[ad_1]

There is little argument that skilled nursing is a difficult subsector in the health sector, but by carefully analyzing the catalysts, investors can be better informed and, hopefully, "sleep well at night".

To analyze the factors that have motivated the performance of operators in recent years, it is important to evaluate these factors prospectively in order to estimate the future performance of operators.

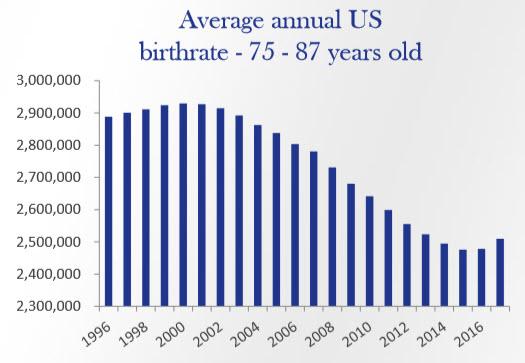

From demographic data, the main driver of skilled nursing facilities is the demand, particularly for the use of age between 75 and 87 years. For an approximation of the headwind, see the table below, which tracks the average annual birth rate of 75 to 87 years for each calendar year (1996-2016).

Source: Omega Health Care Presentation (May 2018)

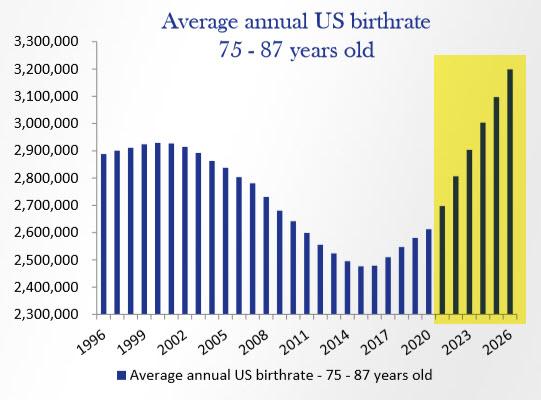

Let's now look at the following chart (1996-2026), which provides demographics on the use of skilled nursing facilities in each age group in order to achieve an expected growth rate for patients of Medicare. The average annual growth rate of 3% is significantly in line with the growth in the birth rate of the NSF core age group.

Source: Omega Health Care Presentation (May 2018)

These growth estimates are in line with analysts' expectations. And as seniors stay active until age 80, 90 and beyond, specialized nursing homes will continue to evolve to meet higher expectations for amenities, decorating and care, within cost limits quite rigid.

In addition to their traditional role of caring for frail and vulnerable older adults, specialized nursing homes are becoming the preferred facilities for short-term rehabilitation of post-acute care: physical therapy after arthroplasty hip, for example.

Facilities must be specifically designed to improve residents' quality of life, improve outcomes for patients, reduce staff stress, improve patient safety and reduce medical errors and infections. These benefits, in turn, improve the financial profile of the operators, the market value of the properties and the return on investment of REIT investors.

But that raises a question.

Should dividend growth not be part of this value creation process? After all, I often read to readers, students and investors about the importance of owning REITs that increase their dividends.

Yet in 2018, Omega Healthcare Investors (IHO) stated that it was not going to increase the dividend at the moment and we subsequently removed the title of the "SWAN" elite from the stock. Recalling that we reserve "SWAN" for their "blue-chip" attributes and that, given Omega's high distribution ratio, we have been forced to degrade the company.

After reviewing the latest (T3-18) earnings results, we decided to take a closer look at the company, focusing on what it would take for Omega to return to SWAN.

