[ad_1]

The big stock market of Bitcoin comes at a critical moment.

Three of the world's largest cryptocurrency manufacturers are planning to sell equities, giving investors a new way to bet on digital currencies. They hope to collect billions of dollars.

Unlike the dollar or the euro, issued by central banks, crypto-currencies are based on computer code. Bitcoin, for example, is created and exchanged via the "extraction" process in which computer algorithms solve increasingly complex mathematical problems.

Bitmain, Canaan and Ebang, all of which are based in China, are making money selling the high-tech parts and systems that power the operation. Together, they dominate the company.

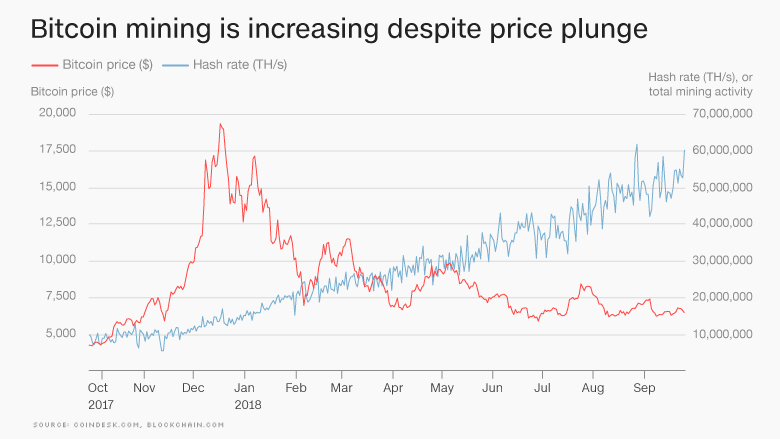

But the three companies operate in a young and unpredictable industry and plan their IPOs in Hong Kong under brutal market conditions. The price of bitcoin, which climbed to nearly $ 20,000 in December, fell by about two-thirds. Other cryptocurrencies like Ethereum have also dropped.

"If the price of the cryptocurrency market suddenly drops … the demand for our mining equipment and our cryptocurrency mining services will also decrease rapidly," warned Bitmain this week.

In addition to this, the Hong Kong stock market, where companies intend to entered a bear market this month, after plunging more than 20 percent from its previous peak due to concerns over China's economic slowdown and the US trade war.

Mining technology companies did not say when they were considering becoming public or how much they were looking to increase. Bitmain and Canaan refused interview requests, while Ebang did not respond to a request.

"These companies may be looking to cash in before the market turns even steeper," said Benjamin Quinlan, founder of Hong Kong-based financial services consulting firm Quinlan & Associates.

He points out that crypto-currencies are increasingly accepted by traditional investors despite recent setbacks and that the revenues of the three mining companies continue to grow. But the industry faces major challenges.

One of the main ones is the way governments manage digital currencies. Last year, China banned most activities involving bitcoin. The country is still thought to be home to a significant amount of cryptocurrency mining operations, but the authorities tried to expel them.

Cryptocurrency miners need huge amounts of electricity to power their computer equipment room permanently. Some utilities in the United States already introduce higher rates specifically for minors.

"Increasing the cost of extracting bitcoins will reduce the demand for mining equipment, hindering the performance of these companies," said Quinlan.

Cryptocurrency trading is already less lucrative than before.

The bitcoin extraction activity has exploded over the past year, which has stimulated demand for this technology. But this means that profits from mining are spread more narrowly over more users. This could affect future demand for mining equipment.

Will the mining boom last?

Bitmain, Canaan and Ebang were all profitable during their most recent fiscal year, according to documents setting out their intention to go public.

But staying in the dark will be a "daunting challenge," said Leilei Wang, a Shanghai-based consultant in the Kapronasia research firm.

Companies are aware of the risks they face and try to adapt. For example, they claim that they are investing more and more in a more advanced chip technology that can be used in areas such as artificial intelligence, cybersecurity and connected devices.

Although the Chinese government has a firm stance on cryptocurrencies in general, it is eager to boost the country's technological prowess in areas such as computer chips. Chinese companies still rely heavily on foreign chip technology, especially the United States.

"What he's doing [the cryptocurrency companies] are able to rotate successfully remains to be seen, "Wang said.

For now, their fate is tied to that of the industry at large.

"Crypto-currencies are likely to fall out of favor," Quinlan predicted. The mining equipment manufacturers "will find it extremely difficult to survive when the cryptocurrency market as a whole will disappear," he said.

But bitcoin bulls are still hoping for money to trigger a recovery as stock markets and large corporations start to take it more seriously.

"As you see more adopting people simply comfortable with that, it feels like it's going to increase," said Mike Novogratz, CEO of the investment company. Galaxy Digital cryptocurrency, at CNN this week.

CNNMoney (Hong Kong) First published on September 27, 2018: 6:56 ET

Source link