[ad_1]

introduction

The Uniti share price (NYSE: UNIT) has fallen more than 50% over the last ten days as a result of an adverse court decision that could trigger or accelerate the failure of its principal payment customer, Windstream (NYSE: WIN). There is speculation about the fairness of the court ruling, the security of the main lease agreement between Uniti and Windstream and the risk or extent of a dividend reduction at UNIT.

In addition to legal uncertainty, the industry's declining revenue base, whether CenturyLink (NYSE: CTL), Frontier (NYSE: FTR) or Windstream, is a major problem. In a declining (deflationary) income environment, debt can no longer be rolled over, but must be repaid, with the borrowing base decreasing.

You often hear how terrible deflation can be for financial investors. Deflation occurs in the Uniti sector: the old capital structure is no longer viable and the shareholders are the last ones online. That's why the shareholders of Windstream and Frontier Communications have virtually disappeared, why Windstream's debt is at the lowest level of junk, why Windstream has just filed for Chapter 11 and why Uniti's equity could also fall more.

We need to understand the logic of Windstream and Uniti stakeholders to assess the true value of Uniti shares. I think the downside risk is substantial and that a suspension of the dividend is more likely than a reduction.

Uniti and Windstream

In this article, I guess the reader is familiar with the Uniti-Windstream arrangements. Windstream sold fiber assets to Uniti and pays rent to it for use under a Master Lease ("MLA"). I think it is too technical funding, but this is not the subject of this article (see previous article).

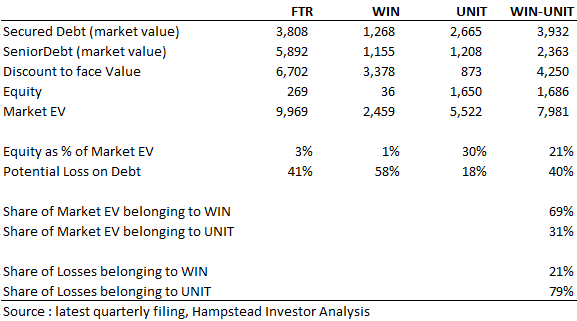

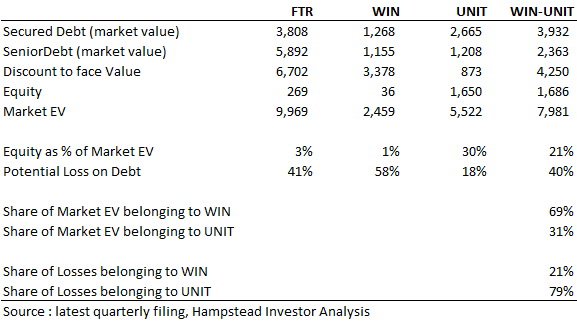

One consequence of this arrangement is to have created an extremely superior instrument in Windstream's capital structure for the benefit of UNIT stakeholders. The super seniority comes from the fact that the MP can not be renegotiated in a Chapter 11 process of Windstream. The valuations of the bonds and shares of Uni and Windstream suggest that the market believes in this super-seniority: the value of Uniti's stock company represents 69% of the total Uniti-Windstream EV but only 20% of potential loss (see Table 1).

The MLA accounts for 80% of UNIT's EBITDA and in this article we will often recombine Uniti and Windstream to better understand the position of the Uniti group.

Table 1: Frontier, Windstream and Uniti

Windstream Stakeholders

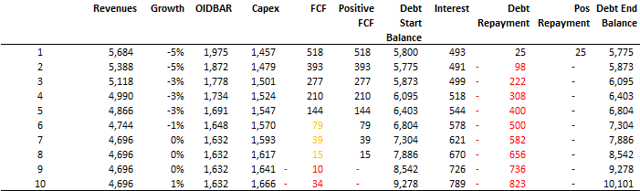

Windstream has just announced its Chapter 11 filing. This is not surprising given that both debts are secured and senior debt is trading at a significant discount. We forecast Windstream's cash flows in Exhibit 2 2; Our main assumption is that incomes will continue to decline before stabilizing. The combination of declining revenues and cost growth (capex being the capex and the MLA), the free cash flow will not remain positive very long. Based on the current trend, Windstream will not even be able to pay interest over the next 12 to 24 months. that is what it means to get a highly speculative Caa3 score (which should soon be in the D range).

