[ad_1]

1. Bear in Hong Kong: The Hong Kong Stock Exchange is crumbling due to growing fears of a growing trade war between the United States and China and fears of slowing economic growth in China.

A decline in the Chinese currency, the yuan, has made it more expensive for Chinese investors to buy Hong Kong stocks, as their price is set against the Hong Kong dollar, which is pegged to the US dollar. Fears about the stability of emerging markets exacerbate general nervousness.

The Hang Seng index fell on a bear market Tuesday, closing down 0.7% for the day to be more than 20% below its recent high in January. There has been a bear market in mainland China since the end of June.

President Donald Trump said on Friday that he was ready to impose a new wave of tariffs on $ 267 billion worth of Chinese products.

In addition to tariffs already in force or in preparation, such a measure would apply new taxes to all of the $ 505 billion worth of goods imported from China by the United States last year.

2. Chip deal: Japanese Renesas Electronics Corp buys US chip maker Integrated Device Technology Inc (IDTI) for $ 6.7 billion.

Renesas Electronics said the acquisition would strengthen its position in the automotive market, adding that it provides for "significant growth through autonomous driving".

Shares in Renesas jumped 4.5%.

3. The agreement with Alibaba in Russia: Ali Baba (BABA) wants to help Russia go big in online shopping. The Chinese e-commerce giant has announced a new joint venture with the Russian telecommunications company MegaFon, the Internet Mail.Ru group and the Russian sovereign fund.

The joint venture, AliExpress Russia, will integrate the main Internet and e-commerce platforms of Russian consumers to "become a leading social commerce joint venture in Russia," the two companies said.

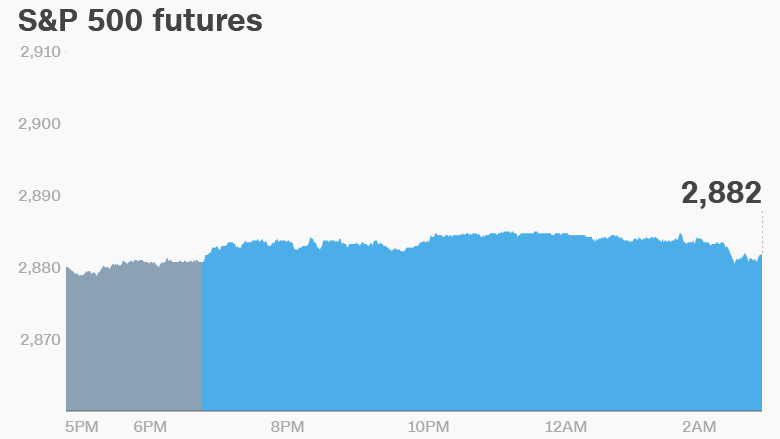

4. World Market Overview: US equity futures were mixed early Tuesday.

European markets were struggling to find a direction. Asian markets ended the session in a mixed way. The Japanese Nikkei closed up 1.3%.

The Dow Jones Industrial Average fell 0.2% on Monday. The S & P 500 gained 0.2%, while the Nasdaq closed at zero.

Before Bell's newsletter: Important news on the market. In your inbox Subscribe now!

5. Business and Economy: Actions in Tencent (TCEHY) fell 1.8% in Hong Kong on Tuesday. The Chinese tech company announced Monday the closure of its popular game "Texas Everyday Hold" em.

Tesla CEO Elon Musk said Tuesday that the company would reduce the number of car colors proposed to five against seven to "simplify manufacturing." You're here (TSLA) is struggling to accelerate the production of Model 3 in order to generate profits – and use that money for impending debt payments.

The latest data in the United Kingdom showed that the unemployment rate was 4% in the three months to July, the lowest in more than four decades.

Markets Now Newsletter: Get an overview of global markets in your inbox every afternoon. Sign up now!

6. Coming this week:

Tuesday – UK reports its unemployment rate

Wednesday – Brookings Institution welcomes panel on financial crisis, Apple announces new products

Thursday – Kroger presents its results, its report on consumer inflation in the United States, the European and British central banks declare their interest rate decisions

Friday – US retail and sentiment reports

CNNMoney (London) First published on September 11, 2018: 5:10 AM ET

Source link