[ad_1]

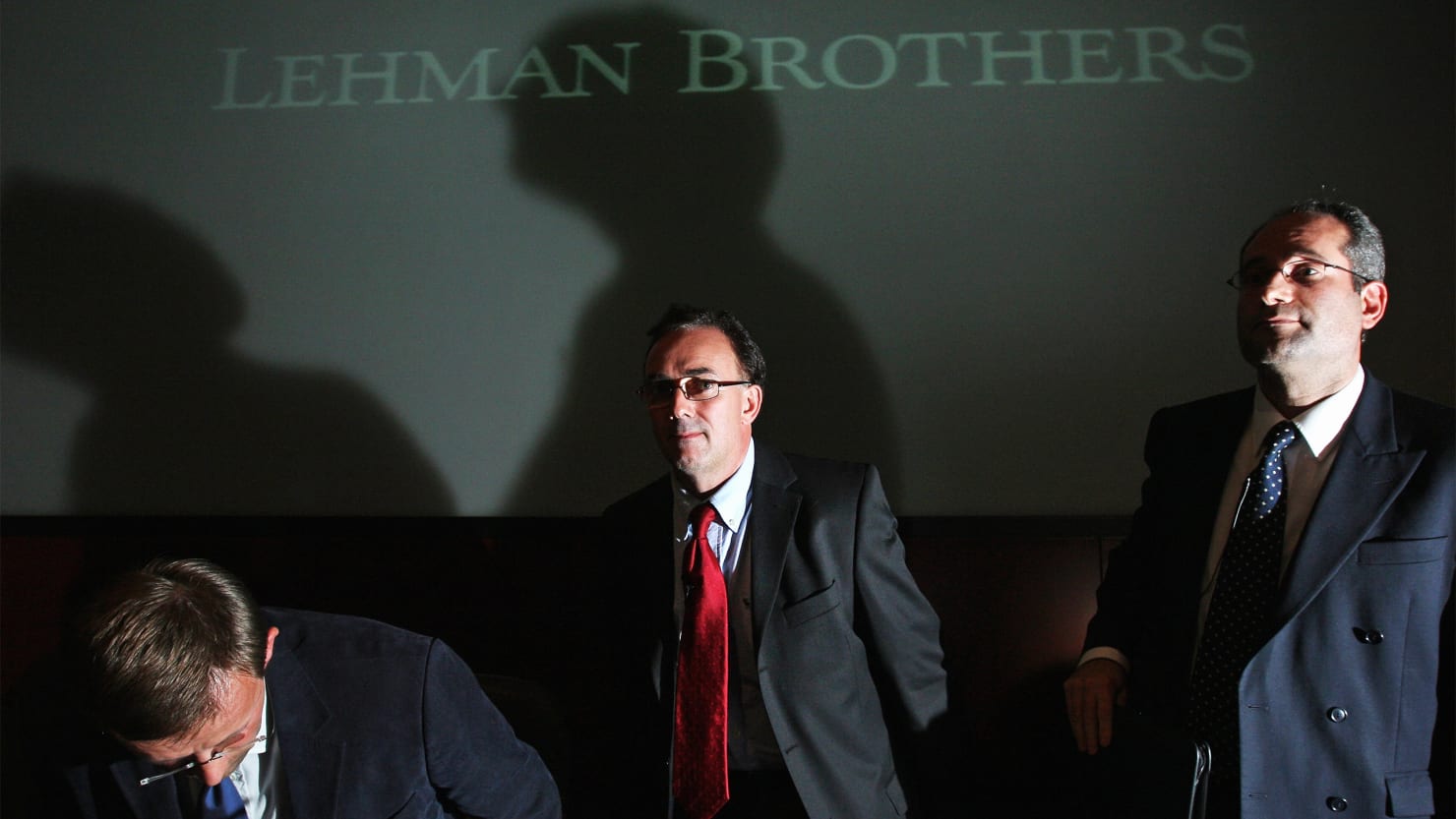

The collapse of Lehman Brothers ten years ago today triggered the financial crisis that paralyzed and even killed for some the American dream as we knew it. Trump, could start changing that, at least for Americans who are not determined to stay in his most blue and expensive cities.

In total, about nine million jobs and nearly $ 20 trillion worth of household wealth were lost. Lastly, employment levels have recovered, but most of those who have suffered from the Great Recession – and in particular current and former middle-income owners – have not seen their wealth restored when the economy has a turnaround.

Perhaps the worst of all, the recession has undermined our traditional belief in a better day. According to a 2014 survey by NBC News and the Wall Street Journal, only one in five Americans is confident that children 's lives today will be better than their parents'. Nearly three out of five Americans expect children today will be worse off, according to a Pew poll in 2017.

Some Certainly, buyers who were trying to catch up and get ahead of the market, thinking that prices would continue to rise, pushed up the homeownership rate with dubious loans that many could not afford to pay back. After approaching 70%, the rate is now back in the range of 63 to 65% of the quarter century before the housing bubble.

