[ad_1]

In September, I wrote two articles dealing with Alibaba Group (BABA). In the first one, I analyzed the company’s multiples, and in my opinion, I substantiated the undervaluation of BABA in sufficient detail. In the second one, I presented a DCF model that indicated Alibaba’s capitalization growth potential when the forecast parameters were rather pessimistic. Today, I’m going to present a third look at the current state of the company’s capitalization.

Sometimes, a simple approach gives the most correct view on a situation.

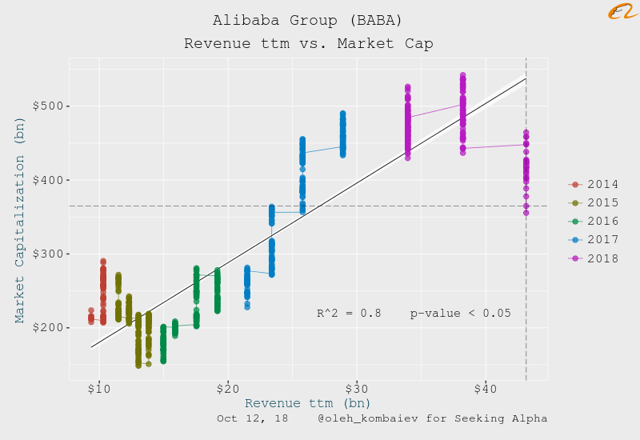

For a company that is at an early stage of its development, the key driver of capitalization growth is usually revenue. Alibaba Group is fully in line with this rule. So, starting from 2015 and up to the last quarter, there was a qualitative (R2=0.8) linear dependence between Alibaba’s capitalization and its TTM revenue size:

At the same time, the company’s capitalization in the last quarter has extremely deviated from this linear trend, despite the fact that Alibaba’s revenue showed a record growth in both absolute and relative terms.

I have already written that the observed drop in Alibaba’s stock price is the result of the external negative impact on China’s stock market due to the trade war that has begun between China and the United States. If we eliminate the influence of this factor, then as part of the revealed dependence, Alibaba’s shares should now cost some $200.

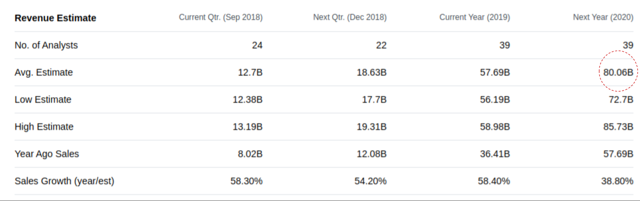

And if you start from the analysts’ average forecasts, at the end of the fiscal year 2020, the company’s anticipated revenue should correspond to Alibaba’s share price of more than $300, i.e. twice as much as the current level.

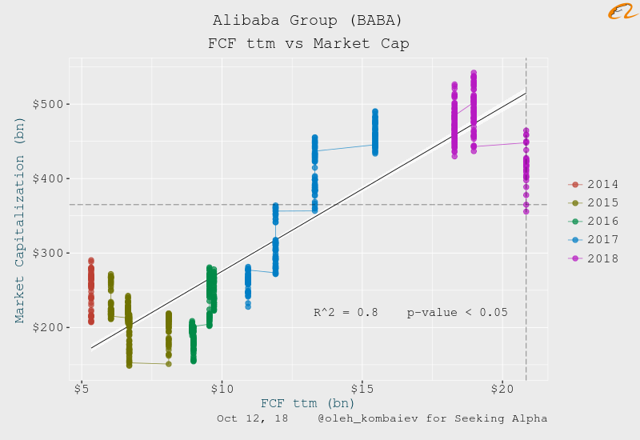

Further, no less qualitative linear dependence is observed between Alibaba’s capitalization and FCF TTM:

It is noteworthy that as part of this dependence, Alibaba’s FCF TTM in the last quarter also corresponds to the share price of around $200.

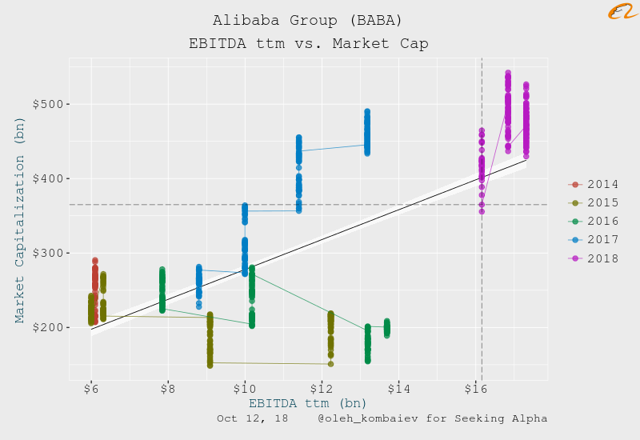

As I have already mentioned, Alibaba is at an early stage of its development and therefore profitability indicators cannot now be its key drivers. This is confirmed by the weak relationship between the company’s capitalization and its EBITDA TTM. But even within the framework of this relationship, the current stock value looks undervalued:

Bottom Line

- As you can see, fundamentally, Alibaba is at least 40% undervalued.

- Less than a month is left before the company’s next financial report will be published, and most likely it will confirm the continuation of revenue and FCF growth. So, the fundamental undervaluation of the company will increase even more.

- It is difficult for me to judge at what stage Alibaba’s fundamental valuation factors will outweigh the external negative factors, but that moment is clearly not far off.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link