[ad_1]

Co-produced with Beyond Saving and PendragonY for High dividend opportunities

introduction

With the Federal Reserve's pause in interest rate hikes, and with the likelihood that rates will not be raised in the next few years, fixed income securities have been in high demand by income investors. This is particularly true for high quality preferred stocks, bonds, birth bonds and fixed income fixed income funds ("CIFs"). Fortunately, this trend was detected early because I had predicted for over a year that the Fed could not raise interest rates in 2019 and beyond. While interest rates are stagnating or falling, he is very optimistic about fixed income: bond and preferred share prices tend to rise and dividend yields tend to go down. We expect that in 2019 and 2020, fixed income securities will be one of the most performing asset classes., as we noted in a recent report entitled: How to protect your income from falling interest rates?

Until now, our points of view have been shared. We have significantly increased our portfolio allocation to fixed income, blocking high returns over the very long term.

Source

Today, we highlight two preferred stocks that bond investors should consider acquiring and holding as a long-term defensive measure in what we view as a declining or declining interest rate environment over the next few years. .

In a previous article, we explained the crucial role that fixed income plays in income protection during a recession.

"Interest rates have only one way of operating in this type of environment and they are down." When economic growth slows down, it becomes more and more difficult to rely on capital gains to generate income. "

While GDP in the first quarter of 2019 was 3.2%, we expect a slowdown in growth for the rest of the year and we expect the Federal Reserve to keep rates flat.

Source: CNBC yield 10 years

Despite the surge in late 2018, the general direction of interest rates has declined over the past year.

Our goal is to find preferred shares issued by companies that have strong and stable cash flow we expect more than just cover the dividend payments of the preferred stock even in the event of a recession. Maintaining high dividend yields will provide significant income protection and it is important to switch to fixed income. before the market rush into them and raise the price. While today, it is increasingly difficult to find preferred stocks, bonds and fixed income products at attractive prices, we are always looking for wrong opportunities. Every week, we browse the fixed income space and share the best opportunities with our investors.

Real estate in particular tends to generate significant cash flow, even during a recession. When rates are stable or decreasing, REITs achieve particularly attractive results as lower cost borrowing costs improve their leveraged returns. As we have described in a recent article:

Real Estate REITs are an ideal building block for a portfolio that will generate stable revenues during a recession, but will continue to offer positive potential in an environment of declining interest rates. "

In addition, the REIT's structure is designed for cash flow, with tax rules that require them to distribute 90% of their taxable income. This provides the preferred shareholders with an additional layer of income security.

We have been able to find quality offers with returns above 7% and are still trading at attractive valuations. It is unlikely that these returns will last and it is important that we position our portfolio before the market is leaked forward. Although preferred shares may potentially realize capital gains, our primary objective is to preserve the current high returns in order to preserve income over a long period of lower interest rates and market volatility.

The two companies we will focus on today:

- Global Net Lease (LNG)

- Reference Infrastructure Partners (LMRK)

Global Net Lease

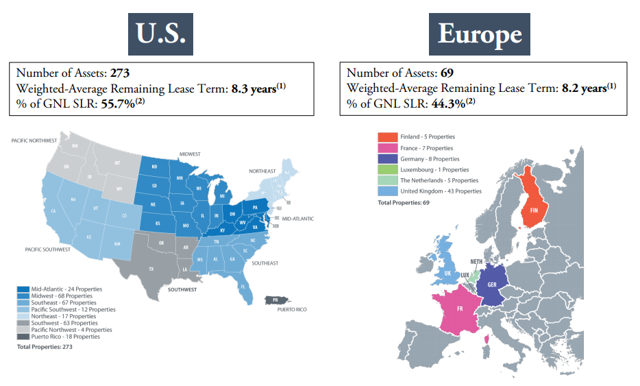

Global Net Lease is a triple net lease trust. LNG has $ 3 billion of real estate assets in 7 countries, which are 99.2% leased. LNG uses long-term lease agreements with a weighted average remaining life of more than eight years. In addition, more than 78% of its tenants are of superior or equivalent quality, and 92% of its leases have contractual rent increases. even in times of recession, the rent will continue to rise.

In terms of assets, LNG meets our expectations: stable real estate with quality tenants, organic growth and long-term leases.

Source: LNG

Many REITs that trade are primarily US-centric. LNG helps to provide some diversification with 44% of its rent coming from European countries. Geographic diversity helps limit the impact of the local economy.

