[ad_1]

Co-produced with Beyond Saving and PendragonY for High dividend opportunities.

Many of you (readers and subscribers) have asked for my opinion on UNIT and if it was a good investment, and my advice has always been the same over the last year: Do not be tempted by performance, AVOID. The risks are too high.

As a long-term dividend investor, I believe that the shipping and telecommunications sectors are two of the riskiest high-yield sectors. The reason is that both sectors are very capital intensive, competition is fierce and, in the case of telecoms, the underlying technology is constantly evolving, which adds another significant risk. In Telecom, it's always best to stay with the best, as AT & T (T). Below you will find the story of what happened on Friday and which affected the stock of UNIT, as well as the reasons why we recommend avoiding it.

Windstream loses his fight against Aurelius

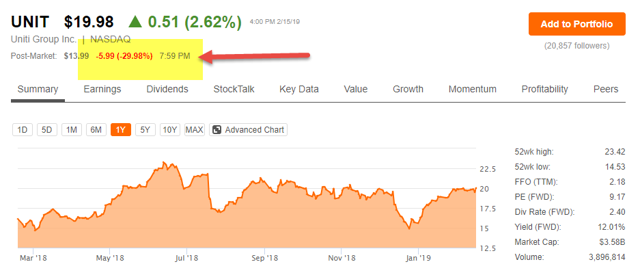

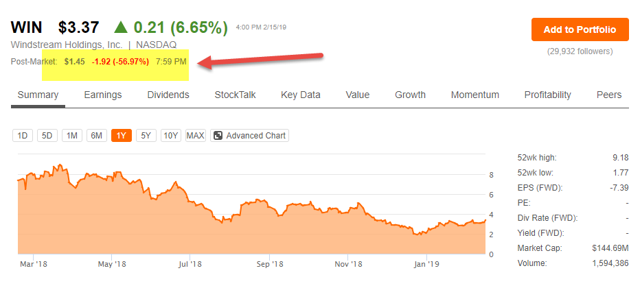

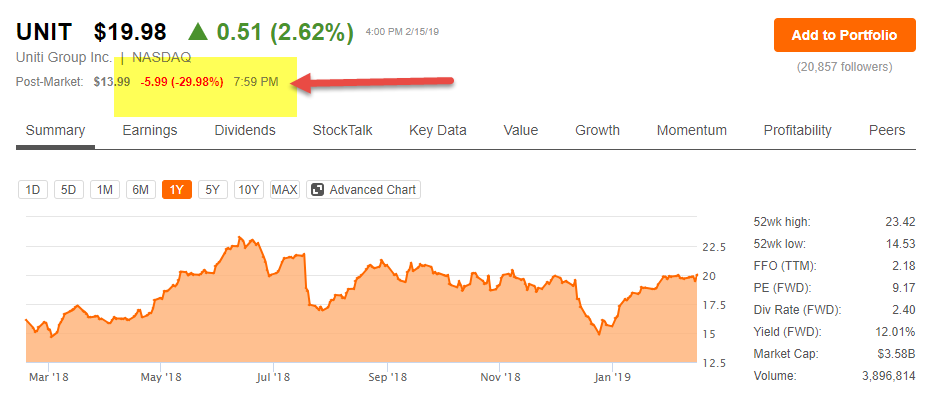

Anyone who has paid attention to Uniti Group (UNIT) is probably well aware of the recent decision against Windstream (TO WIN). The bomb was announced after work hours Friday, resulting in the sinking of both actions. UNIT was down 30% after hours while WIN dropped 56%

For those who do not know the situation: UNIT was originally a spin-off of WIN in 2015, organized as REIT. The split resulted in UNIT acquiring a substantial portion of the WIN network, which WIN rents to WIN. Since the split, UNIT has acquired additional fiber and tower assets, but WIN remains their largest tenant, accounting for approximately 70% of UNIT's revenues.

In September 2017, Aurelius Capital acquired a majority stake in WIN's 2020 bonds, as well as default credit swaps to hedge the risk. Aurelius then issued a default notice based on the receivable. WIN was in default on the bonds because the split operation of UNIT in 2015 constituted a sale and leaseback that prohibited the restrictive covenants. The decision on Friday confirmed that the convents actually banned the transfer of assets to UNIT at WIN. Aurelius bought the bonds and credit default swaps at very low prices and has a huge boon.

