David Fickling is a columnist for Bloomberg Opinion covering commodities, as well as industrial and consumer firms. He has been a reporter for Bloomberg News, Dow Jones, the Wall Street Journal, the Financial Times and the Guardian.

Read more opinions

The recent tariff schedule of published by the US Trade Representative, Robert Lighthizer, threatens to add a 10% tariff on about 200 billion dollars. imports from China, in addition to the 25 percent tax on $ 50 billion worth of goods that have already been listed. If all the levies were passed, the $ 32.5 billion tax would account for about a quarter of the $ 124 billion corporate tax reduction during the fiscal year up to the end of the year. In September.

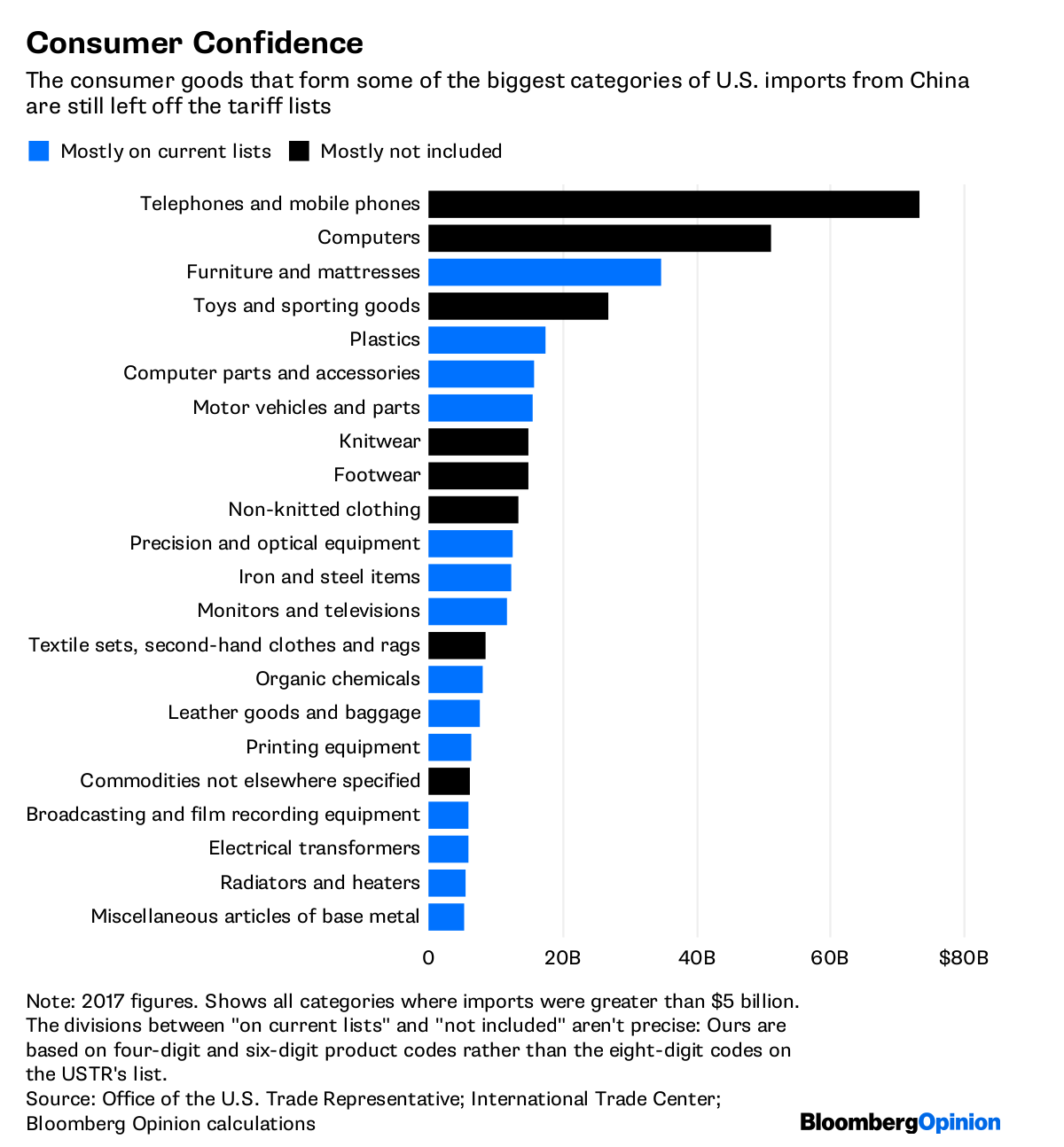

US consumers, who account for the majority of the country's imports from China. But an initial review of the 6,031 merchandise categories included in Lighthizer's latest salvo indicates that businesses should bear the brunt of the burden.