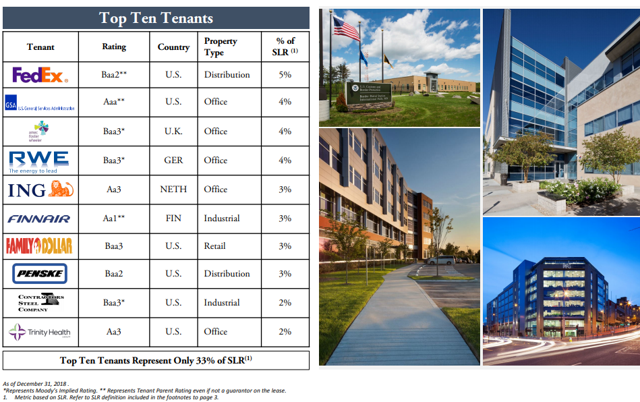

In terms of tenant quality, LNG actually beats peers like Real estate income (O) or National Retail Properties (NNN).

Source: LNG

Its list of top 10 tenants is an excellent example of the diversity of the LNG portfolio. It is diversified by country, by type of property and by sector of activity, and a rating common to all these companies is a high quality credit rating. This is exactly the type of real estate and quality tenants we want to secure.

External management

The most common criticism of LNG is that it is externally managed. External management means that the managers are not employed by the REIT, they are contracted by the REIT and generally have other business interests. LNG is managed by AR Global, which currently manages four REITs, including American Finance Trust (TO).

External-managed REITs generally have a bad reputation and are trading at a discount to their internally managed peers. One of the main causes of this bad reputation is that REIT managers are often rewarded for their assets under management, or AUM, which encourage them to expand the REIT and not worry about the stock price ordinary. This may cause them to issue common shares at prices that are not attractive and to dilute common shareholders.

That's one of the reasons why we would not consider ordinary LNG shares. We have already seen signs of dilution by ordinary shareholders, as LNG issued 4 million common shares last August at $ 20.65 per share and then 7.7 million shares in the first quarter of 2019 through its ATM at $ 19.69 on average.

While this is an excellent reason to avoid common shares and to worry about the fact that the common dividend will be reduced, these shares are positive for the preferred shares. The reason for this is that the ordinary share can not receive a dividend until the preferred share has been paid in full to the dividend to which it is entitled.

From the standpoint of preferred equity, the company has raised more than $ 160 million, which will be used to fund future acquisitions. These acquisitions will pay rent and will also increase the asset base. Common shares that pay for acquisitions have no rights to cash or assets until after privileged equity was paid.

Management's willingness to issue common shares at dilutive prices could conflict with the interests of common shareholders, but would align with the interests of the preferred share.

Favorite cover

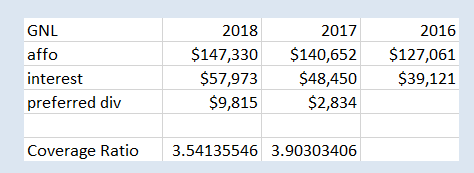

To determine the degree of security of the dividend for preferred shares, and therefore potentially a good investment, look at the AFFO ratio with dividends on interest and dividends on preferred shares, added to the ratio of sum. interest expense and the payment of the preferred dividend. The table below takes these values from the last 10-K and calculates a ratio.

Source 10-K and author's calculations

the coverage rate for 2018 was just above 3.5x. LNG had more than $ 100 million in cash by the end of 2018 and had leveraged an additional $ 80 million through its automated teller machine in the first quarter of 2019. These funds will be deployed in the first half of the year, thus increasing the FPAA.

Another important ratio for determining the security of an investment in the preferred shares is to look at the ratio of net equity to the redemption value of the outstanding preferred shares. The idea being that if the company was going to liquidate, how much money could it produce relative to what it needed to make the preferred shareholders healthy.

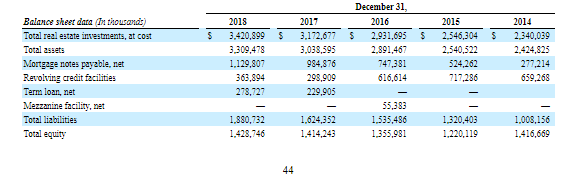

LNG 2018 10-K

Thus, as shown in the table above (from the last 10-K), LNG has assets with a net worth of approximately $ 1.4 billion. The repurchase of the approximately 5.4 million preferred shares outstanding will require approximately $ 135.4 million. The net present value of its assets is approximately 10.55 times the amount required to redeem the preferred shares.

