[ad_1]

I do not need to tell you that the stock of Micron (MU) is going down in areas that many did not think to see for some time, if ever again. Financial media unofficially call the top of the memory cycle. Analysts expect DRAM pricing to be destabilized if it has not already done so and NAND to continue to fall further from already weakened readings.

But could that be analysts and Wall Street call something else?

It's easy to see that after a steady rise in memory pricing, any sign of weakening could be seen as the beginning of the end – the end of good memories and a beginning of squeezing margins and weakening of profitability.

"But wait," you would say, "Semiconductor equipment suppliers and memory players – including Micron – have said that demand trends are secular and supply is disciplined."

And you would be right. The question that arises is: what happens last month as an analyst after analysts have reduced their estimates of turnover and profit for the year? 2019? One of these parts does not tell the truth, right?

Maybe they are all.

It turns out that two things can be true at a time. The difference is that analysts do not really know what they are seeing and Micron's management does not believe that profitability will increase indefinitely from one quarter to the next in this new era of demand.

Cyclic

I do not need to explain much of this to anyone who is interested in the case of the bull or the bear regarding Micron. This is a term we have not been able to overcome because that is where the memory market has developed over the last three decades.

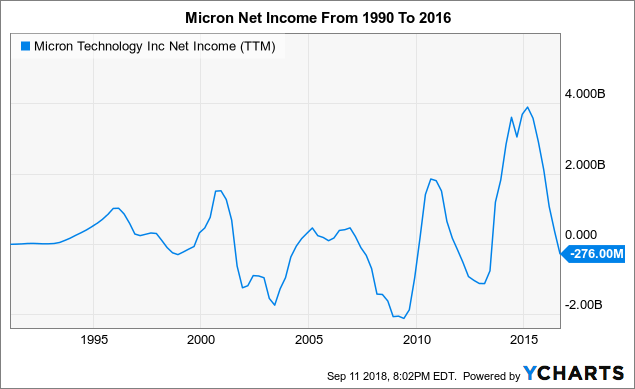

Look no further than Micron's profitability in recent years.

Net income data MU (TTM) by YCharts

These peaks above the zero line are undoubtedly the peaks of the cycles while the hollows below the zero line are obviously the bottom of the cycles. And that has happened with predictability and repetition over the past 30 years.

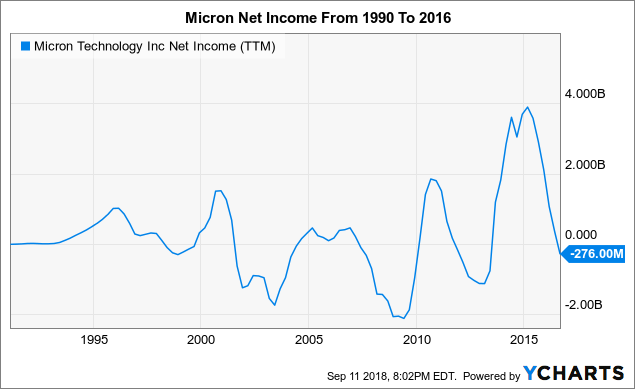

It is therefore not surprising that this term continues to be used because Micron has not proven its effectiveness over time. However, there are differences from previous periods because there are externalities that did not exist before. The easiest to report is the consolidation of the DRAM industry. Over the years, DRAM manufacturers have dropped by half, 23 in 1997 and 11 in 2012 and today, of which only six (Samsung (OTC: SSNLF), SK Hynix, Micron, Nanya, Winbond and Powerchip) . claiming 95% of the revenues of the last calendar quarter.

(Source: A strategic analysis of the DRAM industry after the year 2000 – Kyung Ho Lee, MIT)

There is evidence towards an argument of cyclicity becoming less and less likely. Today, with only three players in almost complete control of the DRAM market, it can be concluded that there is a higher probability that supply is maintained and prepared. In a situation where 23 or even 11 suppliers work, there is less chance of being able to control the market supply. When a manufacturer holds 30% of the market and limits the supply to adjust to the demand, its effect is much greater than one in 20 with only 6% of the market. This 6% can not do much to influence the market, but the 30% can certainly make their strengths.

To get back to where I started, that's where the analysts and the market expect us to go now – pricing is destabilizing and, therefore, the cycle has to turn and move towards the end of the inevitable zero-sum game. . That's how it always happened and nothing in the market has shown that it can not happen again.

But is it possible that there is another explanation?

seasonality

After two years of steady expansion of net profit, two years plus one quarter expected in a week, it is reasonable to expect that this trend will not continue.

Where is he going?

Since memory pricing has been on the rise for most of the time, the first crack in armor prices is an immediate concern for analysts and investors, as falling prices are not good.

Well, wait a minute – this is not how the DRAM and NAND markets work. I'll talk more about it in the next section, but for the moment, I want to discuss Why prices can fluctuate and why some analysts wonder why the demand is down.

