[ad_1]

Discussion points on crude oil price forecasts:

- the A Thing: Crude oil continues to maintain its bull market status in 2019 with a return of approximately 26% as OPEC discipline remains in effect and US oil imports are at their lowest level in 23 years despite record production.

- US President Donald Trump tweeted thatOil prices are getting too high. OPEC, relax and calm down. World can not take a price hike – fragile! ThThe price of oil dropped to a maximum in four weeks before bouncing back quickly, showing the underlying strength.

- Are you in the rough? This A podcast with Tracy Shuchart is a course not to be missed from Master's degree in Petroleum Trade

- While the persistent upward trend to reach the new three-month highs has slowed down, the burden of proof is still on the downside, as the bullish WTI crude pull has shifted the option premium towards higher protection.

- One point of polarity may have been revealed after Trump's tweet, which had the effect of lowering prices until they were able to resist before the bulls rushed.

You're in luck, DailyFX crude oil forecast for the first quarter of 2019 has just been released

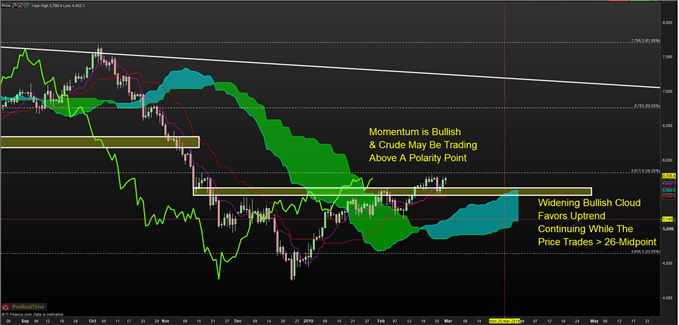

Technical forecasts for USOIL: Bullish

Graphic source: ProRealTime mapping, IG UK Price Feed. Ccreated by Tyler Yell, CMT

Trump's tweet was not enough for the Brude bears to take over, as an unexpected drop in US stocks led traders to keep the price above a new polarity point near the top of the cloud. Ichimoku, at about $ 55.60 / bbl.

The burden of proof on the bears and the US dollar do not see the aggressive gains we saw in the fourth quarter, the environment seems conducive to new oil gains. As recently indicated, traders would probably do better to see the current upward trend compared to the December surrender. Crude traded at a standard deviation of almost 3 deviations from the 12-month average, with the 12-month average at $ 63.45 / bbl, with some of the December low data points having caused concern being on the rise, and production cuts in Saudi Arabia reinforcing its support under the price as evidenced by the gap of the future.

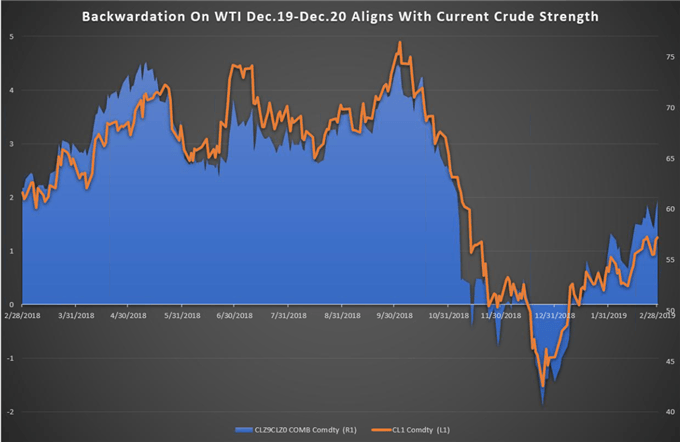

Crude Futures brings buyers backward

Source: Bloomberg

The backwardation is an evolution of the futures curve where quasi-dated contracts of a homogeneous market (such as crude) exchange a premium over later contracts. Apparently, the premium is generated for a multitude of reasons (typically a perceived demand shortage), but for whatever reason, traders who buy back profits earn money by postponing the contract at a later date if the backwardation subsists, which encourages market buyers, and tends to act as a support floor for the price.

The blue box graph above shows the relative premium or discount observed at the end of December for the December 2019 crude oil contract compared to the December 2020 crude oil contract. As you can see, when a premium appears on the Crude 2019 contract, the first month's contract (currently March 2019) also tends to behave well.

What is the risk for my bullish thesis?

When traders look at the crude oil price chart, they will probably start to associate two levels of support that should remain if they remain optimistic.

First, the lowest level of February, at 51.53 USD / barrel, which was the peak of the Ichimoku cloud at the time compared to the price, and 55.14 USD / bar which corresponded to the lowest of last week and at the top of the current Ichimoku cloud of 26 periods. The former seems to be the linchpin of an impulsive rise, while the latter appears as a new polarity point in the oil market, as it acted as a resistance earlier this month and could now be considered a support.

Whatever the case may be, traders would have a hard time selling rough while maintaining above a polarity point, the midpoint of the 9 and 26 periods as well as the delay of the day. widening of the gap from December 2019 to December 2020.

We will see.

Follow DailyFX podcasts on a platform that's right for you

iTunes: https://itunes.apple.com/fr/podcast/trading-global-markets-decoded/id1440995971

Stitcher: https://www.stitcher.com/podcast/trading-global-markets-decoded-with-dailyfx

Soundcloud: https://soundcloud.com/user-943631370

Google Play: https://play.google.com/music/listen?u=0#/ps/Iuoq7v7xqjefyqthmypwp3x5aoi

— Written by Tyler Yell, CMT

Tyler Yell is a Certified Market Technician. Tyler provides technical analysis based on fundamental factors in key markets as well as educational resources. Learn more about Tyler's technical reports via its bio page.

Contact Tyler and shout out your sentence below by posting it in the comments box. Do not hesitate to also include your vision of the market.

Speak on twitter markets @ForexYell

Other weekly technical forecast:

Forecast in Australian dollars – GBPAUD observes the levels of the referendum on Brexit. AUDUSD, AUDJPY May Breakout

[ad_2]

Source link