In the end, WIN will have to pay $ 310.4 million to Aurelius, plus interest since July 2018. It is unclear how other creditors will respond to the decision.

We think the crash will continue after the reopening of markets on Tuesday.

Bankruptcy?

For WIN, the most immediate concern is whether or not they should (or will) declare bankruptcy. Many seem to have taken it for granted that WIN will declare bankruptcy, but this is not certain.

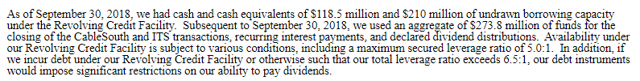

WIN recently sold a portion of Earthlink for $ 330 million and did not specify what it intended to do with the product. Given that WIN has not yet released its fourth quarter results, we do not know exactly where they are in terms of cash. In the third quarter of 2018, they had $ 196 million on their revolving line of credit and $ 37.3 million in cash.

It is possible that WIN pays the judgment mainly with the proceeds of the sale of Earthlink. On the other hand, WIN's bankruptcy and debt restructuring can not be totally excluded. Much of this decision will depend on what other lenders do. They could also use the decision to declare WIN in default, which would force bankruptcy. WIN management has stated its intention to appeal and this could delay any immediate action to resolve the judgment payment issue.

Impact on UNIT

UNIT started 2018 with over $ 500 million in cash. During the year, this began to change as UNIT fired on its revolver and in November, it was clear that it was dependent on the equity to cover the dividend.

AT High dividend opportunitiesFor some time now, we recommend that our investors avoid UNIT because of several factors, including: concentration risk, large cash flow problems and legal disorder. In a recent article, one of our authors Beyond savings warned,

The biggest problem for UNIT remains the same, they have little cash and their cash flow is not enough to cover both the expected cap-ex and the dividend. UNIT will have to raise funds to cover their capitalization needs, unless the dividend is reduced, and it will now be necessary to raise additional funds to finance this transaction.

The dividend of UNIT remains tenuous. If they are to issue between 4 and 5 million shares, their dividend payments will be increased from $ 9.6 to $ 12 million a year at dividend rates in effect. The dividend of Q1 2019 remains subject to a reduction, particularly if Judge Furman continues to delay his decision or if the decision does not create the anticipated rebound in the share price.

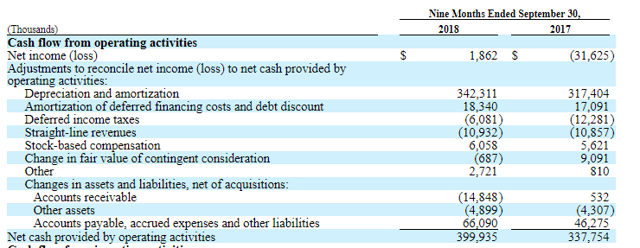

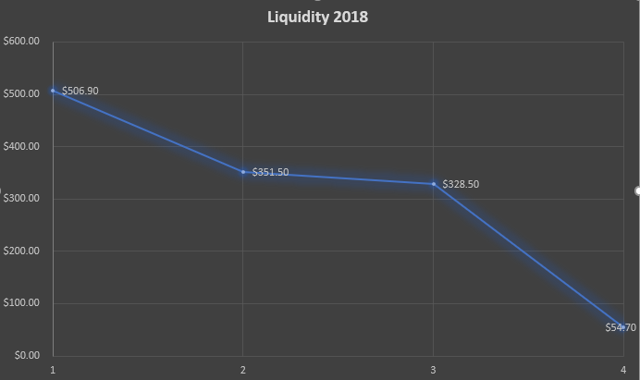

Looking at 10-Q, we can see how tight UNIT is.

They had $ 328.5 million in cash, but after the end of the quarter they used $ 273.8 million. That leaves about $ 54.7 million. Their liquidity had dropped throughout the year.

Source: Company SEC Filings Chart Author & # 39; s

In the first quarter of the business after the third quarter, there is a decrease in liquidity each quarter.

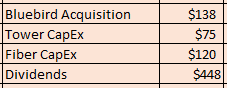

UNIT needs $ 138 million to complete its contract with Bluebird / Macquarie as part of its needs in 2019, as well as finding ways to continue financing its capitalization requirements.

