[ad_1]

We explain the plan to save the housing sector

Save the housing sector in which the party's economic administration has been working for some time; In doing so, we have reached the operational plan to support the banks. The purpose of the transaction is to provide liquidity through the Treasury market and Treasury bond market through a series of complex transactions involving different types of securities. The long plane and the finely knit plane are composed of highly technical steps. The Banking Regulatory and Supervisory Agency (BRSA) directs financial market and capital players as well as public institutions involved in the economy.

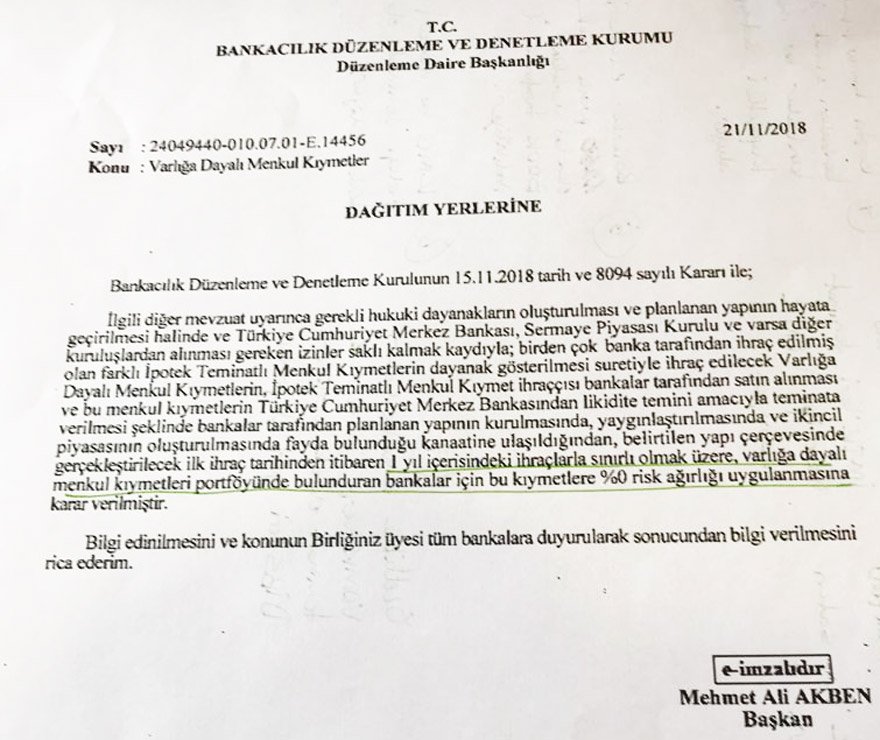

THE PRESIDENT OF ARSB ANNOUNCES

The decision of the Board of Directors of the BRSA of November 15, 2018 was announced to the banking sector by the president Mehmet Ali Akben.

The crucial element of this decision, which establishes the operating system, is as follows:

The BRSA reduced the weighting of the securities applied to these assets for banks holding asset-backed securities (VDMK) to 0 (zero). Risk weighting is important in the calculation of the capital ratio of banks. The BRSA risk weight, which was reduced to zero by the BRSA, was 1.250%. This is a banker "Make risky securities risk free" as described. Indeed, when the BRSA decision is read carefully, this step is the most critical step between the interconnected steps to save the housing sector. According to the decision, the new zero risk weighting application will be limited to issues issued within one year.

The framework and stages of the decision on the ARSR are as follows:

3.2 EXPORTATION OF CIVILIZATION

– Decision banks of Turkey BRSA banks participation was announced in writing by the Union, dated November 21, here 2018.

– Two days later, the Capital Markets Board (CMB) announced a major decision with its November 23 newsletter. Development Bank of Turkey (TKB) in the body of the Asset Finance Fund has 3 billion 250 million TL export authority backed by receivables. The beginning of the operation will constitute this export authorization. With the issuance of the VDMK by MARA, it is planned to replace the mortgage securities (İTMK), which banks are currently issuing for housing loans otek live İp. In that decision, the BRSA reduced the risk ratio to zero in the calculation of the capital adequacy ratio of VDMK, which means that this document is assimilated to debt securities denominated in national currency (GDS). In the next critical phase, a role is assigned to the Central Bank. The Central Bank should accept these papers as collateral. These papers are being modified with the public securities held by the Central Bank as collateral. It is expected that the redeemed GDS will be converted into cash on the Treasury and BIST bond market. Thus, the possibility to lend again to public banks is offered.

LIQUIDITY OF WHAT

One of the main challenges of this seemingly perfect plan is "Independent" How the central bank will accept this task. On the other hand, in the secondary markets to be created to provide liquidity, it is emphasized that the entire burden of return to the Treasury will be very problematic in the future. Some bankers say this plan recalls the table leading to the 2008 mortgage crisis arising from the imprecise use of derivatives. Although the plan was announced to the sector, Sır Queuing from other sectors connected with anxiety.

[ad_2]

Source link