But there are two main reasons why most Americans still have not regained their wealth or position ten years earlier and that most young adults start the race far behind: slow wage growth, and often the most desired markets.

The wages of workers and middle classes, at least until this year, have stagnated. According to Pew, only high-income households have recovered financially from the Great Recession, while the vast majority of middle-income and low-income households have not yet recovered their wealth before the recession.

Meanwhile, housing costs have continued to rise, driven by conscious but unwise policies, particularly in coastal states, where new construction is limited. Second quarter data from the National Association of Realtors shows that median home prices in many blue enclave areas have surpassed 2008 highs. In Portland, Seattle and San Francisco, prices have risen 30% over of the decade. In Denver, prices have risen more than 80%. They rose 60% in San Jose, where the median home price is now $ 1.4 million.

Rents are also increasing significantly in some coastal markets, leaving many Americans in markets like Los Angeles. New York and Miami multiply, fall back on family homes or have trouble paying every month. The biggest losers were the millennials and African Americans. A recent St. Louis Fed survey called A Lost Generation? (PDF) found that the effects of the Great Recession persisted mostly among people in their thirties, who had the highest level of debt in any age cohort, and who may never recover the financial amount lost.

The double blow of high rents and college debt made homeownership out of reach for too many Americans just entering their first years of marriage and home buying. The problem is particularly pronounced in California, where just 25% of people aged 25 to 34 own, compared to 37% nationally.

The percentage of African-American homeowners nationwide decreased by more than ten points between 2000 and 2016, by far the largest decline among racial groups. Many fewer African Americans now own homes in Los Angeles, San Francisco or San Diego than in Dallas, Houston or Atlanta.

The great recession and the new America of Obama

This may have been a tragedy for most Americans, but the recession has been a blessing for many planning employees, media and academics who have seen a large number of suburban foreclosures as the centennial American change toward the suburbs were finished. Rather than welcome dreams of upward mobility, new planners, like Paul, from the Atlantic: Leinberger now proclaims that the suburbs are more likely to become "the next slums".

This, in turn, was supposed to usher in a new urban age of gold. In his book The Great Inversion, Alan Herentals predicted that educated and skilled workers would eventually rise and leave supposed suburban dystopias and return to major cities. This has not been the case, at least to the extent expected, but the narrative continues to enjoy strong support in the national media of New York City.

In this first phase of the recession – from 2009 to 2011 – large cities also had a great friend at the White House at Barack Obama. Its recovery policies were directed, unexpectedly, towards the urban interests that elected it. Obama has bailed out the big banks, also the mainstays of the economy of the main city, as well as the governments; Four dollars of new subsidies were paid to the big banks for every dollar donated to Main Street. The first urban president since the nation became predominantly suburban, the vision of Obama, and increasingly that of his party, has embraced urban containment and densification, while seeking (unsuccessfully) to convert drivers as transit users.

Although the president may reasonably claim to have taken the economy "out of the pit" in which the Republicans had sent him, Obama's recovery was arguably the most unequal in American history, with 95 percent all the gains made in 2013. Silicon Valley, Hollywood and Wall Street flourished and encouraged the president because of the extremely low interest rates and massive fiscal stimulus that supported the capital markets and inflated the equity pools. capital risk.

The big banks behind the recession have increased their share of deposits by 50% since 2007. Not a big banker went to jail for nearly knocking down the global economy.

Generally satisfied with Obama, few progressives noted that even though elites liked these policies, a lot of the polloi hoi did not usually do it – even though voters deserted in 2010 and 2014 and in 2016 leaving a decisive control over Washington as an unprecedented number of public offices.

The Tea Party's 2010 revolt may have been associated with opposition to Obamacare, but its cultural and economic roots were much deeper. For much of the country – including Texas, the Great Plains and Intermountain West – Obama's "green" economic policies threaten key local industries such as energy, manufacturing and homebuilding. As the Democrats left their working and working-class roots to become the party of the coastal elites, blue-collar workers had real reason to fear democratic rule.

Just as important were the new demographic trends that, along with the long-standing patterns that progressives had insisted on no longer apply. As the millennial generation began to turn 30, the movement back to the city began to slow down as early as 2011. Even with the improved performance of major cities, domestic migrations continued to favor the US suburbs. Affordable subway areas including Houston, Dallas-Fort Worth, Orlando, Nashville, Charlotte and Raleigh.

In 2017, New York's population growth rate had dropped from its 2010 level. During the same period, one million net residents left Los Angeles. In San Francisco, almost half of those surveyed now say to pollsters that they want to leave.