Photo source

The economic model of Omega

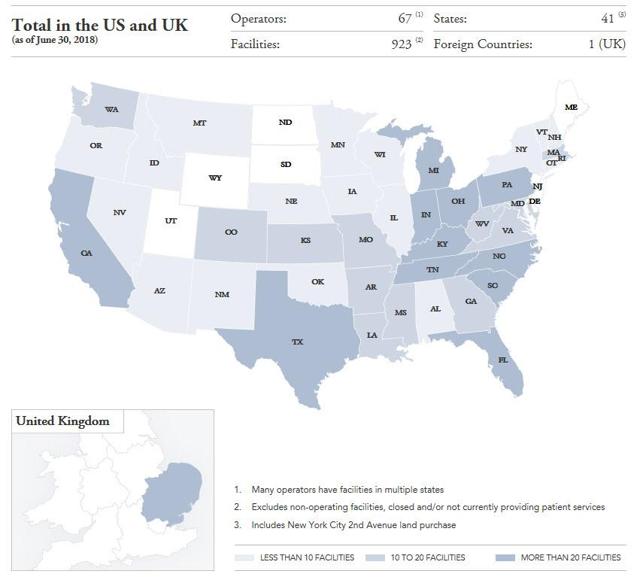

IHO was listed on the NYSE in 1992 and is one of the first publicly traded REITs explicitly structured to finance the sale and leaseback, construction and renovation of specialized nursing facilities. In 2015, Omega merged with Aviv REIT, creating the largest real estate investment company in the US dedicated to the NSF.

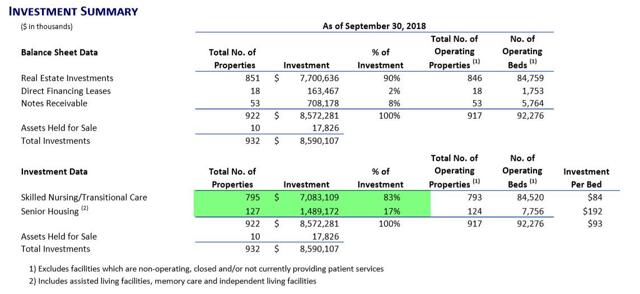

Omega's portfolio is approximately 83% NSF and 17% senior housing, with gross investments totaling approximately $ 9.1 billion. In addition, the company has invested more than $ 2.8 billion since the merger with AVIV for reinvestments and new construction. The portfolio includes 922 facilities (and 10 assets held for sale) representing approximately 93,000 operating beds.

Source: Omega website

Omega has long-term, three-tier, cross-collateral leases and most operators have strong credit profiles (with three to six month guarantee deposits).

Omega's revenues are Medicaid (53%), Medicare (34%) and Private Pay (12%). Since leases are triple nets, property expenses are the responsibility of the operator (labor, insurance, property taxes, capital expenditures).

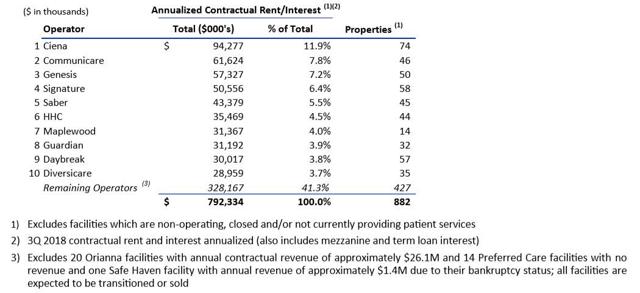

Omega collects fixed rents from its tenants, with annual indexing, and the operators collect revenue through the reimbursement of Medicare, Medicaid and a private remuneration for the services provided. Here is an overview of the main operators of Omega:

Source: IHO Q3 Supplemental

Asset repositioning is nearing completion

Most of the negative news regarding the reliability of Omega rents are related to the operators of the company. Many qualified nurses have been under pressure, leading to a deterioration in income.

However, Omega has made considerable progress in meeting the challenges and the company has almost completed its strategic repositioning and portfolio restructuring. In the first three quarters of 2018, Omega sold 71 facilities for a total consideration of $ 340 million. The reduction in revenue from these sales was $ 38 million, while the 12-month cash flow from these assets was $ 26 million.

With a sale proceeds of approximately $ 340, Omega was able to realize a sale proceeds equivalent to a cash flow yield of 7.6%. As noted by Taylor Pickett, CEO of Omega, about the recent call for results

We believe that we will be able to redeploy these products into higher quality assets with adequate coverage, with minimal impact on revenues. We will probably sell 10 to 15 additional installations, but the bulk of our asset repositioning sales is now complete, excluding the final outcome of the Orianna portfolio.

