[ad_1]

When John Taylor begins to remember the years before the financial crisis, his fury is again felt.

As president of the National Community Reinvestment Coalition nonprofit, he warned Congress against fraudulent and predatory loans that fueled a housing bubble as early as 2000. Legislators have asked the Federal Reserve to develop rules But the crash came first.

"Thinking back now, I can feel angry about it," Taylor said, with a slight emphasis left by his education in Boston's housing projects. "Because we fought when we saw these things happen, we brought them to the attention of Democrats and Republicans, and in the end it took the economy of the country Collapse before feeling the need to do something. "

The rising crisis turned into a real crash almost 10 years ago, when Lehman Brothers filed September 15, 2008 the biggest bankruptcy in the history of the United States. and imploded after several acquisition transactions.

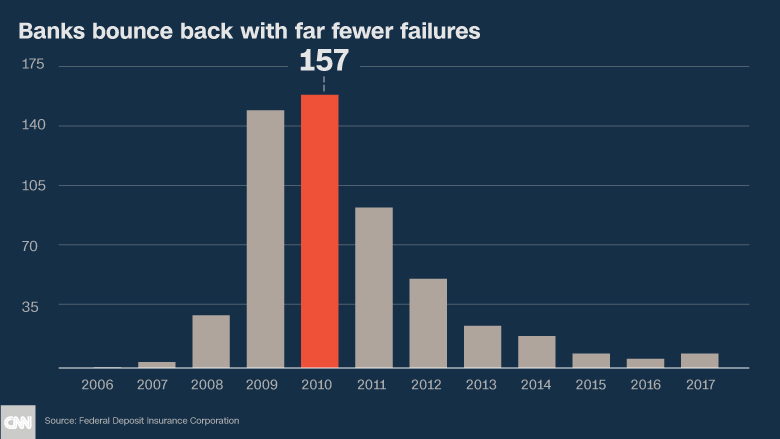

The collapse triggered a chain reaction of bank failures that required unprecedented federal action to undo.

Now that the prosperous economy is finally starting to lift some of the most depressed pockets in the US, CNNMoney looks back on the decade that followed the financial crisis and signs that something similar could again be on the horizon, as Congress and regulators begin to relax some of the rules they have put in place to resolve and prevent problems.

"We are sitting here, 10 years later, with a short-term memory that does not seem to remind us how we got into this mess," Taylor said. "We got into this mess because of the lack of regulation, and now we are talking about making banks less responsible." That makes no sense. "

The scars that remain

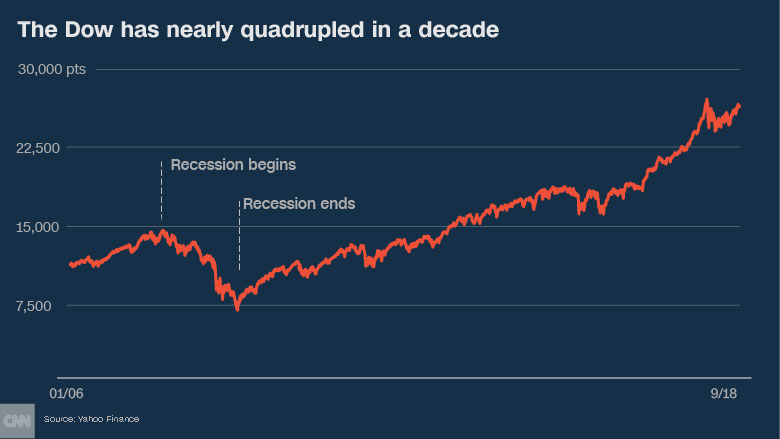

Of course, America has come a long way since the The Federal Reserve and the Treasury had to intervene to save the banking system. Corporate profits are at record highs, the unemployment rate is at its lowest in 18 years and the Dow Jones Industrial Average has almost quadrupled since its inception. Nadir from the era of the recession in 2009.

