[ad_1]

A smelter melts copper in Zhejiang, China.

Photo: TPG / Getty Images AsiaPac

Photo: TPG / Getty Images AsiaPac

Freshly spent a $ 1.9 trillion stimulus bill, US President Joe Biden on Wednesday turned his attention to a large package of infrastructure investments, which means the United States will need more commodities. There is only one problem: China.

America needs steel, cement and tarmacadam for roads and bridges, and cobalt, lithium and rare earths for batteries. Most of all, it needs copper – and many. The copper will go into the electric vehicles President Biden has announced he will buy for the government fleet, into charging stations to power them, and into cables connecting new wind turbines and solar farms to the grid. But when it comes to these commodities – and copper in particular – Washington is a step behind Beijing.

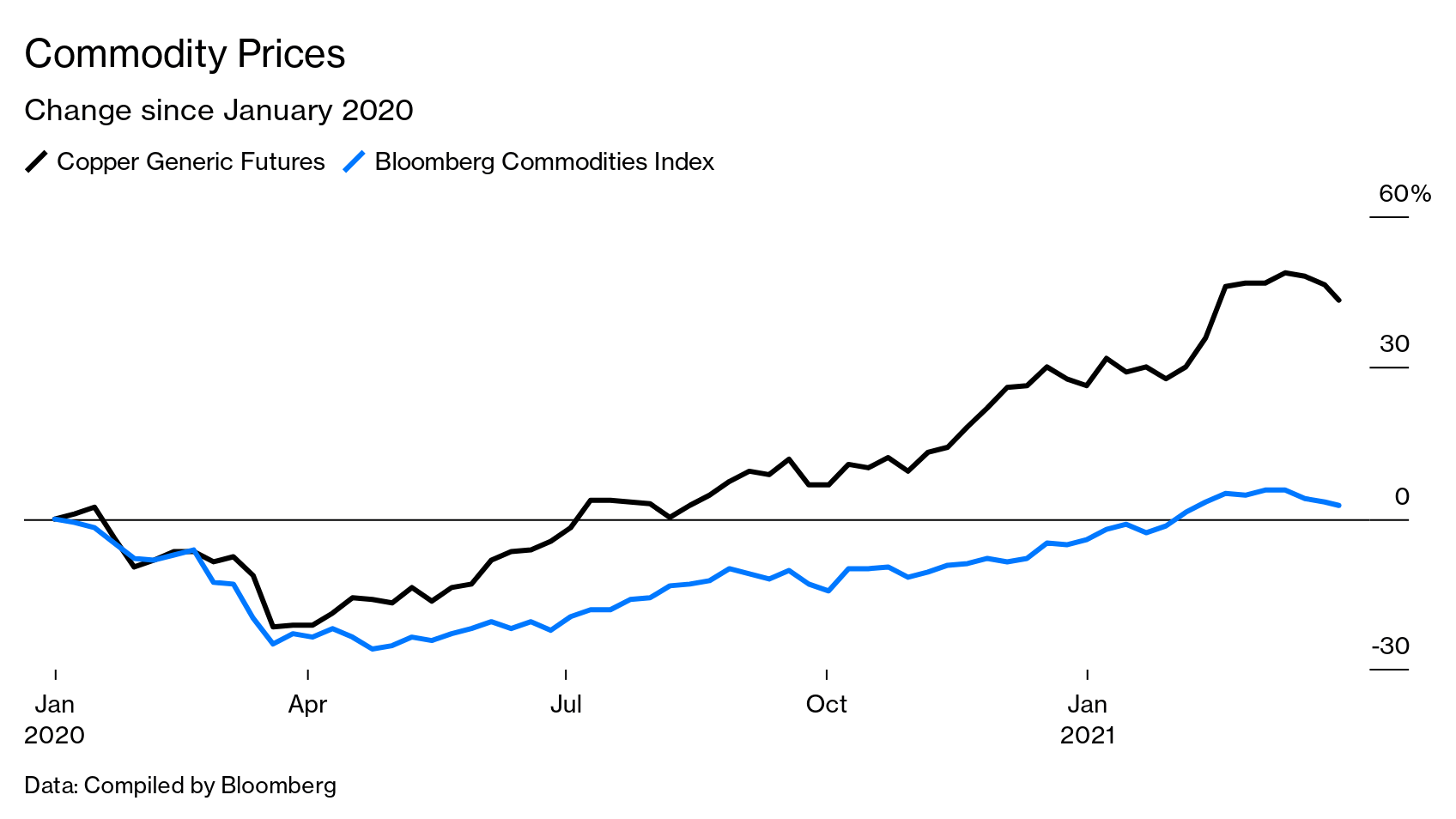

Commodity prices

Change since January 2020

Data: compiled by Bloomberg

China was the first country where the coronavirus struck, but it is also the first country in the world to start recovering from the pandemic. As the rest of the world went into lockdown and commodity prices Diving in March and April 2020, China has embarked on a buying frenzy. Chinese manufacturers, traders and even the government have approached global commodity markets as a shopaholic could approach a fire sale.

