[ad_1]

(Source: imgflip)

The bottom line of my retirement dividend growth portfolio is to find excellent long-term investments that I can hold for years, if not decades. I am looking for stocks that can generate generous, safe and exponentially growing revenues in all economic environments, and buy them at attractive prices.

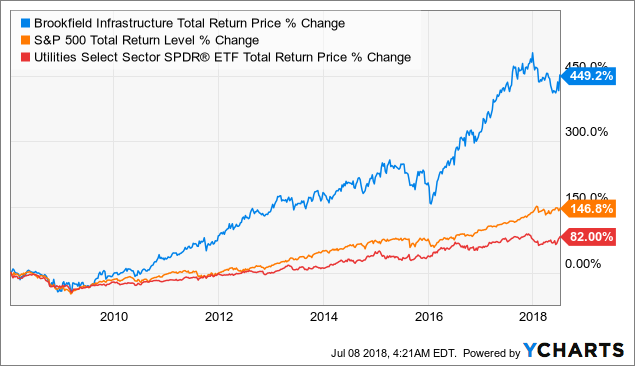

BEEP by YCharts

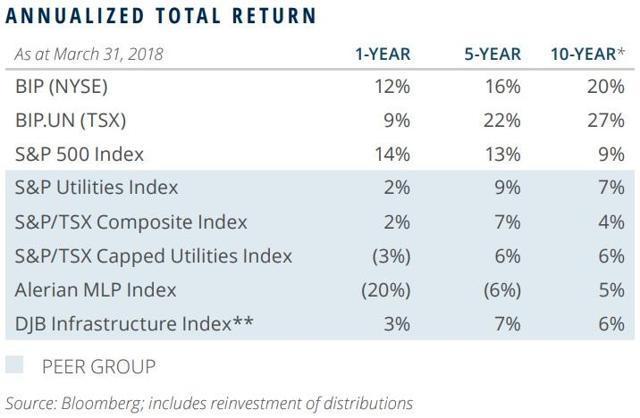

In the past, I explained why Brookfield Infrastructure Partners (BIP) is my preferred high-yield income growth investment of all time. This is not only because Brookfield has managed to crush other utilities as well as the S & P 500.

It's rather because Brookfield Infrastructure has what I consider to be a unbeatable combination of world-class management, broad moats, cash a rich asset base and many growth catalysts that should allow it to continue to generate extraordinary returns (from 12% to 15% per annum for decades to come). Let's take a look at the five reasons why I am more convinced than ever that Brookfield Infrastructure Partners is potentially the best long-term investment in high-yielding income growth in the world. One that represents a good buy today for almost any diversified income portfolio.

1. The ultimate business model on a large scale

The essence of any good investment focused on revenue growth is the basic business model. Specifically, a stable source of recurring cash flows, hopefully, from large areas of wealth that can not be easily disrupted by rivals.

Utilities are generally a great source of defense because of their defensive nature. monopolies. This means that they represent the ultimate deal of wide moat. However, the disadvantage of most regulated utilities is that they are generally highly geographically concentrated and have slow to modest growth potential.

On the other hand, Brookfield Infrastructure Partners is the most diversified utility company in the world. This creates much more growth potential than most utilities because of its ability to tap not only many fast growing countries, but also every corner of the global infrastructure market.

(Source: Brookfield Infrastructure Fact Sheet)

Specifically, Brookfield Infrastructure owns 35 assets worth $ 29 billion on five continents, including:

- ] km of power lines in North and South America

- 2,000 km of gas pipelines in South America

- 3.4 million global connections for electricity and gas

- 880,000 smart electricity meters in the United Kingdom

- 10 300 km of railways in South America and Australia

- 37 ports in North America, Europe and Asia

- 4000 km of toll roads in South America and India

- 15 000 km of pipelines in North America

- 600 billion cubic feet natural gas storage in North America

- 20 800 water and waste treatment connections

- 5,000 km of fiber optic lines in Europe

- 7,000 towers Communications in Europe

Presence in: Regulated Utilities, The transportation of energy, public transportation and communication infrastructure enable it to benefit from extremely stable and recurrent operating funds (FFO) and Adjusted Operating Fund (AFFO). This is ultimately what finances distribution, a form of tax-deferred dividend (more details on this in the section on risk).

