[ad_1]

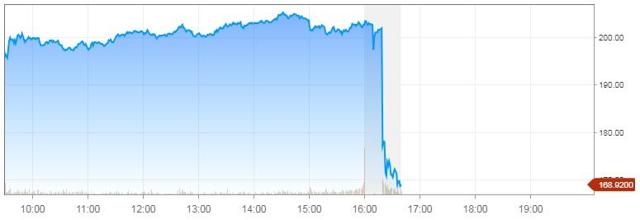

Thursday after the bell, chip maker Nvidia (NVDA) saw its shares plunge 15% after the company's third quarter financial report. As the company beat profits and increased its capital return plan for its shareholders, revenues were missed and forecasts were catastrophic. In the short term, the growth of the company has disappeared, which means that this name is no longer a darling of the street.

The company announced revenue of $ 3.18 billion for the third quarter of fiscal year, up 21% from the prior year. However, the street was looking for a little more growth and asked for estimates of $ 3.24 billion. Gross margins increased 90 basis points from a year ago as operating income and net income increased even more. On a GAAP basis, diluted earnings per share amounted to $ 1.97, up 48%, compared with a shattering estimate of $ 1.71.

In my previous article on the name, I explained how a plan was needed for the company's cash flow. Revenues and profits had skyrocketed, but the capital return plan had remained neutral. In fact, during some quarters, there was no redemption. I was wondering when things would go a little further and we had this important update in the publication of the results:

In the first nine months of fiscal 2019, Nvidia paid back $ 1.13 billion to shareholders through a $ 855 million share repurchase and quarterly cash dividends from $ 273 million.

In November 2018, the Board of Directors authorized an additional $ 7 billion under the Company's share repurchase program, for a total of $ 7.94 billion available until the end of the year. December 2022.

Nvidia has announced a 7% increase in its quarterly cash dividend from $ 0.15 per share to $ 0.16 per share. The quarterly cash dividend will be paid to all shareholders of record on November 30, 2018.

Nvidia intends to return an additional $ 3 billion to its shareholders by the end of fiscal year 2020, which could begin in the fourth quarter of fiscal year 2019.

Investors still love dividend increases, although an extra dime per share does not represent much when stocks are trading around $ 170. The company's market capitalization approaching $ 100 billion, which means that redemptions of about $ 2.5 billion made over the next year will serve as a little help to profits and to other elements.

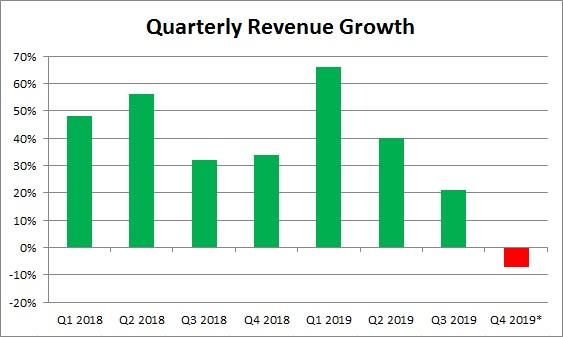

The main problem with this report, however, was the forecast for the fourth quarter. Management requires revenues of $ 2.70 billion, plus or minus 2%. This would imply a drop of about 7.2% at mid-point compared to the same period of the previous year, which was $ 2.91 billion. Unfortunately, not only was the street not looking for such a big decline, it was not looking for a decline at all. In fact, the street was expecting a significant increase in its revenues, by nearly 17%, to reach $ 3.40 billion. This is a huge deficit, which has probably caught many investors off guard, and totally eliminates the growth in business revenue presented below.

(* Guide medium. Source: publication of Nvidia's results, see here)

This is not the first chip maker to disappoint recently, as Advanced Micro Devices (AMD) also surprised the street negatively last month. With the cryptocurrency bubble bursting earlier this year, chip sales have peaked and companies now face tough comparisons from one year to the next. Nvidia has a better record and is more profitable than AMD, but neither of these two names could escape poor indications.

Nvidia shares fell more than 15% Thursday after the release of the third quarter results. Not only did the company miss the top line, but it also released a major disappointment in forecasting, calling for a significant drop in revenue as the street was looking for significant growth. While earnings were up for the quarter and the capital return plan was increased, the fact that revenue growth has stopped is likely to lead to a major re-evaluation of the name, even though has already fallen by 42%.

Additional information from the author: investors are always reminded that before making an investment, you must exercise your own due diligence for any name directly or indirectly mentioned in this article. Investors should also consider seeking the advice of a broker or financial advisor before making any investment decisions. Any element of this article should be considered as general information and not as a formal investment recommendation.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link