[ad_1]

<div _ngcontent-c15 = "" innerhtml = "

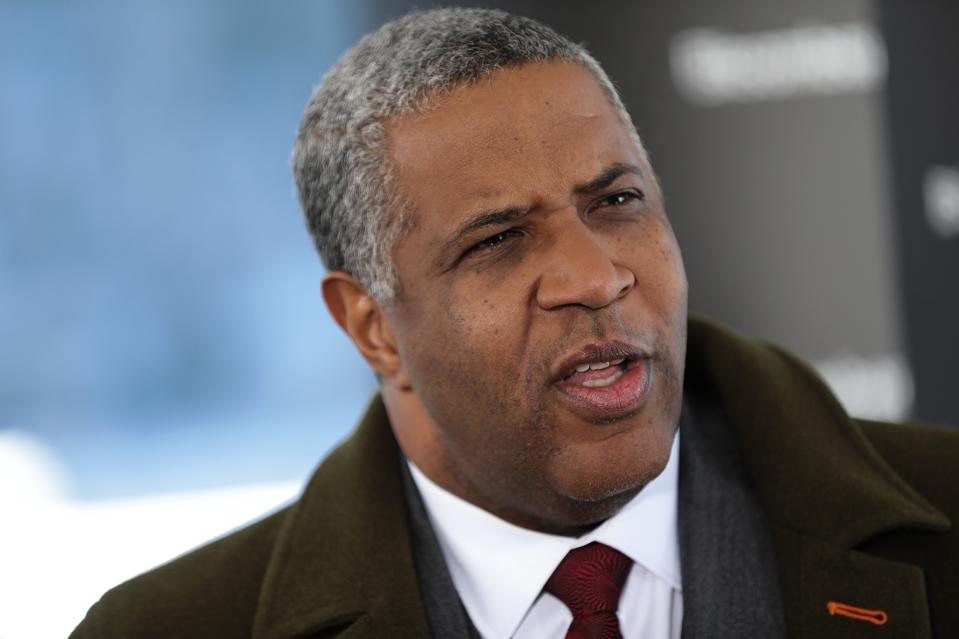

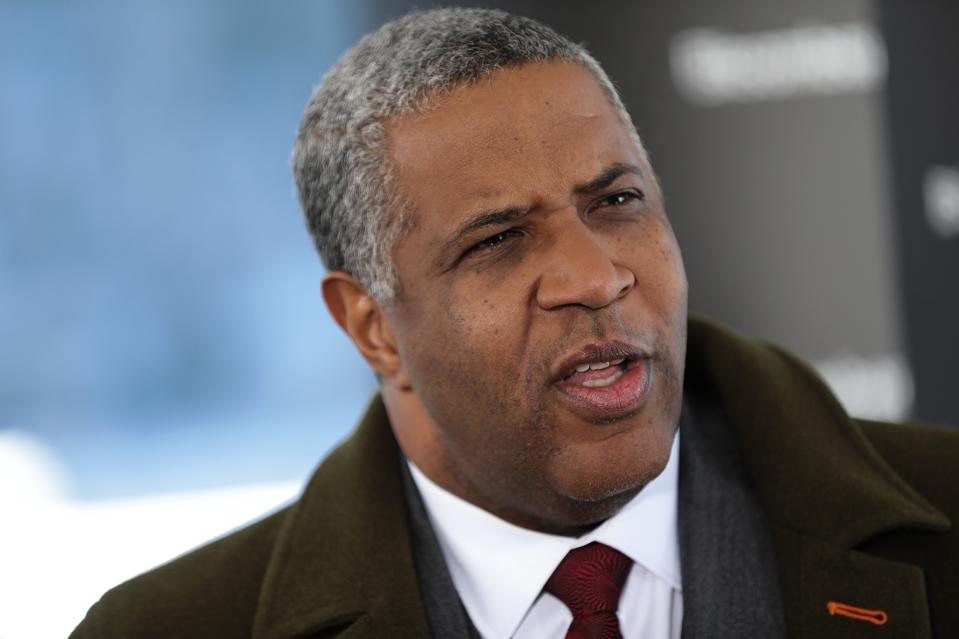

DAVOS WEF 2017© 2017 Bloomberg Finance LP

Two years ago, billionaire private equity firm Robert Smith made a big bet on a marketing automation software company that many of them thought Wall Street might not work.

On Thursday, Vista Equity Partners announced that it would sell Marketo to Adobe for $ 4.75 billion, confirming a strategy that Smith and his billionaire Vista co-founder, Brian Sheth, initiated while gambling

Vista will realize $ 3 billion in two years from the sale of Marketo, the largest single-company profit in the history of the private equity firm for 18 years.

Former investment banker Goldman Sachs, Smith founded Vista in 2000 to invest only in software companies. At the time, the conventional view on Wall Street was that the creation of a leveraged buyout activity around software was impossible because the target companies did not have assets to lend.