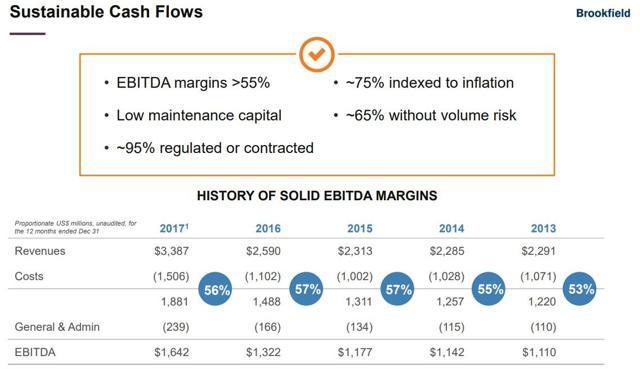

How stable is Brookfield's cash flow? Well, consider this: 95% of its FFO is either under long-term contract (up to 20 years) or in regulated utility industries. 75% of its cash flows are indexed to inflation and 65% do not present any volume risk. In addition, it operates almost exclusively with top-tier counterparties (such as regulated utilities), which means that the risk of default is very low

(Source: Brookfield Infrastructure Investor Presentation)

The infrastructure it owns means that Brookfield has high and stable EBITDA margins. This translates into a 13% return on AFFO from new investments, which is well above the weighted average cost of capital

|

Approximate weighted average cash cost |

5.2% |

|

Cash yield of invested capital |

13.0% |

|

Gross investment profit |

7.8% |

(Sources: Income Supplement, FastGraphs, Gurufocus)

For context the Most middle-income stocks (such as REIT, MLP, LP and YieldCos) are pleased to generate 2% to 5% gross return on invested capital. However, thanks to the combination of Brookfield's cash-rich assets, purchased at extremely attractive (opportunistic) valuations, Brookfield is one of the most profitable smugglers (or utilities) not only in America, but in the whole world. supplement)

That's why it has been able to generate such impressive distribution growth since its IPO in 2008 (11.4% CAGR). This includes increases even during the worst financial crisis since the Great Depression. As a result, Brookfield has been able to significantly hedge long-term management expectations of 12% to 15% annual total return.

(Source: Brookfield Infrastructure Fact Sheet)

And it is unlikely that Brookfield Infrastructure will be able to continue to generate annual total returns of 20% in the future, I am very confident that it will be able to easily reach its ambitious performance goal of 12% to 15%. This is because of its greater competitive advantage (world class management team), combined with the longest growth track of any stock I know.

2. High growth catalysts and a world-class management team

Long-term investment success requires a lot of factors, but perhaps the most important is good management. After all, investors rely on their hard-earned money to adapt to changing industry conditions, distribute their capital profitably, and ultimately ensure safe and sustainable growth.

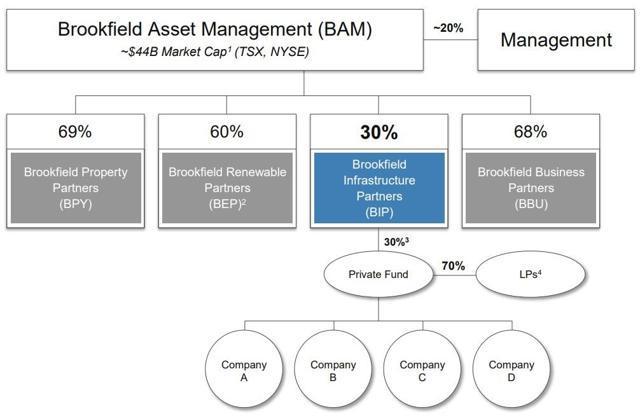

(Source: Brookfield Investor Presentation)

a limited partnership or limited partnership and is part of the Brookfield Asset Management (BAM) empire. BAM is the oldest, largest and most reliable manager of infrastructure / utilities / real estate with:

- 115 years of experience

- 28,000 employees (over 80,000 who work indirectly for this ) in more than 100 offices in more than 30 countries

- $ 285 billion in assets under management

The way it works is that BAM conducts lucrative infrastructure transactions which it gives then a reduction to BIP, under very favorable conditions. BIP meanwhile buys in these cases with capital raised from four sources:

- cash-flow withheld (60% to 70% FFO payment ratio)

- recycled capital (sales of assets at huge profits) )

- debt (mainly non-recourse), fixed rate long-term bonds)

- shares (new units sold at discounted prices)

This capital then buys high quality recurring cash flows from infrastructure and utilities that support the growth of cash flow per unit and therefore stable and secure distribution growth. Meanwhile, BAM, as the owner of 30% of BIP's limited shares, as well as the holder of its GP and incentive distribution rights, receives approximately 55% of BIP's cash receipts. BEEP. This also helps finance other profitable transactions in the future.

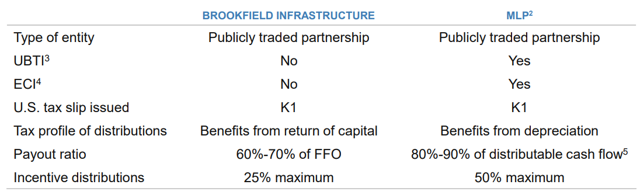

BAM also receives a basic management fee of 1.25% (on the value of the assets plus the net debt at the level of the company). In this way, BIP can be considered as similar to an MLP, BAM serving as a sponsor. However, there are significant differences with the BIP business structure.

(Source: Brookfield Infrastructure Investor Presentation)

More specifically, BIP IDRs are capped at 25%, unlike most MLPs that have 50% capitalization. have IDRs). Most importantly BAM has designed BIP to avoid UBTI, making it safe to own in retirement accounts. In fact, as I will explain in the section on risks, BIP's unique structure makes it ideal for IRA or 401 K.