“They bought a lot last year, and I don’t think it’s just for their industrial needs,” says David Lilley, a seasoned copper trader who is the UK company’s managing director. Drakewood Capital Management. “It was also about building up the strategic copper reserves needed for their projects.”

China imported 6.7 million tonnes of raw copper last year, a third more than the previous year and 1.4 million tonnes more than the previous annual record. (The year-over-year increase, on its own, equates to the entire annual U.S. copper consumption.) Traders and analysts believe the powerful and secretive Bureau of State Reserve from China bought between 300,000 and 500,000 tonnes of copper during the fall in prices. .

It already seems like a smart job. Thanks in part to purchases from China, copper prices have doubled from their March 2020 nadir to current levels of around $ 9,000 per tonne. But some believe that copper and other commodities still have a long way to go. The combination of rebounding global growth and government largesse blew up the bulls. Wall Street analysts are enthusiastic about a new commodities ‘supercycle’ – a period of above-trend prices driven by a structural shift in demand, comparable to the Chinese boom of the 2000s or the period of global growth that followed World War II.

Oil skeptics say faster adoption of electric vehicles will inevitably mean less demand for crude. But for metals like copper, there is less disagreement. Normally, cautious traders try to outdo themselves in their forecasts of new record prices. Mark Hansen from Concord Resources Ltd., a London-based trading house, sees copper surpass its previous record of $ 10,190 to trade at $ 12,000 a tonne over the next 18 months. Trafigura Group, the leading copper trader, thinks copper goes to $ 15,000. “This is a demand shift as big as China’s urbanization,” says Graeme Train, senior economist at Trafigura.

The Chinese state has invested huge sums of money in infrastructure for two decades, so much so that the country now accounts for about half of the world’s demand for many metals. It also forced him to become smarter in his purchases of raw materials.

Chinese copper smelters meet to conduct negotiations with miners around the world. Chinese entities, many state-owned, bought mining operations everywhere Democratic Republic of Congo and Peru to Indonesia and Australia. In recent years, they have also bought international trading companies.

As for what we might call the raw materials of the future, China is also ahead of the game. It is by far the world’s largest producer. rare earths, essential in all kinds of high-tech applications. This dominates the processing of raw materials needed to manufacture lithium-ion batteries— lithium, cobalt, nickel and graphite – which are the building blocks of the electric vehicle revolution. While only 23% of the world’s battery raw materials are mined in China, 80% of their intermediate processing takes place in China, according to Simon Moores, chief executive of Benchmark Mineral Intelligence, which advised the White House on the battery industry.

In his last five-year plan published in March, Beijing showed how it intends to strengthen its system of energy and raw material reserves, in particular by holding strategic stocks. An official with the country’s reserves office laid out Beijing’s perspective on commodity security in an article published in a Communist Party magazine last year: Store a range of commodities. This includes those in short supply, those with heavy import dependence, those with large price fluctuations, and those produced in politically and economically unstable countries, the official wrote.

In the United States, this security of supply was only a peripheral concern. When Washington paid attention to the geopolitics of commodities, it focused on the oil resources of the Middle East, and even this relationship evolved as the Shale Revolution reduced America’s dependence on it. -vis of imported oil. Copper and other metals were an afterthought. While Chinese demand for copper has skyrocketed over the past two decades, in the United States it has fallen, analysts at Macquarie Group Ltd.

The proliferation of stimulus packages means that surely is about to change. While details of Biden’s infrastructure push are yet to be negotiated in Congress, consulting firm CRU Group estimates that $ 1 trillion in spending could require an additional 6 million tonnes of steel, 110,000 tonnes of copper and 140,000 tonnes. aluminum per year.

“China has been looking at vulnerabilities in its top-down supply chain for a while and increasing its strategic reserves,” said Lilley, the copper trader. “I don’t think the West even started to think about it. There is still a casualness here regarding the supply of raw materials.

Read more: China’s new belt and road has less concrete, more blockchain

[ad_2]

Source link