[ad_1]

What happened

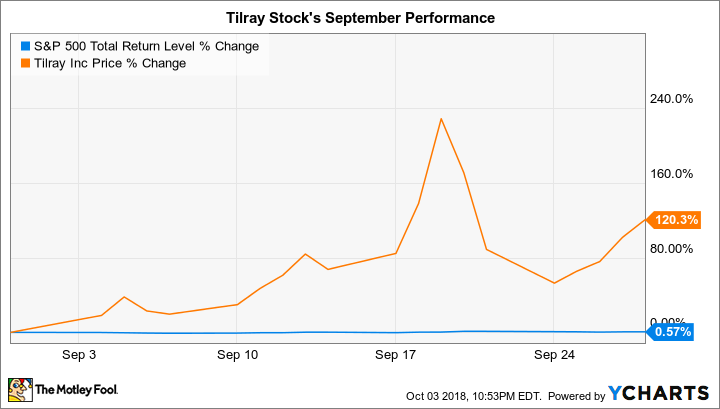

Tilray (NASDAQ: TLRY) Shares climbed 120% in September, according to S & P Global Market Intelligence data.

By updating investors, the shares of the Canadian marijuana producer rose 2.2% from October to Friday, October 5, when they closed at $ 146.91. # 39; action. This brings their total gain since the company went public at $ 17 per share on July 19 at 764%.

Source of the image: Getty Images.

So what

The powerful performances of Tilray in September can be attributed to several catalysts. First, Tilray enjoys a favorable wind that boosts the cannabis space: the recreational pot will be legal for adults in Canada starting October 17th.

Second, Tilray's actions have been reinforced by the belief of some market players that the company will sign an agreement similar to that reached with another Canadian marijuana producer. Cover growth (NYSE: CGC) signed with the giant of alcoholic beverages Constellation Brands (NYSE: STZ). In mid-August, beer maker Corona and Modelo revealed that he was investing $ 3.8 billion in Canopy. Both companies are certainly working on the development of a range of cannabis-infused drinks. These drinks are expected to get the regulatory approval in Canada next year.

On Sept. 17, Tilray's stock jumped 10.2% on a BNN Bloomberg TV report according to which Coca Cola was in discussion with Aurora Cannabis on the development of cannabis-infused drinks, as written compatriot Keith Speights. This gave investors hope that such an agreement was in the near future of Tilray. You can see this move as part of the huge three-day peak in the Tilray stock chart in September.

The next day, Tilray's stock climbed 29% after the company announced that it had received US government approval to provide a cannabinoid drug at the Center's medicinal cannabis research center. University of California San Diego, to use in a clinical trial for Essential Tremor. It will not move the needle for Tilray from a financial point of view, but this seems to be a nod to the quality of cannabis in the company. In addition, it shows that cannabis could be used more and more to treat more diseases.

Then, on Sept. 19, Tilray's stock shot up 38.1 percent after Brendan Kennedy, the company's CEO, had an interview with CNBC the day before. Crazy money host Jim Cramer. This interview probably attracted the attention of the company on many investors who did not know him well. In addition, as one could expect, Kennedy was very optimistic about the industry itself and the prospects of its business.

As the chart shows, what the market offers (too easily), it does so often as quickly. Most of these price movements were well exaggerated.

Now what

The cannabis industry is expected to experience strong growth – and this is just one factor in the legalization of marijuana for recreational purposes at the federal level in the United States, which seems only a matter of time. There are therefore probably interesting long-term investment opportunities in this space.

That said, equity valuations are such that massive growth is already embedded in the price. Marijuana stocks seem to be in a dot-com bubble, so investors need to be very cautious.

Currently, pure-play marijuana stocks are aimed at speculative traders and not long-term investors. Investors who want to be exposed to the rapidly growing space of marijuana, but with far less risk than pure gaming, might consider investing in Constellation Brands.

Beth McKenna has no position in the mentioned actions. The Motley Fool has no position in the mentioned actions. Motley Fool has a disclosure policy.

[ad_2]

Source link