[ad_1]

(Bloomberg) – US stock index and European equity futures have fluctuated in a narrow range on Wednesday as markets were trying to stabilize after the market pullback caused by fear of trade this week. The pound slid as hopes of breakthrough in Brexit faded.

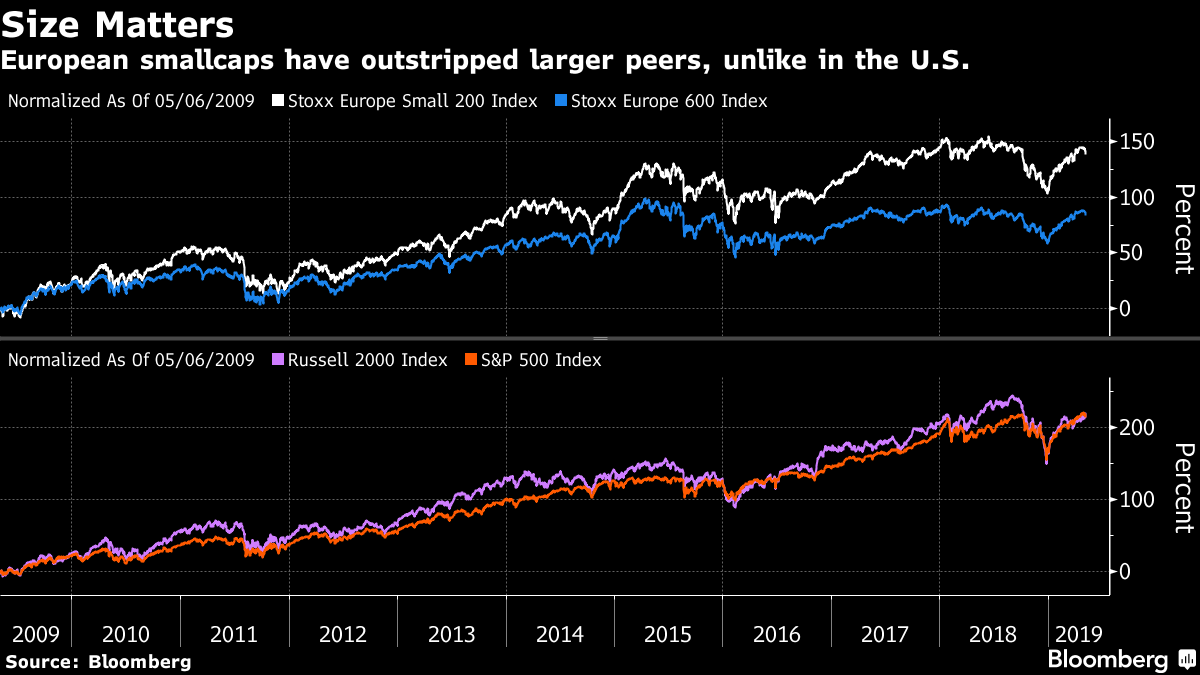

Contracts for the S & P 500, Nasdaq 100 and Dow Jones Industrial Average rose from modest gains to losses, as investors took stock of strong US sales a day earlier. The Stoxx Europe 600 index also struggled to find its bearings, as the decline of banks and automakers offset the rise in industrial shares. While wider market movements eclipsed corporate results this week, the earnings season continues apace. Commerzbank's results were in line with expectations, while Siemens posted record time. Lyft exceeded sales expectations after Tuesday's close.

Previous stocks fell in Asia, with the largest declines in Japan and Hong Kong. The yen and gold climbed as demand for some paradise assets continued. The euro has changed little after rising earlier thanks to optimistic data from German factories.

The unexpected escalation of President Donald Trump's rhetoric on trade over the past few days has seemed to surprise the global stock markets. Many of them had already peaked, their price seeming to be perfect, assuming that an agreement between the United States and China would be concluded. JPMorgan's boss, Jamie Dimon, still put the probability of that at 80%, and the S & P 500 fell back to its level of a month ago. Nevertheless, investors will closely follow the visit of the main Chinese trade negotiator in Washington this week.

"The two largest economic powers, the United States and China, will be either in a trade war or in a commercial peace. In reality, only two people know the answer to this question and it 's not those of us on Wall Street, "Larry Robbins, CEO of Glenview Capital Management, told Bloomberg TV in New York. "We must expect some volatility in this critical week."

Elsewhere, the yuan was stable as data showed that Chinese exports unexpectedly fell in April and imports increased. The New Zealand dollar fell more than 1% when the central bank lowered interest rates, although it subsequently reduced much of the fall. Oil has lost ground.

In emerging markets, the lira has extended losses against the dollar because of the fallout from the Turkish decision to revive the municipal elections in Istanbul. The South African rand strengthened as the country headed to the polls for national elections.

Here are some notable events to come:

The United States is releasing trade data on Thursday. South Africa is holding national elections on Wednesday. China is releasing a report on inflation on Thursday. The United States releases Friday's April CPI report. A Chinese trade delegation is expected to arrive in Washington for talks.

These are the main movements on the markets:

stocks

The futures on the S & P 500 fell 0.1% at 10:14 am London time. The Stoxx Europe 600 index plunged 0.1% to its lowest level in nearly six weeks. The UK's FTSE 100 index fell 0.2% to its lowest level since almost six weeks ago. MSCI Emerging Markets Index fell 0.6%, its lowest level in almost six weeks.

Coins

The Bloomberg Dollar Spot index rose less than 0.05%. The euro rose less than 0.05% to 1.195 dollar. The pound lost 0.3% to 1.3038 dollar. The yen rose 0.2% to $ 110.09, the strongest in more than six weeks.

Obligations

The yield on 10-year Treasuries fell by one basis point to 2.45%, its lowest level in nearly six weeks. Germany's 10-year yield has fallen from one year to the next. base point at -0.05%, its lowest in five weeks. Britain's yield fell three points to 1.125 percent, the lowest in four weeks.

Basic products

Gold gained 0.2% to 1,287.64 dollars an ounce, the highest level in more than three weeks. West West Intermediate crude dipped 0.1% to 61.33 dollars per barrel, its lowest level in almost six weeks.

– With the help of Adam Haigh and Justina Lee.

To contact the reporter about this story: Samuel Potter in London at [email protected]

To contact the editors in charge of this story: Christopher Anstey at [email protected], Yakob Peterseil

<p class = "canvas-atom canvas-text Mb (1.0em) Mb (0) – sm Mt (0.8em) – sm" type = "text" content = "For more articles like this, make -we visit bloomberg.com"data-reactid =" 43 "> For more articles like this, go to bloomberg.com

© 2019 Bloomberg L.P.

[ad_2]

Source link