In terms of debt, LNG mainly uses non-recourse mortgages. Mortgage loans of $ 1.1 billion are a series of loans secured by specific properties. In case of LNG default, the lenders have no recourse against the company. This helps to isolate the company and its other assets in the event of a localized decline in value. For any property whose selling price is greater than the amount of the mortgage, only the revolving credit facility and the term loan will have priority rights over the excess over the preferred shares.

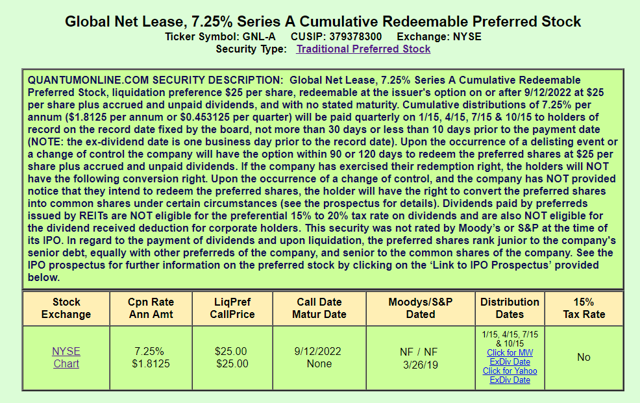

The opportunity: GNL.PA

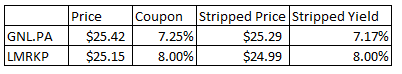

Global Net Lease 7.25%, cumulative preferred shares (GNL.PA) is currently trading at $ 25.42. The appeal date is in over three years and LNG provides significant cash flow hedging and net asset coverage greater than 10,55x. All price less than $ 25.60 will block a return higher than 7.1%.

Reference Infrastructure Partners

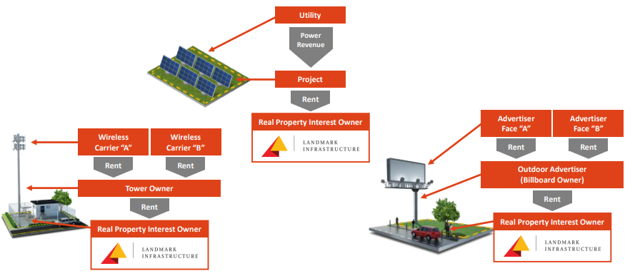

Reference infrastructure has a unique business model where he leases land to towers, outdoor advertisers and renewable energy companies.

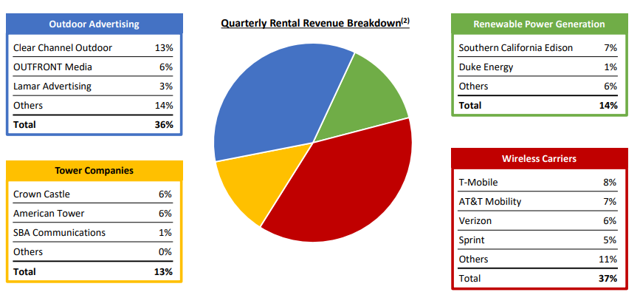

Source: Landmark

As the owner of the underlying land, but having little to do with the operations of the tower, billboard or utilities located there, LMRK maintains an incredibly high level of security. 98% operating margins maintenance free cap-ex.

Source: Landmark

LMRK's revenues are well diversified and its tenants are recognizable names in national footprints.

Whether it's solar panels, a tower or a visible advertising space, tenants have made important investments that are difficult to move and are of strategic importance for the tenant. That's why LMRK has a 99% renewal rate on his leases. Taking into account the options for extension, the average lease of LMRK has 22 years old remaining. When it is in the tenant's interest to contractually guarantee decades of rental rights, this creates a lot of predictability and stability for the homeowner.

Virtually no cap-ex, decades of leases, and high quality tenants with a national footprint all contribute to a business model that will provide significant stability in all economic conditions.

Although Landmark plans to become a REIT in the next two to three years, it has not done so. As an MLP, it still issues a K-1, but it's a very simple form for the favorite problems.

