[ad_1]

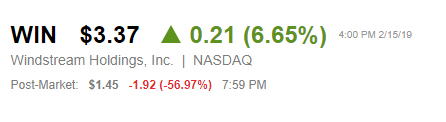

Windstream (WIN) lost its battle with Aurelius and its investors were certainly not celebrating this long weekend.

The decision states that the court's task was not to advise on the financial wisdom of Windstream Services' decisions in the transaction, but to enforce the trust deed.

"In doing so, the Court concludes that the financial maneuvers of Services – and many of its arguments here – are half too cute," reads the decision.

"That is, the 2015 transaction qualifies as a sale and leaseback transaction because, in essence, the selling affiliates sold the transferred assets and then leased them, either directly or indirectly; as signatory of the main lease did not change these facts. "

The traders tested the depth of the aftermarket and found that it was missing.

Source: Looking for alpha

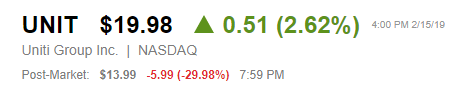

Although we have little desire to go long (or short) to win, we played at UNITI Group (UNIT) from both a long and short standpoint. We went in this result without any position, but with the post-hour quotes from UNIT rather interesting, we decided to analyze the situation to see if she deserved another long position on Tuesday.

Source: Looking for alpha

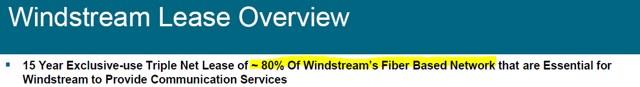

decision

The 55-page decision decided to use the "duck clause".

In summary, the use and enjoyment of assets ceded by the ceding subsidiaries operate like a lease and speak like a lease. That's because it's a lease. And, in any event, the Services can not argue the opposite argument in these proceedings because it had previously taken a contrary position in the judicial proceedings before the supervisory authorities and that position had been adopted by the supervisory authorities. Therefore, the court finds that the 2015 transaction constitutes a sale and leaseback transaction within the meaning of the trust deed. It follows that, unless it is excused or cured by the 2017 transaction, the 2015 transaction constitutes a violation of section 4.19 of the Trust Deed.11.

WIN will appeal but the judge has awarded Aurelius a pecuniary judgment in the amount of $ 310,459,959.10, plus interest, which must be filed first. WIN's balance sheet is currently tense and the $ 315 million will not be easy to find.

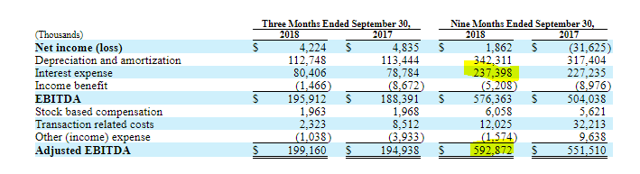

Source: WIN Q3-2018 results

What does it mean for UNIT

WIN is the biggest customer of UNIT. Although the question of the survival of the lease by bankruptcy has been debated endlessly, it is likely that we will have a real control of this theoretical problem. It is interesting to note that although this is not a critical issue, the judge has addressed some rather interesting aspects of the WIN lease. We are talking about the huge amounts of money that WIN spends on upgrading and maintaining UNIT assets, in addition to rent (the focus is on ours).

Significantly, since the close in April 2015, the ceding subsidiaries incurred significant costs related to the use of the transferred assets. First, the ceding subsidiaries bore all the maintenance, insurance, utilities and taxes on the transferred assets. See Tr. 156, 259. Second, the ceding subsidiaries substantially improved the transferred fixed assets; from mid-2017, they spent more than $ 339 million on maintenance, repairs, overbuilding, upgrading and replacing portions of the transferred assets.

Why is it relevant from a distance? Well WIN generates $ 2 billion in OIBDAR annually (operating income before depreciation, rents and rents).

Source: WIN presentation Q3-2018

The Earlink and Broadview acquisitions, which probably do not work on the UNIT network, account for 20% of this total. WIN also has its own network that has never been sold to UNIT and represents about a fifth of the total network.