Table 2: Windstream: Revenue Forecasting

The lawsuit with Aurelius has just given secured creditors the opportunity to take control now rather than wait until next year. Based on our forecast above, we estimate the NPV of positive free cash flow at around $ 1.4 billion (discounted at 7%). This does not cover secured debt, as such secured lenders should be in charge.

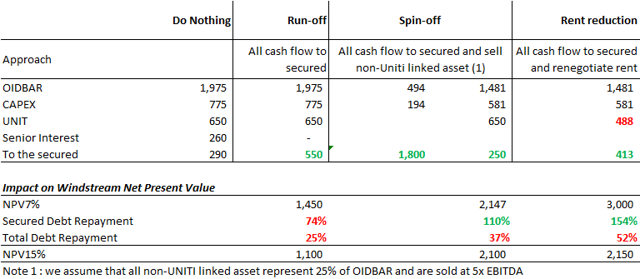

In assessing where EBITDA is spent (Table 3), we can see several ways to strengthen the position of secured lenders; it's not just about reducing the number of MPs:

- Immediate termination of first interest payments will save $ 260 million annually (a 40% reduction in unit rent).

- When the recovery potential is only $ 1.4 billion, $ 260 million of senior interest or $ 300 million relates to Aurelius.

- Second, some OIDBARs are not tied to assets "pledged with Uniti", but must be sold or split. If this represents 25% of Windstream's OIDBAR, this could rise to $ 1.8 billion, bringing the recovery to $ 2.15 billion.

- In the above approaches, Windstream bondholders simply proceed with a flow as long as there is a positive cash flow. They would then place the company in Chapter 11 (again) or return the keys to Uniti when ranking in Chapter 7.

Another option is to negotiate a rent reduction with UNIT. According to my predictions, a 25% reduction is needed to stabilize Windstream for a decade or more, which would bring the NPV7% to $ 3 billion. However, the benefit of a reduced rent slowly returns to the creditors and it can be difficult to obtain both a rent reduction and a split. When I manage a NPV15%, the approach of selling all non-UNIT assets, managing spot activity and minimizing capital investments, would produce similar results for the fund holders. guaranteed bonds and would be faster.

This is where the balance of power between Uniti and Windstream may not be so good for Uniti. Windstream's secured lenders have the means to recover their capital by running the business in cash, without rent reduction, leaving Uniti in an uncomfortable and uncertain situation (eventual bankruptcy, underinvestment, etc.).

Table 3: Options Open to Windstream Guaranteed Lenders.

UNITY: the logic of bondholders

Now, put yourself in the shoes of the UNIT bondholders; you may have already lost money in Windstream or FTR bonds and you see a drop in industry revenues. You must understand that this income deflation is essential in the creditor's assessment: it suggests that fiber optic assets are not perpetual assets, contrary to what was envisaged at the time of the split. If fiber assets are not "perpetual", the debt must be repaid. Thus, the criterion for a sustainability analysis of the dividend or debt is not simply that Uniti has enough cash to cover the interest, but that it has enough cash to repay the debt and the interest. .

Back to being a bond creditor. What would you do if you have the opportunity to act? Are you allowing Uniti management to continue paying dividends or making acquisitions? Do you plan to collect the debt when it is due or do you think other creditors will obligate you to pay? Do you think that any of these approaches will make your career easier if or when things go wrong?