What do BIP investors get for this affiliation with Brookfield Asset Management of AFFO?). How about 160 business employees who are now working for Brookfield Infrastructure full time. This includes 13 senior executives with an average of more than 20 years of experience in the industry, including in complex emerging markets.

(Source: Brookfield Infrastructure Investor Presentation)

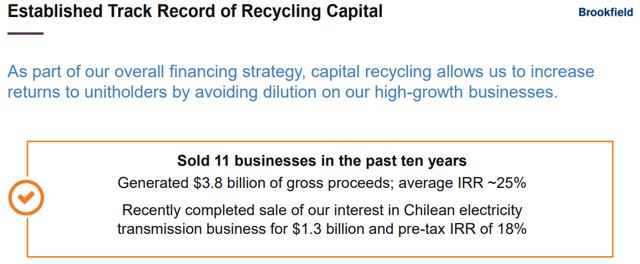

The Brookfield management team has proven to be the benchmark for profitable investing. Specifically, they opportunistically purchase heavily undervalued infrastructure / utilities, for example when a country is in a recession and valuations are low. They then develop these assets through organic growth investments, which makes them more valuable. And when the timing and opportunity are good, they are returning those assets generating annualized internal rates of return of 25% on average over $ 3.8 billion in asset sales over the past decade.

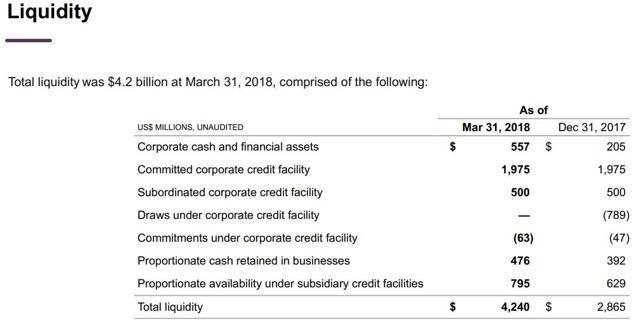

Thanks to its most recent asset sale Brookfield Infrastructure now has record liquidity of more than $ 4.2 billion.

(Source: Brookfield Infrastructure Income Supplement)

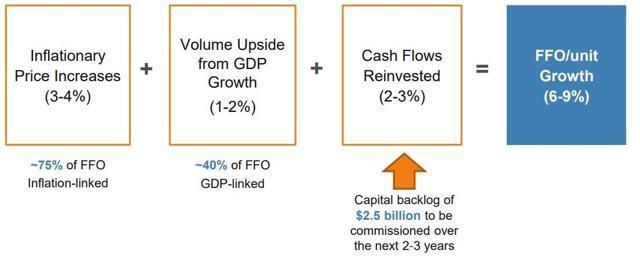

A portion of this amount is used for LP's $ 2.5 billion organic growth order backlog, consisting of expansions of two to three years. Management believes that organic growth alone is sufficient to achieve its long-term growth target of 5% to 9%, which would be among the highest in the utilities sector.

(Source: Brookfield Infrastructure Investor Presentation)

This impressive growth in distribution, combined with the current generous yield, explains why management believes that it can achieve total returns of 12 % to 15% over a long period. -term. For the context, the total return of the S & P 500 has been 9.2% since 1871.

However, the main reason for liking Brookfield Infrastructure is that the proven ability of management to achieve acquisitions highly profitable means that growth of 7% growth that investors can expect. In fact, BIP's long-term growth path is so great that the Partnership is likely to be able to achieve payment growth closer to the top (9% or even 10%), not just for the next few years, but potentially for over 50 years old.

3. Recent examples of Brookfield's long growth trajectory

In June 2018, Brookfield entered into a $ 1.1 billion agreement with AT & T (T) to acquire 31 global data centers. . AT & T will remain the primary tenant of these centers and will help provide ongoing service to more than 1,000 existing customers who currently use them (under long-term contracts). According to BIP's CEO, Sam Pollock data:

"is the world's fastest growing commodity, with exponential growth in global usage, which requires exponential growth from data centers and data centers. telecommunications, massive investments in networks to store and transmit, like fiber and telecommunications, where we have already invested and focus on the growth of our portfolios. "- Sam Pollock

BIP began to interest to data / telecoms by investing in TDF, the largest independent communications tower infrastructure company in France. This brought with him 6,700 telecommunications towers and 3,000 miles of fiber optic cables. Since then, BIP has continued to develop these data assets and is currently planning to invest $ 1.3 billion in new fiber optic lines.