Twenty-three of the 42 Orianna facilities were transferred or sold and 22 facilities were transferred to five existing Omega operators with a corresponding annual rent of $ 16.8 million. A facility in Tennessee was sold for $ 4.3 million.

There remain 19 facilities that will be sold or released and Omega expects these facilities to generate rent or rent equivalent to more than $ 15 million, which is in line with expectations.

Omega was targeting $ 32 to $ 38 million of Orianna assets, and to date approximately $ 16.8 million has been released (released) and one property has been sold (rent equal to $ 400,000). dollars). The remaining 19 facilities are still going bankrupt, but with 50% "in the books", it appears that the $ 32 million to $ 38 million goal is warranted.

It seems that the worst has happened for Omega, the company having reworked successful lease agreements with Signature, Genesis (GEN) and Daybreak. In 2018, the volume of acquisitions of the company being almost equal to the activity of disposals, Omega therefore essentially reinvested the revenues, replacing the properties of inferior quality by properties of superior quality.

Disciplinary report

In the third quarter of 18, Omega had 10 facilities valued at $ 18 million, classified as assets held for sale, and the company is still estimating approximately $ 60 million of potential divestitures opportunities that could occur in the coming quarters.

Source: IHO Q3 Supplemental

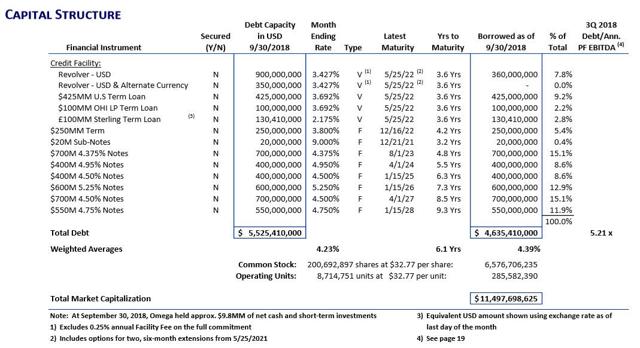

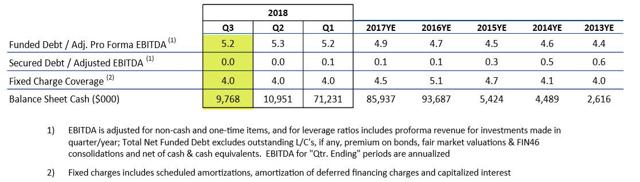

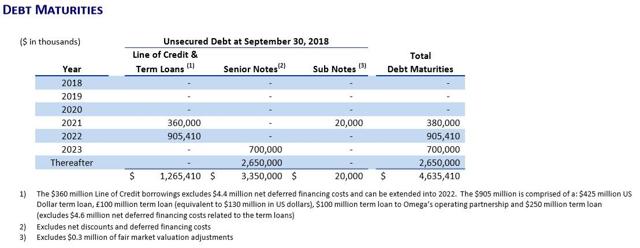

The balance sheet remains strong with an adjusted annual net debt / EBITDA ratio of 5.42 times and a fixed charge coverage ratio of 4x. (Note: in these calculations, EBITDA generates only $ 17 million of annual revenues related to Orianna facilities and no proceeds related to construction and new construction processes.)

After adjusting for the likely range of expected Orianna rental results, the known business figure on new builds and the removal of sales revenue from sales. T3-18 assets, the pro forma leverage is about 5 times.

Source: IHO Q3 Supplemental

These strong sales results since the beginning of the year reflect the continuing appetite for specialized nursing assets among private buyers in the local market. Omega minimizes encumbered assets (less than 1% of total assets), providing the company with exceptional flexibility.

Source: IHO Q3 Supplemental

The company is rated BBB- by S & P, and robust credit statistics provide adequate protection against the potential adverse effects of tenant-related operating difficulties with Medicare's repayment changes and regulatory and regulatory risks. licenses.

