[ad_1]

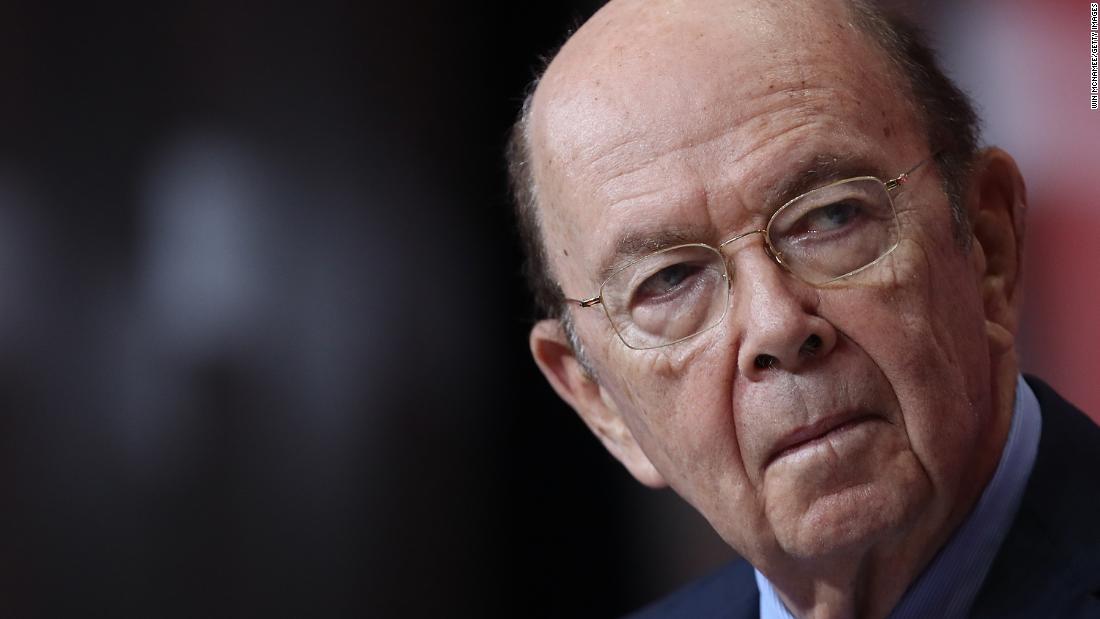

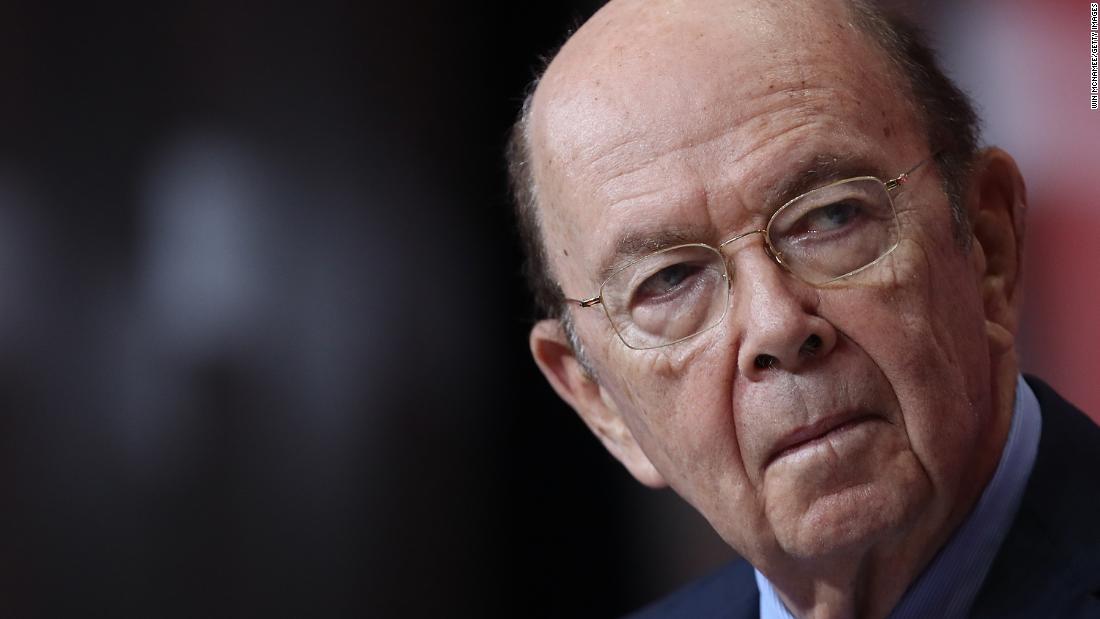

Asked in an interview with CNBC on Thursday, the billionaire-investor said, "I know it and I do not quite understand why, because I do not quite understand why." I've already mentioned that the obligations they would assume, such as borrow from a bank or a credit union, are actually guaranteed by the federal government, so the 30 days of pay that some people go to losing is not a real reason why they should not be able to get a loan against it. "

The government is partially closed for more than a month, with no apparent end.

A pantry opened by chef Jose Andres in central Washington was invaded by workers in search of hot food, while laid-off employees from across the country visited food banks and sought further assistance.

White House economic advisor Kevin Hassett said earlier this month that fired federal workers who are not paid during the partial government shutdown are "better off" because they will not benefit. of vacation days and will eventually be paid anyway.

"A huge number of government employees were going to take holidays, for example, between Christmas and New Year's Day." And then we have a work stoppage so they can not go to work. they are not Hassett told PBS during an appearance on "NewsHour." He later stated that he sympathized with the workers and that his comments had been taken out of context.

M. Ross, who made a fortune buying distressed debt, noted that banks and credit unions were providing zero-interest loans and other forms of assistance to clients.

Banks and credit unions should offer them credit. If you think about it, it is in fact government-guaranteed loans because the government is committed to getting these people unpaid once everything is settled. "Ross said in the interview.

" So there's really no good excuse for triggering a liquidity crisis, "Ross said." Now, it's true that people may have to pay a little interest, but the idea that the salary is equal to or equal to zero is not a really valid idea. "

[ad_2]

Source link