Smith ignored the opponents and made Vista an extremely successful private equity firm, becoming the richest African-American.

Smith was so successful that imitators rushed in, and eventually many private investors tried to buy the kind of traditional software companies that Vista focused on restructuring, which drove up prices. on the market. In 2016, according to DeaLogic, private equity firms had traded $ 58 billion in technology transactions, one-third of all US transactions.

So Smith and Sheth have rotated in a different direction. They decided to write big checks and buy software companies that were still in a growth phase, but which had fallen into disuse. In San Mateo, California, Vista has found Marketo and its cloud-based marketing automation software. With a declining sales growth rate, Marketo's stock market price fell by some 50% in the first months of 2016.

In May 2016, Vista reached an agreement to buy Marketo for $ 1.8 billion. This was an acquisition at a very high price, a premium of 64% compared to the date of trading of the share. The deal was also mostly with equity because Vista injected $ 1.3 billion in cash for the purchase to be possible. The terms helped Vista hijack Marketo from strategic buyers, like Adobe. But everyone on Wall Street did not think Smith and Sheth knew what they were doing. Marketo was losing a lot of money and, with its promising growth, the best employees were heading to the exit and looking for better opportunities elsewhere in Silicon Valley.

Vista replaced Marketo's founding CEO, Phil Fernandez, who had been running the company for a decade. His successor, Steve Lucas, a SAP executive, had more experience reviving the growth of a software company. The company has reviewed its product development and decided to tackle important transactions in the corporate space, where retention rates are higher and incentive sales are easier. At the same time, Vista has modified its secret sauce booklet to reorganize software companies and applied it to a growth story.

In 2017, Marketo's business turnover reached approximately $ 321 million, compared to $ 209 million in 2015 and, in early 2018, the company generated a positive EBITDA. it had a $ 50 million EBITDA in the 12 months prior to the Vista acquisition. Marketo remains a powerful marketing automation platform with a large installed subscription base and wind in the growing market.

Other signs indicate that Vista's other high growth bets on companies such as Tibco and Cvent are also under development. Smith's gamble on growth now seems wise.

">

DAVOS WEF 2017© 2017 Bloomberg Finance LP

Two years ago, billionaire private equity firm Robert Smith made a big bet on a marketing automation software company that many of them thought Wall Street might not work.

On Thursday, Vista Equity Partners announced that it would sell Marketo to Adobe for $ 4.75 billion, confirming a strategy that Smith and his billionaire Vista co-founder, Brian Sheth, initiated while gambling

Vista will realize $ 3 billion in two years from the sale of Marketo, the largest single-company profit in the history of the private equity firm for 18 years.

Former investment banker Goldman Sachs, Smith founded Vista in 2000 to invest only in software companies. At the time, the conventional view on Wall Street was that the creation of a leveraged buyout activity around software was impossible because the target companies did not have assets to lend.

Smith ignored the opponents and made Vista an extremely successful private equity firm, becoming the richest African-American.

Smith was so successful that imitators rushed in, and eventually many private investors tried to buy the kind of traditional software companies that Vista focused on restructuring, which drove up prices. on the market. In 2016, according to DeaLogic, private equity firms had traded $ 58 billion in technology transactions, one-third of all US transactions.

So Smith and Sheth have rotated in a different direction. They decided to write big checks and buy software companies that were still in a growth phase, but which had fallen into disuse. In San Mateo, California, Vista has found Marketo and its cloud-based marketing automation software. With a declining sales growth rate, Marketo's stock market price fell by some 50% in the first months of 2016.

In May 2016, Vista reached an agreement to buy Marketo for $ 1.8 billion. This was an acquisition at a very high price, a premium of 64% compared to the date of trading of the share. The deal was also mostly with equity because Vista injected $ 1.3 billion in cash for the purchase to be possible. The terms helped Vista hijack Marketo from strategic buyers, like Adobe. But everyone on Wall Street did not think Smith and Sheth knew what they were doing. Marketo was losing a lot of money and, with its promising growth, the best employees were heading to the exit and looking for better opportunities elsewhere in Silicon Valley.

Vista replaced Marketo's founding CEO, Phil Fernandez, who had been running the company for a decade. His successor, Steve Lucas, a SAP executive, had more experience reviving the growth of a software company. The company has reviewed its product development and decided to tackle important transactions in the corporate space, where retention rates are higher and incentive sales are easier. At the same time, Vista has modified its secret sauce booklet to reorganize software companies and applied it to a growth story.

In 2017, Marketo's business turnover reached approximately $ 321 million, compared to $ 209 million in 2015 and, in early 2018, the company generated a positive EBITDA. it had a $ 50 million EBITDA in the 12 months prior to the Vista acquisition. Marketo remains a powerful marketing automation platform with a large installed subscription base and wind in the growing market.

Other signs indicate that Vista's other high growth bets on companies such as Tibco and Cvent are also under development. Smith's gamble on growth now seems wise.