[ad_1]

1. Tower of debt: US companies are drunk easy money

US companies, encouraged by a decade of incredibly low loan costs are sitting on 6,300 billion dollars of debt, according to S & P Global Ratings. This sum, which excludes banks, is more than before the Great Recession – or at any other time in history.

Companies used this debt to invest in the future, make spectacular acquisitions, and reward shareholders with a windfall of share buybacks.

But it is a hard time to owe a lot of money.

After years of extraordinarily low interest rates, borrowing costs are finally on the rise. This makes it more expensive for companies to refinance their debt at maturity. These costs will only increase if inflation heats up, forcing the Federal Reserve to increase rates faster.

The US economy is cruising. Economic expansion is already the second longest in history. But another recession will come eventually. In previous downturns, companies with too much debt struggled to repay their loans, forcing some into bankruptcy.

The "huge amount of debt" accumulated by US companies "should worry investors as we enter the final laps of a credit cycle in a context of rising rates," writes L & # 39; S & P analyst Andrew Chang.

Related: Why has the race for world markets become so bumpy?

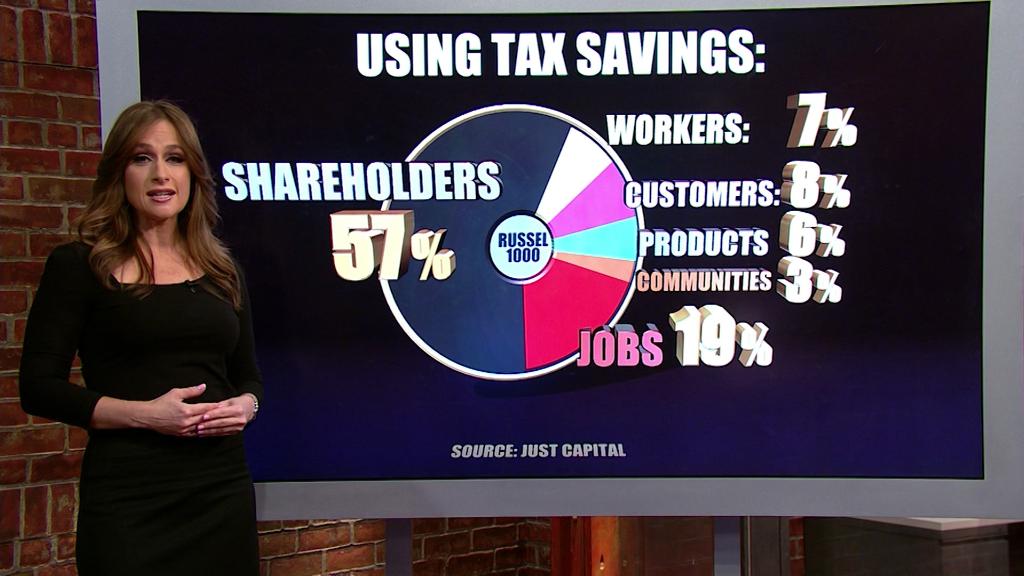

Of course, Corporate America has more than ever the firepower to repay its debts. The strengthening of the economy and the reduction of corporate tax Republicans have unlocked vast sums of money for businesses.

Indeed, S & P found that at the end of 2017, the 1,900 US companies that it evaluates, excluding banks, had accumulated $ 2.1 trillion in species. That's up 9% from the previous year – and more than double what they were sitting in 2009.

However, this pile of money n & # 39 is not divided equally. In fact, 1% of the richest US companies control more than half of the cash, said S & P.

By the end of 2017, only seven companies claimed $ 800 billion in cash: ] Apple ( AAPL ) Microsoft ( MSFT ) Alphabet ( GOOGL ) Cisco CSCO ) ] Oracle ( ORCL ) AT & T ( T ) and Amgen ( AMGN ) .

Although tax legislation improved corporate balance sheets, it also triggered a record wave of leveraged buyouts and acquisitions.

S & P said that he believes that US companies have reached their peak in monetary hoarding. This is because companies reward shareholders while adding debt because of "the lure of cheap money".

"We believe that we are now entering the era of Grand Unfolding," writes Chang.

Companies with strong balance sheets can afford to bring a lot of money back to shareholders. The rest? Not really.

S & P found that the category of the most risky borrowers – with a rating known as junk – has never been as indebted as she did. 39 is currently. They hold $ 8 of debt for every dollar of money.

What could go wrong?

2. Jobs Report : How Can the US Labor Market Tighter? We will know this on Friday when the Labor Department releases the June Jobs Report.

Unemployment is already 3.8%, the lowest since 2000. It's falling again, it will be the lowest in half a century. Analysts surveyed by Thomson Reuters expect a solid gain of 200,000 jobs.

3. Tradedowndown: This is the week when the commercial fight of President Donald Trump with China becomes real.

On Friday, US customs officials will start charging a 25% duty on about 800 Chinese goods worth $ 34 billion, the first wave of a series of trade sanctions to 50 billion dollars. These commodities include jet engines, batteries and industrial dryers. The same day, China will impose a tariff on $ 34 billion in US exports, including cars and beef.

For investors, the big risk is climbing. Trump has threatened tariffs on hundreds of billions of dollars worth of extra goods. And China has vowed to wage a trade war "until the end".

4. Why the Fed raises rates: When the Fed releases its reports on Thursday, we will see more closely why the central bank is more optimistic about the economy – and eager to Raise rates faster than she had originally planned.

Last month, the Federal Reserve raised its benchmark rate by a quarter of a percentage point, the second increase this year.

The majority of the Fed's board of governors said they expect a total of four interest rate increases this year. Fed officials had been split on the possibility of raising rates three times this year or four.

5. Xiaomi Award his IPO: Once the most valuable startup on the planet, Chinese smartphone maker Xiaomi is about to go public.

The company plans to raise $ 4.7 billion in its IPO, a person familiar with the IPO told CNNMoney. It's at the bottom of its expected range. Earlier this year, Xiaomi reportedly asked for up to $ 10 billion in registration.

The IPO, whose price is expected Friday, would value Xiaomi at around $ 54 billion – not a huge leap from the $ 45 billion to which Xiaomi was rated in a private finance round at the end of 2014 Xiaomi's luster has declined because investors worry about its earnings growth potential, as it supplies the lower end of the smartphone market more and more saturated.

6. Coming this week:

Monday – Facebook ( FB ) COO Sheryl Sandberg to testify before Parliament European

Tuesday – US automakers report June sales; US markets are closed early

Wednesday – US markets are closed for Independence Day

Thursday – US Federal Reserve reports its minutes of the Board of Governors

Friday – Report on Employment in the United States; tariffs on the first $ 34 billion of Chinese goods come into effect

CNNMoney (New York) First published July 1, 2018: 7:13 ET

[ad_2]

Source link