While some price increases may have been natural given the boom, for example in San Francisco, local policies have made things worse. The Brown administration is strongly opposed to the development of the suburbs, where construction has been allowed towards small, generally expensive flats that rarely attract older people, especially those with children, and are generally not affordable for low-income households. The kind of natural outdoor movement that created the original Silicon Valley in the 1960s and 1970s and affordable suburbs around the world was stopped in his footsteps.

The restrictive approach to development in California and some other states, including Washington, DC, Oregon, New York and Massachusetts, has sharply increased prices. Since 1970, housing prices in California's major metropolitan areas, relative to income, have tripled compared to the national average. An entire generation of young adults has been encouraged to leave for another country or to accept the status of servant for life.

The Trump era: cause and effect

As in 2010 and 2014, the media dominated by cities and coastal areas can not register diverging opinions elsewhere. Convinced that we are on the road to a "green" urban future, progressives still have not recognized that many industrial workers, suburban owners, small entrepreneurs, and others did not want to emulate urban elites but away from it in the suburbs.

It is there that lies the true secret of trumpism. Many Americans did not want to see the continued erosion of industries that offered decent wages to the middle class and the working class. Trump has promised to reverse this trend and, to date, its policies have triggered widespread national growth in an otherwise struggling global economy. Small businesses, for example, now enjoy the highest level of trust ever recorded.

For the moment, at least, the economy of Central America is making a strong comeback, contrasting sharply with the period that followed the collapse of the real estate market. Industrial employment reversed the declines that hit the end of the Obama years, increasing 327,000 jobs over the past year, the best performance since 1995. The sector recorded the highest production in fourteen years in August . Retailers, home builders, business services companies are all recruiting and, for the first time in more than a decade, wages in the bottom half of the labor force are growing and even the long-term unemployed are returning to the market work.

More importantly, Trump may have changed the geography of economic growth. The share of growth currently recorded in US non-metropolitan areas has quadrupled. The Bureau of Economic Analysis's most recent data shows that state GDP growth is highest in Washington State, but most other leaders are in the west (Utah, Colorado and Wyoming) . South Dakota) and Texas. According to them, personal income growth in the last quarter was the strongest in the Washington Blue, but the strongest revenue growth is now occurring in West Uttah (Utah, Colorado and Arizona). ). , Indiana, Missouri and Michigan) as well as Texas. New York and California are not the leaders in both categories.

Much of this growth comes from the growth of a revitalized industrial and energy sector. Meanwhile, the Resistance states, New York and California, are experiencing increasing internal emigration. The population growth rate in California is among the lowest in the country – less than half that of Texas.

Despite the good news, we are far from having corrected the displacement caused by the Great Recession. Housing production remains well below historical norms, one-third lower than the 1980-2000 rate, adjusted population, with local and local government policies continuing to discourage suburban growth in favor of.

To solve this problem, state and local governments are reverting to policies such as rent control and "inclusion zoning" mandates, in order to raise prices for all by slowing the pace of change. construction. California's mandate for zero-emission homes is expected to raise already-high prices by at least $ 20,000 – and without doing much for the environment, environmentalist Mike Shellenberger warns.

As prices rise nationally, highly regulated markets like California are seeing their home sales fall by more than 12% in the largest market, Los Angeles-Orange County.

This concentration centered on the urban could prove to be expensive. The sales areas in the formerly hot big cities are now experiencing an erosion of rent rents. According to CBRE, rents for offices and industrial premises are also down.

Another potentially damaging trend for many cities, particularly on the coast, could be the decline of foreign investors – especially Chinese who invested $ 40 billion in foreign real estate in 2017 – which helped keep prices high. , especially in California. sent a third of their money here in Washington State and New York. Chinese investors have placed millions of luxury apartments in New York City and downtown Los Angeles, some of which are difficult to market to locals but instead offer Chinese buyers.

Other Chinese investors have also bought single-family homes, particularly in the highly Asian suburbs of the Bay Area, Orange and the suburbs of Los Angeles. Now, for the first time in recent memory, there are more sellers than buyers, as sales are falling. Worried about financial problems in its own national real estate market and fighting a trade war, the Chinese government is striving to send strong signals to both individual investors and businesses to reduce new real estate projects.

This river of money could dry up as the higher interest rates we eventually see will mean a rapid increase in mortgage costs for buyers. Higher interest rates tend to compromise the viability of high-priced markets in particular. New York, which has barely experienced a small recession, let alone a large, while artificially low interest rates have weighed on banks, the city relies on buzz and massive foreign investment has pushed up price of real estate. As investment activity decelerates and interest rates rise, New York's financial sector may suffer, driving the city's economy.

At the national level, we could set the stage for a new kind of housing debacle, a recovery no one wants to see. There are already worrying signs, such as the increasing percentage of buyers paying 45% of their income or more in mortgages; quadruple compared to 2010. Then there is the return of the mortgage market to its pre-recession level.

As we begin to recover from the damage done a decade ago, a new housing crisis could spill over beneath the surface.

Source link