[ad_1]

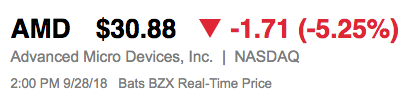

One of the best times to buy a momentum is down because of the changing market news that is being misinterpreted by the market. In such a scenario, Advanced micro systems (AMD) is down more than 5% to return to $ 30 on a Intel (INTC) updated on supplies for 2018.

The market is exaggerating the update offering a gift to investors.

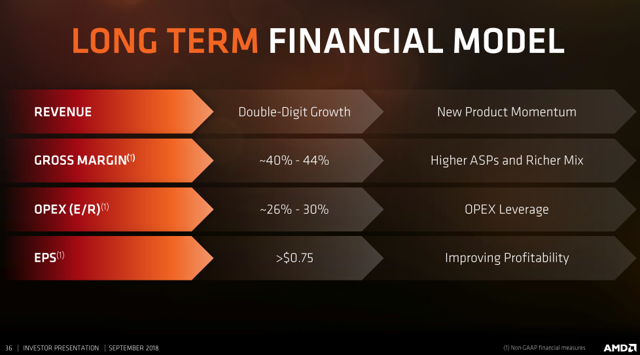

Source of Image: AMD's September presentation

Market Update

Intel surprised the market Friday with an open letter to its customers and partners regarding supply problems. In essence, the company wanted to convince the market that the chip giant would have supplies to meet market demand.

Interestingly, however, the Acting CEO is committed to meeting the revenue targets. The market has interpreted the press release as a statement of satisfaction of the claim, but this statement suggests the opposite:

We continue to believe we will at least have the supply to meet the fone-year turnover outlook We announced in July a $ 4.5 billion increase over our January expectations.

It is clear that Intel is committed to meeting all market demands. The target is the revenue estimate, and such a statement should perhaps not be surprising on the part of the CFO.

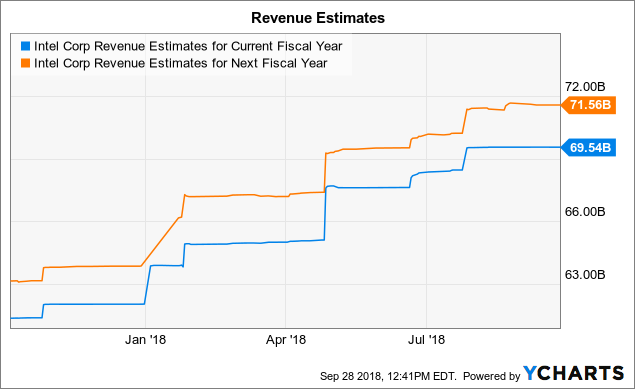

AMD's arguments were not exactly based on Intel's goals. Analysts were still predicting that the chip giant would reach this goal of $ 69.5 billion worth of discounted business. January's initial forecast forecast sales of $ 65.0 billion this year, so July's $ 4.5 billion increase is only 7% up.

INTC revenue estimates for current fiscal year data by YCharts

Another key point is that analysts were expecting Intel to increase its revenue by $ 2.0 billion in 2019. The problem was still whether Intel would have chips to meet the demand, whether through supplies or performance.

The big problem is the transition to 10 nm with AMD that goes to 7 nm. If Intel actually puts up to 2H & 19 to achieve a volume output of 10nm chips, AMD is expected to capture significant market share gains. This statement does not really answer this question, however:

We are progressing with 10 nm. Yields are improving and we continue to expect volume production in 2019.

Of course, to achieve the 2019 targets, Intel must gradually improve returns, making it an inaccurate statement. The company does not really change the schedule except to try to prevent customers from jumping from one ship to another while waiting for the new chips.

AMD Play

Intel's update is a desperate attempt to prevent AMD from gaining more market share. The move appears to be an attempt to address customer concerns based on statements by analysts such as Raymond James this week:

Intel's biggest strategic problem is their delay in producing 10nm. We do not expect Intel's 10-nm server chip before two years. Delays of 10 nm create a window for competitors, and the window can never close again.

According to Jefferies (via CNBC), a report from Fubon Research has both HP (HPQ) and Dell (DVMT) is already planning to use more AMD processors for PCs in 2019. The report suggests that HP is ready to give AMD 30% of the shares that the chip company could never give up. This update of Intel does not solve the scenario of under-supply of the fourth quarter of 2016 in the second quarter of 19 planned by Fubon Research, where AMD should take market share due to the lack of Intel with competing chips.

It should be understood that AMD is aiming for an annual business turnover of only $ 6.7 billion, or less than 10% of Intel. The company only has about 10% PC market share and a target by the end of the year in the server market. The TAMs of these two markets are around $ 25 billion.

AMD needs limited market share gains to reach $ 10 billion in annual revenue by 2020. With sales of $ 10 billion and gross margins of 45%, AMD will realize gross profits of $ 4.5 billion of dollars. With 27% of operating expenses similar to those of the first half, the chip production company would generate operating margins of 18% or $ 1.8 billion.

The key point of AMD's long-term EPS target is that the number is> $ 0.75. The central point here is the sign ">". The company never intended the ultimate goal to be $ 0.75, but rather a general target, so investors do not get stuck by focusing on the limited profits of the past.

Source: AMD September presentation

With some $ 120 million in interest that AMD could reduce with these levels of operating profits, the company has a base case scenario for EPS in excess of $ 1.50 in 2020, using the diluted share count of second quarter of 1.15 billion shares. With the flood of cash, AMD could reduce the number of shares and interest charges and further increase the total GAPs by 2020.

To take away

The main asset of the investor is that Intel offers a gift to investors. The chip giant did nothing, via the company update, to change the momentum of the chip industry. AMD is poised to take market share in several key areas. The drop to $ 30 is a gift.

Warning: The information contained in this document is for informational purposes only. Nothing in this article should be construed as a solicitation to buy or sell securities. Before you buy or sell shares, you must do your own research and reach your own conclusions or consult a financial advisor. The investment includes risks, including the loss of capital.

Disclosure: I / we have no position on the actions mentioned, but I could initiate a long position on AMD in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I have no business relationship with a company whose stock is mentioned in this article.

[ad_2]

Source link