[ad_1]

The Dow Jones lost 400 points, or 1.6%, on Friday afternoon. The Nasdaq lost 2%, while the S & P 500 fell 1.5%.

Stocks traded higher earlier on Friday, but the market fell sharply as a result of conflicting messages from the Trump administration about trade.

"We have received a mix of conflicting messages from people belonging to the same government," said Art Hogan, chief market strategist at B. Riley FBR. "We do not know who we are supposed to listen to."

alternated between good and bad cop at the commercial level .

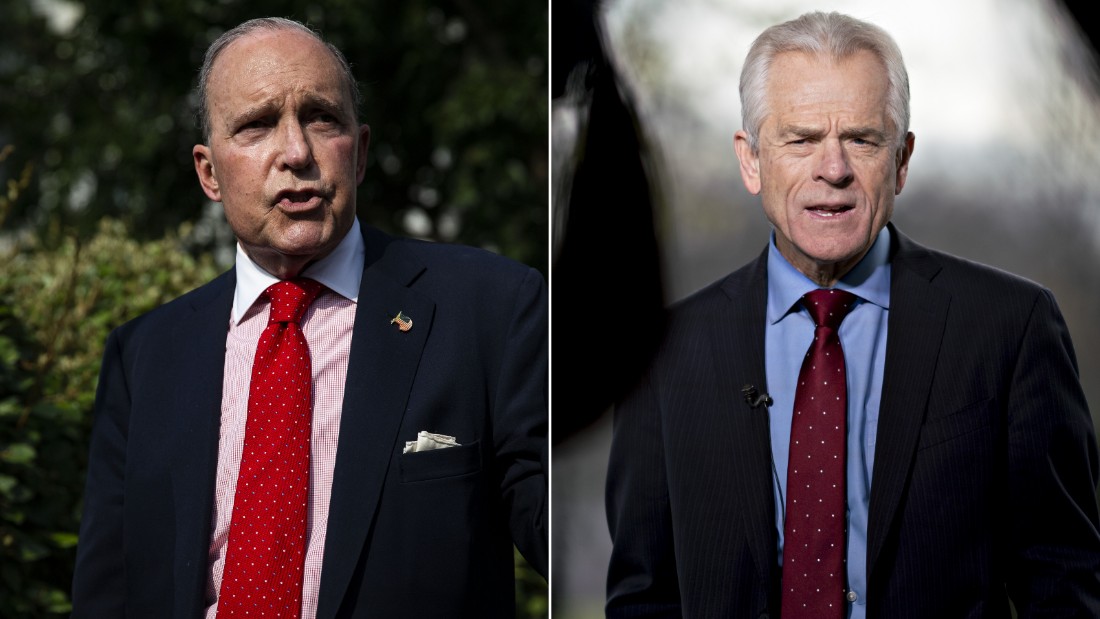

Kudlow told CNBC on Friday that trade talks with China were "extremely promising".

Kudlow, director of Trump's National Economic Council, said that he had indicated that he would be willing to extend the 90-day trading deadline if there is "good, solid move and good action" .

Navarro, the White House Hawker for Commerce, gave a different tone to CNN. Asked that the administration would step down if the problems with China are not resolved within 90 days, Navarro suggested that Mr. Trump would simply increase existing tariffs on Chinese products worth 200 billions of dollars.

If China does not change its business practices, "we have a president who will resist this for once," said Navarro.

Navarro also defended the $ 12 billion that the United States raised through tariffs, although this money is mostly paid for by consumers and businesses in the United States.

"We continue to receive conflicting reports of these types," said Joe Saluzzi, co-head of trading activities at Themis Trading. "The markets are confused."

Trump himself added to the confusion. While Trump expressed the wish to make an agreement with China, the president also alarmed some investors by calling himself "tariff man" on Twitter on Tuesday. This tweet was blamed for helping to plunge the market.

Still, on Thursday night, Trump said on Twitter that he was in agreement with a recent encouraging statement from China expressing its confidence in a trade deal within 90 days.

"Today is a microcosm of what we have known all week: conflicting messages," Hogan said. "Every message is contradicted."

Source link