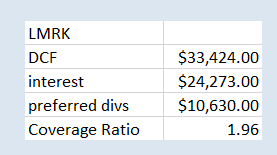

Favorite cover

Benchmarks reports a non-GAAP measure called DCF (Distributable Cash Flow) that deducts a large portion of the items removed from the cash flow from operations. It can be used to display a coverage rate of Landmark's favorite shows. As a result, the DCF plus interest expense and payment to preferred units divided by the sum of such interest expense and the payment of preferred units 1,96x. Landmark generates nearly twice as much cash as it needs to make payments to its bondholders and preferred shareholders.

The coverage is not as wide as for LNG; However, given LMRK's inherent revenue stability and much lower capitalization requirements, the cover creates a comfortable cushion.

Source: LMRK 10-K

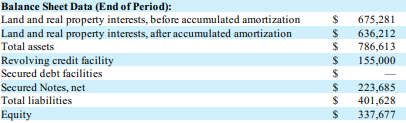

With respect to net asset coverage, LMRK has $ 155 million outstanding on its revolving line of credit and $ 223.685 million of notes secured as a single debt. With 143.5 million dollars of outstanding preferred shares, the net asset coverage is over 2,35x.

Since real estate is mainly composed of land and not buildings, the volatility of the value of property is less. LMRK does not benefit from high LNG coverage rates, but this is outweighed by the lower risk and inherent stability of the LMRK business model.

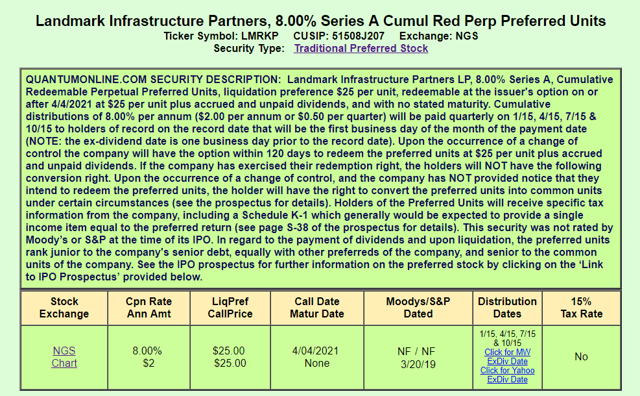

The opportunity: LMRKP

Landmark Infrastructure Partners, Cumulative Perpetual Preferred Units, Series A of 8.00% (LMRKP) is trading for $ 25.15. A return above 7.75% can be blocked at any time. price under $ 25.80.

Landmark also has another favorite stock we like, namely Landmark Infrastructure Partners, preferred shares of Cumul Red Perp Series B at 7.90% (LMRKO) and gives pretty much the same thing as LMRKP. Investors can choose one or the other, depending on the highest yields at the time of purchase.

Conclusion

We like to invest in the preferred shares of companies that are owners. These companies, especially when organized into REITs, have very predictable cash flows, which allows for very secure dividends on preferred shares. Global Net Lease and Landmark Infrastructure Partners are both lessors, although Landmark has not yet been converted into an REIT (it plans to do so in the near future).

Preferred shares are backed by stable cash flow, which should be reasonably sustainable under difficult economic conditions. Both companies have a strong base of underlying assets, high quality tenants and long-term leases. This is exactly the kind of stability we are looking for with preferred equity investments.

Comparing the two, GNL.PA benefits from superior cash and asset coverage; However, its yield is also significantly lower. Due to the stability of its business model and assets, we believe that LMRKP is an excellent opportunity. Its cash flow and asset coverage are sufficient to provide strong security for preferred investors.

Both investments have their place in a well diversified preferred portfolio and will provide a stable income during a downturn. GNL.PA is a buy less than $ 25.50 and LMRKP is a buy less than $ 25.80.

Thank you for reading! If you liked this article, please scroll down and click Follow next to my name to receive future updates.

Note: Members of high dividend opportunities get a first look at all preferred stock options.

High Dividend Opportunities, the # 1 service for investors and retirees

We are the largest community of income and retiree investors with over 2400 members. We recently launched our Portfolio of stocks and preferred bonds for safe high yields before a weaker economy and market volatility.

Join us to get instant access to our model wallet target a return of 9 to 10%, our preferred share portfolioand income tracking tools. You also have access to our report entitled "Our favorite choices for 2019"

START YOUR FREE TRIAL HERE

Disclosure: I am / we have long been GNL.PA, LMRKO, LMRKN. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link