[ad_1]

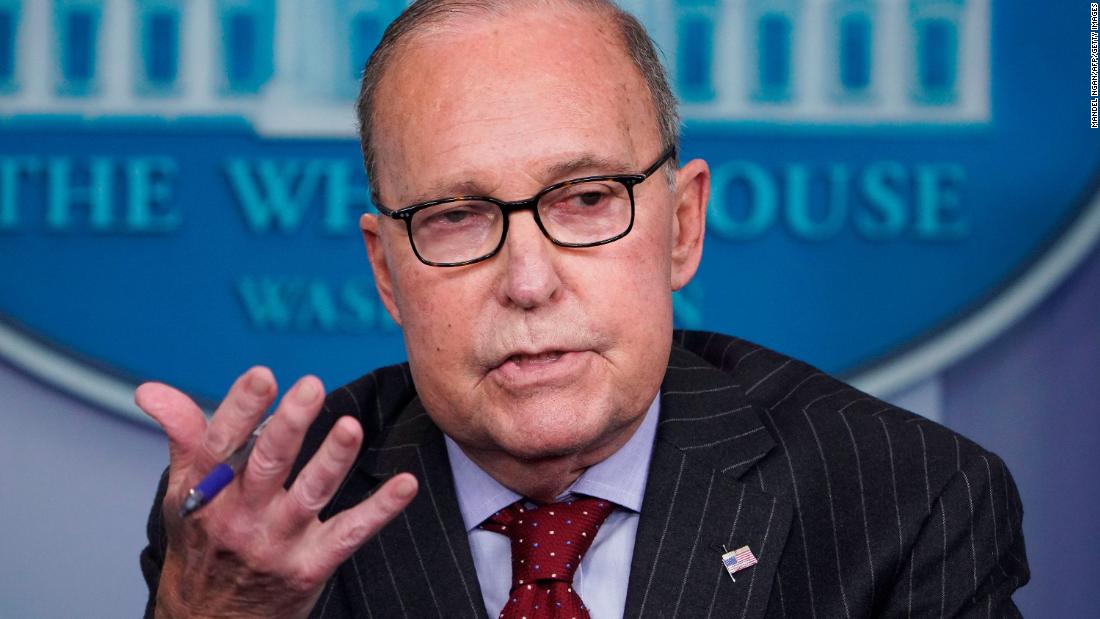

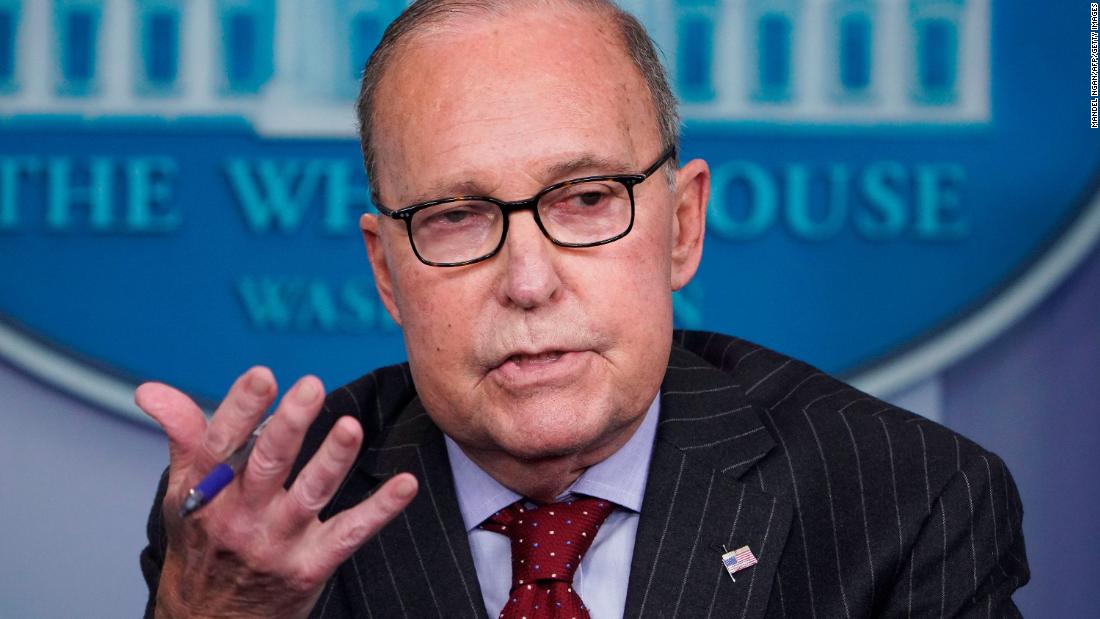

Markets fell immediately after Larry Kudlow, director of the National Economic Council of the White House, hinted that the US and China were not close to a new trade pact . The Dow ended the day at the lowest but still lost more than 220 points, or 0.9%. The S & P 500 also fell 0.9% while the Nasdaq was down more than 1%.

"The President said that he was optimistic about a possible trade deal," Kudlow told Fox Business. "But we have a long enough distance to go here."

The Dow Jones had lost only 100 points before his comments. Shares of Large US Multinational Enterprises That Do Significant Business in China, Including AAPL Apple [BA] ) Caterpillar ( CAT ) and Intel ( INTC ) were among the biggest losers of the Dow.

And only three shares of Dow ended the day with earnings – Walmart ( WMT ) Insurer . Passengers ( TRV .]) and Coca-Cola ( KO ) .

Incidentally, CNBC announced Wednesday morning that a senior US administration official had said "very improbable" Trump will meet with Chinese President Xi Jinping before the March 2 deadline to conclude a new trade agreement.

Trump said Thursday that a meeting was unlikely before the deadline.

The stock market experienced a strong comeback this year, in part because investors had grown up with the hope that Washington and Beijing would be able to reach a new trade deal in the coming weeks. The Dow and S & P 500 indexes each gained about 8% in 2019, while the Nasdaq rose by almost 10%.

Other members of the Trump administration were more optimistic about the evolution of the negotiations with China.

Treasury Secretary Steven Mnuchin, who will visit Beijing next week to conduct more trade negotiations, has been more optimistic about reaching an agreement before expiry. from a 90-day commercial truce.

Mnuchin told CNBC on Wednesday that the government had "fruitful discussions" with China.

Trump himself said that he still hoped that a new agreement could be reached and hinted that there could be a shake-of-hands agreement with China. extend talks beyond March 2nd.

But investors are clearly becoming more nervous and more and more suspicious of all conflicting reports. In addition, there is much more at stake than simple rates.

The United States and China should also discuss the concerns of many US (and global) technology companies in the face of intellectual property theft in China.

The financial chief of the Chinese technology giant Huawei is currently detained in Canada at the request of Washington, which adds to the tension between the two countries.

– Kevin Liptak of CNN contributed to this situation report

[ad_2]

Source link