[ad_1]

The action of Nvidia Corp. (NVDA) has suddenly fallen out of favor, investors have collapsed by 50% over the past month. According to technical analysis, the title could fall an additional 16%, against $ 145 currently. Even worse, Nvidia could lose up to 32% by comparing its valuation to that of other stocks in the industry.

The free fall of the stock is accelerated after the company releases weak business forecast for the fourth quarter.

NVDA data by YCharts

Big Miss

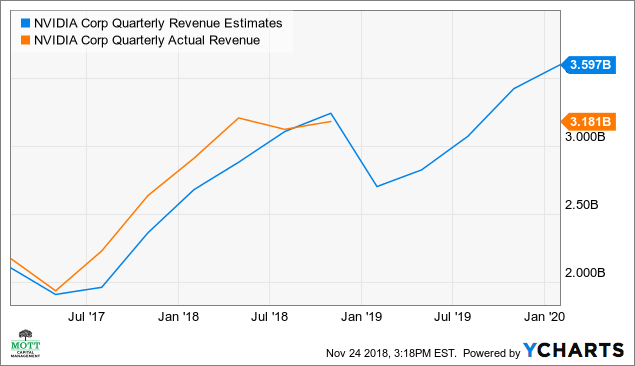

Nvidia's third quarter results are lower than analysts' estimates. The company attributed this error to a cryptographic backup attempt because of the longer than expected duration of the inventory of encrypted channels. However, in his second quarter conference call, when the company released its third-quarter revenue forecast, management did everything to assume that it had not assumed any contribution from cryptography in the third-quarter forecast.

NVC Quarterly Revenue Estimates by YCharts

Lack of demand

(Mott Capital)

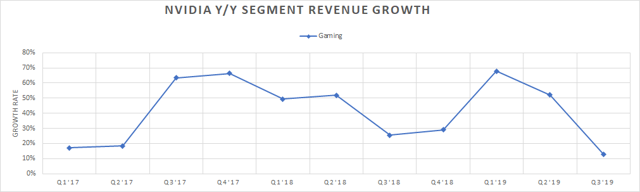

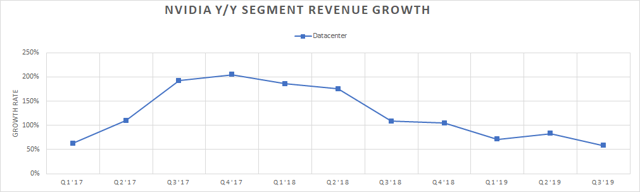

The real problem is perhaps lack of demand for Nvidia chips. His gaming unit has only increased by 13% in the last quarter compared to last year. This is the smallest increase in the unit since the first quarter of 2017. According to the overall revenue forecast, games are likely to decrease in the next quarter. Revenue from datasets was not the only factor affecting the quarter, as its growth also slowed since the fourth quarter of 2017.

(Mott Capital)

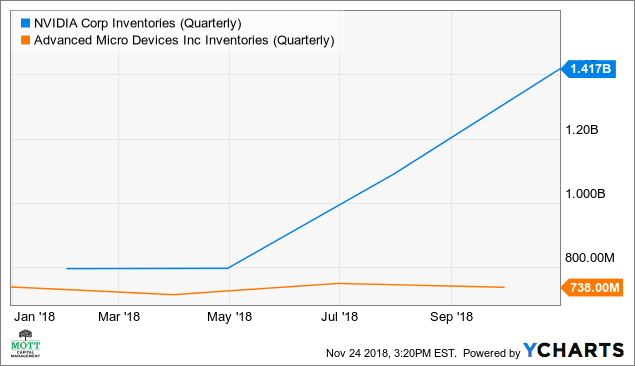

The inventory goes off

Perhaps most surprisingly, Nvidia's stocks reached $ 1.4 billion, its highest level ever. The company noted in the CFO's comment that the reason for this increase was due to an acceleration in the production of the Turing chip. However, the upward trend in the number of days required to convert inventory into sales (ISD) is worrisome, with the ISD falling from 86 days in the previous quarter to 73 days and 73 days in the previous year. Compare that to Advanced Micro Devices Inc. (AMD), which saw its inventory drop from $ 750 million to $ 738 million in the last period.

NVDA (quarterly) stocks by YCharts

At the same time, accounts receivable also reached their highest level ever, at $ 2.2 billion. The outstanding amount of the day (DSO) reached 63 days, compared with 48 days the previous quarter.

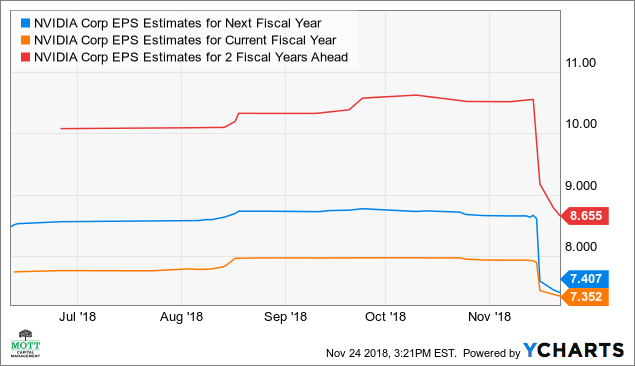

Cut estimates

Since the company released its results, analysts have reduced their revenue estimates by 21% to $ 2.7 billion, while earnings estimates have fallen 31% to $ 1.40 per share. Even worse, analysts now predict that profits will increase by less than 1% in fiscal year 2020, reaching $ 7.41 per share, and revenue by 9% to $ 13.3 billion. That's down from August's estimates for earnings growth of 10% and revenue of 13%.

NVDA EPS estimates for next year's data by YCharts

overrated

The most important problem is the valuation of the security at a 2020 PE ratio of 19.6. This makes the stock very expensive given the potential lack of growth next year. The average 1-year PE of the 25 largest stocks in the iShares PHLX Semiconductor ETF (SOXX) is 13.2 with a median of 10.3. If Nvidia were to trade at the industry average, its value would be only $ 98, a decline of 32% from the current price.

NVDA PE ratio data (before 1y) by YCharts

Low technical table

The technical table indicates that the stock is approaching the technical support level at $ 139.50. If the shares fall below this level, the shares could fall to $ 121.40. In addition, the relative strength index has been steadily declining, suggesting that the stock may be down.

Thesis on the risks to bear

One of the main risks today for this thesis is that the sentiment is already very bearish and that, if the sentiment were to change due to a broader market recovery, the stock could rise significantly. In addition, if the company could demonstrate that inventory reductions were progressing faster than expected, it could also help move the stock forward.

It may take at least one to two quarters for the company to convince investors that the worst is behind. Investors would need strong growth in net sales, while showing that stocks are falling. Until that happens, the stock will likely continue to face a risk of falling stock depending on its valuation and technical chart. Otherwise, Nvidia could become an ordinary share with a much lower stock price and deserving a much lower earnings multiple.

Disclaimer: Mott Capital Management, LLC is a registered investment advisor. The information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of securities, investments or specific investment strategies. Investments involve risks and, unless otherwise stated, are not guaranteed. Be sure to consult a qualified financial advisor and / or tax professional before implementing any of the strategies described in this document. Upon request, the advisor will provide a list of all recommendations made over the last twelve months. Past performance is no guarantee of future performance.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link