Almost all types of goods regularly purchased by US consumers are excluded from the action, including phones and computers – the largest categories of imports from China – as well as toys, clothes and shoes. This should have the effect of isolating individuals from the price increases imposed on the entire US economy, making the gambit more acceptable to voters.

Consumer Confidence

Consumer goods that are among the largest categories imports from China are still excluded from tariff schedules

Source: Office of the US Trade Representative; International Trade Center; Bloomberg Opinion calculations

It should be noted that less frequently purchased hard goods, where consumers will have fuzzier price concepts – such as flat-screen TVs and furniture – are on the list after being left out.

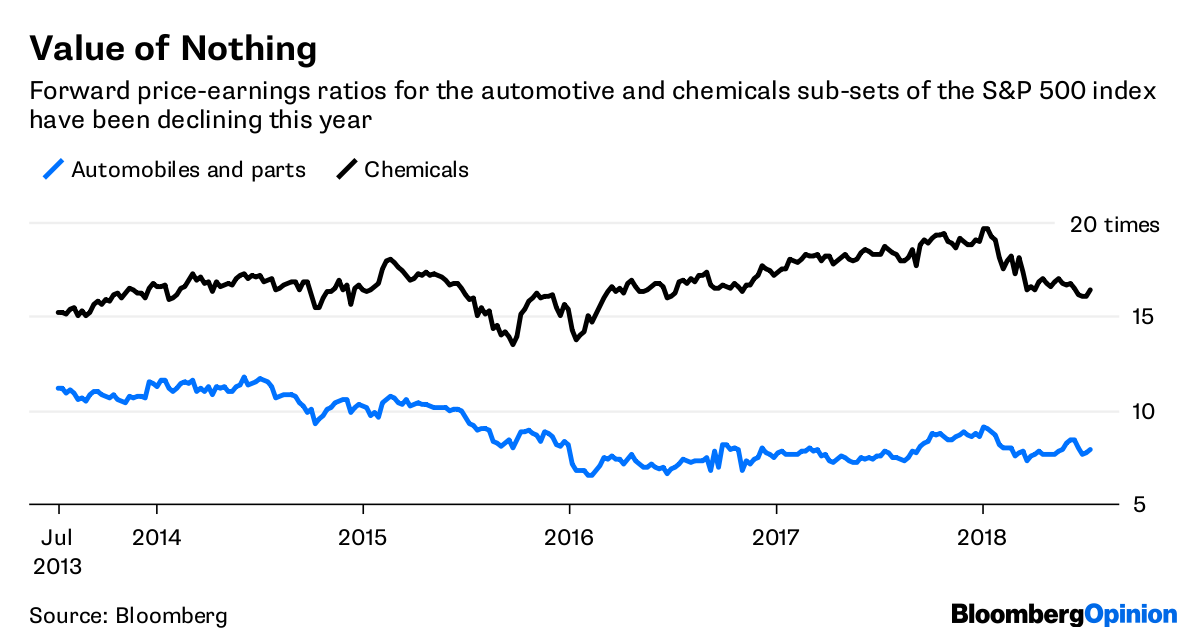

of the strategy will be borne mostly by the companies. Most of the tariffs are likely to fall on auto parts, industrial machinery, plastics and precision equipment. This could further aggravate the situation for companies in the automotive and chemicals sector, which have already sold in recent weeks.

