[ad_1]

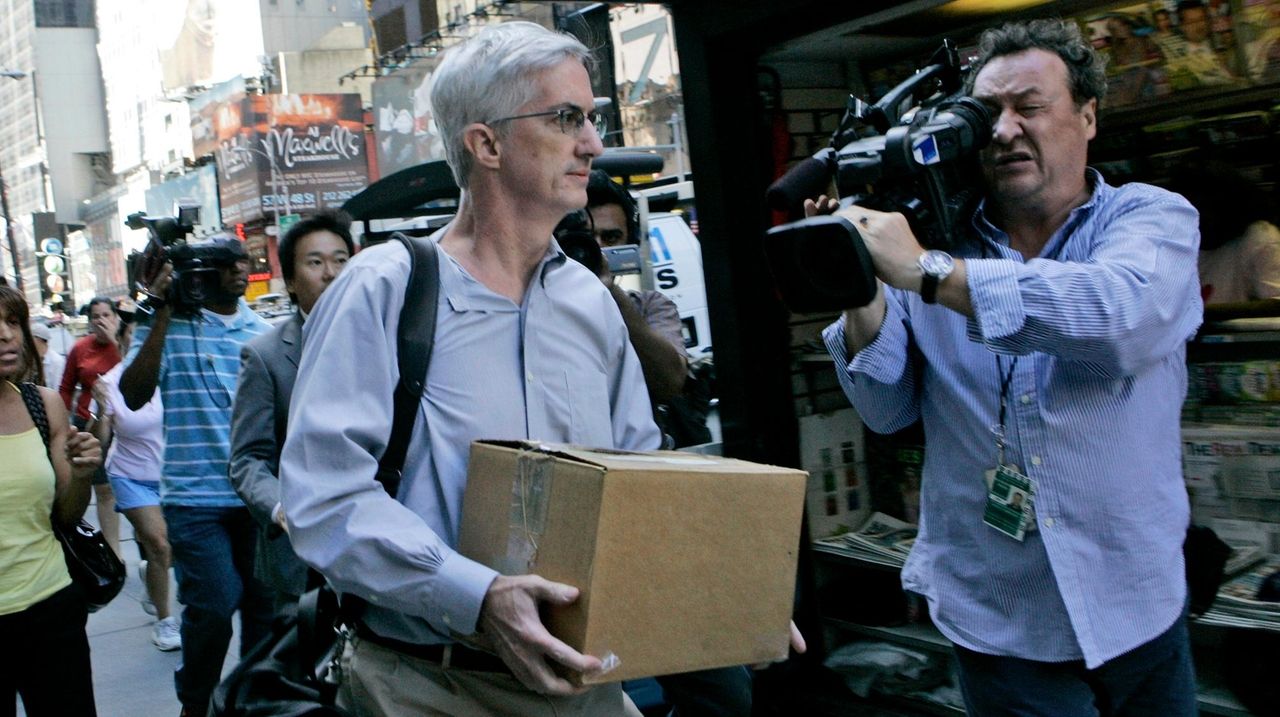

The collapse of Lehman Brothers investment bank, on September 15, 2008, triggered the most severe financial and economic downturn since the Great Depression.

For Lenny Messina, former chief pastry chef of the investment bank's senior executives, the turmoil was personal.

"It was devastating," said the resident of Farmingdale.

The bankruptcy filing of Chapter 11 left the 19-year-old veteran unemployed, disrupted his son's college plans and devastated his retirement account, which was responsible for the company's stock. "If I were still in Lehman, I would have retired now," said the 56-year-old.

The bankruptcy of Lehman Brothers has spread far beyond the headquarters of Vecsey Street in Manhattan. Millions of subprime mortgage borrowers who have defaulted on their obligations, which was at the root of the Wall Street crisis, have deprived thousands of Long Islanders and millions of Americans of their jobs and their houses.

It has also become a global crisis.

"Spain has seen a huge housing bubble," said Juan Carlos Conesa, president of the economics department of Stony Brook University, who taught at the Autonomous University of Barcelona at the University of Barcelona. # 39; era. When the bubble burst, unemployment and business bankruptcies increased in Spain.

One of the defining elements of the financial crisis was that few people had seen it coming.

"Everyone thought that the economy was in good shape in 2007," said Mitchell O. Goldberg, president of the Melville-based investment firm, ClientFirst Strategy Inc.

The roots of the crisis can be traced to a cavalier attitude to risk and widespread borrowing by investors, from Wall Street banks to homeowners.

In the United States, many real estate brokers have sold variable rate mortgages to unskilled homebuyers – what's called subprime mortgages. Goldberg said some were "ninja" loans: "No income, no work, no assets".

Instead of being owned by the banks that provide the loans, these mortgages were then combined and grouped into exotic securities sold to institutional investors.

Lehman's "is aggressively attacking mortgage-backed securities without having any idea," said Anoop Rai, a finance professor at Hofstra University. Adding to the problem, he borrowed a lot, he said.

And when then-U.S. Treasury Secretary Hank Paulson has not been able to sell Lehman, Rai said.

"It becomes a question of liquidity at this stage," he said. "If the market perceives problems, nobody will lend in the short term."

Jojo Granoff, a resident of Baldwin, worked in the area of investor relations with Lehman's private equity unit. "It's like waiting for the other shoe to fall," she said.

Despite the bankruptcy, the private equity unit was isolated from the creditors because of its structure. Granoff said the funds simply found new sponsors and continued their operations.

Yet Lehman's stock, which accounted for about 12% of his annual eight-year bonus in the company, went from over $ 80 a share to a few cents. "I have never sold any of my Lehman titles," she said.

In the end, Washington decided to bail out the economy by providing billions of dollars for other banks to survive after the collapse of Lehman. And the Federal Reserve has purchased for billions of dollars of Treasury debt – a practice known as quantitative easing – to lower interest rates, increase money supply, and promote lending.

Messina, today pastry chef of Pier Sixty at Chelsea Piers in Manhattan, recalled the golden lifestyles of the Lehman executives he served.

"My pastry shop was on the 19th floor, right behind the PDG's private hairdressing salon," he said. "My job was making desserts and pastries for the top 100 leaders and their customers."

He recalled a case where an executive with a home in Connecticut sent an air conditioned limo to take two flourless chocolate cakes on a hot summer day.

"My cakes are in the back of a limousine while I'm riding in a subway," he said. "All the way back on the Long Island Rail Road, I think about my cakes, until in the end they lived great."

Source link