[ad_1]

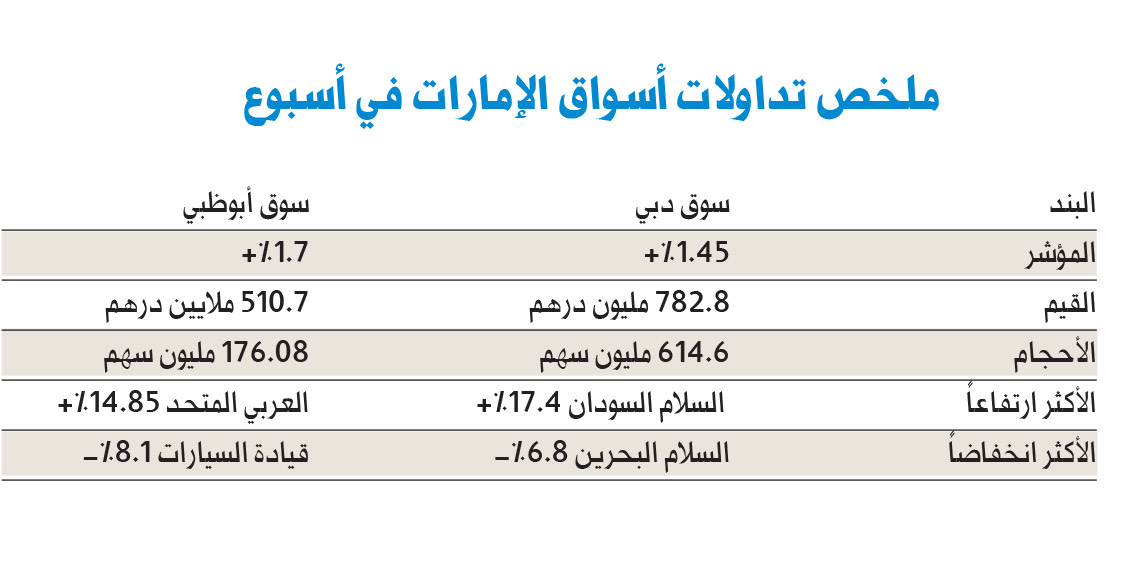

The performance of local stock markets on all Arab and Gulf stock exchanges has exceeded last week's expectations as investors are optimistic about the medium-term performance of listed companies, especially banks, after announcing earnings records exceeding expectations. The Abu Dhabi Securities Exchange (ADX) rose 1.7% to 4,770 points, boosted by gains in the banking, insurance and energy sectors, continuing its ascent for the fourth week

The Dubai Market comes in second after 1,346 points, With rising banks' share and real estate, investment and transportation continued their marathon gains for the third consecutive week.

The survey showed that the Saudi Stock Exchange rose by 1.05%, Bahrain by 0.91%, Tunisia by 0.67%, Muscat 0.2%, Kuwait by 0.16%. Local firms performed strongly last week on the strong performance of listed banks, particularly in the Dubai market after tackling the barrier, "said Ayad al-Barriqi, general manager of Al Ansari Financial Services. 10 billion dirhams in the first half.

The net profit of five banks in Dubai increased to 10% and 9.7 billion dirhams for the first half of this year, an increase of 23% compared to about 7.8 billion in the same period of last year, according to the survey "economic statement", assets reaching the threshold of 1 trillion dirhams after 947.76 billion dirhams Al-Bariryi said that the announcement of the majority of Listed companies not to be exposed to the "Abraaj" as a strong boost for investors, coupled with the return of institutional and foreign purchases on major stocks in the middle of the anticipation of announcing the rest companies for their mid-term results.

According to the follow-up "Albia The total number of unlisted companies in the financial markets of Dubai and Abu Dhabi rose to 114, while the number of companies reporting direct and indirect exposures on 12 companies s & # It amounted to AED 2.4 billion.

In the coming weeks, the half-year results marathon will continue, which we expect to stimulate investor sentiment and boost liquidity.

Abu Dhabi

The banking sector index rose by 3.36% while "Abu Dhabi I" rose by 4.78% While investors should announce the results next week

Abu Dhabi Islamic Bank gained 1.29%, after posting a net profit of AED 1.163 billion in the first half of 2018, up 3% over the same period the year last. (19659002) The energy sector gained 1.18%, followed by Dana Gas (0.96%) and Taqa (4.17%). On the other hand, real estate fell by 0.94%, Aldar by 0.96%, Ashraq by 1.59% and Telecommunications by 0.29% with the drop of Etisalat.

The capital market has approached 180 million dirhams, up 4.78% to close at 13.15 AED, the highest-rated share at 71 million euros. , down 0.29% to 17.15 AED. From 0.7% to 7.05 AED

United Arab Bank was the first winner with a 14.85% increase to AED 1.16 and Abu Dhabi Ship Building of 9.24% to AED 2.01 [19659002] Emirates Driving Company recorded the largest decline in a week of 8.1% to 6.8 AED, followed by Investment Bank of 6.67% at 2.24 AED, followed by Gulf Industries In Dubai, the sector of real estate rose by 1.97% with Emaar Properties up 2.39%, Arabtec up 2% and Drake in the United Arab Emirates (AED1.55) (1.19%), Emaar Properties ( 1.93%), Union Properties (2.23%).

The banking sector grew 1.2% with Emirates NBD gaining 2.48% 29% to AED 5 billion in the first half Loan growth and continued improvement in margins compared with the first half 2017. Operational performance was also strongly supported by an improvement in provisions of 40%

Dubai Islamic Bank, which closed at 4.94 billion dirhams at 4.96 AED, an increase of 14% compared to 2.143 billion dirhams. billion dirhams in the same period of 2017, thanks to a significant increase in the revenues of large companies.

