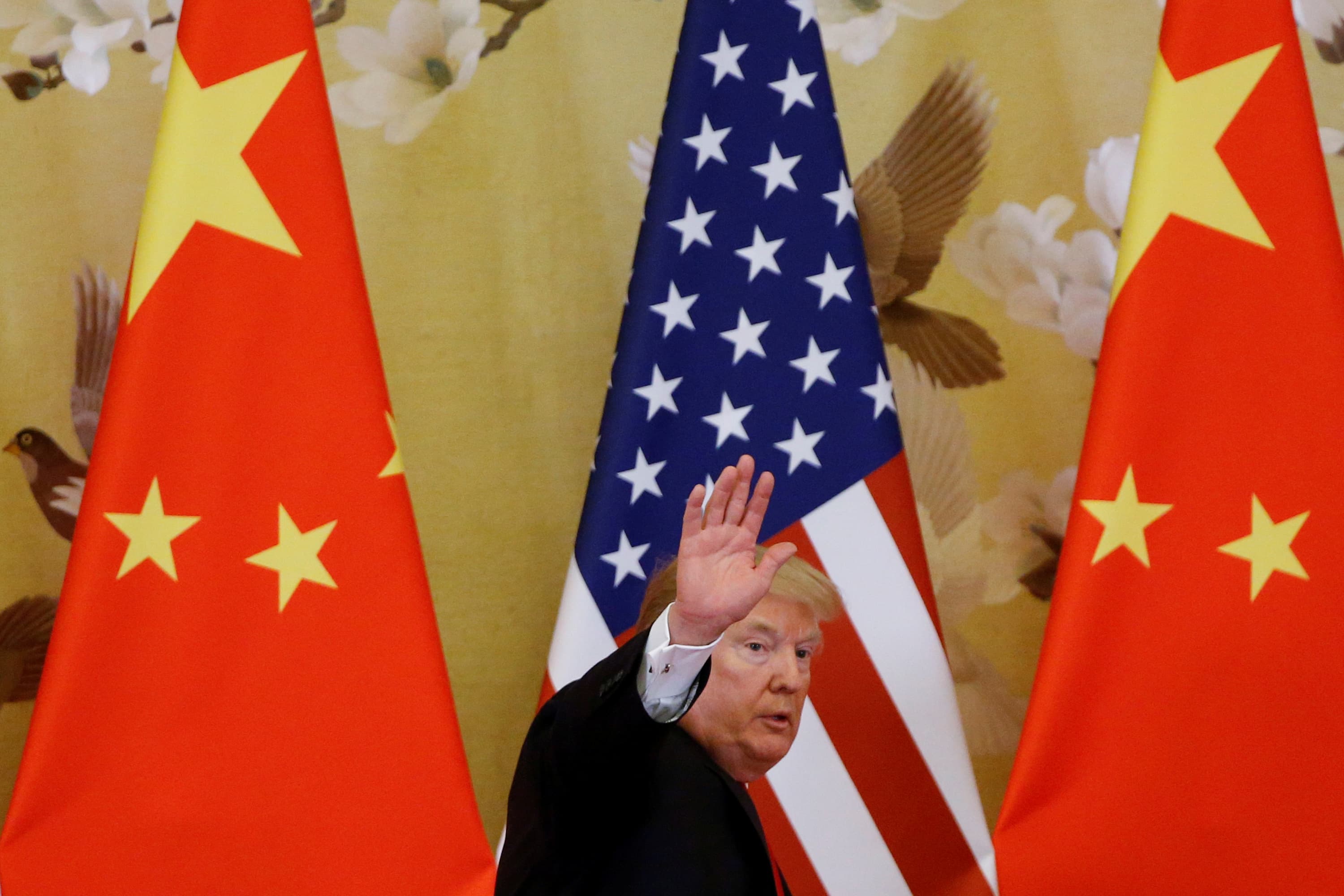

On November 9, 2017, President Donald Trump salutes Chinese President Xi Jinping's joint statements at the Great Hall of the People in Beijing, China.

Thomas Peter | Reuters

Goldman Sachs said that the cost of customs duties imposed by President Donald Trump last year on Chinese goods had "dropped" entirely for US businesses and households, with a larger than expected impact on prices in the US. the consumption.

The bank said in a note that consumer prices were higher in part because Chinese exporters had not lowered their prices to compete better in the US market.

Trump repeatedly repeated – and inaccurately – that China would pay for US tariffs.

"One could have expected that Chinese exporters of goods affected by tariffs would be forced to lower their prices slightly to compete in the US market, by sharing the cost of tariffs," he said. Mr. Goldman.

"However, the extremely detailed item-level analysis in the two new studies shows no drop in prices (excluding customs duties) of goods imported from China and facing tariffs . "

In addition, US producers have increased prices "opportunistically" because of the protection of Chinese competitors, said the bank.

Goldman also said that the risk of a last round of tariffs on remaining imports of about $ 300 billion from China has now risen to 30%.

The further escalation of the trade war could also have a negative impact of 0.4% on GDP. If trade tensions provoked a massive sell-off in the stock market, the impact on growth could worsen, Goldman said.

"Our basic objective is for the United States and China to reach an agreement later this year, which we believe would result in a gradual and phased reduction of tariffs on a" last in, first out "basis. bank.

"There is however a risk of further escalation," said Goldman.

Investors are questioning whether trade relations between the United States and China will worsen.

The most recent trade negotiations, which ended Friday without any final agreement, were eclipsed by President Donald Trump's decision to impose more than twice as much tariffs on Chinese goods from one country. worth $ 200 billion, from 10% to 25%.

White House economic adviser Larry Kudlow said on Sunday that Trump and Chinese President Xi Jinping would likely meet at the G20 summit in Japan in June. He said he hoped China would retaliate against the United States and agreed that the United States would pay for China's tariffs.

Some traders hope that there is still time to conclude an agreement, citing the idea that the new tariffs do not apply to Chinese exports that were already in transit before the deadline, which leaves more time before duties are applied to goods entering the United States.

[ad_2]

Source link