Source: IHO Q3 Supplemental

Focus on the fundamentals

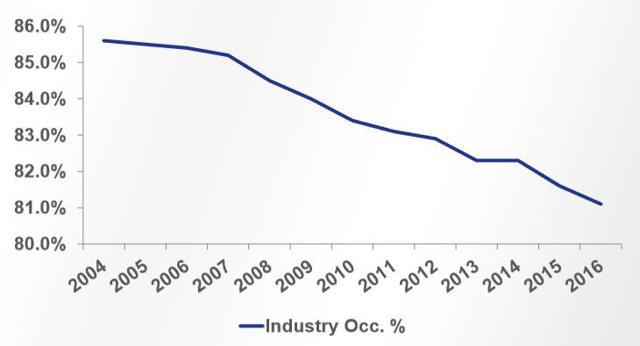

Let's talk about occupancy first, reminding ourselves that the declines in occupation in the industry were caused by: 1. Migration from Medicare to Medicare Advantage; 2. reduction of hospital discharges; 3. adverse demographic data; and 4. decrease in length of stay.

Source: Omega Health Care Presentation (May 2018)

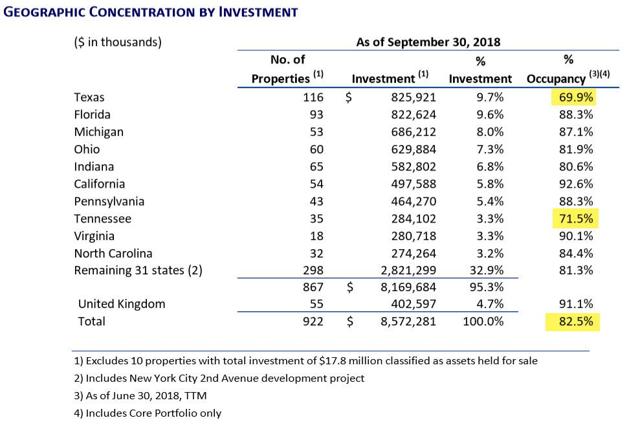

As you can see below, Omega's last-quarter occupancy was 82.5%. Note that Texas (69.9% occupancy) and Tennessee (71.5% occupancy) are the least performing states (based on occupancy). As stated above, the main catalyst of skilled nursing is the use of age, and we consider that demographic factors are real.

Source: IHO Q3 Supplemental

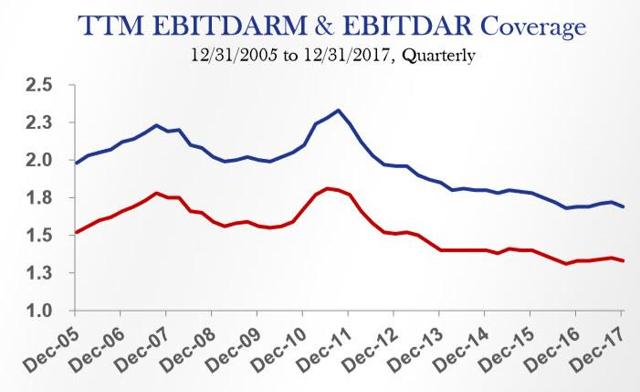

Let's now look at the EBITDAR and EBITDARM hedges: EBITDAR has been below 1.5x for more than four years now and the decrease is mainly due to two factors: 1. Occupancy and 2. Reimbursement against cost growth.

Source: Omega Health Care Presentation (May 12018)

