[ad_1]

L-shaped recovery for air ducts. Milestones of their future on a vaccine.

By Wolf Richter for WOLF STREET.

American Airlines on Friday, and Delta Air Lines on Thursday, warned of a further slowdown in bookings. The highly profitable business air travel segment remains predominantly zombie, but leisure travel has picked up a bit in recent months, and over Thanksgiving it has grown by a microscopic amount again. But the total number of trips unfortunately remains down compared to last year, even on the best day, and is now heading down again.

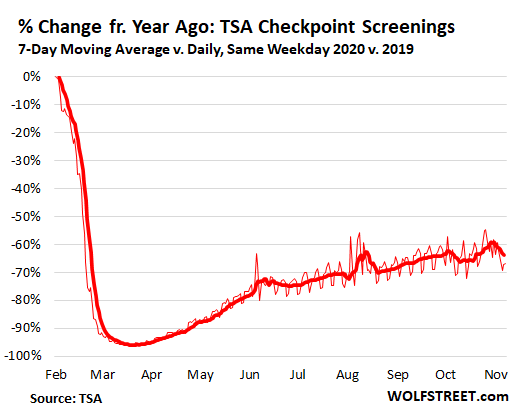

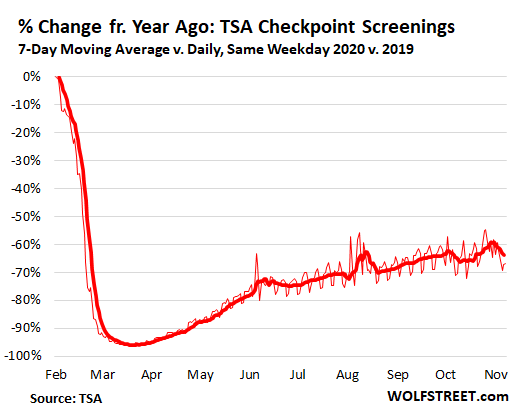

The number of passengers passing through TSA checkpoints to enter secure areas of U.S. airports during the week after Thanksgiving through Saturday, December 5, compared to the same weekday the same week last year , showed deterioration: between -64.2% and – 69.2%. And what airlines have warned about is a drop in bookings from those already low levels.

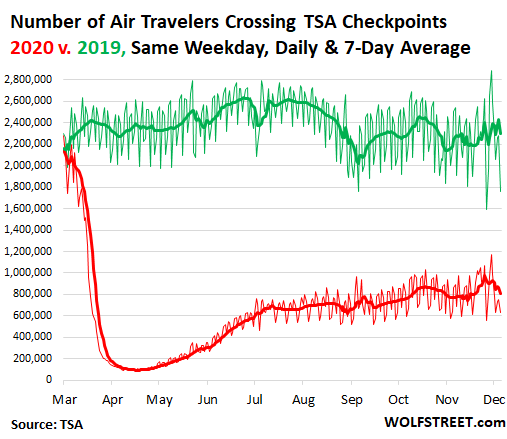

The graph shows the total number of TSA checkpoint projections in 2020 (red) and 2019 (green) for each day and the seven-day moving average (lines in bold). The four peaks of over one million daily screenings during the Thanksgiving travel period (Friday, November 20; Sunday, November 22; Wednesday, November 25; and Sunday, November 29) were a pale imitation of peaks from last year. during that time, but on the best of these days, Nov. 22, the year-over-year decline narrowed to -54.9%, which was the least worst collapse since the collapse of aviation activity started in March:

So now it’s airline confession time again.

Friday, American Airlines [AAL] issued a statement saying that “like others in the industry,” she “has seen a slowdown in demand and term bookings due to the recent acceleration of the pandemic.”

And he added that “the increase in the number of COVID-19 cases and the associated travel restrictions in the immediate period leading up to the Thanksgiving holiday led to a slowdown in the growth of net bookings, which persisted until December. . “

And in the fourth quarter, “daily cash consumption,” the industry measure born out of the pandemic, would be at the top of its previously estimated range of $ 25 to $ 30 million per day “due to the slowdown in the economy. request and referenced term reservations. above and slightly higher fuel prices. “

A “daily cash consumption” of $ 30 million translates into a cash consumption of $ 2.8 billion per quarter. American Airlines “continues to expect the recovery in demand to be volatile and difficult to predict accurately,” he said.

Thursday, Delta Air Lines [DAL] had launched the hour of confession. Amid a bunch of blah-blah-blah about employee screening and voluntary contracting for inbound international travelers, he said, “While we did enjoy increased travel volumes over the Thanksgiving holiday , in reality, they were still less than half of what we normally steal during the holidays.

“Less than half” the best day of Thanksgiving is what the industry as a whole has experienced. Checks at TSA checkpoints during the Thanksgiving travel period ranged from -54.9% on the least bad day compared to the same day a year earlier, to -64.7% on the worst day. Controls at checkpoints have weakened further since then. And the seven-day moving average, at -65.0%, is back to where it was on September 4 – three months ago:

Delta said that “like others in the industry, we have seen a slowdown in demand and forward bookings as COVID cases increase across the United States.”

And he expects his fourth-quarter earnings to slump by about 70% from last year. And he expects “daily cash consumption” to be about $ 2 million per day higher than its previous estimate, now between $ 12 million and $ 14 million per day in the fourth quarter.

US airlines have reduced capacity to meet collapsing demand, shelving or withdrawing hundreds of planes. And they laid off tens of thousands of people. It started early in the pandemic and has allowed airlines to reduce their daily consumption of cash. Despite these cuts, they need a significant increase in demand to break even.

Like the entire industry, Delta is eagerly awaiting vaccines. His hope of breaking even in the spring “has been bolstered by continued positive developments with vaccines,” he said.

“Although it will take months for a vaccine to be widely distributed, this is a clear sign of light at the end of the tunnel,” Delta said. “Widespread vaccinations among our customers and employees will be critical to Delta’s sustainable recovery and the start of our rebound.”

It is therefore best not to have any hiccups with these vaccines. Everything now depends on them.

And the V-shaped recovery starts to look weirdly like an L. See the table above. While vaccines, if they become widely available, will eventually at least partially recover leisure travel, the big profitable segment of business travel spending is not returning to normal.

Businesses figured out – in fact were forced to figure out – how to hold many of these types of online meetings, and found it to be far more efficient than wasting time and money coming and going. Of course, there will be business travel, but the old glory days of business travel are over, nixed by corporate cost cuts that have now found a working alternative. And the airlines themselves have come to accept this.

Office occupancy plunged the most in Dallas. In San Francisco, where it was already at its lowest, it plunged into single-digit numbers. Lily... The state of the American office: suddenly emptying under the second wave

Do you like reading WOLF STREET and want to support it? You use ad blockers – I fully understand why – but want to support the site? You can make a donation. I really appreciate it. Click on the mug of beer and iced tea to find out how:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

![]()

[ad_2]

Source link