/cloudfront-us-east-2.images.arcpublishing.com/reuters/TF5DG3DDOFLG3A3UBFBZLF4RJM.jpg)

[ad_1]

WASHINGTON, July 20 (Reuters) – US housing construction rose more than expected in June, but permits for future housing construction fell to their lowest level in eight months, likely reflecting the uncertainty caused by expensive building materials as well as labor and land shortages.

The Commerce Department report released on Tuesday suggested that a severe housing shortage, which has driven up prices and sparked bidding wars across the country, may persist for some time. Demand for homes is being driven by low mortgage rates and the desire for more spacious housing during the COVID-19 pandemic.

Although lumber prices are falling from record levels, builders are paying more for steel, concrete and lighting, and are struggling with shortages of household appliances like refrigerators.

“Reports of months-long delays in the delivery of windows, heaters, refrigerators and other items have surfaced across the country, delaying delivery of homes and forcing builders to limit activity. , and many builders continue to report a shortage of available workers as a separate challenge, ”said Matthew Speakman, economist at Zillow.

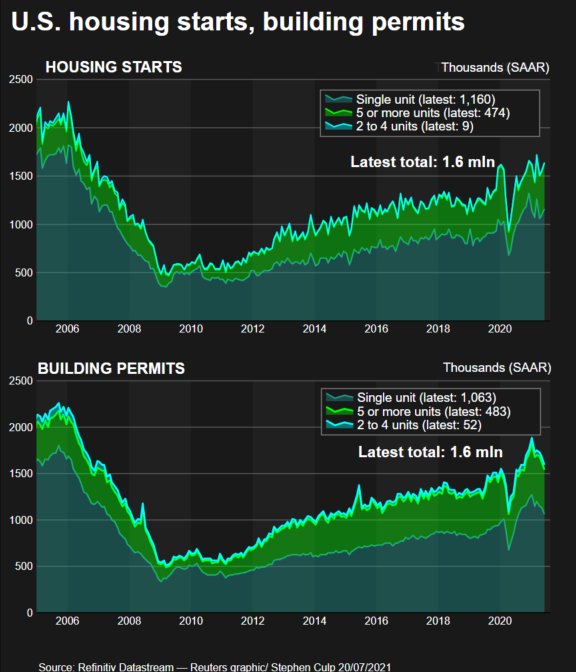

Housing starts rose 6.3% to a seasonally adjusted annual rate of 1.643 million units last month. Data for May has been revised down to a rate of 1.546 million units from the previously reported 1.572 million units. Economists polled by Reuters had predicted that housing starts would rise at a rate of 1.590 million units.

Despite the increase last month, housing starts remained below the March rate of 1.737 million units, which was the highest level since July 2006. Housing construction rose in the west and south populated, but declined in the northeast and midwest.

Single-detached housing starts rose 6.3% to 1.160 million units. The volatile multi-family residential construction category advanced 6.2% to 483,000 units.

Housing starts rose 29.1% year-on-year in June.

Building permits for future homes fell 5.1% to a rate of 1.598 million units in June, the lowest level since October 2020. Permits are now lagging, suggesting that home construction will slow In the coming months.

US stocks opened higher after Monday’s massive selloff. The dollar appreciated against a basket of currencies. US Treasury yields have fallen.

PRUDENT MANUFACTURERS

While lumber futures fell nearly 70% from the peak reached in early May, softwood lumber prices rose 125.3% year-on-year in June, according to the reports. latest data on producer prices.

There are also signs that the exodus to suburbs and other low density areas in search of larger accommodations for home offices and school is gradually fading as vaccinations allow businesses to recall workers in downtown offices. The increase in COVID-19 infections among unvaccinated Americans also poses a risk to the outlook for the housing market.

“Builders are more cautious and ask for fewer permits for new construction, as earlier confidence in reopening the economy has started to falter,” said Chris Rupkey, chief economist at FWDBONDS in New York.

The supply of second-hand homes is near its all-time low, leading to double-digit growth in median house prices.

A survey by the National Association of Home Builders on Monday showed that builders’ confidence of single-family homes fell to its lowest level in 11 months in July. The NAHB noted that “builders continue to face high prices for building materials and supply shortages, especially the price of oriented strand board, which has climbed more than 500% above its January 2020 level “.

Home builders and a group of other stakeholders met with White House officials last Friday, including Commerce Secretary Gina Raimondo and Housing and Urban Development Secretary Marcia Fudge, to discuss strategies for dealing with the short-term supply chain disruptions in the homebuilding industry.

Building permits fell in all four regions in June. Single-family home permits fell 6.3% to a rate of 1.063 million units. Permits for multi-family dwellings slipped 2.6% to a rate of 535,000 units.

Home completions fell 1.4% to a rate of 1.324 million units last month. Single-family home completions fell 6.1% to 902,000 units, the lowest level since October.

Realtors estimate that housing starts and completion rates for single-family homes need to be between 1.5 million and 1.6 million units per month to close the inventory gap.

The housing stock under construction rose 1.8% to a rate of 1.359 million units last month.

Reporting by Lucia Mutikani Editing by Chizu Nomiyama and Paul Simao

Our Standards: Thomson Reuters Trust Principles.

[ad_2]

Source link