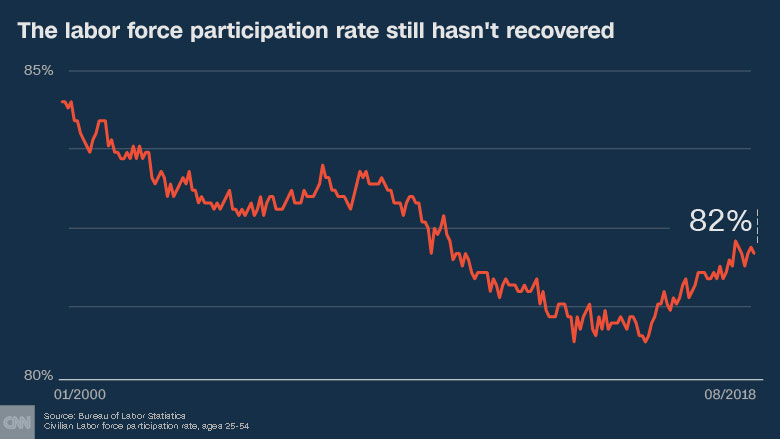

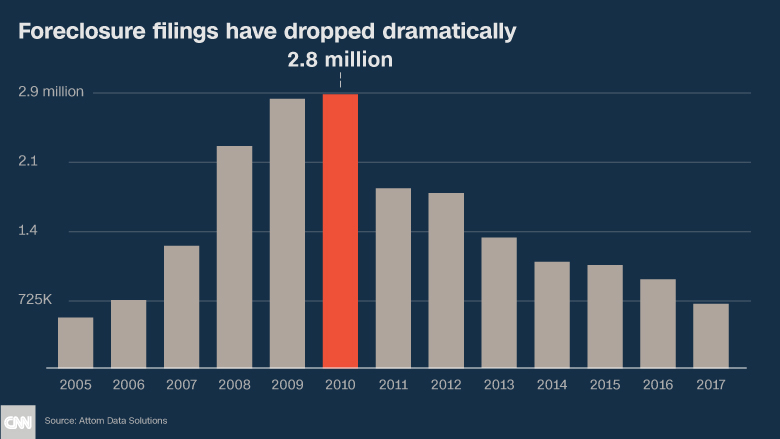

But it's still a changed country. By many parameters and for millions of Americans, the recovery must still happen. Take the home ownership rate, For example: it was not until 2017 that it stopped its long fall, as private investors bought hundreds of thousands of foreclosed homes and rented them out to their previous owners, many which they have seen their credit so badly damaged that they can never buy again. Men's participation in the workforce is still almost as low as ever, with blue-collar occupations particularly hard hit and not fully rebounding.

The recovery is thorough division by other means: geographically, with big tech centers and cities rich in natural resources booming and the rust belt is late. Depending on the level of education, people with a bachelor's degree joining the workforce faster than those who dropped out of school or only graduated from high school. And by income, most of the gains going to households are in the top 10% of the salary scale.

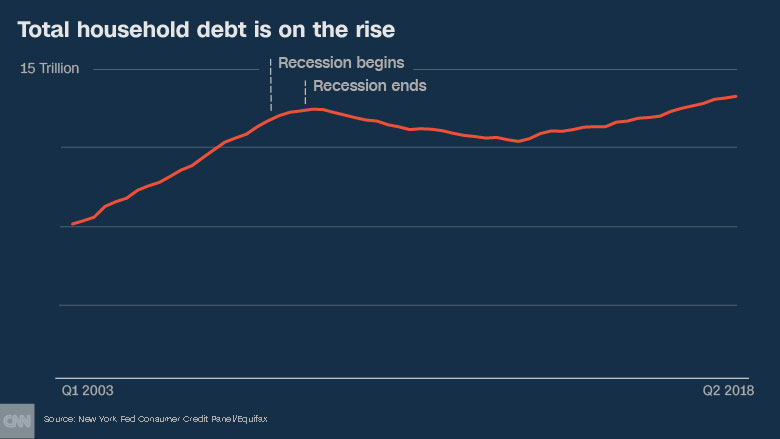

The median net worth of households remains lower than in 1998, according to the Federal Reserve, even as households contract more debt than ever before. There is also a shortage of affordable housing, a legacy of the dryness of mortgages and construction that lasted long after the end of the recession.

The memories of these difficult days seem to have disappeared from the public consciousness, just like the lessons we learned about how we got there.

Related: my road to the Great Recession

The Congress tried to answer this question by creating the Commission of Inquiry on the financial crisis, and the autopsy of the year 2011 remains excellent. His fundamental conclusion: the financial crisis was not like a meteorological phenomenon, like some bankers and regulators claims. On the contrary, it was made by man, predictable and entirely avoidable.

If only lawmakers had not eliminated legal safeguards in the 1990s, this had prevented banks from remaining small and relatively simple. If only bank CEOs had thought more critically about the complex titles they had created and negotiated with abandonment. If only the Federal Reserve had acted to stop the flow of toxic mortgages that would rot at the heart of the country's largest financial institutions – they could have saved the global economy from disaster, the commission said. found.

