[ad_1]

(Source: imgflip)

Long-time readers know that the main strategy of my high yield, income growth retirement portfolio is to buy stocks when they offer the best combination of:

- maximum safe return (including during a recession)

- potential for rapid growth of the long-term dividend (usually double-digit)

- large assessments (high safety margin)

So many people might be surprised that I recently bought a share of Amazon (AMZN). I also plan to devote the majority of my dividend income to a position of approximately one share per quarter (as long as its fair value or less).

Has the Sensei dividend gone crazy? Buy a non-dividend-paying growth stock after what is arguably one of the most epic rallies in the history of the market?

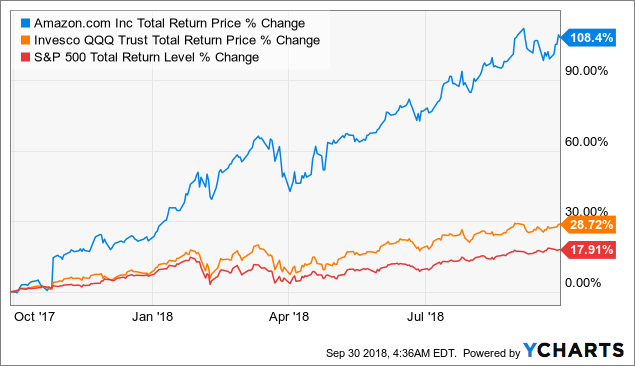

AMZN Total Return Price by YCharts

Whoever saw Amazon increase 33 times in value and crush the S & P 500 and Nasdaq, which is full of technology.

In fact, while I'm still attached to the principles of investing in long-term revenue growth, there are six reasons why I consider Amazon to be a key player in growth and buying at home. long term. The one that should generate about 20% of total returns in the long term, which will make it a better market in the foreseeable future. Let's see what these reasons are, including why I consider the stock as a good buy today; even at the price of almost record action today.

1. Hyper Growth engine continues to fire on all cylinders

Today, Amazon has about 400 million users worldwide, including over 100 million Premium members. This rapidly growing user base has allowed it to become one of the best hyper growth stories on Wall Street. This includes the following growth rates over the last five years:

- Active users: 14% CAGR

- physical and digital sales: 25% CAGR

- sales to third parties: 31%

In the first half of 2018, Amazon's hyper-growth engine continued to run at full speed. This includes more than 40% growth in total turnover and more than 3 digits

|

Metric |

2018 first half results |

|

Increase in income |

41.1% |

|

Growth of cash flow from operations |

152.7% |

|

Growth in net income |

352.0% |

|

EPS growth |

346.0% |

(Sources: publication of results, Morningstar)

The most important indicators to focus on are revenue growth and operating cash flow and earnings. Indeed, Amazon is legendary for its willingness to reinvest its cash flow in the growth of its business. This results in extremely volatile profits and EPS.

And, of course, what really matters is the long-term fundamentals and, in the last 12 months, Amazon's earnings and bottom-line results have been excellent.

(Source: Amazon Revenue Presentation)

The company has managed to increase its revenues by 39% year-on-year, to more than $ 208 billion. Sales growth of 39% on a $ 150 billion basis is indeed impressive and is reminiscent of the year of extreme growth for Apple (AAPL). In addition, the company, which was once a simple American company, is now completely international with 30% of its sales abroad (mainly online retailers, but also Premium customers). But, of course, the value of an action ultimately depends on its bottom line, which best fits Amazon's operating profit.

(Source: Amazon Revenue Presentation)

In its online retail business, Amazon has been able to increase its economies of scale, created by decades of building one of the world's largest logistics and distribution systems. That's why its North American business is seeing its operating income grow much faster than its sales. This should continue and help to increase the company's long-term operating margins.

On the international front, Amazon continues to generate losses on its online sales, but note that operating losses down 32% over the past year. This shows that Amazon is poised to achieve long-term profitability abroad, which alone represents decades of potential growth.

But, of course, the show's star is, as always, the company's cloud computing company, Amazon Web Services or AWS. This is the second most successful business of the company and the second most profitable. Advertising is the fastest and most profitable activity (more on this in a moment).

