[ad_1]

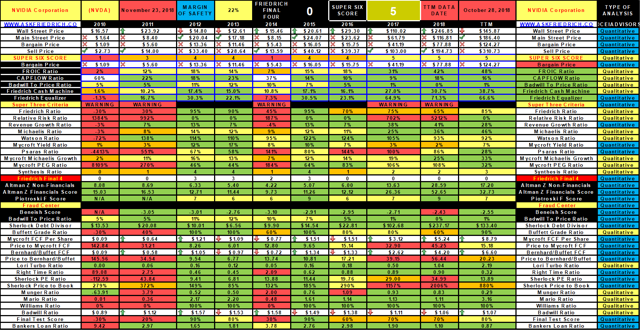

On November 15, 2018, Brandy Betz, Editor-in-Chief of SA News, published the following information about Nvidia Corporation (NVDA). Nvidia -17% on the guide of declines at the end of the boom of cryptography. This earnings report was a shock to investors and, as a result, many ran for the outings. At Friedrich Global Research, we love it when we wait patiently for Nvidia to finally have a bad quarter. As potential investors in Nvidia, we do not doubt that the company will soon regain its former glory, because its future prospects are rather promising. We can say that with confidence, because Nvidia is a key player in the fields of gaming, professional visualization, data centers and the automotive industry. For a company to be involved in only one of these high-growth sectors, it would be enough to consider Nvidia as a potential investment, but its involvement in all four areas is truly unique. NVIDIA, in our opinion, has gone from overbought to fair value and we believe that it will be sold "sooner rather than later" because the panic of selling its stock has been swift and furious.

In this article, we will present unique ratios used by our Friedrich investment system and present a real-time quantitative analysis demonstrating the power of free cash flow in the investment process. In doing so, we will also teach everyone how to analyze the holdings of their wallet between Main Street and Wall Street. At the same time, we will also explain how the methodology involved in this analysis came into being.

Main Street is where Nvidia operates and Wall Street is the location of its transactions. The Nvidia shares that can be bought on Wall Street are in the public domain and the company has little control over how each stock will trade. Nvidia is required to publish its quarterly earnings reports and also publishes press releases for its shareholders (and the general public) to keep it informed of developments in Nvidia's business. Main Street.

Main Street is where Nvidia invests in its own operations and sells to its customers. The manner in which the CEO of Nvidia and its executives sell these products determines the level of profitability of the company. Wall Street then reacts based on the success or failure of management to achieve its goals. Main Street and Wall Street are therefore related, but as anyone with a computer, an Internet connection and a brokerage account can buy or sell shares at any time, the company is not in a business. Expertise is not needed to invest on Wall Street. This makes Wall Street a very dangerous place for investors because many investors tend to act with emotion or tend to follow the herd in stocks. In bull markets, investors feel they can not go wrong because "the rising tide lifts all boats". But when a bear market suddenly comes up, these same investors tend to panic and sink like lemmings on the cliff. Thus, we have the classic case of "greed against panic".

Having noticed this problem about 30 years ago, I spent the last three decades building an algorithm called Friedrich. Our algorithm has been designed to help all investors (professionals and novices) and allow them to quickly compare the operations of a company on Main Street with its valuation on Wall Street (conditions of overbought or overbought). Friedrich can do this on an individual basis or help users analyze a complete index such as the S & P 500, an ETF, a mutual fund or an individual portfolio, using our portfolio analyzer.

Many years ago, reading the 1986 Berkshire Hathaway (BRK.A) letter to shareholders, I discovered a ratio that Mr. Buffett had titled "Owner Profits," or that we might consider as Mr. Buffett's version of "Free Movement of Capital." To my astonishment, in this little footnote, Mr. Buffett explains how to use it and roughly indicates that it is one of the key ratios that he and Charlie Munger used to analyze stocks. . In that article, he defined the term "owner's gain" as the cash flow generated by the business activities of the corporation.

[Owner earnings] represent [A] declared earnings more [B] depreciation, depletion, depreciation and certain other non-monetary charges … less [C] the average annual amount of capitalized expenditures for facilities and equipment, etc. necessary to the company to fully maintain its long-term competitive position and unit volume. "

I've used this free cash flow ratio for decades, using data from the Value Line Investment Survey, whose founder was Arnold Bernhard. Mr. Bernhard was a big supporter of free cash flow and probably introduced it earlier than Mr. Buffett. I know this because I was able to calculate the FCF ratio using the old Value Line sheets for my 60 year DJIA backtest from 1950 to 2009.

