[ad_1]

Numbers: The cost of goods and services rose sharply again in August and left the US inflation rate at its highest level in 30 years, with all signs that price pressures would creep into next year. .

The personal consumption expenditure price index climbed 0.4% in August, the government said on Friday. It was the sixth consecutive big increase.

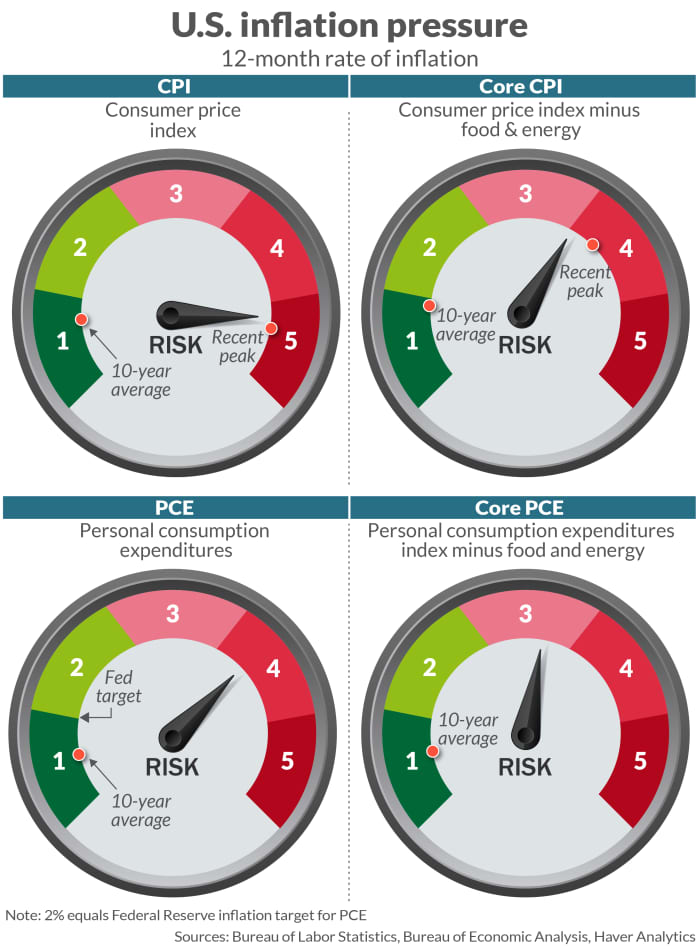

The rate of inflation for the 12 months ended August fell from 4.2% to 4.3%, the highest rate since 1991, when George HW Bush was president.

Until recently, Federal Reserve officials insisted that inflation would begin to fall back to pre-pandemic levels of 2% or less by the end of this year.

Yet over the past week, senior central bank executives have acknowledged that inflation could remain high until 2022 due to continued shortages of crucial business supplies and even labor.

Read: Powell says high inflation could last until next year due to shortages

The central bank wants average inflation of 2% per year in the long run, using the PCE gauge as a starting point. Still, the Fed is poised to let inflation exceed its target for a while to offset a period of very low inflation over the past decade.

Big picture: The highest rate of inflation in decades is suffocating families and businesses and taking a toll on the economy. The big question is how long does it last.

Most of the rise in inflation is linked to the complete reopening of the economy. A huge surge in pent-up demand has overtaken companies’ ability to keep up, especially with computer chips and other materials in short supply.

Read: Supply bottlenecks fueling US price hikes could last until next spring, ISM official says

Faced with rising costs, companies have also increased their prices. Hence the surge in inflation.

These shortages were expected to ease now, but instead it looks like it could get even worse. Fed Chairman Jerome Powell said the shortages could last until next summer.

Most economists still think the Fed is right and it will fall back to its 2% target, but it will take longer.

“Supply chain issues have caused the prices of many goods and services to increase, but some of those high prices are now starting to drop and others are increasing at a slower rate,” Chief Economist Gus said. Reap from PNC Financial Services. [T]The danger of runaway inflation is fading.

Other analysts believe that inflation could remain high for the next several years.

“I have no doubts that we will be getting closer to 2.5% inflation for an extended period,” said Joel Naroff of Naroff Economic Advisors. “By the Fed saying they’re going to average inflation, I think they’re thinking the same thing.”

Also: The Fed has bet on a future of low inflation. Here’s what could go wrong

Key details: A separate measure of inflation that excludes volatile food and energy prices rose 0.3% in August. It is known as the policy rate and is considered by the Fed to be a more reliable weather vane for inflationary trends.

The hike in the policy rate over the past 12 months has remained unchanged at 3.6%, but it has also hit a 30-year high.

The PCE index is considered to be a more accurate measure of inflation than the better known consumer price index. It follows a wider range of products and gives more weight to substitution – when consumers buy a cheaper product to replace a more expensive product.

Also on Friday, the government said consumer spending rose 0.8% in August. The increase was half as large if inflation is taken into account.

what do they say? “Even with more modest monthly inflation gains in the coming months, year-over-year increases will be high until 2022,” said senior economist Will Compernolle at FHN Financial.

Market reaction: The Dow Jones Industrial Average DJIA,

and S&P 500 SPX,

increased in Friday trades.

For now, most investors have bought into the Fed’s argument that high inflation is temporary. Bond yields mostly remained at historically low levels and DJIA stocks,

SPX,

are not far from a record, although the gains have been more difficult to achieve in recent times.

[ad_2]

Source link