[ad_1]

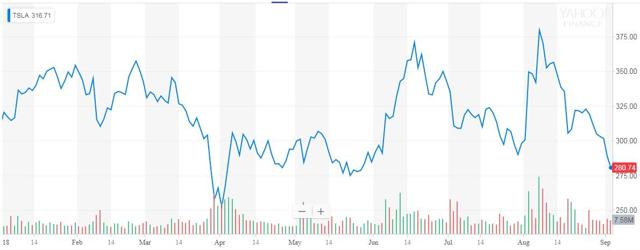

It did not last well for a few days for Tesla investors (TSLA), be it those who hold the capital or the debt. After CEO Elon Musk decided that switching to private activity was not the best solution, shares fell to $ 280 and bonds reached a new low, as shown below. What appeared to be good Wednesday sales estimates could not even help, so one has to wonder if Elon Musk's wager could have stopped big strides.

(Source: Finished page for Tesla 2025 bonds, seen here)

Over the last five weeks, these bonds have lost more than $ 8.50 from their recent peak, down almost 9.2%. Wednesday's close of $ 85 marks a new low and the yield on these bonds is now above 8.00%. Given that the 7-year US Treasury (at about the same date as the Tesla 2025 bond) currently accounts for only 2.85%, Tesla's bonds report more than 500 basis points more than the comparable "no risk" rating. This shows that investors are currently seeing a lot of risk in this business.

Previously, I had already discussed the fact that the month of August could be a revealing month for Tesla, and this could be in more ways than one. Ignore the go-private fiasco for now, and let's focus on how the business is really doing. Estimates are beginning to be felt for Tesla's monthly sales, and I have shown below the figures we have so far compared to the same period in 2017 for the S and X models.

(Source: teslastats.no, TMC Europe tracker, InsideEV monthly dashboard)

With a handful of countries still without data, Tesla seems to have done well in August, with around 1,150 units in the first two months of the third quarter. However, these positive trends are probably somewhat outweighed by China because of the major tariff problem there because some report major sales are decreasing. Management has already stated that if Chinese demand is to fall, it will move vehicles to the United States and Europe, then we could see it now.

As I mentioned earlier, the S / X inventory jumped in the first half of 2018, which could hurt Tesla's margins in the third quarter if the company sold older inventories. It also appears that the company is taking advantage of the levers to boost sales in the short term, the latter involving the lifting of restrictions on leases, allowing customers to exit a current lease if they enter a new Tesla by the end of the quarter.

The other news that seems to be positive is the estimate that Tesla delivered 17,800 model 3 units in August, according to the InsideEvs link above. This would be a new monthly record for the company's most recent vehicle, with approximately 3,550 more vehicles than in July. Another month with this type of progress in September would put Tesla's third quarter shipments in the 50,000 to 50,000 range. That's what was forecast for Model 3 production this quarter, but the Management stated that deliveries should exceed production, as more than 11,000 units were in transit at the beginning of the quarter.

However, there are still a number of major problems with Tesla. According to Electrek, the company did not reach its target of 6,000 Model 3 units per week at the end of August and the major Autopilot update announced in August now seems to be not arriving by the end of September, which means that I can add another one. failure to the list. The other major problem goes back to the whole of the private situation, where not only important lawsuits were filed by investors who lost money, but now, Elon Musk is prepares for possible action by the SEC.

In the past, if we had seen a huge monthly number of models 3 or what appeared to be strong sales of S / X, I would expect securities to be in effect and the stock to react positively. The fact that Tesla's shares and bonds did not do so Wednesday, on the contrary, shows how much the sentiment is currently around the name. Any progress made on the business front may have been completely destroyed by all the problems resulting from the go-private fiasco. As seen below, Tesla's shares have now declined by more than $ 100 from their recent peak, after Elon Musk declared that he was considering taking the private name. Secured courtesy seller.

Disclosure: I / we have no position in the actions mentioned and we do not plan to enter positions in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

Additional disclosure: Investors are reminded that before any investment transaction, you must do your own due diligence for any name mentioned directly or indirectly in this article. Investors should also consider seeking advice from a broker or financial advisor before making any investment decisions. Any item in this article should be considered general information and not be considered a formal investment recommendation.

[ad_2]

Source link