Probably not, the more likely you are to run a few scenarios and realize that the combination of Windstream's stock (described above), a continued potential growth in negative income and legal risk could put your capital at risk or make it very difficult. difficult to repay the loan by Uniti within a reasonable time.

Chapter 11 of Windstream should give back control to Uniti bondholders, as this could trigger a cross-default of MLA and then Uniti's obligations. Bondholders of the Unit have an interest in being cautious and suspending the dividend to start reducing the debt.

Bondholders are not paid more to think that the industry will recover through 5G or some other method; they are not paid more to get an idea of the binary catastrophic legal risk. If these problems are solved, the shares will be able to refinance or convince the bondholders to allow dividends again. Bondholders do not have this clarity now.

Some scenarios

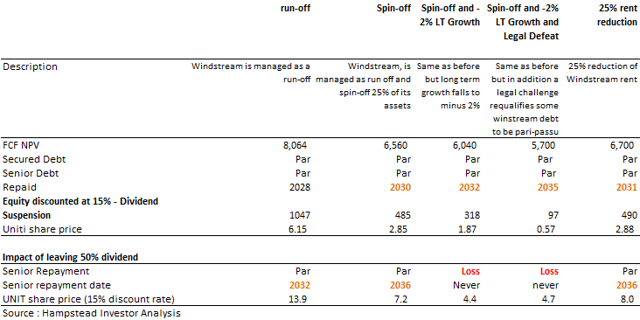

We evaluate the net present value of Uniti Free Cash Flow under the same scenarios as those contemplated with Windstream (Table 4), using a similar cash flow forecast. What do we see?

- Even if 100% of the cash flow is diverted, the debt can not be repaid until 2030 or later.

- If Uniti continues to pay 50% of the dividend ($ 200 million), debt repayment will be delayed by 5 or 6 years in 2035 or 2036.

- Worse, in an adverse scenario of continued income deflation and legal losses, senior bond holders could lose money and would never be repaid if 50% of the dividend was retained.

- A 25% rent reduction could stabilize Windstream and Uniti, but even with all cash flows dedicated to debt repayment, debt repayment would take 12 years, exposing Uniti bondholders to further risk degradation Sales and Legal Affairs of Windstream.

The goal is not to guess which scenario is most likely but to recognize that there is material uncertainty. Bondholders should seek to suspend the payment of dividends until at least the rules are reinstated and do not risk waiting for a reduction in rent to act.

The Uniti share price may drop dramatically if the dividend is suspended. In our modeled forecasts, the fair value is between $ 0.5 and $ 6 per share (Table 4). This decrease is partly due to the effect in value over time of postponing dividends until repayment of the debt, which is very conservative.

Table 4: Stakeholders at the Unit – positions in various scenarios

A few words on the methodology

We use a forecasting approach similar to that used for Windstream on Uniti. If you are interested, you can send me a private message to receive the tables. This type of analysis takes a lot of time but is quite necessary to be able to take any point of view in a situation of fixed income distress.

Guaranteed bonds of Uniti

Using this type of analysis, Uniti's covered bonds are strong enough and would only result in a perfect storm of long-term negative growth, court challenge and ongoing payout of $ 200 million. dollars of dividends.

An average high-80% seems hard to break if Uniti bondholders can take control quickly. Personally, being particularly conservative, I would expect an even lower entry point. This type of entry point can be created by combining Uniti's long-term covered bonds with a shorter term on Uniti shares.

Conclusion

We did not attempt to analyze the intrinsic value of Uniti; there are too many uncertainties to do so with confidence. We limited ourselves to understanding the potential shares of Windstream and Uniti bondholders in assessing the risk of dividend suspension.

Chapter 11 of Windstream is likely to give Unitholders control of Uniti. Whether or not the member is renegotiated, we believe that it will be in the interests of the bondholders to suspend the dividends at Uniti and start paying off the balance of the debt.

We believe that the risk of a decline in Uniti's share price is high and that it could remain below $ 5 in this uncertain environment.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link