A missed opportunity to change the system

Even at the time of writing the commission's report, the next chapter of the recession was unfolding.

In 2009, President Obama set up a $ 787 billion stimulus package to save jobs and started home loan modification programs to help those facing foreclosure.

A year later, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 created new oversight bodies to coordinate the alphabetic soup of regulators who had shunned responsibility by acting in isolation. He also created the Consumer Financial Protection Bureau, which was explicitly charged with monitoring the misappropriation of lenders. he has instructed financial regulators to draft new rules for derivatives, credit reporting agencies, mortgage valuations, executive compensation, corporate governance and other factors that have played a role in the economic implosion.

Related: The dramatic fall of Bear Stearns and his CEO

Although most agree that the financial system is safer than before the crisis, the response has been widely criticized.

Many argue that homeowners' bailouts should have been much more generous in order to avoid new foreclosures and better stabilize neighborhoods, and that banks should have been encouraged to lend to qualified borrowers once the new measures were taken. security measures put in place.

Others have blamed Obama for not punishing leaders responsible for careless loans. Although their businesses – and therefore their shareholders – have paid hundreds of billions of dollars in fines, none of the people who manage these investment banks and mortgage lenders have gone to jail. The Inquiry Commission on the Financial Crisis itself sent eleven criminal cases to the Justice Department and none was prosecuted. Committee Chairman Phil Angelides said the lack of action had sent a message to Wall Street that the consequences for individuals would be minimal.

"I think the Obama administration has failed to hold accountable to those responsible for the wrongdoing," said Angelides. "If someone robbed a 7-Eleven of $ 1,000 and could just ask someone to pay $ 50, would he do it again? Of course they would." "

Related: banks too big to fail continue to grow

Banks spent billions of dollars to comply with Dodd-Frank, even fighting the rules as drafted, resulting in long delays in implementation. By mid-2016, 20% of the prescribed rules had not been proposed at all.

The Treasury's independent Treasury Financial Research Office, created by Dodd-Frank to serve as a rapid alert system in the event of an imminent crisis, has been significantly reduced.

More broadly, Anat Admati, a professor at Stanford's Graduate School of Business, argues that reformers have missed their chance to increase the transparency of the financial system and reduce the industry's reliance on industry. debts.

"We have not experienced a major crisis or bailout," Admati said. "But in terms of one's predisposition, I'm disappointed that relatively little or not enough has really changed."

Deregulation starts again

In early spring, after years of attempts, Republicans broke through the biggest failed Dodd-Frank regulation since the passage of the bill, with the help of 16 Democrat Senators who voted for exempt the banks The bill also frees most banks from the obligation to report loan data used by police for Discrimination and weakens mortgage underwriting standards, amidst a host of other provisions.

Meanwhile, President Trump's choices to head the federal agencies overseeing the banks have either worked for the sector, such as Chairman of the Securities and Exchange Commission Jay Clayton, or have been harsh critics of the agency they have been charged, such as the financial protection of consumers The Acting Director of the Bureau, Mick Mulvaney. They slowed down or halted enforcement and rule-making, and imposed hiring freezes, limiting their ability to pursue fraud.

Internationally, the United States has pulled out of some of its most important alliances, weakening relations with countries such as Canada, the United Kingdom and Germany, which would become indispensable in the event of a new crisis.

"The landscape of the political economy has shifted, with an increasingly weak commitment to international cooperation – ironically, the very kind of cooperation that has prevented the crisis from becoming another Great Depression", said Christine Lagarde, Executive Director of the International Monetary Fund. the week.

Related: 10 years after Lehman, Mark Carney says another crisis could happen

Add to all this an exuberant market and it again carries great risks, ranging from the increase in corporate debt to cyber threats that could cripple entire businesses in an instant. Combined with weaker tools to address financial failures, Columbia law professor Kathryn Judge is concerned that these pro-sector regulators will take action again if necessary.

"There has been a shift from security to growth," says the judge. "But if you want to have a growth-oriented system, then you have to accept that there will be fragility, how will we deal with this fragility when it becomes manifest?"

A decade later: It has been 10 years since the financial crisis shook the US economy. In one special seriesCNNMoney examines the causes of the crisis, how the country is still feeling and the lessons we've learned – and that we have not learned.

Editor 's Note: This is an updated version of an article first published in March 2018.

CNNMoney (New York) First published on September 13, 2018: 8:05 ET

Source link