(Source: Amazon Revenue Presentation)

|

Segment |

T2 operating margin 2017 |

T2 2018 operating margin |

Change |

|

North America |

1.9% |

5.7% |

+ 3.8% |

|

International |

-6.3% |

-3.4% |

+ 2.9% |

|

AWS |

22.3% |

26.9% |

+ 4.6% |

(Source: Amazon Revenue Presentation)

Note that Amazon's operating margins are improving at an impressive rate. However, the margins of AWS are not by far the highest, they are also growing rapidly.

The improvement in the company's profitability is due to its incredible ability to integrate its various services into a unified ecosystem. This gives it a wide gap and a stronger pricing power. As a result, the value-oriented company can continue to gain market share while increasing profitability.

But, if Amazon's short-term growth is great, it's ultimately the company's incredible long-term growth path that makes it an indispensable stock to buy and keep.

2. A massive optionality creates a very long growth track

The epic growth of Amazon is due to its ability to innovate and maximize what are called options. It means entering new markets by offering new products and services that can be integrated into your ecosystem. This allows him to leverage his massive investments in ever better services (by locking his user base), while increasing his profits faster than his income.

AWS is by far the biggest opportunity for long-term growth, especially in terms of profits. Amazon was one of the pioneers in this sector, with the launch of AWS in 2006. Today, the Gartner analyst firm estimates that Amazon's cloud computing capacity is four times that of the top 14 cloud providers combined.

Estimated size of the global cloud computing market

And given that the global cloud computing market is expected to more than double between 2017 and 2021, reaching more than $ 300 billion, this bodes well for AWS 'growth prospects.

Indeed, the early launch of cloud computing by Amazon has given it a considerable advantage, with a global cloud market share estimated at 34% today. The dominance of Amazon in the cloud is largely due to the significant network effects created by its ecosystem. For example, Amazon has facilitated the migration of a company's database to its cloud platform through its AWS database migration service. As a result, more than 80,000 corporate customers have done so. This is partly because Amazon is never resting on its laurels but is constantly improving its offering in the cloud with artificial intelligence or more and more advanced capabilities based on AI.

In the first half of 2018, AWS added 800 new services and features to its platform. As more companies migrate to AWS, more data from Amazon must power its machine learning algorithms, which can then improve at an exponential rate. Coupled with an ever-expanding software suite on its cloud platform, Amazon is poised to create an iOS-like "walled garden" around its fast and growing cloud client base. profitable.

However, in the medium term, investors should be particularly excited about Amazon's growing advertising sector, whose sales surged 129% in the second quarter to $ 2.2 billion. This represents an $ 8.8 billion track representing about 4% of current sales.

The key to Amazon's advertising success lies in its knowledge of the shopping habits of its customers, based on AI. According to Forrester Research, Amazon's search capabilities in retail have begun to reduce Google's market share in the areas of research and advertising. Indeed, 55% of all online product searches in the United States take place on the Amazon site and generate converted ads at a rate 3.5 times higher than Google. This actually means that Amazon offers advertisers much more for their money than Google or even Facebook.

Now awarded, Alphabet (GOOG) (NASDAQ: GOOGL) and Facebook (FB) remain the dominant names in online advertising, with respectively 37% and 20% market share, according to the consulting firm eMarketer. Amazon's advertising market share is 4% today, but is expected to reach 7% by 2020, which will make Amazon the third largest online advertising agency in the world. world.

More importantly, because of its higher conversion rates, Amazon's advertising activity is much more profitable than that of Google or Facebook. According to Piper Jaffray, Amazon's operating margins in advertising are 75%. This is relative to the operating margins of Facebook and Google of 44% and 28%, respectively. Amazon's best performing advertising margins are based on the fact that it is able to exploit its fixed costs in many of its interconnected businesses. It also means that, along with Amazon's advertising revenue growth, its operating profit and cash flow will increase, potentially resulting in hyper growth rates similar to those of the past. Think it's impossible? Well, consider this.

