[ad_1]

For years, this has been the best case for computer chip companies. Now, however, they are increasingly trapped in world political wars.

The latest example to date is the decision of a court in China to temporarily ban some sales by Micron Technology Inc., the memory chip maker of Idaho, essential to most smartphones. The trial focuses on the specialized technology that Micron stole, even though the controversy seems less related to the law and especially the efforts made by the Chinese government to develop at any cost a national computer industry. The patent infringement action was filed on Micron products used in the computer graphics cards rather than on the company's cash cow business in chips for them. more powerful computers and Phones. This means that the financial impact on Micron of the sales ban will most likely be limited, although the political implications are profound.

Ouch

Micron shares fell to 8% on Tuesday after a Chinese court temporarily banned its sales in the country

Source: Bloomberg

Chip companies have been among the industry's biggest winners an economic superpower, but now they find themselves caught between the United States and China, the two largest computer chip markets.

In addition to Micron's legal battle in China, Qualcomm Inc. is fighting China's investigations and an acquisition that is being blocked by China's antitrust authority, possibly in retaliation for the sanction by the US government of the Chinese telecommunications equipment company ZTE. Token makers also seem to be on the losing end of US tariffs that try to prevent, among other things, the kind of Chinese technology theft that seems to have happened to Micron. One trade group said US policies could pervert US chip makers subject to 25 percent tariffs for Chinese companies.

This is because chips believed to be imported from China may not be so. Micron revealed that 51 percent of its revenue during its last fiscal year comes from sales in China. This figure is based on where the Micron products were shipped, rather than the final country where finished products arrive. For example, Micron could count among its revenues in China its memory chips which are found as components of smartphones assembled in Chinese factories, even if these phones are sold to customers in the United States or Europe.

We Are the World

Micron is among the US chip makers that generate a significant portion of China's revenues – though the numbers may be misleading

Source: The companies

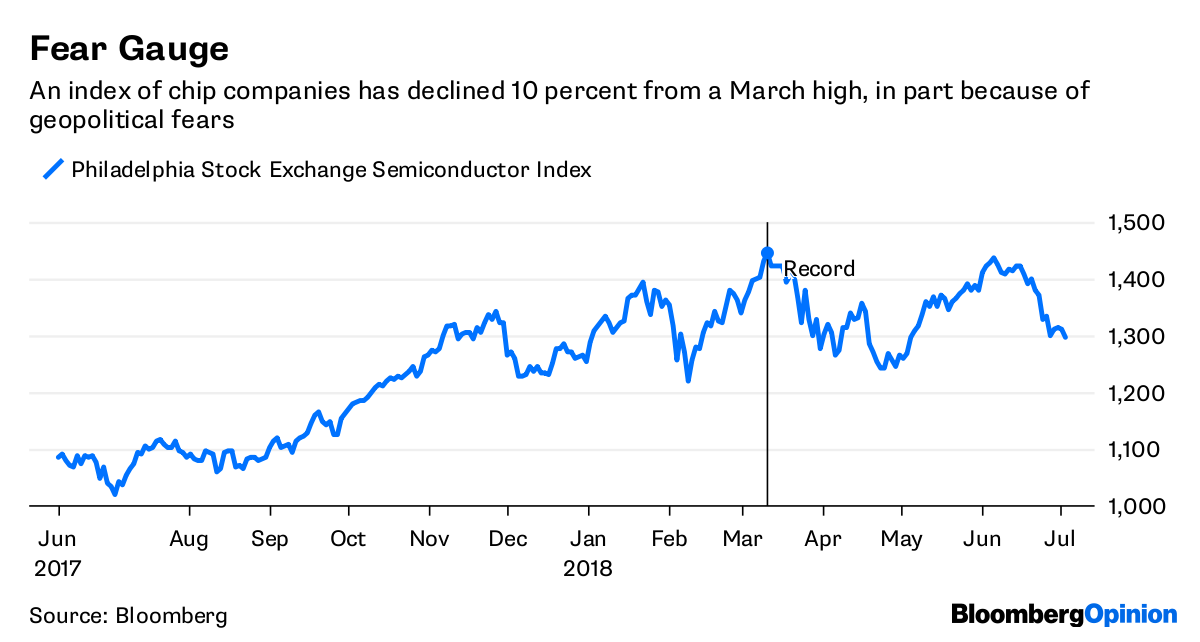

The Battle of Patents Micron's is emblematic of the stew of factors that make investors sour on chip companies. In addition to the tariff war with China and fears of intellectual property litigation with Chinese companies, there is concern that the typical cycle of expansion and slowdown of some categories of business. chip industry is about to end. Partly because of a regulatory review motivated by global political factors, further consolidation will be difficult in the industry, even in categories that can use it. All this anxiety has pushed the semiconductor companies index down 10% since March 12th.

Fear Gauge

An index of flea companies dropped 10% from March's highs. 19659006] Source: Bloomberg

This is not the worst time for chip makers, however. The financial results have held up well for many companies and seem to benefit from technologies such as artificial intelligence and driverless cars, likely to increase the demand for computer chips. The prospects could be bright for the industry, but in the present unpredictable actions of governments around the world have caused chip makers to lose control of their own future.

This column does not necessarily reflect the opinion of the editorial board

For contact the person responsible for this publication:

Daniel Niemi at [email protected]

Source link