[ad_1]

Danylyshyn explains the situation with the coincidence of seasonal factors and does not anticipate further exchange rate collapses.

The National Bank does not intend to adjust the hryvnia rate according to certain limits, since the purpose of the regulator is not this, but low and stable inflation. This was stated by the chairman of the NBU Board Bohdan Danylyshyn in response to requests for recent changes in the hryvnia exchange rate

"The exchange rate depends mainly on the supply and demand of foreign currencies on the foreign exchange market .. completely "left" the market ", – Danylyshyn pointed out and explained that the cash segment of the foreign exchange market is very dependent on non-cash, which means that" the main factor in the formation of hryvnia is the state of the interbank foreign exchange market of Ukraine.It, according to Danylyshyn, does not allow to assume the presence of serious problems. "In recent years, the currency supply has exceeded its demand in the cash segment, which means that the population sells more foreign currency than purchases, which should strengthen the hryvnia "

? – the high prices of goods sold by the Ukrainian producer, the growth of exports and, consequently, the inflow of foreign currency in Ukraine. At the same time, however, there is an increase in world prices for oil and gas and other processes that can affect some aspects of the balance of payments and currency fluctuations. "In July, the official exchange rate hryvnia against the US dollar is depreciated by nearly 50 cents, generating a wave of publications and reports on this subject, which echoes in the conversations of ordinary citizens, while Rarely mentioning the January 20 hryvnia reached almost 29 UAH for the US dollar and over the course of several months, the rate has strengthened more than two hryvnias and a half, after which it has stabilized.These volumes of fluctuations were set last year, but we are not used to such fluctuations.

"The National Bank stole three times": the deputies said why they trust their capital for dollars, not hryvnia

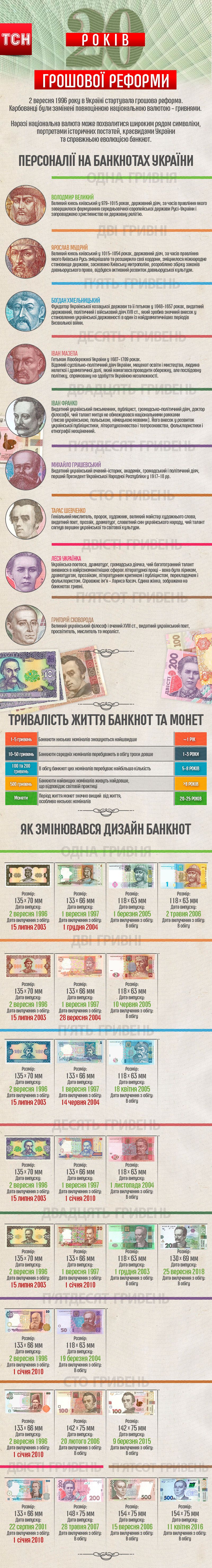

The representative of the NBU called the main factors of the depreciation of the hryvnia – a speculative increase in demand for foreign currency, the current situation in the non-monetary market, the emergence of surplus hryvnia mass by VAT refunds and payments to non-residents. "In this case, VAT refunds have a dual effect on the foreign exchange market, since these funds are partly intended for the purchase of foreign currency by exporters and used by exporters as working capital, which reduces the need to "pull" foreign currencies in Ukraine.Because of the impact of short-term factors, due to increased demand for foreign currency, the National Bank is ready to turn to the foreign exchange market of Ukraine with and to avoid a sharp change in the exchange rate of the hryvnia infographic "class =" img center-block "img-sensible" data-src = "https: // img. tsn.ua/cached/1531824073/tsn-7fb3ba3a1c366fde98f9c353dffa928f/thumbs/x/22/8e/4749b1cb72656fa4c9ac748e2e368e22.jpeg”/>

TSN.ua

TSN.ua