[ad_1]

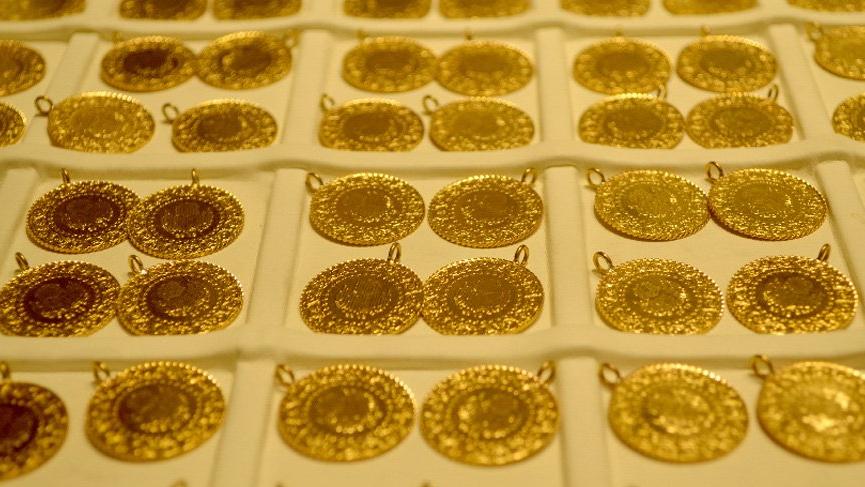

The latest gold price of July 24 was the result of the Central Bank's decision on interest rates! What is the price of a quarter of gold and a gram of gold today? The price of the morning began to trade at about 6 pounds. Especially prices below the weekly price which is the object of the small investor, buyers have found the price very high. We are up to date on the latest gold prices dated July 24th. Gram is sold at 193.11 lire when gold is taken on 193.08 lire. Here are the current prices of gold in the Grand Bazaar …

The enthusiasm of the investor who is curious about gold prices is at the top! Merkaz Bank's decision on interest rates began to increase in conclusion. What is the price of quartz and grams of gold? On July 24, gold prices began to rise faster than the days we spent. What is the price of gold at this time? How much are the grams of gold?

BIG GOLD AND QUARRY WHEN WHEN?

193.08 is taken from the read, 193.11 is sold to read it

How much was the price of gold quarter?

A quarter of gold is sold at 308.79 lire while it is sold at 316.35 lire.

WHAT GREEN HAS BEEN?

Half of the gold is sold from 615.65 to 632.71 lire

MUCH?

Republic of gold finds buyers of 1260.00 pounds from 1247.00 pounds.

tRIMESTRE gOLD MANY gram?

expressed in a quarter of gold in Turkey gold content of 1.75 grams of equivalent and it is 22 months. There is 1.6065 grams of 24 carat gold under the quarter which is a quarter of the Republic's gold, the price is calculated on it, and then it is sold with the workman and the share of profits. This part may vary depending on the year of purchase.

HOW A GOLD EVALUATION

Gold prices rise in case of demand or purchase, while gold prices fall in the opposite case. This is the simplest situation that affects the price of gold The main reasons for the rise in gold prices are as follows:

Global and local inflation

Inflation; is defined as the measure of the increase in the general level of prices. If inflation is high, your purchasing power goes down. In the global inflation, the purchasing power of the currency also decreases. In this case, gold prices have always been on the rise. As the value of money buying decreases, gold prices rise and you can not buy gold in the same amount as your money. For this reason, global and local inflation is the biggest enemy of gold prices.

Global Liquidity

This is a term we constantly hear in liquidity market programs. liquidity; is a stock market term meaning cash flow. The increase in liquidity is directly affecting gold prices and gold prices are skyrocketing. The increase in the cost of gold while the amount of gold is fixed and the increase of money on the market will result in the increase of the prices of the gold. 39; gold.

Situation of gold stocks

Gold stocks are present in some quantities worldwide. In the absence of new gold resources, existing inventories are declining and gold prices are rising dramatically during this period. This usually happens without going into the summer months known as the wedding season. Gold prices have increased tremendously over this period, with gold purchases at the highest level worldwide.

Global Risks

Gold is preferred as an investment tool because it is a product that protects its value at all times and does not harm it. However, these are global risks that affect gold prices and drive up gold prices. Gold is the easiest currency to convert into money and trade around the world, so every person buys gold for investment purposes. Especially with increasing global risks, the possibility of wars, people do not trust the prices of foreign currencies and buy gold by turning their money into gold. Gold purchases also cause the market to contract and cause excessive price hikes in gold.

Real interest rates

Real interest rates; is known as the cost of holding money in the hands. For this reason, the gold you hold in your hands also has a holding cost: when the real world interest rates increase, the real local interest rates also increase. In this case, people and investors want to reduce the cost of holding cash by turning their money into gold. Cash transfers towards the bottom of the market lead to a decrease in gold and an increase in direct prices

[ad_2]

Source link