According to Michael Olson, an analyst at Piper Jaffray, by 2021, Amazon 's only advertising revenue could rise to $ 16 billion, against a profit from operations. $ 15 billion for AWS. This means that in three and a half years, advertising could be the biggest source of profits for Amazon. It also means potentially $ 31 billion in operating profits from only its two largest cash cows. As a reminder, today, the company's total operating income (on an annualized basis from record-breaking second quarter results) stands at $ 11.9 billion. Thus, advertising and AWS could potentially triple Amazon's total operating profit in less than four years. And that does not even count his other businesses like Prime or Retail.

Amazon's seemingly endless ability to penetrate and rapidly dominate large and profitable markets is why analysts expect the company's profits to continue to climb at a fast pace. . Not just for a year, maybe five, but for the next decade.

|

Time range |

Estimated growth of BPA (CAGR) |

|

1 year |

46.5% |

|

5 years |

45.9% |

|

10 years |

52.9% |

(Sources: Yahoo Finance, FastGraphs)

Now, these long-term EPS growth forecasts should always be considered with a grain of salt, as they are only rough estimates based on spreadsheet models. Personally, I model a much more conservative 10-year EPS growth (about 20% to 25%) or less than half the consensus of analysts.

But, even though my much more conservative growth estimates are accurate (Bezos could easily prove me wrong), then Amazon will likely remain one of the fastest growing companies in America. It's thanks to so many worlds to conquer. But such conquests are expensive, which is why Amazon invests so much in its activities.

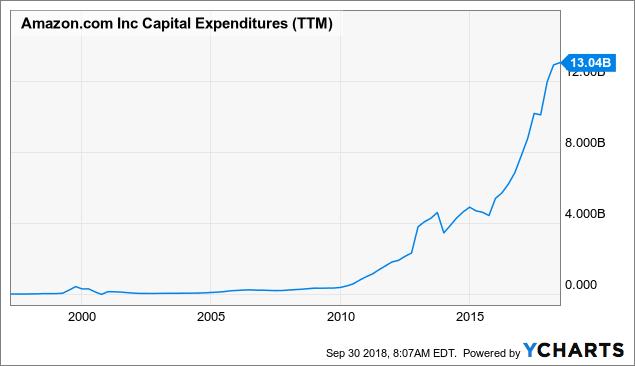

AMZN Capital Expenditure Data (TTM) by YCharts

Fortunately, Amazon's record is strong enough to allow it to continue to wage its multi-frontier dislocation war. In fact, Amazon has $ 27.1 billion in cash and $ 24.6 billion in long-term debt alone.

|

Company |

Debt / EBITDA |

Interest coverage ratio |

S & P credit rating |

Average interest rate |

Return on invested capital |

|

Amazon |

0.9 |

17.5 |

AA- |

5.0% |

36.4% |

|

Average of the industry |

2.5 |

27.5 |

N / A |

N / A |

N / A |

(Sources: Morningstar, Gurufocus)

This means that Amazon's leverage ratio (debt / EBITDA) is well below that of most of its peers. That's why it has a very good credit rating and is able to borrow at interest rates seven times lower than its return on invested capital.

The bottom line is that Amazon has one of the best long-term growth prospects of any company I know. More importantly, it has the financial resources and balance sheet needed to compete successfully and even dominate high-margin markets such as cloud computing and online advertising. But what fascinates me the most in the long-term future of Amazon, it's not his physical activities, but his advance in software. This could potentially lead the company to become a leading player on even more markets in the future.

3. A leading position in AI means that Amazon has a head start in all the markets it wants to enter

The incredible faculty of Amazon is the key to breakthrough more and more markets in the future. But success in these markets will depend on its ability to substantially reduce costs in order to create the best value proposition for consumers.

The reason I'm so confident that Amazon will succeed is its huge lead in cloud computing. I expect that Bezos will use this to make Amazon one of the leading names in artificial intelligence, which will be essential for future competition in almost every country. sectors.

Let's take physical retail as an example, especially grocery stores and convenience stores. Bloomberg announced that Amazon plans to massively expand Amazon Go stores in the coming years:

- 1 store in early 2018

- 4 open now

- 10 stores by the end of 2018

- 50 stores by the end of 2019

- up to 3,000 by the end of 2021

Amazon Go stores are convenience stores without boxes without payment lines. You connect to a phone application, then a multitude of sensors, cameras and artificial intelligence algorithms follow what you put in your cart. You leave and Amazon bills your account. This new store format is nothing short of revolutionary and has the potential, once perfected, to include thousands of items, to change the game in the world of grocery stores (a company to the shelter of the recession).