Value of Nothing

The futures price-earnings ratios for automotive and chemical subsets of the S & P 500 have declined this year

Source: Bloomberg

Harley-Davidson Inc. and BMW AG recently announced plans for boosting production in factories outside the United States to reduce dependence on US imports hit by tariffs, while General Motors Co. has warned that the company is likely to be in a state of emergency. commercial action could reduce the company and the American automotive workforce. DowDuPont Inc., too, said that it is studying construction plants in Canada or Argentina rather than on the Gulf Coast following the moves.

The arbitrage between corporate rates and tax cuts will not be simple. Tax relief will be the most important for companies with the largest share of revenue in the United States. the impact of duties will fall more heavily on internationally oriented companies with global supply chains.

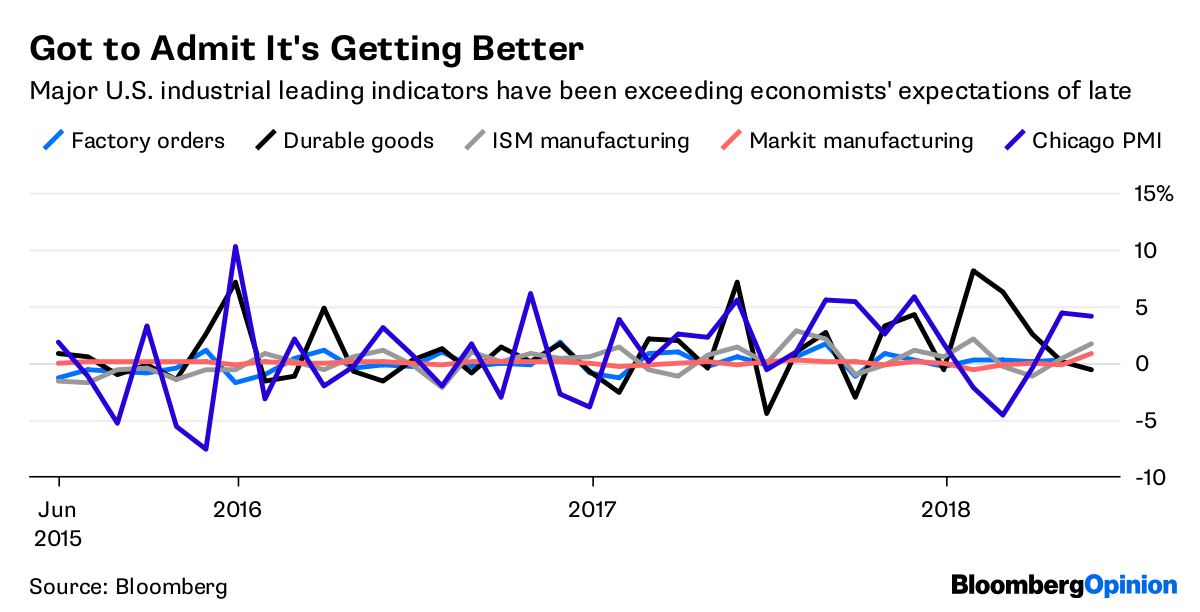

True, the harsh health of the US economy and business in 2018 suggests that companies will be able to bear the weight of the levies. Leading industry indicators have consistently outpaced economists' forecasts, and Bloomberg's consumer weekly comfort index is approaching one of the highest levels since the start of the survey in 1985, leaving to see a lot of leeway to pass on the price increases. The current list, too, is preliminary. It can therefore be reduced after the contribution of the industry.

Admittedly, things are getting better

The main US industrial indicators have exceeded the expectations of economists lately

Source: Bloomberg

However, the impact of increased costs tends to be seen more easily at the back -view mirror than through the windshield. US producer prices, expected to rise on Wednesday, rebounded to the highest levels since 2011, and these costs will eventually be passed on to consumers.

Wealth of Nations

Oil prices are rising and interest rates are rising northward, which only adds to the picture of increasing pressure on costs at a time when wage gains are still low. by historical standards. The burgeoning global economy has given Washington the leeway it needs to wage its commercial struggle with the Chinese. This respite should not be taken for granted.

To contact the author of this story:

David Fickling [19659032] at [email protected]

To contact the editor responsible for this story:

Paul Sillitoe [19659031] at [email protected]

[ad_2]

Source link