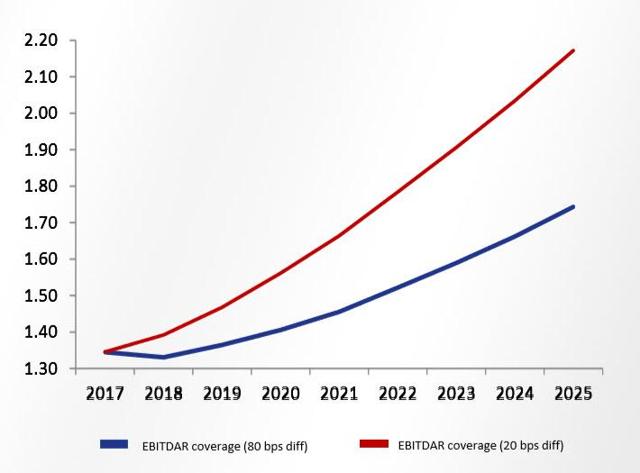

However, after applying the documented assumptions, the EBITDAR hedge increases to 1.74 times at the end of the 2025 fiscal year. By applying an income of 20 basis points over the cost deficit, the EBITDAR hedge 2.17x from here 2025.

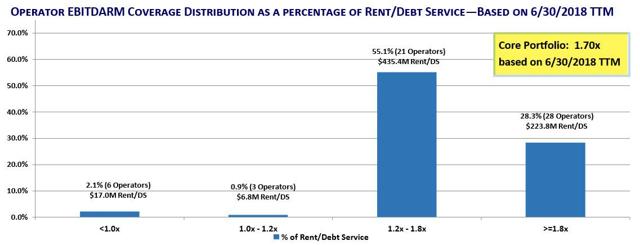

As you can see below, the EBITDARM coverage of Omega's core portfolio is 1.70x (based on 30/06/18) with around 3% of operators with less than 1.2x. Omega defines the "core portfolio" as representing 87% of the current rent / debt service, which is representative of all stable properties. Stable assets generally include any triple-net rental property except it 1. is a new development that is not yet completed / open; 2. is not yet stabilized and is still within 12 months of the budget stabilization date; 3. is for sale and / or is intended to be closed or to be sold; or 4. is about to be transferred or has been transferred to a new operator within the last 12 months.

EBITDARM and EBITDAR hedges of the 12-month trader for the core portfolio increased slightly in the second quarter of 2017, to 1.7x and 1.34x respectively, compared to 1.69x and 1.33x respectively for the period closing date ended March 31, 2018.

Source: IHO Q3 Supplemental

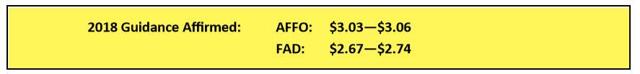

Let's now consider the cash generating cash flow to declare amounting to $ 159 million, or $ 0.76 per share, in the third quarter. The Company's adjusted operating cash flow was $ 163 million or $ 0.77 per share for the quarter and excludes the impact of a recovery of $ 2 million for unrecoverable accounts. a mark-to-market loss of $ 1.2 million on GEN warrants and $ 4 million of stock-based compensation expense. Here is an overview of the Omega guide ranges:

Source: IHO Q3 Supplemental

When will Omega Healthcare become a swan again?

Now that we have dissected the results of the third quarter, let's dissect the dividend. Omega's dividend for the third quarter of 2003 is $ 0.66 per share, which corresponds to a payout ratio of 85% of the adjusted operating cash flow and 96% of the available cash for the third quarter. distribution (or DCP). Note: The DCP payment has decreased a little from Q2-18:

Source: IHO Q3 Supplemental

The 96.4% payout ratio includes partial proceeds to Orainna's 22 re-leased facilities, but all of the $ 16.8 million ($ 4.2 million per quarter) will be included in Q4. 18 and it is likely that the 19 remaining Orainna facilities will be sold and sold. $ 15 to $ 21 million a year ($ 3.75 to $ 5.25 million) should be considered in the first and second quarters. Our back of the estimate of the towel: The disbursement of DCP falls to 94%.

Then, remember that Omega's portfolio generates annual rent reductions of around 2.5%. The DCP drops to 92%.

Omega believes that the repositioning is nearing completion and that the company is expected to begin making standardized acquisitions of approximately $ 400 million annually. The DCP drops to 88%.

Finally, Omega and Maplewood Senior Living are building a senior community in one of New York City's most affluent neighborhoods, the Upper East Side, where Second Avenue and 93rd Street meet.