According to analyst Brian Nowak of Morgan Stanley, opening 3,000 Go stores would cost between $ 500 and $ 3 billion to Amazon, which is a drop of water for a company with resources financial resources of Amazon. Combined with the acquisition of Whole Foods in 2013, worth $ 13.7 billion (with 460 physical stores), this could one day allow Amazon to become one of the best grocers in America.

This is especially true now that Amazon integrates delivery within 2 hours via Prime Now. Basically, this means that even if 3,000 Go stores do not move the needle for Amazon in terms of revenue or earnings growth, this represents a huge future potential. Specifically, this Amazon could eventually become:

- the biggest online retailer (is already)

- third online advertiser (already on site)

- the largest cloud computing company (already completed)

- third largest grocery retailer (behind Walmart (NYSE: WMT) and Kroger (NYSE: KR))

- one of the largest brick and mortar retailers

- the second largest video streamer in the world (underway from here 2022)

The bottom line is that Amazon's expertise in data collection, processing, and analysis gives it tremendous power not to break through, but even to dominate many large, potentially highly profitable markets.

But the options and the long-term potential do not make sense without a world-class management team charged with overseeing the construction of such a complex empire. Fortunately, Amazon is a company run by its founder. One whose CEO, Jeff Bezos, is nothing short of a mad genius. In fact, I consider him one of the best capitalists to have ever lived.

4. First day of business culture and incredible leadership of Bezos

Amazon started as an online book retailer and, over the years, has become the "all store". But under the firm hand of this crazy genius Jeff Bezos, he went from a mere retailer to a giant of advanced technology (cloud computing), a media company (online streaming), an advertiser and a grocer .

This highlights the incredible faculty created by the company's "first day" business culture. The first day means that Amazon is perpetually in startup mode, without ever resting on its laurels, lest someone disturbs it.

The outside world can push you to Day 2 if you do not want or can not quickly adopt the most prominent trends. If you fight them, you are probably fighting for the future. Kiss them and you will have a favorable wind. "- Jeff Bezos

That's why Amazon is trying to disrupt all other sectors, finding ways to provide products and services that will delight its users better than anyone else. Few companies are as willing to experiment and fail as Amazon. In fact, the company has tried in many areas, including in the following areas:

- Beyond Groupon (GRPN), by partnering with LivingSocial, which was later purchased by Groupon after the failure of the transaction and by which Amazon has significantly reduced its efforts.

- Mobile Payments, which Amazon has attempted to dominate, not once, twice, but three times, through its Wallet, Local Register and WebPay services, intended to tackle PayPal (PYPL) solutions and Square (SQ). In 2016, all three attempts were closed.

- In 2015, Amazon launched in the online travel industry, targeting Expedia (EXPE) and Priceline (NASDAQ: BKNG). The effort was deployed in 35 cities but was halted six months later.

- Amazon has targeted GrubHub (GRUB), with online food shipments, but GrubHub still controls 50% of the market, compared to 11% for Amazon.

- In 2015, Amazon's focus is on Etsy (ETSY) and the household products sector. Thanks in part to what an analyst calls a "dictatorial platform exercising almost total control over the sales process, thus depriving sellers of any autonomy", Etsy sales continue to climb (20% this year and 18% next year).

- The Fire Phone 2014, so bad that it would not even be sold for $ 0.99 on contract.

But Bezos has a VC mind, in Silicon Valley, which means it only takes one experiment to successfully change the rules of the game. That's why the visionary founder of Amazon always adopts a perspective to long term growth. In 2017, Bezos told an audience in Washington DC "I ask everyone not to think within two to three years, but to think within five to seven years."

The Amazon Echo Home Speakers are a perfect example of this innovative and experimental nature. For my part, I was rather skeptical about Echo speakers when Amazon introduced them. I thought it probably would not be a switchman for the company. However, Amazon is not trying to sell hardware, but to become the leading software provider for future smart homes. That's why its Echo speakers are run on Alexa, its AI-based platform that is now capable of performing 45,000 tasks.

