[ad_1]

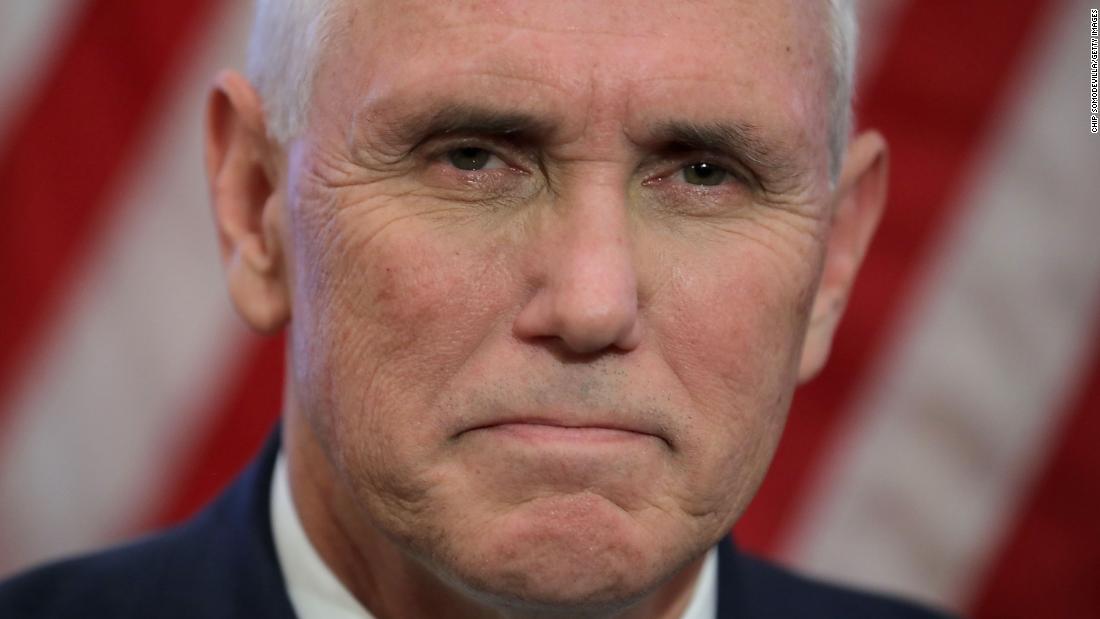

"It may be time for us to consider reducing interest rates," Pence told CNBC.

And Kudlow told Bloomberg: "This is our position.We think that a low unemployment rate can work in tandem with rate cuts."

The Fed has several tools to speed up or slow down the economy. Its most important and important tool is its interest rate setting mechanism, which affects debtor rates across the country.

When rates fall, loans become cheaper, which increases the flow of capital. But inflation can become a problem.

When rates rise, loans become more expensive, which can slow down the economy. But this usually reduces inflation.

Why would the Fed want to slow down the economy? When growth is too fast, the economy could be overheated, which could result in too high inflation. Individuals and businesses could go into debt too much, which could worsen a recession and happen faster than it otherwise would have. Bubbles can form on the stock market or in other asset classes.

Bogeyman deflation

The Trump administration says that inflation is not a concern. And that is largely correct: core inflation has fallen to 1.4% in the first quarter, which is well below the 2% target of the central bank.

In an interview with CNN's Poppy Harlow, White House chief economist Kevin Hassett on Friday refused to say the Fed should lower its rates. But he worries about the possibility that inflation will fall again – or that prices may even begin to fall, a disastrous economic situation called deflation.

"There is this risk that we can import deflation, and I think I know that my friends at the Fed are watching closely and watching closely," he said.

But Fed Chairman Jerome Powell said it was too early to declare his victory over inflation. Asked about inflation at a press conference on Wednesday, he said the decline was "transitory", noting that inflation was close to 2% for most of 2018.

"At the moment, we do not see strong arguments to go both ways," he said.

If the Fed were to cut rates now, it would not be technically unprecedented. The Fed made precautionary rate cuts outside recessions in 1995 and 1998. But growth slowed down; it's accelerating now.

Even more weird …

The administration also suggested – but not directly asked – to limit the power of the Fed.

"It may be time for us to think about this again … the fact that the Fed is looking at full employment, monetary policy and inflation," Pence told CNBC on Friday. "And instead, just looking at inflation, you would say clearly that there is no inflation here, that the economy is booming."

Pence said he had not spoken to President Trump about this idea and Kudlow said the administration was not considering imposing new rules on the Fed.

"It looks like we are focused on inflation rates," Larry Kudlow told the media outside the White House. "They might decide to lower target rates, but we are not considering any legislation on this."

Limiting the Fed would be an extraordinary change from the norms of the last century. But nothing in the management of the Fed by the Trump administration so far can be considered "typical".

[ad_2]

Source link