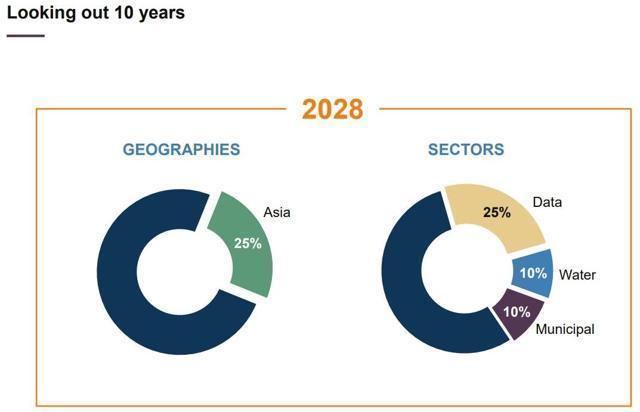

(Source: Brookfield Infrastructure Investor Presentation)

Over the next 10 years, the company expects its ongoing investments in data / telecom will enable it to reach 20% of its cash in 2028 will come from this fast growing industry. One that is likely to grow exponentially as far as the eye can see.

Brookfield 's latest transaction is the $ 3.3 billion acquisition of Canadian mid – market assets from Enbridge Inc (ENB). This means that Brookfield will acquire 19 natural gas processing and liquids handling facilities and add 2,200 miles of pipelines and pipelines to its current mid-market portfolio. According to the CEO of BIP:

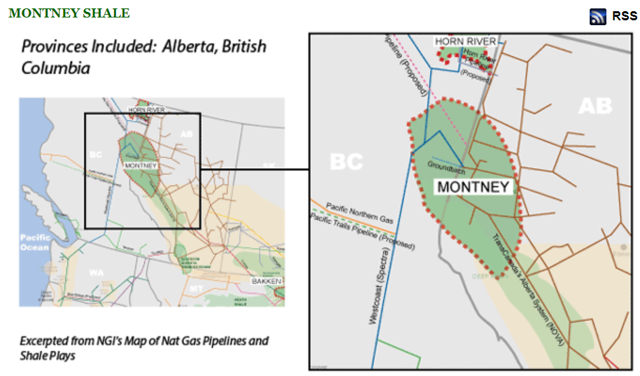

"This investment represents an excellent opportunity to invest on a large scale in one of the largest Western gas gathering and processing companies. strategically positioned to continue the development of the prolific Montney Basin. The cash flow of the business is based on a firm contract profile with a weighted average life of 10 years. – Sam Pollock

(Source: Natural Gas Intel)

The Montney shale formation in Canada resembles the hyper prolific Marcellus. / Utica Shale in Pennsylvania, Ohio and West Virginia Montney is estimated at 700 trillion cubic feet of gas and Montney helps companies like Encana (ECA) to generate 30% annual growth in production Intermediate Assets Brookfield acquires not only serve Montney, but also includes pipelines that connect it to major markets in the Pacific Northwest, West and West Canada.

Brookfield Infrastructure gets a 30% discount on this transaction in exchange for a cash payment of $ 500 million, funded by the sale of its Chilean electricity transmission business. In other words, BIP finances about 15% of the transaction, but obtains a 30% interest in the long-term and highly stable contracted cash flow that these assets represent. It's exactly the kind of love contract that makes Brookfield's close affiliation with its sponsor so valuable. The agreement will be concluded in two parts, with Canada's approval scheduled for the end of 2018 and US federal approval by mid-2019.

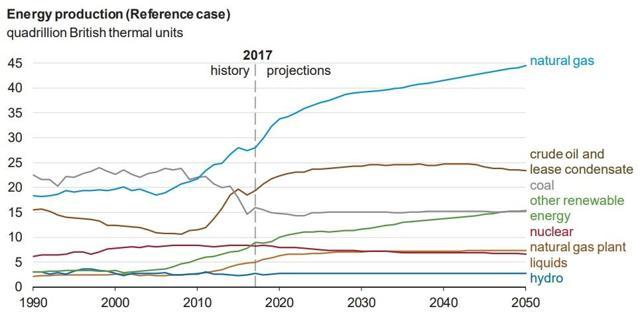

(Source: US Energy Information Administration)

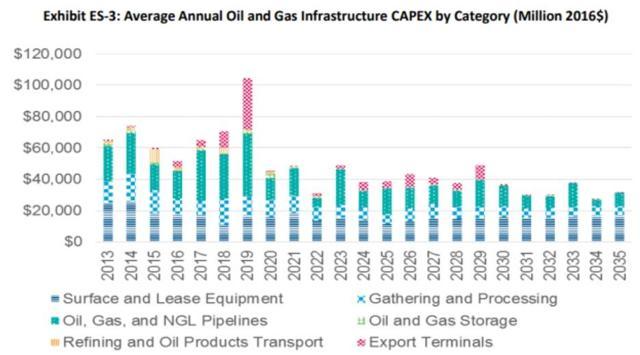

Energy infrastructure such as these intermediate assets are another Brookfield super catalysts. According to the US Energy Information Administration, US oil and gas production is expected to continue growing until 2030 and 2050, respectively. That's why the Interstate Natural Gas Association of America or INGAA estimates that by 2035, $ 791 billion in new infrastructure will be needed to ensure this increase of the production

(Source: INGAA)

and the infrastructure of the developed countries, it is another important growth market for Brookfield. Indeed, according to PricewaterhouseCoopers by 2025, the United States, Canada, Europe and Australia will need $ 5,500 billion of additional investment in the US $ 5,500,000. infrastructure. This is to improve and maintain their existing assets, much of which is between 30 and 50 years old.