And as for smart speakers not constituting a great growth opportunity, I must admit that Bezos has proven otherwise. Indeed, according to Nielsen (NLSN), the rate of adoption of smart speakers in the United States rose 2% in the second quarter of 2018, rising to 24%. It means that Americans are adopting this technology. And thanks to Amazon who invented this market, it now dominates the market share of home loudspeakers.

And remember that Amazon perfectly masters the cross selling and integration of its ecosystem. Alexa powered home speakers are not meant to drive hardware sales, but to allow customers to stay in their ecosystem, especially with a stronger premium subscription.

Speaking of Prime, we can not forget the incredible power of profit growth that this represents for society. Prime went from a loyalty program offering free and unlimited shipping within two days (on over 100 million items today) to today, offering its subscribers no less than 29 distinct benefits.

(Source: Amazon.com)

The genius of Prime is double. First, by bundling more and more convenient services and features, including a free 2-hour delivery on Prime (50 global cities), Amazon Prime is well worth its annual price of $ 119 / year for US members. It's less than $ 10 a month, which is worth getting paid for free and fast shipping. Take into account streaming services, including Prime Video, which is increasingly impressive (22 Emmy nominations for Amazon exclusives), and you'll understand why Amazon Prime now has more than 100 million members. Although not all are US members (lower prices in other countries), some are students who also pay less. But the fact is that Prime is now a source of extremely stable and recurring revenue.

Morgan Stanley (MS) estimates that core members spend about 366% more per year than non-core members. Core members are expected to constitute 51% of US households by the end of this year. This means that as Amazon's retail business becomes more efficient (and its margin increases), it should be able to generate strong growth in net income and net income for the period. decades. More importantly, as Prime becomes more and more efficient (new services and more exclusive Premium Video content), the company will likely be able to steadily increase its subscriber prices, while maintaining low cancellation rates.

But to give you an idea of the current size of Prime and its size, consider these estimates:

- 70% of Americans earning more than $ 150,000 have a premium membership

- Between 2016 and 2018, the number of international subscribers Amazon Prime has increased by 56%, according to estimates.

- By the year 2022, an estimated 178 million total number of subscribers to Prime Video (Amazon would be the second largest broadcaster in the world behind Netflix (NASDAQ: NFLX)).

But the strong growth of Prime should not stop by 2022, far from it. According to Citi analysts, the number of global premium subscribers is expected to grow from 35% to 40% of the CAGR over the next decade. potentially 275 million members by 2029. Citi estimates that by then, 80% of US households will be Prime customers and that Prime alone will generate $ 633 billion in gross sales. That would mean that in a decade, Amazon would probably become the largest retailer in the world.

And remember that retail sales are expected to become a smaller part of its revenue and its profit stream in the future. Indeed, the fastest growing companies in the company are also its largest margin. Here are the estimated growth rates over five years (up to 2022) of different Amazon companies, courtesy of Morningstar's Joe Gemino:

- physical stores: 9% CAGR

- Online Detail: 13% CAGR

- third-party seller services: 26% TCCA

- AWS: 33% (with an operating margin up to 30%)

- Subscription Services (Bonus): 37% TCCA

- Advertising: 66% CAGR

- Overall sales growth of the company: 23% CAGR

- Overall operating margins: 8% (vs 5.6% in Q2 2018)

- Overall growth in the company's operating profit: 33% of TCCA

Given that Amazon's fastest growing businesses also make up its highest profit margin, operating profits should enable operating profits to grow 43% faster than revenues for the next five years. But more importantly, at least from a long-term investor's point of view, this means that Amazon is likely to become one of the best dividend growth stocks in the world.