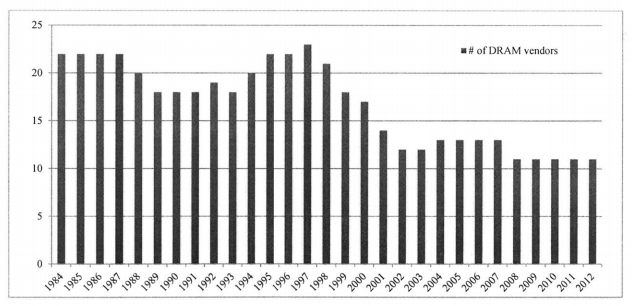

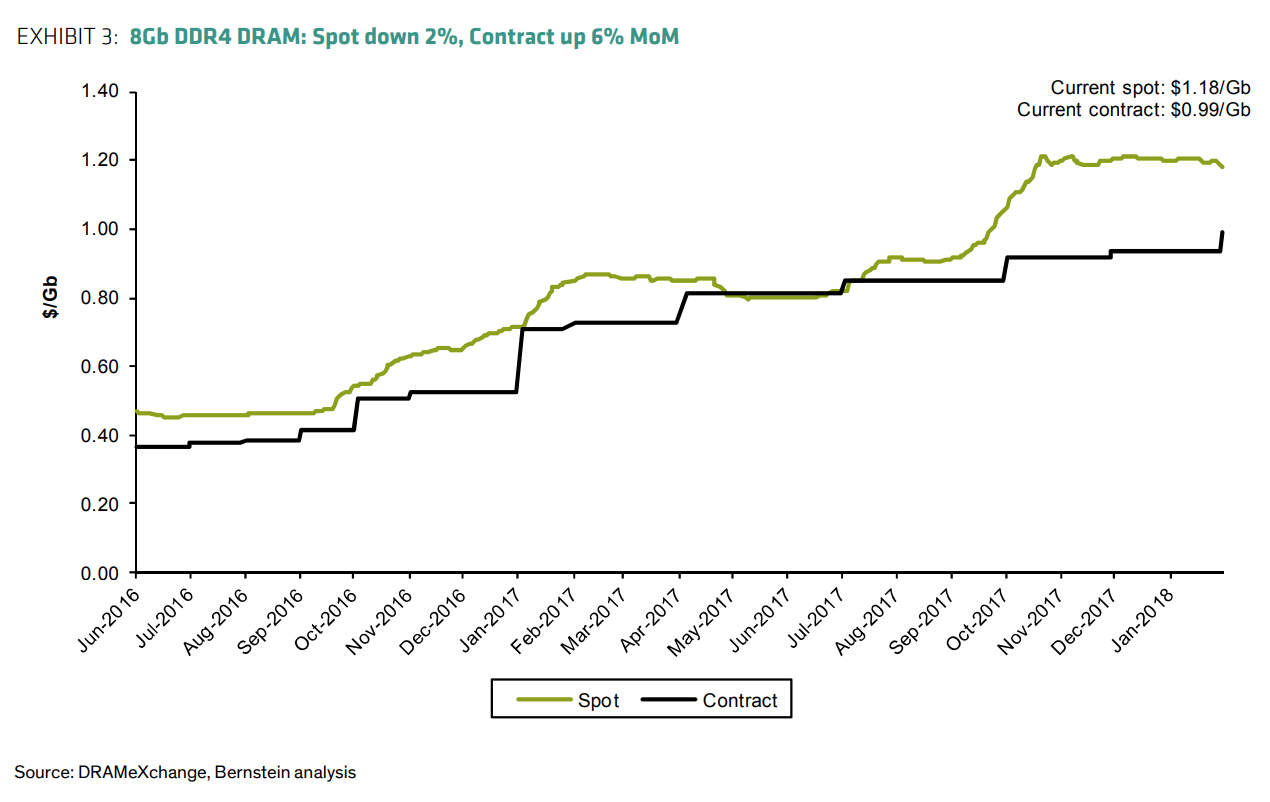

During the second half of the 2017 calendar year (the first half of Micron's 2018 fiscal year), the pricing of memory was still very much up.

(Courtesy of Micron's Electric Phred: We're in the chips)

This strength in pricing has easily outpaced any type of seasonality in the market. Seasonality has been tempered by constant pressure on prices, masking the effects. Now, what season are we talking about exactly? The seasonality of most major technology brands, from Apple (AAPL) to GoPro (GPRO) through Nvidia (NVDA) and HP (HPQ). In the fourth quarter, all these consumer brands are sold and all require a lot of storage, memory or both.

You could say, "Is the seasonality of the fourth quarter not good for firmer prices and an indicator of strong demand before this quarter? Yes you could. You can also check this East What's happening in the memory market right now because all the analysts have done is concerned about expectations from a drop in prices because of the current tendencies they see. Taking DRAM, for example, there was not much conviction that prices fell significantly in the current quarter. Analysts said their ratings were based on the perceived weakening of demand and the accumulation of stocks. This do I see the seasonality? Between the third quarter and the fourth quarter, inventories have increased dramatically to provide the names of consumers mentioned above, among many others, to reduce the risk of component shortages. own.