(Source: Brookfield Infrastructure Investor Presentation)

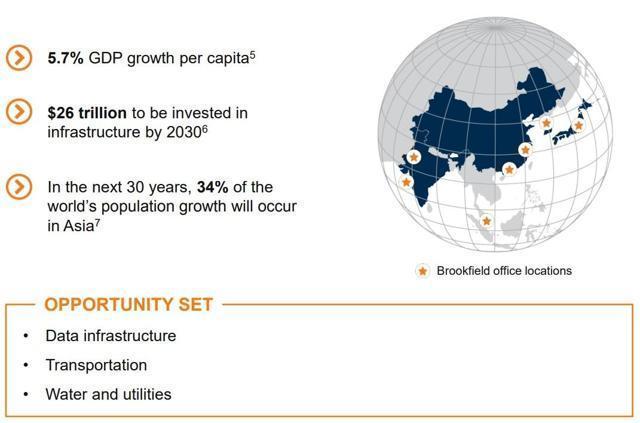

But the biggest growth potential lies in fast-growing emerging markets, such as India, Latin America and the United States. Asia. However, Asia is by far the most important price for Brookfield, with its CEO explaining:

Asia is the largest and most dynamic market in the world, with GDP growth of nearly 6%. It is also estimated that by 2030, the middle class in Asia should account for more than 150% of what it is today with nearly 3.5 billion people. With this growth and Brookfield's established presence in Asia, we will seek to allocate capital to fund the construction and maintenance of critical infrastructure in all areas where we invest. – Sam Pollock

(Source: Brookfield Infrastructure Partners Investor Presentation)

The Combination of Asia: Large Population, Rapid Population Growth, World's Best Economic Growth Rate, and Population Underway Rapid urbanization means that Asia represents the biggest investment opportunity of the BIP. LP is already investing $ 100 million in Indian toll roads, as well as Indian telecom towers and fiber optic networks.

Meanwhile, Brookfield continues to open offices in China and conduct extensive research from here to 2028, BIP expects that 25% of its cash flow will come from Asia .

And Asia is not the only opportunity for international growth. Thanks to rapid growth in all parts of the world, including Latin America and Africa, the G20 estimates that by 2040, nearly $ 100 trillion in new investments in global infrastructure will be needed . For a context that accounts for about 130% of total global GDP in 2017 and 12,400 more than total BIP investments to date ($ 7.6 billion).

This ultimately means that anyone looking for a way to take advantage of global economic growth In general, emerging markets, data and North American energy growth in particular do not need to go further than Brookfield Infrastructure Partners. Because when you take into account the massive growth of this stock and decades of growth, the result is the easiest way to generate: Generous, secure and fast growth in revenue while taking advantage of the overwhelming market returns for decades to come up. Payment Profile: The simplest way I know to achieve overwhelming returns for the next 50 years

|

Stock |

Yield |

Reprocessing Ratio AFFO |

Projected 10-Year Dividend Growth |

10 Year Projected Total Return |

|

Brookfield Infrastructure Partners |

4.6% |

65 , 2% |

5% to 9% [19659031] 12% to 15% |

|

|

S & P 500 |

1.8% |

] 40% |

6.2% ] |

8.0% |

(Sources: Income Supplement, Management Guide, Gurufocus, FastGraphs, Multpl, CSImarketing)

The most important aspect of any income investment is the payment profile which consists of three parts: yield, security, and growth potential. g term.

Brookfield's 4.6% return is not only three times that of the S & P 500, but it is also 1.2% higher than the 3.4% return. More importantly, with an AFFO payout rate of only 65.2%, this payment is extremely well covered by the stable and recurring cash flows of the LP.

Of course, given the highly capitalistic nature of this industry, the balance sheet. If a public service has dangerous debt amounts, not only can the payment be jeopardized, but its growth potential can also be limited. EBITDA / Interest

Debt / Equity

Credit Rating S & P

Average Rate of Interest

Brookfield Infrastructure Partners

4.0

5.4

41%

BBB +

4.4%

Utilities Average

3.6

5.4

49%

NA

NA

Sources: Gurufocus, Morningstar, Fastgraphs, Earnings Supplement)

Fortunately, Brookfield has a very strong balance sheet, with a leverage ratio slightly higher than the average utility and below the average of 4 , 4 of the MLPs. In addition, its very stable and robust interest coverage rate, as well as its affiliation with BAM, gives it a high investment grade credit rating. This allows it to borrow at low rates, which translates into low capital costs and very high gross monetary returns on investment.