5. One day, Amazon will become a big dividend growth stock

While today, Amazon is a stock of pure growth, I hope someday to become a growth stock with considerable dividends. Of course, it will take several decades, probably when Bezos will be gone and the company will no longer have any opportunity for growth. What am I based on? Well, Apple was once a pure growth story, and under Steve Job it was known to keep his money and refuse to pay a dividend. But finally, when his free cash flow has grown enough and he has started paying a modest dividend, which has recorded double-digit growth every year since 2012.

|

Projected FCF (net leasing costs) TTM |

2028 |

2038 |

2048 |

2058 |

|

$ 4.1 billion |

$ 25.4 billion |

$ 102.8 billion |

$ 266.6 billion |

$ 434.3 billion |

(Source: author's calculations)

I expect the same from Amazon, once he's short of worlds to conquer. This is based on what I consider to be cautious growth assumptions for free cash flow, which include the company's significant leasing expenses:

- FCF growth in the next 10 years: 20% TCCA

- FCF Growth 2028 to 2038: 15% CAGR

- Growth from FCF 2038 to 2048: CAGR 10%

- FCF Growth 2048 to 2058: CAGR 5%

Note that Amazon reaches better scales and is rapidly expanding its higher margin business over time, these numbers could easily be cautious. Even assuming a slowdown in growth over time, I hope that Amazon will eventually generate a large free cash flow that will allow it to return capital to its shareholders through redemptions and dividends.

So, my purchase of Amazon in 2018 is actually a long-term dividend strategy. It's a map created around the age of 50 that means that in half a century, Amazon's share of dividends could fund a comfortable retirement with a modest number of shares bought decades ago.

6. Estimate: Believe it or not, Amazon is currently undervalued at around 9%

AMZN Total Return Price by YCharts

Amazon is frequently touted as one of the best examples of "bubble stock". Since stocks have more than doubled over the last year, it's understandable.

On the basis of many common evaluation measures, Amazon seems indeed overvalued, even obscene.

- Ratio TTM PE: 158.7

- PE ratio forward: 73.0

- Implied 10-year EPS growth included in equities: 32.3%

- Price / FCF: 125.6

- Price / tangible book value: 46.3

- TTM PEG report: 3.5

- PEG ratio forward: 1.6

Les actions enregistrant une croissance du BPA à long terme d'environ 32% (sur la base du BPA à terme prenant en compte la réforme fiscale), de nombreux investisseurs considèrent que le prix payé par Amazon est parfait et donc massivement surévalué.

Alors, comment un investisseur de valeur comme moi peut-il justifier l'achat d'Amazon à un coût de 2009 $? Parce qu'évaluer ce qui reste essentiellement une start-up, avec ce type de potentiel de croissance à long terme (connu et inconnu), est bien plus complexe que ne le permet aucune mesure. Ainsi, lorsqu'il s'agit d'évaluer Amazon, je me tourne vers le modèle de flux de trésorerie actualisés à trois étapes de Morningstar.

Les modèles DCF estiment la juste valeur en fonction du taux actualisé de tous les flux de trésorerie futurs. Théoriquement, ils constituent l'approche d'évaluation la plus pure et la plus précise. En réalité, ils sont limités par la nécessité de faire de nombreuses hypothèses de croissance lissées sur des décennies (techniquement, à jamais). Ils peuvent également être volatils en fonction du taux d'actualisation que vous utilisez (votre taux de rendement cible), ce qui est différent pour tout le monde.

Toutefois, si je pense que le DCF de Morningstar est potentiellement un excellent outil d’évaluation pour Amazon, c’est parce que ses analystes sont axés sur les fondamentaux à 100% à long terme. Morningstar ne s'embarrasse pas d'objectifs de prix sur 12 mois. Ses analystes utilisent plutôt des hypothèses plus conservatrices que la plupart des analystes (ou de la gestion d'événements elle-même) pour tenter d'estimer la juste valeur d'une action.

|

Morningstar Estimation de la juste valeur |

Cours de bourse actuel |

Remise à la juste valeur |

|

2 200 $ |

2 003 $ |

9% |

(Source: Morningstar)

Après avoir étudié les hypothèses de leur modèle DCF (énumérées précédemment), je les considère comme réalistes et me sens donc à l'aise avec leur estimation du prix à la juste valeur de 2 200 $. Pour une entreprise de classe mondiale comme Amazon, je suis plus qu'heureux de payer la juste valeur sous le mantra Buffett selon lequel "il est préférable d'acheter une entreprise merveilleuse à un prix raisonnable plutôt qu'une entreprise équitable à un prix exceptionnel". Avec Amazon maintenant à environ 9% sous-évalué, je le considère comme un bon achat aujourd'hui.