The investment sector gained 0.84%, Dubai Investment gaining 1% Financial Services. The transportation sector grew 2.2% after Air Arabia gained 2.86% and Aramex 2.3%, while Gulf Navigation declined 1.5%.

The highest gain for the week was Al Salam Bank Sudan, 17.39% to AED 1.62, "Salam Group Holding" shares rose 10.67% to AED 0.42, followed by "Commercial Bank of the Gulf "to close 3.63% to 0.83 AED

The biggest losers" Al Salam Bank Bahrain "After falling 6.78% to AED 1.1, the Dubai Refreshments fell from 6.25% to 12 AED, followed by "Symbol Corporation", down from 5.8% to 1.3% The Saudi market continued its rise for the second week in a row: the TASI index rose by 1.05% on the week of 87.56 points to close at 8449.97 points, against 8362.41 the previous week.

Saudi shares gained 25.06 billion riyals over the week to 2.989 billion riyals, while cash fell 1.1% to 14.815 billion riyals, trade volume falling to 558.78 million, a decrease of 5.7%. 19659002] The market experienced an increase of 13 sectors over last week topped by the media sector with growth of 12.5%, then the food sector by 4.7%, followed by banks with a rise of 2.7%, while 7 sectors led by food production fell 3.7%, energy 2.5% and real estate development by 2.1%.

Kuwait

During the week, the general index fell 0.05% to 5210.85 points, while the main index of the market fell from 0.46% to 4 492.96 points, while the index of the first market during the week rose 0.16% to 5353.02 points. The weekly business figure rose 34.2% to 628.32 million shares against 955.31 million shares the previous week. Liquidity decreased 19.2% to 144.7 million dinars, against 179.14 million dinars the previous week. The Bahrain Stock Exchange (BSE) advanced 0.90%, with a gain of 12.14 points to close at the end of last week. With cash raised to 9.83 million dinars after trading 42.18 million shares through 681 trades, the Bahrain Stock Exchange continued its sixth consecutive week of gains, the highest since March. after the banking sector gained 2.79%. Thanks to the gains of "Ahli United" of 3.85% and "Al Salam Bank" of 3.57%

In contrast, the index of the service sector fell by 0 While Saif Properties fell of 2.56%, the shares of Ahli United Bank were the most traded shares in the market during the week with 28.75 million shares of value 7 , 2 million AED

Sultanate of Oman

The General Index of the Muscat Securities Market rose 0.17% to 7.48 points to close at 4448.28 points , while the market value rose to 17.603 billion riyals with market gains of 13.62 million riyals

Trade volume increased by 127.08% to 62.41 million shares, and the value of trade rose 84.62 percent to 9.69 million riyals.

The market rally during the week boosted the positive performance of the financial sector and services indices, after rising respectively by 1.12% and 0.36%, while the sector index decreased by 1.33%.

The shares rose 20% during the week "Building Materials", then "HSBC" followed by "Takaful" with 7.69%, followed by Oman Fish by 9.52%, Al Maha by 6.98% for Ceramics and 6.9% with Salalah Mills.

Egypt

The Egyptian Stock Exchange continues its decline for the third week in a row, the main index "Eiji X 30" falling by 2.9% to 15416.31 points and l & # 39; 39, "EGX70" index of 2.9% to 752.60 points, "EGX EX 100" index rose 3.1% to 1927.29 points

Market capitalization closed at 867 billion of LE, losing LE 22.9 billion, against 889.9 million EGP at the end of the previous week. During the week, the index of the Amman Stock Exchange fell to 2023.9 points during the week against 2037.6 points the previous week, down 0.67% On the plane sectoral, the index down 2.6% to 2636.26 points. The financial sector decreased by 0.28%, the services sector decreased by 0.97% and the industrial sector decreased by 1.35%.

Last week, it rose to about 2.5 million dinars against 3.3 million dinars the previous week, a decrease of 22.8%, for a total volume of 12.7 million dinars against 16.4 million dinars the previous week. The number of shares traded during the week rose to 10.3 million shares, executed through 5770 contracts.

In terms of sectoral contribution by volume, the financial sector ranked first, reaching 8 million and 62.9% of the total volume of trade, followed by the services sector with a volume of 2.4 million and 19%. , 2% and the industrial sector by 2.3 million and 17.9%.

Gulf investors and foreign investors tended to buy in GCC markets In contrast, investors and Arab citizens were sold with a net investment of AED 47.16 million, of which AED 41.7 million for nationals and AED 5.4 million for Arabs. In the Dubai market, investors and Arab citizens tended to buy with a net investment of 14 million from AED, of which 5.48 million AED for Arabs and 8.5 million AED for nationals, while GCC and foreign investors tended to sell with a net investment of 14 million AED. Of which 6.6 million for Gulf nationals and 7.4 million for foreigners 02] while investors from Abu Dhabi and the Gulf were net buyers with an investment net of AED 61.17 million, of which AED 53.3 million for GCC nationals and AED 7.8 million for foreigners, while Arab and national investors were net with AED 61.17 million, of which AED 10.87 million . The performance of portfolios and institutions varied during the week as they tended to buy in Abu Dhabi with a net investment of 95.4 million AED, while a net investment of 26 million AED was sold in Dubai, retail investors in Abu Dhabi with a net investment of 95.4 m Dubai Islamic Bank dominated the Dubai market activity during the week with liquidity of AED 104.16 million, followed by Emaar Properties with a liquidity of AED 102.8 million, and increased by 2.39% to 5.14 dirhams, followed by "Drake & Scull" with liquidity of 95.5 million dirhams, and 0 , 4% to 0.69 dirhams.

Source link