In the backtest that I mentioned above, I have demonstrated that if one can buy a company whose shares are selling 15 times or less, its price / free cash flow ratio , the probability of success will increase considerably in most cases. I renamed the ratio "free cash flow ratio of Bernhard Buffett" in the honor of both men. This is how this report is calculated below.

Price to Bernhard Buffett Free Cash Flow Ratio = Sherlock Debt Splitter /[(net income per share + depreciation per share) + (capital spending per diluted share)]

Sherlock Debt Dividend = Market Price per Share – ((Working Capital – Long-Term Debt) / Diluted Shares Outstanding)

The above is the ratios I use when analyzing an action on Wall Street and below are the ratios that I use to analyze a stock Main Street.

FROIC stands for "Return on free cash flow on invested capital"

Free cash flow at term = [((Net Income + Depreciation) (1+ % Revenue Growth rate)) + (Capital Spending)]

FROIC = (free cash flow forward) / (long-term debt + equity)

The FROIC ratio shows the free cash flow generated by the Company on Main Street relative to the total capital employed. So, if a company invests $ 100 in total capital in Main Street and generates $ 20 in free cash flow before, it has a 20% FROIC, which we consider excellent. This is just one of the key ratios (66 in total) we use to identify a company's performance on Main Street, because we are convinced that if a company kills a deadly company on Main Street, this information will eventually appear on the market. Wall Street radar.

So let's start our analysis and at the same time try to teach everyone how to do a similar analysis on their own portfolio. By analyzing the price ratio of Nvidia at the price of Bernhard Buffett FCF, we must first analyze Nvidia Sherlock Debt Divisor. Here is a detailed definition of this report:

Sherlock Debt Dividers = Business analysis is of great concern to me today about the amount of debt incurred by each of its businesses and the fact that management is abusing this situation by taking on more debt than necessary. Debt, when used wisely, allows for leverage that can be extremely beneficial in some settings. On the other side of the coin, recourse to debt can also be excessive and jeopardize the future of the company. So, what I did to determine whether the company's debt policy is beneficial or abusive is to create the Sherlock Debt Splitter.

What the Divisor does is punish companies that use debt recklessly and reward those who use it successfully as leverage. How can I do this? Well, I take the working capital of a business and subtract its long-term debt. If a company has much more working capital than long-term debt, I reward and punish those whose long-term debt exceeds their working capital. Thus, if this result is higher than the current stock price, a leverage is used and the more a company is in debt, the more the results of this ratio will be bad and the less its stock will be attractive.

Thus, after successfully defining the Sherlock Debt Splitter, we need the following four financial data bits to calculate it for Nvidia. The TTM for those who do not know it is "over a period of 12 months" or data as close as possible in real time, depending on when each company publishes its report.

Market price per share = $ 144.71

Working Capital = Total Current Assets – Total Current Liabilities

Total current assets = $ 11,386,000,000

Total Current Liabilities = $ 1,608,000,000

Working capital = $ 9,778,000,000

Long-term debt = $ 1,987,000,000

Diluted shares outstanding = 625 million

Sherlock Debt Dividend = Market Price per Share – ((Working Capital – Long-Term Debt) / Diluted Shares Outstanding)

Sherlock Debt Dividend = $ 144.71 – (($ 9,778,000,000 – $ 1,987,000,000) / $ 625,000,000))

Sherlock Debt Dividers = $ 144.71 – $ 12.46 = $ 132.25

Since Nvidia has less long-term debt compared to working capital, we must reward it and use the new $ 132.25 as the new numerator in all our calculations.