Cela dit, lorsque je modélise le potentiel de rendement à long terme d'Amazon, j'utilise une approche encore plus conservatrice. Plus précisément, j’estime que le taux de croissance du BPA à long terme de la société sera inférieur à la moitié du consensus actuel des analystes. Je suppose également que des compressions multiples sont probables, même si les actions sont légèrement sous-évaluées.

|

Prévisions de croissance des ventes sur 10 ans |

Espérance de croissance du BPA sur 10 ans |

Attente de rendement annualisé sur 10 ans |

|

15% à 20% |

20% à 25% |

15% à 25% |

(Source: estimations de l'auteur)

Cela offre un potentiel de rendement estimé à long terme (10 ans) compris entre 15% et 25%, en fonction du type de compression multiple susceptible de se produire lorsque de nouvelles prévisions de croissance à long terme sont générées au cours de la prochaine décennie.

En résumé, j'estime qu'Amazon est capable de générer environ 20% de TCAC au cours des dix prochaines années. À titre de comparaison, le rendement historique du S & P 500 (depuis 1871) est de 9,2%. Et d'après les évaluations actuelles, Morningstar, BlackRock et Vanguard estiment que les rendements totaux du TCAC devraient s'élever à 0% à 5% d'ici 5 à 10 ans.

C'est pourquoi je m'attends à ce qu'Amazon reste non seulement un batteur de marché à long terme, mais l'un des meilleurs titres que vous puissiez posséder au cours de la prochaine décennie et au-delà. C'est pour tout investisseur à l'aise avec son profil de risque.

Risques à prendre en compte

Le risque le plus important inhérent à la propriété d’Amazon, du moins à l’esprit de nombreux investisseurs, est que le cours de l’action pourrait fluctuer au cas où il serait aussi surévalué que le pensent certains baissiers. N'oubliez pas que pour les leaders en innovation, comme Amazon, qui fonctionnent efficacement en tant que startups, l'évaluation est extrêmement difficile.

Cela est d'autant plus vrai qu'Amazon est confronté à des centaines de challengers dans son nombre croissant de marchés. Cela inclut des rivaux énormes et bien capitalisés dans le cloud computing tels que: Microsoft (MSFT), Alphabet et Alibaba (BABA). Si ces rivaux dans le nuage s'emparent de parts de marché ou obligent Amazon à se lancer dans une guerre des prix contre AWS, cela pourrait avoir un effet négatif sur ses taux de croissance à long terme et le sentiment désastreux de Wall Street.

Et comme les cours des actions à court terme sont principalement influencés par le sentiment des investisseurs, le cours des actions de cette société est extrêmement volatil. En fait, en examinant le bêta de l'action (volatilité par rapport à S & P 500) sur plusieurs périodes, nous pouvons constater qu'Amazon est l'une des actions les plus volatiles à Wall Street:

- Bêta d'un an: 1.85

- Bêta de 3 ans: 1.75

- Bêta de 5 ans: 1.60

- Bêta de 10 ans: 1,94

- Bêta moyenne dans le temps: 1,78

De manière générale, Amazon est environ 80% plus volatile que le S & P 500, ce qui est très utile lorsque l’économie est en croissance et que les actions sont sur un marché haussier. Cependant, cette volatilité beaucoup plus grande oblige les investisseurs à long terme à accepter certaines baisses de prix vraiment déchirantes.

Cours de l'action Amazon lors d'un crash technique

Données AMZN par YCharts

Lors du crash technologique, les actions d'Amazon ont plongé de 92%. Certes, la société était beaucoup plus petite et moins diversifiée qu'aujourd'hui. Cependant, lors de la Grande Récession, les actionnaires ont également dû subir une chute vertigineuse.

Cours de l'action Amazon en période de crise financière

Données AMZN par YCharts

Maintenant, bien sûr, le crash technologique et la Grande Récession sont des exemples extrêmes. Habituellement, les marchés baissiers ne voient que 34% de baisse entre le pic et le creux. Et la plupart des marchés baissiers surviennent pendant une récession, pour laquelle nous courrons un très faible risque au cours des deux prochaines années.