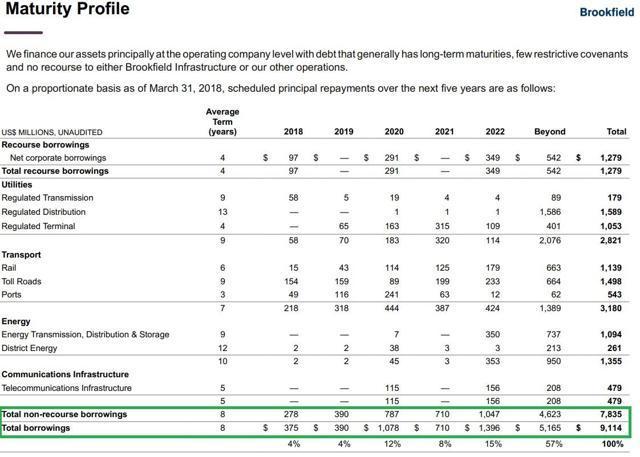

(Source: Brookfield Infrastructure Investor Presentation)

90% of BIP's debt is long-term fixed rate (average duration 8 years). This means that 57% of its debt will not come before 2023 or beyond. More importantly, 86% of its debt is active, non-recourse and self-depreciable.

This means that the BIP business ratio (of which investors are responsible) is only 0.5. The operation of Brookfield Infrastructure consists of selling long-term bonds to finance individual assets. These loans are non-recourse and self-depreciable, which means that the cash flows generated by each asset amortize the debt over the term of its contractual cash flows. In the meantime, because each asset is itself a limited partnership, it means that in the event of default (worst case scenario), borrowers can not take out Brookfield Infrastructure investors. . In other words, BIP finances its rapid growth while creating a highly reliable gap around its LP-level cash flows, thus increasing the security of its payment.

The growth rate of this payment is the ultimate reason for owning this stock. Thanks to its many and massive long-term growth catalysts, analysts believe that BIP will achieve long-term distribution growth of 9% over the next decade. Some utilities like Dominion Energy (D) and NextEra Energy (NEE) may increase their dividends faster in the next few years (10% and 13% respectively). However, no public service has the potential for global growth that would allow it to maintain a high growth in the single-digit rate of distribution over the next 10 years, let alone the next 50 years.

means a long-term total return potential of about 13.6% from the current valuation. And given the promising and exaggerated results of Brookfield Infrastructure, I would not be surprised if it could achieve slightly faster distribution growth in the coming years (10%).

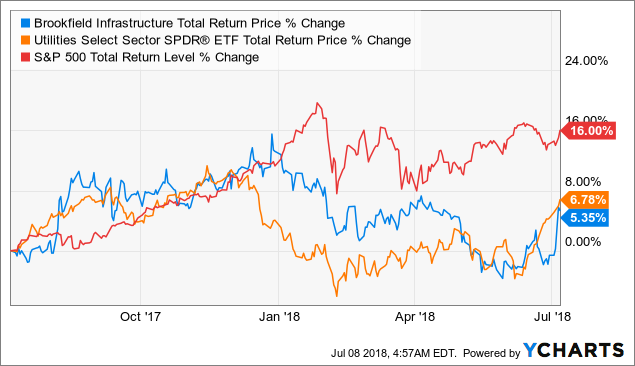

5. Valuation: Despite the recent BIP Pop is still a buy

BIP Total income data by YCharts

Until recently, Brookfield Infrastructure's share holders have had difficult months, with stable total returns over the past year. This underperformed most utilities as well as the general market. However, news of the Enbridge deal has pushed up the price of BIP (almost 6% the day the news broke out). Fortunately, the stock remains a good buy even after this short-term jump.

Now, it must be said that there is no objectively correct way to 100% value a title. There are dozens of difference methods, including those with strengths and weaknesses.

That is why I use several methods to determine if a stock of income is trading at a sufficiently high margin of safety. to argue it is worth recommending or buying for my own wallet.

The first approach is the total return potential of the payment profile. I want a stock that I recommend to have a realistic chance of beating the market. And personally, I am looking for stocks with 10 +% of total return potential. In both cases, Brookfield Infrastructure passes hands down.

The second approach I use for a security like BIP is to look at the relationship between price and cash flow. Specifically, I use it to estimate the rate of price growth. This allows me to estimate how lucky an investment has to beat expectations and achieve multiple expansion and therefore higher returns over time.

|

Stock |

P / FFO |

Implicit Ten-year growth rate |

Yield |

] Historical Median Yield |

|

Brookfield Infrastructure Partners |

12.0 |

1.8% |

4.6% [19659031] 4.5% |

(Sources: Gurufocus, Fastgraphs, Income Supplement, Benjamin Graham

On an annualized basis, BIP trades at 12 times the FFO, which is very low compared to utilities or MLPs. For example, the average MLP is currently trading at approximately 12 times cash flow. However, most MCSs do not have the potential to "buy and keep forever" from Brookfield Infrastructure since the oil and gas era will end one day, while the demand for the necessary infrastructure is eternal .

long-term (10 years) FFO / growth rate of the share of only 1.8%. That's about three times less than what the backlog of organic growth management is capable of generating. Important factor in major deals like with AT & T and Enbridge, and I think Brookfield Infrastructure will have no trouble eliminating this ridiculous rate of minimum return.