In the third quarter teleconference, Mark Wallace said:

Yes. And to answer your last question, in terms of the capital expenditures for 2019, we obviously have not completed our planning cycle, but as for the tours, I would say that it should be on the order of this year at maybe $ 10 million. So, probably between $ 75 million and $ 85 million next year, depending on the number of rewards earned. And I'm thinking of the fiber optic sector, which is expected to be in the range of 130 to 140 next year on a net basis, the CapEx net. "

That's a total of $ 205 to $ 225 million. Dividends are currently $ 448 million / year. So their cash needs look something like this.

For a total of 781 million dollars.

In the third quarter, cash flow from operating activities was just under $ 400 million for the nine months. T4 contributed about $ 169 million. If we use it as a current rate, it gives UNIT about $ 676 million a year. More than $ 100 million short to cover their projected needs for 2019.

We believe that UNIT will have no choice but to reduce its dividend. With WIN in trouble, it is more important than ever to continue to invest in its fiber optic business to reduce its dependence on a troubled tenant. It is also important for them to be able to conclude the Macquarie / Bluebird contract.

There is simply no room for maneuver between current dividend payments and CFFO (cash flow from operating activities). Therefore, with the increase in the number of sales of shares totally excluded, the reduction in capital expenditure can come only from a reduction in the dividend. The only outstanding questions are how much UNIT can afford to reduce the dividend, how much the dividend will actually be reduced and what other measures UNIT will take to generate the cash it needs..

Investors can also expect UNIT to sell their tour activities in Latin America. They had already telegraphed when announcing the Macquarie / Bluebird deal. While this is a dual benefit of raising capital and reducing capitalization needs, it is unlikely that such an agreement can be reached early enough for the dividend to be saved.

How much of a dividend cut?

We estimate the dividend will be reduced to $ 1.30 to $ 1.40 a year, which is likely close enough to the minimum required to maintain its REIT status. To maintain its REIT status, UNIT will have to pay 90% of its taxable income in the form of dividends. We estimate this based on the USD 1.53 dividend of UNIT's 2018 dividend which has been declared as an ordinary dividend according to the reported tax treatment. Although it does not perfectly reflect taxable income, it is a rough indicator for estimating it.

In the last 9 months, WIN has generated just under 70% of UNIT revenues. If other lenders use this decision to impose a default on the amounts owed to them, WIN will probably be forced to declare bankruptcy, reorganize (Chapter 11) rather than liquidate (Chapter 7). ).

This would provide UNIT with an additional $ 180 million in cash to meet their needs. Although they can theoretically get out with a less significant reduction, the psychological damage will already be done, but we think that they will reduce it enough so that they are not forced to proceed. to a new reduction. WIN could use this decision to assert that the lease payments were in fact fraudulent transfer payments and use this to obtain a reduction of its $ 650 rent paid to UNIT. Such a grant from UNIT would reduce both the cash generated and the minimum amount of dividends to be paid to maintain its REIT status.

Conclusion

The unexpected decision against WIN is a blow for UNIT. It will be impossible for them to issue shares at an attractive price this year. There is a chance, though small, that WIN will avoid bankruptcy and continue to pay the lease as agreed. This largely depends on WIN's willingness to materialize its intention to appeal the decision and reaction of its lenders.

The problem of UNIT is that they do not have enough capital to finance their acquisitions and their capitalization needs. They have gone through their revolving line of credit with the certainty that, when WIN receives a favorable ruling, they could issue shares to repay it. This bet has failed and UNIT will have to resort to more drastic measures.

UNIT will have to drastically reduce its dividend and may have to slow down its growth capex. Things will get worse for UNIT before they improve. We recommend avoiding UNIT for the moment. There is more risk of decline for this stock!

Thank you for reading! If you liked this article, please scroll down and click Follow next to my name to receive future updates.

About high dividend opportunities: We are the largest community of income and retiree investors with over 1900 members. This is a Top-Rated service, ranked # 1. Your subscription includes:

- A model portfolio of high dividend stocks and bonds current yield greater than 10%.

- A "dividend tracking" to track your next dividend / interest.

- A free "Portfolio Tracker" to track your assets and income. Watch the video Right here.

Join the largest community of income investors and start generating high dividends TODAY & # 39; HUI. S & # 39; register RIGHT HERE.

Disclosure: I am / we are long T. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link