(Source: Moon Capital Management)

Toutefois, compte tenu de la forte volatilité d'Amazon (bêta moyen sur une période de 1,78), cela signifie que les investisseurs pourraient connaître une baisse d'environ 60% au cours du prochain marché baissier au cours de quelques trimestres ou années.

Et nous ne pouvons pas oublier que si les marchés baissiers sont rares, les corrections de marché ne le sont pas. Ils constituent une partie naturelle et saine du cycle de marché. Historiquement, corrections:

- se produire une fois par an (pour le Dow)

- voir le marché en baisse de 13,3%

- 71,6 jours de bourse (14 semaines) jusqu'à ce que le marché récupère un nouveau plus haut historique

Comment Amazon s'est-il comporté lors des deux dernières corrections (fin 2015 à début 2016 et début 2018)? La dernière correction du marché a été particulièrement favorable à Amazon, mais celle qui a précédé a vu les actions plonger dans le marché baissier.

- 29 décembre 2015 au 9 février 2016: -30,5%

- 31 janvier 2018 au 9 février 2018: -7,7%

C'est pourquoi je ressens le besoin de souligner deux citations spécifiques de Bezos concernant les mouvements de prix à court terme de son entreprise.

Lorsque le stock est en hausse de 30% dans un mois, ne vous sentez pas 30% plus intelligent – parce que lorsque le stock baisse de 30% dans un mois, il ne sera pas très agréable de se sentir plus bête à 30%. "- Jeff Bezos

Rappelez-vous que Bezos dirige son empire avec une période à long terme de cinq à sept ans. Ainsi, les résultats d'un trimestre, voire d'une année entière, ne lui importent pas, pas plus que les investisseurs. Ce qui compte en fin de compte, ce sont les fondamentaux.

Le stock n'est pas la société. Et la société n'est pas le stock. Et alors, comme J'ai regardé les actions chuter de 113 $ à 6 $Je surveillais également tous nos indicateurs commerciaux internes – nombre de clients, profit par unité… chaque chose concernant l’activité s’améliorait. Et donc, alors que le cours des actions allait dans le mauvais sens, tout dans l'entreprise allait dans le bon sens." – Jeff Bezos

La raison pour laquelle je me passionne autant pour la volatilité d'Amazon est qu'il s'agit d'une arme à double tranchant pour les investisseurs. For those with too short a mindset, a 30% to 60% price crash during the next correction or bear market might easily cause you to panic sell at the bottom. However, volatility is ultimately the friend of the long-term investor because it means you have the opportunity to add shares at incredible values and thus boost long-term returns.

This is especially true with a disruptive innovation machine like Amazon. The company's success is built on experimentation and being willing to ignore short-term profits to try what might seem at first to be crazy ideas. But those few ideas that succeed ultimately become growth engines that have made Amazon one of the most successful companies in history.

The bottom line on Amazon stock is that you need to have a long-term time horizon, focus on the fundamentals, and remember that bull markets make you money, but bear markets make you rich.

Bottom Line: Amazon Is A Wide Moat, Innovation Juggernaut, And A True Buy And Hold Forever Stock

Amazon is unquestionably one of the best run and most impressive long-term success stories in market history. Bezos' long-term focus and dedication to his "Day One" start-up mentality means that he's constantly finding new ways to serve customers better in innovative and delightful ways.

The company's willingness to forgo short-term profits in a never-ending quest to experiment and break into new (and often higher margin) markets has made countless investors rich over the decades. I'm confident that with Bezos likely to lead Amazon for many years or even decades to come, Amazon will prove to be a great "buy and hold forever" growth story. And when the hyper growth is finally over because there are no more worlds to conquer. Well, then Amazon is likely to pull an Apple and become a great dividend growth stock.

That may be 20 to 40 years in the future, but anyone buying Amazon in 2018 with a time frame that long, could potentially retire from the dividend income from a handful of shares bought today. That's because, while Amazon's valuation is impossible to pin down with 100% accuracy, I agree with Morningstar that shares are likely about 9% undervalued today.

That means today is a great time for long-term investors (with 6+ year time horizons) to get in on what's likely to continue to be a market-crushing growth stock for at least the next decade.

Disclosure: I am/we are long AMZN.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link