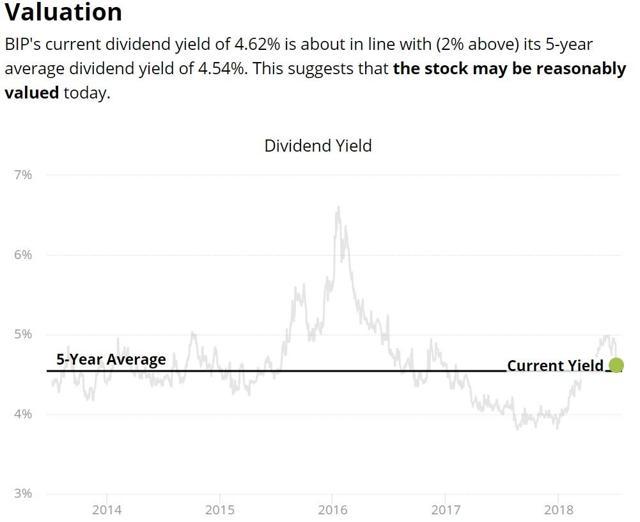

Finally, the last valuation technique I use is to compare the yield to its historical performance, both the five-year average and the long-term median value (13 years). This is for two reasons. First of all, for very stable companies like this one, the returns tend to be cyclical but to return to the average. This means that they are moving around a relatively fixed point that approximates fair value over time.

The reason I use a yield of 5 and 13 years (10 years) is rate) did not skew the results.

(Sources: Simply Dividend-Secure)

In the case of Brookfield Infrastructure Partners, the median 10-year return and the 5-year average return are all two of 4.5%. In the short term, the valuation of a stock could be shaken by the sentiment of investors. But over such long periods, only fundamentals are important. This means that the 4.5% return is probably a good indicator of the intrinsic value or fair value of BIP.

Grâce à la récente hausse de 6% de l'action, cela impliquerait que Brookfield Infrastructure se négocie à peu près à sa juste valeur. Cependant, je n'ai toujours aucun scrupule à le recommander aujourd'hui pour deux raisons. Premièrement, payer seulement 12 fois le cash-flow d'un blue chip de ce calibre, avec une croissance à long terme aussi forte et un potentiel de rendement total, est susceptible de s'avérer une décision intelligente.

De plus, selon le principe Buffett pour acheter une compagnie merveilleuse à un prix raisonnable qu'une compagnie juste à un prix merveilleux ", je suis enclin à recommander n'importe quel morceau bleu de catégorie A à la juste valeur ou mieux. Ainsi, en combinant les trois méthodes d'évaluation avec la thèse de croissance fondamentale incroyablement solide de Brookfield Infrastructure, je peux tout recommencer à recommander à n'importe quel investisseur de revenu. Bien sûr, en supposant que vous êtes à l'aise avec son profil de risque.

Risques à prendre en considération

Bien que Brookfield Infrastructure Partners soit la quintessence du sommeil la nuit ou SWAN stock, comme Charlie Munger, Buffett à Berkshire Hathaway (BRK.B), aime dire "inverser, toujours inverser". Cela signifie examiner les éventuels inconvénients de tout investissement pour comprendre son profil de risque

Commençons par examiner l'as pect le plus confus du modèle d'affaires de Brookfield, à savoir ses incidences fiscales. Bien que la société en commandite ait son siège social aux Bermudes, en raison de son affiliation avec Canadian Brookfield Asset Management, les investisseurs font toujours face à une retenue étrangère de 15% (sauf dans les comptes de retraite comme IRA ou 401K). Heureusement, les investisseurs américains sont admissibles à un crédit d'impôt dollar pour dollar pour compenser leur facture d'impôt sur les dividendes aux États-Unis. Toutefois, chaque individu / couple ne peut réclamer que 300 $ / 600 $ par année pour l'ensemble de ses portefeuilles de crédits d'impôt tout en utilisant le formulaire d'impôt simplifié 1040. Pour les chiffres au-dessus de ces limites, vous devez utiliser le formulaire 1116 plus complexe.

Une autre chose à savoir à propos de BIP est que comme il est structuré comme un LP dont les actifs sont eux-mêmes LP, il a une structure fiscale plutôt unique. Plus précisément, il utilise un formulaire K1, que de nombreux investisseurs n'aiment pas en raison de la complexité fiscale supplémentaire.

Dans le cas de Brookfield Infrastructure, la complexité est encore compliquée par le fait qu'elle est conçue pour éviter de générer un revenu imposable. Cela le rend sûr pour posséder dans les IRA ou 401Ks. L'inconvénient est que cela signifie également que les distributions de BIP sont considérées ROC par l'IRS (diminue votre base de coûts), mais aussi que la LP transmet le revenu aux investisseurs.