In fact, Micron's CFO alluded to this lack of concern about inventory levels at the Citi Technology Conference conference saying, "I'm not sure inventory levels end up in the future. to be a big story with time. This is a simple explanation: the inventory levels at this time are seasonal, no long term indicators. And if that is what Wall Street analysts have in mind in their portfolio, it's because they have forgotten what could be a seasonal effect, because last season was overshadowed by a dominant pricing.

Secular

It's also there that some people worry – the word of this new era of memory is lost or never existed. The concern comes from this trend of the memory market, which is supposed to be the savior of the cycle, to be a smokescreen and not to actually materialize. Secular trends can not degrade prices, prices must remain stable as long as secular demand remains intact.

Or it's the design – or rather the misconception.

This is not what we mean by secular. When Micron talks about secular trends, it means much more sustainable trends than a PC market or a rising gaming market, trends such as cloud infrastructure or peripheral computing or the ## 147 ## 39, deep learning. These trends are progressing more slowly and lasting longer as the world moves towards computing in this way. The highly flexible and malleable requirements of the PC market come and go depending on the purchase of workstations and laptops and the amount of consumable consumables. The demands for data centers and data centers that can meet the growing needs and constant capacity for in-depth AI learning come from a different source of demand and funds. This market is growing exponentially and is not comparable to the current or past PC market. In fact, AI returned should increase 57 times between 2016 and 2025 – this is only in a little over six years, not 10 or 15 years. This means that any major company in the world will have to outsource or create its own platforms and AI servers to capitalize. All this will require DRAM, storage and new types of memory (think 3D XPoint).

Throughout this growth of major IT trends, there will be ups and downs in the price of memory market. However, focusing only on the price aspect does not fit the situation. These secular trends will last for years and this means that the underlying demand will remain fundamental. This is not the same as memory being the same price over this period; memory will become "cheaper" with time and technology. The key is the offer and the cost. To return to the above cyclical discussion with three major players seeking to maintain a good balance of supply, we can focus on costs, which is the meeting point of rubber.

Without going into details about technology node transitions to determine more bits per slice and thus reducing costs – as we all learned about Alpha's research on the relative costs of memory – I want to focus on the simple equation of the less expensive bits of the face to sell for less. Lower memory prices do not mean that revenues or even profitability are decreasing or even stop growing. If costs can be reduced faster than average selling prices while the volume of bits shipped increases (a factor in more bits per slice), Micron remains a very happy company.

If Micron reduces bit production costs at a rate higher than bit price cuts, it can still see margin growth. But let me go a step further by reminding you that it's not just about chips prices (contracts) when the company produces products with higher value and stronger margin – which allowed an increase in PSAs last quarter. I am specifically referring to the company's NAND ASPs, which are increasing while NAND prices are falling.

At constant perimeter, NAND prices fell slightly sequentially our ASP NAND set has increased in the percentage range to a higher-middle digit, driven by a richer mix of high value solutions in our NAND portfolio.

– CFO Micron, FQ3 conference call

Do not confuse the three

There is not much more to say – pricing is not the end in itself. Lower prices can still generate a very profitable and important free cash flow business. Quarter-over-quarter growth will not be in the range of 20% and 30% from a year ago, but Micron does not need to grow every quarter for equity prices to rise. The action simply needs a change in market perception in order to see a multiple expansion, resulting in an increase in the magnitude of stock prices. And all that to say that prices could not even fall or fall in the next two or three quarters, as analysts predict! But guess what? Even if they do, read this article again because it does not change.

Although my opinion and my analysis do not make you feel better about the suffering of your wallet, at least eliminate it: if the forecasts of the analysts and Wall Street are mistaken on what they expect (and they the have been recently) This is one of Micron's greatest buying opportunities. It will not take long to prove that everything is due to fears from a return to a cyclical past. Analysts can simply read the seasonality, but claim a cyclical character while ignoring secularism.

If you wish to be informed of my opinion and my analysis in the future about Micron and other technology companies, I encourage you to follow me by clicking on the "Follow" link at the top of this page, next to my name .

Subscribers have a first overview

I've talked to my subscribers about my thoughts about Micron via my service's discussion board as well as my podcast before this article was published. Not only were they aware, but they also received the strategy and explanation of the datasheet to take advantage of it, which I do not share with my public readers in articles like the one you just read. To be aware of opportunities like this one and the strategy to take advantage of it, you must join me at my service, Tech Cache. My department deals with technology and technology-related companies and the opportunities therein because the growing needs of your portfolio are in technology. Right now, you can try it without risk with a free 2 week trial!

Disclosure: I am / we are long MU

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link