Price to Bernhard Buffett FCF Ratio = Sherlock Debt Dividers /[(net income per share + depreciation per share) + (capital spending per diluted share)]

Sherlock Debt Dividers = $ 132.25

Diluted net income per share = $ 4,694,000,000 / $ 625,000,000 = $ 7.51

Diluted per share amortization = $ 241,000,000 / $ 625,000,000 = $ 0.39

Capital expenditure per diluted share = -813,000,000 $ / 625,000,000 = -1.30 $

$ 7.51 + $ 0.39 + ($ -1.30) = $ 6.60

Price to Bernhard Buffett Free Cash Flow Ratio = $ 132.25 / $ 6.60 = 20.04

Now, if you go to our FRIEDRICH LEGEND (on what is considered a good or bad result), you will notice that our score of 20.04 is considered average.

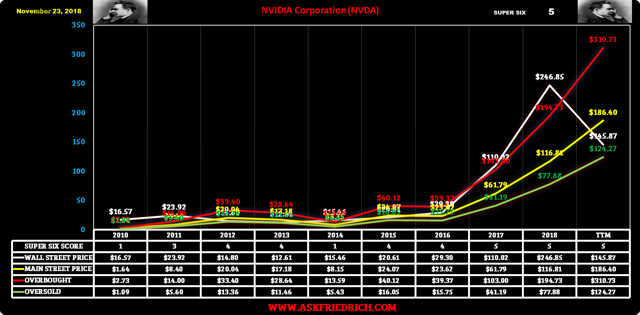

The last time we ran our data file for Nvidia on November 21, 2018, our Friedrich algorithm recommended to our subscribers that Nvidia be a "hang", as indicated by our Friedrich data file and our chart below. . You will also find the results of the last ten years of free cash flow from Nvidia's Price to Bernhard Buffett.

Now that we have taught everyone to calculate our free cash flow ratio from Price to Bernhard Buffett, let's turn now to learning how to calculate our FROIC ratio.

Here's how we calculate it:

FROIC stands for "Return on free cash flow on invested capital"

Free cash flow at term = [((Net Income + Depreciation) (1+ % Revenue Growth rate)) + (Capital Spending)]

FROIC = (free cash flow forward) / (long-term debt + equity)

Diluted net income per share = $ 4,694,000,000 / $ 625,000,000 = $ 7.51

Diluted per share amortization = $ 241,000,000 / $ 625,000,000 = $ 0.39

Capital expenditure per diluted share = -813,000,000 $ / 625,000,000 = -1.30 $

$ 7.51 + $ 0.39 + ($ -1.30) = $ 6.60

TTM revenue growth rate = 27.8%

[(((7,51 $ + 0,39 $)) (127,8%)) + (-1,30 $) =[((.51 + [65].39) (127.8%)) + ($ -1.30) =$ 8.79

Long-term debt = $ 1,987,000,000

Shareholders = $ 9,475,000,000

Diluted shares outstanding = 625 million

FROIC = (free cash flow forward) / (long-term debt + equity)

$ 8.79 / $ 18.34 = 48%

FROIC = 48%

Now, if we go back to my FRIEDRICH LEGEND (on what is considered a good or bad result), you will notice that our 48% result is a great result and tells us that Nvidia on Main Street generates $ 48 in cash flow. cash available for every $ 100 invested in total capital employed.

On Main Street, Nvidia is doing well, while on Wall Street, it is becoming more attractive because of the panic of investors. Now, if you can build a portfolio with similar excellent results on Main Street and buy it all at an attractive price, because of Bernhard Buffett's free cash flow ratio, your portfolio should be a star at a time on Main Street and Wall Street. Finding companies that have great results on Main Street and Wall Street (simultaneously) these days unfortunately comes back to looking for a needle in a haystack.

Our current overselling price, shown in the data file and in the graph above, gives us a bargain price of $ 124.24 and we believe that the Nvidia stock price could easily reach this target price. Nvidia's historical record reached 289.36 USD on 1 October 2018, so if we can reduce it to 124.24 USD, we will resume after a fall of -57.06%.

If you enjoyed this article, be sure to click the Follow button at the top of this article because we plan to produce more articles using the same format in the future. Also, feel free to comment below if you have any questions.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: This analysis is not advice for buying or selling this or any stock; it is simply a matter of emphasizing an objective observation of unique models developed from our research. Evidence comes from sources considered reliable, but the poster is not responsible for any errors or omissions or results of actions taken on the basis of the information contained in this document. Nothing contained herein shall be construed as an offer to buy or sell securities or individual investment advice.

[ad_2]

Source link