The senior community will live on 23 floors, with an average height of 212,000 square feet and will include 215 assisted living units, enhanced care and memory care with views of the city. East River. It will be one of the first projects of such stature in the city for over two decades.

(Source: IHO website)

Render: IHO website

Taylor Pickett, President and CEO of Omega, said in a press release:

We are very excited about what the Maplewood team brings to Manhattan. Inspire Manhattan is our 14th investment with Maplewood and our first in New York. Greg Smith and his entire team have built their business by combining the highest level of quality care and service amenities with innovative and contemporary design. The Inspīr project reflects all the best of what Maplewood does exceptionally well, combined with a level of design and sophistication that we believe the Manhattan market will value and embrace.

Construction in progress: IHO website

Again, behind the towel, but this new development (IHO cost is $ 285 million) is expected to generate an additional $ 20 million annually in the income statement. The DCP drops to 85%.

Based on history, Omega maintained a DCP distribution ratio in the 1980s at 80. We therefore believe that in the absence of more tragedies (operator problems), Omega could be able to grow its dividend again in 2020, just in time for the "silver tsunami" to be triggered. While Omega has demonstrated its talent throughout the unstable health cycle, we are not ready to go to the "elite" club until the company is able to grow its dividend.

It worked well

Although we downgraded Omega after launching SWAN, we continued to maintain a purchase, and it worked well:

Source: Yahoo Finance

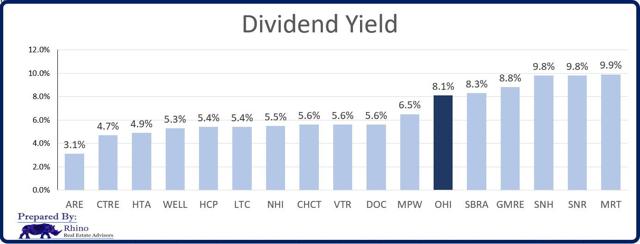

It's clear that Omega has managed to orchestrate a discipline-based strategy and that smart investors have been able to take advantage of pricing errors. How does the dividend compare today?

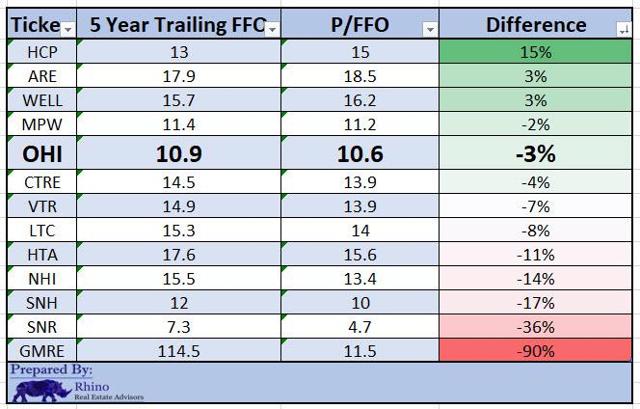

You can see that Omega is now aligned with normalized valuation levels, but we do not consider stock as expensive or cheap. Perhaps this better way of describing society is "validly evaluated". As stated, I do not think Omega deserves a "SWAN" bonus and I think a return of 8% is reasonable given the asset class and quality. Let's now examine the multiple P / FFO:

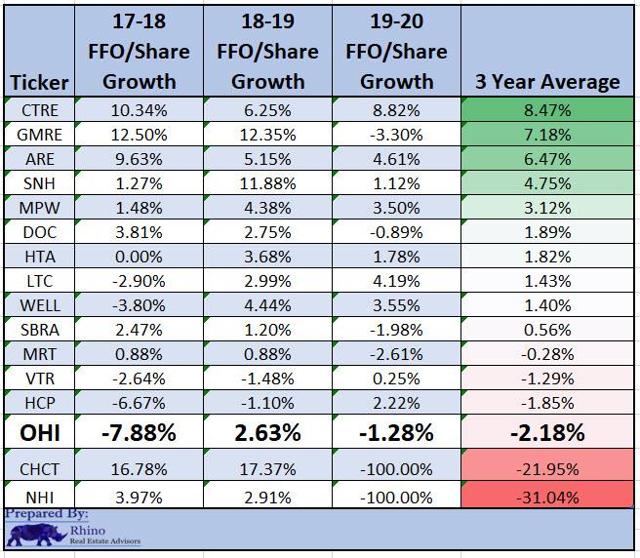

Again, the historical comparison (P / FFO over five years) indicates that Omega is well valued. The most obvious conclusion from this chart is Ventas' "cheap" (VTR) (read my recent article on the VTR here). Moreover, as seen below, analysts do not expect robust growth for Omega in 2019 and 2020, so the "SWAN "could become" later than early ".