Cela signifie que votre base de coûts réels ne tomber par le montant de distribution (passif d'impôt différé) comme il le fait avec la plupart des MLP. La base de coût est plutôt réduite par le montant de la distribution, puis augmentée par votre part imposable du revenu de transfert du LP. Par exemple, disons que vous possédez 10 000 $ de BIP que vous achetez au prix d'aujourd'hui. Cela générera des distributions annuelles de 460 $, ce qui réduira votre coût de ce montant (passif d'impôt différé). Toutefois, si votre part du revenu imposable de LP est de 700 $, et vous êtes dans la tranche d'imposition marginale de 22% (comme la plupart des Américains) alors vous devez 154 $ IRS en impôts. Bien que je pense personnellement que la croissance du revenu à long terme de Brookfield et son potentiel de rendement total valent bien cette structure fiscale plutôt complexe et déroutante, mes lecteurs ont souvent tendance à réduire leur coût de base de 460 $. voyait cela comme la principale raison pour laquelle ils l'évitaient.

Qu'en est-il des risques pour le LP lui-même? Eh bien, il y en a plusieurs dont vous devez être conscient. Le premier est le risque de change, ce qui est l'inconvénient d'être un géant mondial des services publics et des infrastructures si diversifié. En effet, 45% des liquidités du LP proviennent des marchés émergents, avec une exposition importante au Brésil

- Brésil: 34% des FFO

- US: 22%

- Australie: 18%

- UK: 15%

- Reste du monde: 11%

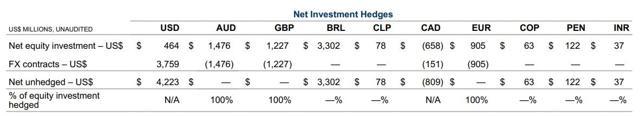

Brookfield utilise des couvertures de 12 à 24 mois pour minimiser les fluctuations de ses flux de trésorerie à l'étranger.

(Source: Supplément de revenu de Brookfield Infrastructure)

Cependant, même avec ces couvertures, 61% seulement des FFO de BIP sont libellés en dollars américains et la plupart de ses couvertures concernent des devises de marchés développés. comme la livre sterling, le dollar canadien et le dollar australien. Il ne couvre pas la majeure partie de son exposition aux marchés émergents, y compris en Amérique latine et en Inde. In Q1 2018 negative emerging market currency translation resulted in a -4.6% growth headwind.

The good news is that the Enbridge deal will increase the cash flow coming from more stable currencies. The downside is that even once the deal is concluded in 2019, Brookfield will still have potentially significant currency exposure to emerging markets, which are its largest potential growth sources.

Emerging market currencies can be extremely volatile relative to the dollar, especially during times when US interest rates are rising (as they are now). This means that Brookfield potentially faces growth headwinds because its emerging market revenue might translate into less USD when it comes time to report earnings and pay its distributions. Fortunately currency fluctuations tend to be mean reverting over time (cancel out) and as emerging market economies develop their currencies tend to become more stable. And thanks to its low payout ratio any potential short to medium-term growth headwinds created by currency volatility are unlikely to threaten the payout's safety, just its potential growth rate.

Finally we can't forget that there is a lot of execution risk that comes with owning, building, and investing in global infrastructure. That includes both in emerging markets and developed economies.

For example management needs to be able to bring its organic growth pipeline online in a timely fashion and on budget. However, volatile input costs such as steel prices (a global commodity) can end up increasing project costs. And regulatory challenges can result in costly delays that mean that cash flow from its backlog might be late. This can impact its short-term results and potentially result in slower than expected payout growth (lower end of guidance).

And of course when dealing with emerging market infrastructure there is even more complexity. Brookfield has the best track record of successfully navigating the byzantine regulatory environment of emerging market bureaucracy. However even they can at times be tripped up by delays in permits, deal closings, and sometimes outright cancellations. For instance, in 2017 Brookfield attempted to acquire partial ownership in 40,000 telecom towers in India from Reliance Communications. However that deal was ultimately contingent upon Reliance Coms merger with Aircel, which was delayed by regulators long enough to kill the deal. As a result Brookfield's purchase fell through as well.

This shows that, while the LP's growth potential in countries like India and China are enormous, politics, regulations, and bureaucracy can end up creating increased complexity that makes perfect execution impossible.

Bottom Line: Brookfield's Latest Deals Mean The World's Best High-Yield Income Growth Stock Just Keeps Getting Better

While no stock is actually perfect, especially for all investors, Brookfield Infrastructure Partners is the closest candidate I've yet found. The LP's combination of: world class management, a wide moat, cash rich business model, and several mega growth catalysts, mean that it should easily be able to generate market crushing returns for decades to come.

Brookfield's latest two deals, tapping into the megatrends of global data growth and North America's epic energy boom, is a clear sign that Brookfield's growth thesis as strong as ever. And while the price is up recently, at today's valuation I still consider BIP a good buy for almost any income investor looking to enjoy: generous, safe, and fast growing payouts for the foreseeable future.

Disclosure: I am/we are long bip, enb, D, T.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link