[ad_1]

Initial unemployment insurance claims soared to 965,000 last week amid signs of a slowdown in hiring due to pandemic restrictions, the Labor Department reported Thursday.

The total was worse than Wall Street’s estimate of 800,000 and above the previous week’s total of 784,000.

The markets have reacted little to this number, as the decline in economic activity should be met with more stimulus from Washington. President-elect Joe Biden will announce his hopes for another probably over $ 1 trillion package later on Thursday.

Futures prices continued to point to fractional opening gains on Wall Street.

Yet the number of unemployed for the week ended Jan. 9 was another sign of economic turmoil brought on by restrictions in activities aimed at tackling the pandemic. The total was the highest since the week of August 22, when just over a million claims were filed.

Continuing claims were also higher, going from 199,000 to 5.27 million. This figure is one week lower than the total weekly claims and has increased for the first time since late November.

The total number of recipients of government benefits has fallen sharply despite rising weekly figures. This level fell to 18.4 million from 19.2 million the previous week. Data runs two weeks after the total weekly claims. The decrease is mainly due to a drop in the number of those filing emergency pandemic claims, though it remains well above the 2.18 million people receiving benefits a year earlier .

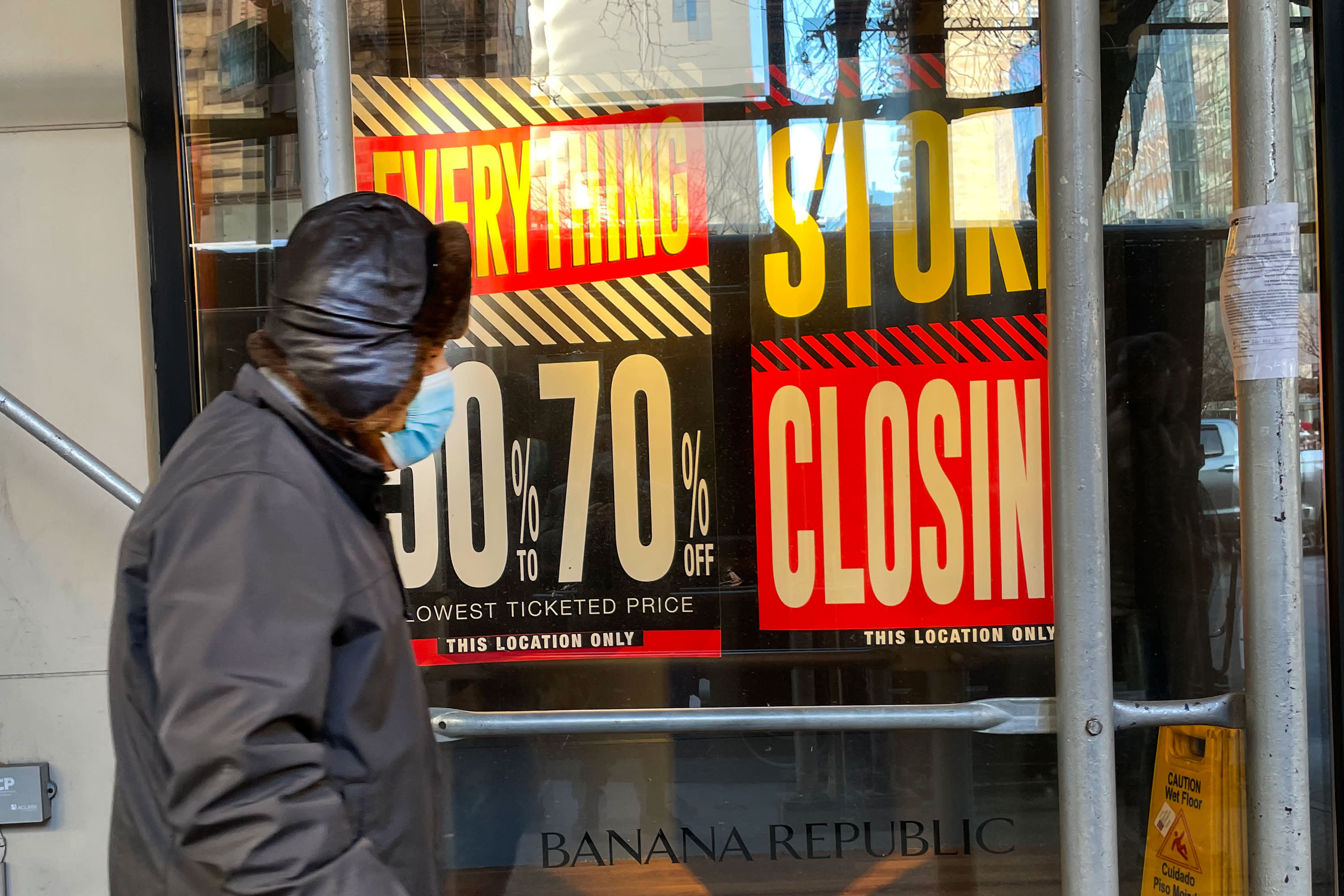

The increase in claims was spread across a handful of states, primarily those with tighter restrictions on business.

Illinois, where Chicago cracked down on restaurants, posted a jump of 51,280, according to unadjusted data. California, which doesn’t even allow alfresco dining, saw its number of complaints increase to 20,587, a 13% increase. New York increased by 15,559.

However, several states with relatively loose restrictions also saw notable gains. Florida saw its claims more than double to 50,747, while Texas saw an increase of 14,282.

Signs have recently emerged that job gains that started in May have started to cool.

In December, the non-farm payroll fell for the first time during the recovery from the Covid market lows, falling by 140,000 as the unemployment rate held steady at 6.7%.

The Federal Reserve said on Wednesday that business contacts in the 12 central bank districts pointed to a reduction in hiring and difficulty in filling positions. Economists generally consider the 2021 economy to start slowly, but gain momentum as the year progresses and the Covid-19 vaccine spreads.

[ad_2]

Source link