As you can see below, Omega has been the "best performer" of the year in the health sector:

On January 5, I said, "Discipline is thinking long-term, and that's why I'm sticking to Omega – it's time to take charge! "

On February 15, I said, "Sometimes I have to go against the flock and even risk being called a dummy. "

On April 25, I said:The stock remains one of my biggest holdings and I thought it would be a good time to take a closer look at the results before the Q1-18 results. "

On July 30, I said, "Last week,I had to write a ticket again when a writer wrote an article about Omega Healthcare. "

On September 19, I said:I will continue to ride the wave and enable the Omega management team to leverage its disciplined expertise, relationships and capital management capabilities. "

Source: Rhino Realtors

Recognizing that Omega was substantially misjudged, I was able to take advantage of the opportunity recognizing that there was a considerable margin of safety. In other words, it is not necessary to have a SWAN to earn money on the stock market. Howard Marks explains:

Most investors believe that quality, as opposed to price, is the determining factor in determining whether something is risky. However, high quality assets can be risky and low quality assets can be safe. It's just a matter of price for them … High public opinion, then, is not only the source of the low return potential, but also the high risk.

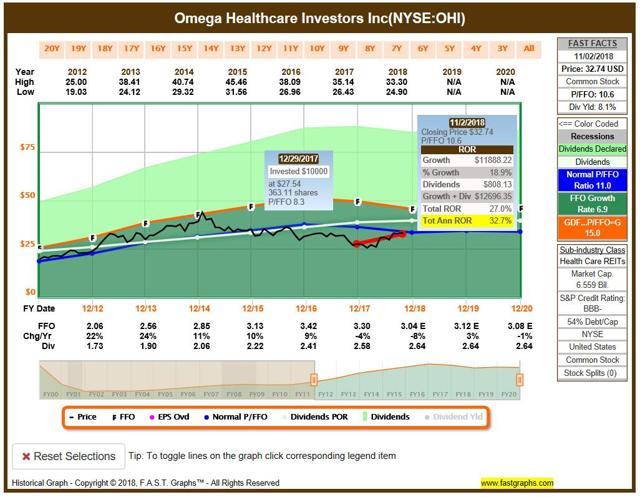

So, in other words, even though Omega is not officially recognized as a SWAN, I was able to take advantage of this opportunity: Omega has recorded a 33% return since the beginning of the year and I sleep well at night.

Author's note: Brad Thomas is a Wall Street writer and that means he's not always right with his predictions or his recommendations. This also applies to his grammar. Please excuse any typos and be assured that he will do his best to correct any errors.

Finally, this article is free and its only purpose is to help research, while providing a forum for second-level thinking.

Source: F.A.S.T. Graphs.

Other REITs mentioned: (SNR), (MRT), (HTA), (SNH), (ARE), (DOC), (VTR), (LTC), (NHI), (WELL), (CHCT), (CTRE ), (HCP), (MPW), (GMRE) and (SBRA).

Brad Thomas is one of the most read writers on Seeking Alpha and over the years has developed a trusted brand in the REIT industry. His articles generate significant traffic (about 500,000 views per month) and he has thousands of satisfied customers who rely on his expertise.

Market subscribers have access to a growing list of services, including weekly real estate updates and weekly recommendations. Also, we are now provide daily REIT recaps early in the morning, comprising recent news throughout the REIT universe. Take charge!

Disclosure: I am / we have long been HTA, DOC, VTR, LTC, NHI, MPW, IHO.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link