[ad_1]

According to Mr. Saez, wealth tax should apply to less than 0.1% of US households and raise $ 2 trillion over 10 years.

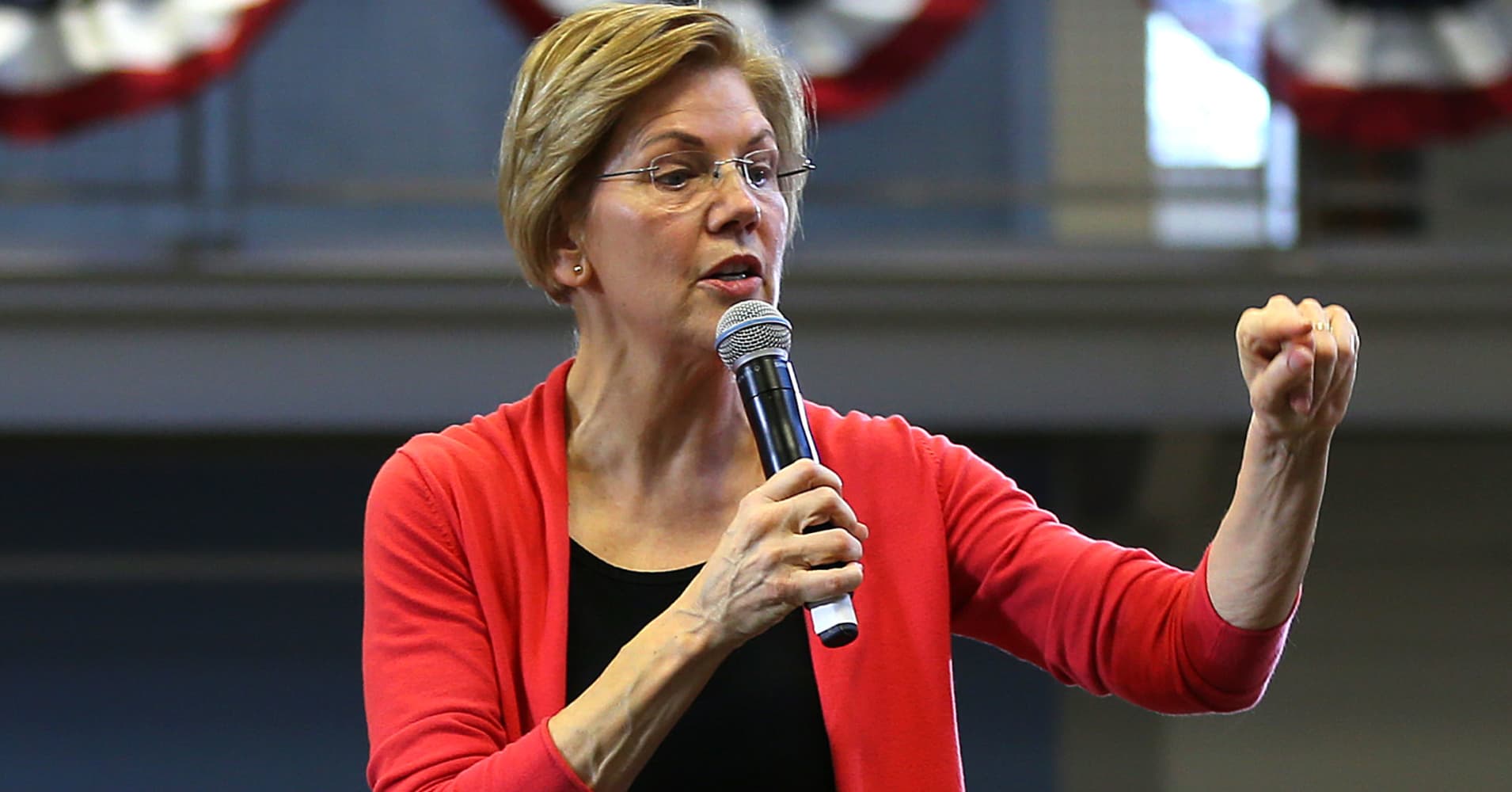

Warren's idea joins the plans of other Democratic legislators. to pay for ambitious political goals, such as a "new new green" aimed at reducing economic inequalities and tackling the causes of climate change.

Development has not gone unnoticed by investors and wealthy leaders, many of whom are World Week at the World Economic Forum in Davos, Switzerland.

"From here to the presidential election, the situation will accelerate," said CNBC's Scott Minerd, chief investment officer at $ 265 billion worldwide, Guggenheim Partners. this week.

He specifically referred to the proposal of the new student Alexandria Ocasio-Cortez regarding a marginal rate of 70% on income over $ 10 million.

While his plan is a tax on income, the war Ren's proposal would impose wealth. The inequality of wealth in America is greater than income inequality.

While the highest percent of Americans earn about 20% of total income in the United States, the first percent of wealth holders collectively hold more than 40% of income. the total wealth of the nation, according to a report released Wednesday by the Institute of Taxation and Economic Policy, which pleaded for a wealth tax.

The Post reported that Warren had been briefed by two left-wing economists affiliated with the University of California, Berkeley, on an agreement that would impose a 2% wealth tax on Americans with more than 50 million dollars of assets. For Americans whose assets exceed $ 1 billion, this tax rate would rise to 3%.

The newspaper, quoting a person familiar with the plan, announced that Warren's plan would attempt to fight tax evasion by increasing funding for the Internal Revenue Service, and imposing a tax penalty unique to people over 50 million who are trying to give up their American citizenship. It would also be necessary for a number of people who pay the wealth tax to be subject to annual audits, reported The Post.

The taxation policies of the rich are not a new phenomenon among political candidates. In fact, Trump himself adopted a similar measure in 1999 by exploring a presidential candidacy as a candidate for the Reform Party.

Trump's proposal was to impose a single tax of 14.25% on individuals and trusts worth more than $ 10 million. According to reports of the time.

On Tuesday, Saez and another of his economic advisers, Gabriel Zucman, published an article in the New York Times in which he defended the Ocio-Cortez proposal.

"An extreme concentration of wealth means a concentration of economic and political power, and although many policies can help to remedy it, the progressive imposition of income is the most just and the most powerful of all," he said. they write.

Source link