Source: Uniti and Windstream, Dire Straits

In summary, WIN's own network assets and UNIT's leased assets generate an OIBDAR of approximately 1.6 billion USD (0.8 X 2.0 billion USD), the rest representing 0.2X from Earthlink and Broadview. Now, if we divide that $ 1.6 billion between the assets owned by WIN and the assets rented by UNIT, we get a breakdown of $ 320 million and $ 1,280 million. We now understand the argument that the division may not be uniform and UNIT's assets may be indispensable. The argument is that even some of WIN's assets are indispensable to the functioning of the company. In any case, we are comfortable with this view, although investors may have a different feeling.

Taking this thinking further, including rent, capex and property taxes, WIN pays UNIT nearly $ 900 million to $ 1 billion a year. All this to generate an OIBDAR of 1.28 billion dollars a year.

For us, this is essentially a lease that favors the owner. We have not looked at all the companies on the planet, but examples showing that 70 to 80% of OIBDAR goes to rent and investments on a property will be virtually non-existent in our opinion. Although WIN does not have a choice right now, in the event of bankruptcy, it will be the main target of the negotiations if WIN commits itself in this way. The judge's decision also emphasizes that this whole configuration was at best debatable.

Notably, although Holdings' counterparties in the main lease are CS & L's subsidiaries, the principal lease was not negotiated at arm's length. See Tr. 92-93. In fact, the parties to the main lease would not have been able to negotiate it at arm's length, since CS & L did not even exist before the implementation of the 2015 transaction. Thus, the main lease – like the rest of the 2015 transaction – was designed and written by Windstream.

How to play

The holders of UNIT shares all now consider whether the dividend will be reduced or maintained. There are now excellent arguments in favor of a reduction and we will certainly not bet that it will be maintained after this decision. We had also previously shown that beyond the maintenance capex, UNIT was required to make significant capital expenditures and that this was the main argument in favor of the company. a reduction in the dividend.

Nevertheless, part of the game theory would suggest that UNIT maintain its position on the dividend because cutting it would indicate that it is expecting a negative outcome during a negotiation of lease with WIN. That is, by reducing the dividend, UNIT would encourage trading tactics for the future WIN lease. Regardless of dividend prospects, stocks are now a very risky structure. However, high risk equity does not mean that society is not sustainable. In fact, our basic case is …

Bonds, just bonds

When you pull on a part of the capital structure, all the others move. We therefore believe that UNIT's obligations will collapse on Tuesday. Uniti bonds in 2023 are expected to fall to 85 cents per dollar.

Source: Cbonds

With a coupon of 8.25%, if the price drops to 85 cents, the yield to maturity will be 12.5%.

Source: Investing Answers

Unlike the extremely tight coverage on dividends, interest payments are well covered at 2.5X.

Source: UNITI results T3-2018

In the assumption of a bombarded reduction of 30% Windstream lease payments during a renegotiation, the EBITDA of UNIT would drop by about 20% (the WIN represents about 66% of the revenues of UNIT), which would raise EBITDA interest coverage to approximately 2X. The worst offer that the market is likely to present is therefore the worst case of 2X interest coverage, alongside the 12.5% compound return potential, and investors should seize it with both hands.

The wheel of fortune is a comprehensive service covering all asset classes: common stocks, preferred shares, bonds, options, currencies, commodities, CEE and ETFs.

Take advantage of the free two-week trial period and access our:

- Monthly review, where all trades are monitored.

- Trading Alerts. We do not trade every day, but we average one transaction per trading day.

- Portfolio model, aiming to beat the performance of the S & P 500.

- "Prepare for 2019", a series of 19 articles featuring our best choices in eleven sectors and eight segments.

Warning: Please note that this is not a financial advice. It may seem like, but, surprisingly, it is not. Investors are required to exercise due diligence and consult a professional who is aware of their objectives and constraints. Tipranks: HOLD on both stocks

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link