[ad_1]

Markets rarely move in a straight line; rather, they move up or down via overturning and filling during short, medium and long-term trends. The bull market for crude oil began on February 21, 2016, when the price of the WTI NYMEX crude oil futures contract reached its lowest level since 2003, at $ 26.05 per barrel. Since then, the energy commodity has recorded higher troughs and peaks, reaching its most recent peak at $ 76.90 in early October 2018.

The path of least resistance in the price of the commodity that feeds the world is a complex combination of a myriad of factors. While supply and demand play an important role in the direction of Brent and WTI crude oil futures prices, exogenous factors such as geopolitical events, weather conditions and other issues can have a significant impact on prices at times. With respect to the fundamentals of crude oil, market structure or price relationships on the oil scene often provide valuable clues to future prices. During rallies and correction periods, refining, location, quality and timing margins can be a barometer for the next rise or fall in the price of the energy product.

Brent and WTI futures hit a record high in early October, but prices have fallen since the new high. The uptrend in the oil market remains intact, and the puzzle could tell us that oil prices will find support at one low before moving to another among a series of higher highs before too early.

I continue to favor the purchase of the Brent Crude Oil (BNO) ETF product in the United States for those who do not engage in the highly leveraged and highly volatile work of the futures market. My analysis continues to highlight the most positive potential of futures on Brent, which would support the price of the BNO.

Crude oil undergoes another correction, but it has not exceeded significant technical levels

After peaking in early October, the WTI and Brent crude futures were trimmed down.

Source: CQG

While the Crude Oil Futures contract peaked at $ 76.90 on October 3, the contract in effect for December peaked at $ 76.72 per barrel that day. Since then, WTI futures fell to $ 65.74 on October 23, with a correction underway. The first level of technical support is at the bottom of August 16, at 63.48 dollars per barrel. As the chart indicates, while the correction continues, the price dynamics on the daily chart has deteriorated to become an oversold territory.

Source: ICE / RMB

As shown in the Brent December futures chart, after peaking at $ 86.72 on October 3, Brent's closest close contracts hit their lowest level recently, at 75 , $ 13 on October 24th. Brent's contract technical support is $ 70.83 per barrel. .

The two leading crude oil futures markets retreated from their highs at the start of the month, but none exceeded the technical support level.

I continue to believe that recent price measures offer a downside opportunity at their current level for four reasons.

Reason one – the Middle East

More than half of the world's crude oil reserves are in the Middle East. While the region continues to be a political case, the chances of an explosion in the region remain high.

Sanctions against Iran will come into effect on November 4th. US pressure to isolate theocracy in Tehran may result in retaliatory action by Iran. Any action affecting production, refining or logistics routes in the Middle East could lead to price hikes in the Brent and WTI futures markets.

The Saudis and Iranians remain mired in a proxy war with fronts in Yemen and Qatar. Hatred between the two nations could potentially degenerate into more hostile acts in the weeks and months to come.

The recent assassination of Jamal Khashoggi in Turkey has put the Saudis on the dock with regard to relations with Europe and many American leaders. Crown Prince Mohammed bin Salman is at the center of the controversy and the man who will soon be elected to the throne of the monarchy could be the target of sanctions in the coming weeks, as details emerge over the brutal murder of Saudi Embassy.

While President Trump continues to press for increased oil production on the Saudis and other allies within OPEC, at a recent unofficial cartel meeting in Algeria, 39; OPEC has shown no sign of compliance with the US wish. However, it is likely that Saudi Arabia has increased sales to calm the United States in recent sessions. The Middle East continues to be a region of the world that is likely to drive up prices on the oil futures markets.

Second reason – the spread of Brent-WTI

The difference between the price of Brent oil futures and that of WTI is a gap in location and quality. Brent is the pricing mechanism for European, African and Middle Eastern oil. WTI is the benchmark for North American production. Two-thirds of the world's population uses the price of Brent for its production and consumption needs. Brent is a heavier crude oil than WTI with a higher sulfur content. Brent is the preferred crude oil for refining into distillates, while it is easier and less expensive to turn WTI into gasoline.

At the same time, as the Brent landmark is used by the Middle East, the gap between Brent and WTI is a political risk barometer in the region of the world that is home to more than half of the world's oil reserves.

Source: CQG

As shown in the daily chart of WTI futures minus Brent December, the Brent premium has risen to around $ 10.00 per barrel on October 26th. The premium increase reflects the market's concern for the Middle East's political stability. An increase in the Brent premium tends to raise the price of Brent and WTI on a historical basis. The Brent premium has had higher highs and lows since early August. On the December futures, the gap seems to move towards a test of the lowest threshold of May 31 to 11.69 dollars per barrel, which is a bullish sign of the price of the energy product.

Reason three – refining margins

Refining margins or crack margins can provide clues to the demand for the fundamental equation in the crude oil market. The increase in treatment spreads is a sign of strong demand, while the decline often indicates that inventories are increasing and requirements are falling.

Source: CQG

We are now at the heart of the off-season demand for gasoline in the futures market. The peak driving season takes place during the summer months and the winter is a time when people tend to do less mileage on their automobiles. As a result, crack propagation in gasoline tends to decrease in the weeks leading up to winter each year. As the weekly chart shows, the gasoline processing gap fell to $ 7.73 on Oct. 26, but rebounded from the lows and traded around the $ 8.40 a barrel level. at the end of last week.

Last year, during this week, the price of cracked oil was between $ 16.65 and $ 19.12 per barrel, a level well above the current level. However, the NYMEX crude oil futures were $ 67.59 on October 26 and last year reached a high of $ 54.20 this week, or more than $ 13 or more. 24.7% compared to their current price on the NYMEX futures contract. The current weakness of crack propagation in gasoline could be the result of seasonal factors. At the same time, distillate refining differentials indicate that demand for oil-based energy remains strong.

Source: CQG

As shown in the weekly chart of the oil crack gap, which is an indirect indicator of the distillate price, at $ 29.17 a barrel on October 26, the treatment gap is significantly higher than that of last year, trading between $ 22.65 and $ 22.65 at $ 25.12 per barrel. As a result, price developments in the distillate refining gap indicate that demand for oil-based energy continues to be strong at current prices, which supports the price of oil. basic product of the raw energy.

Reason four – backwardation

The maturity structure of the crude oil market remains downgraded for longer term contracts in the WTI and Brent futures markets.

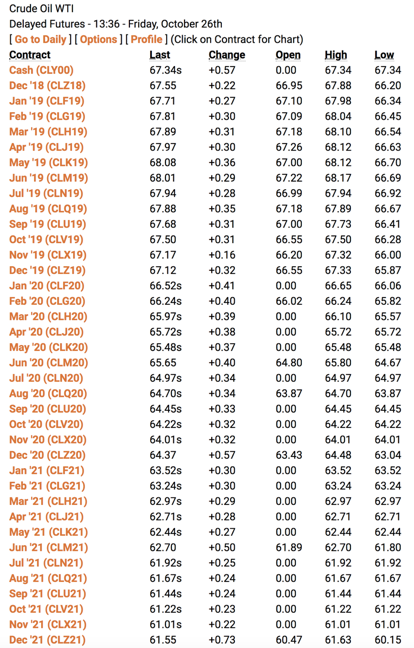

Source: NYMEX / RMB

As the NYMEX forward futures curve shows, crude oil trades at $ 6.00 in December 2021 less than in the futures contract near December 2018. The regularization or decline in future prices compared to nearby prices is a sign of concern of market players compared to nearby supplies. Although the narrowing of the gap from December 2018 to December 2019 compared to December 2019 has been narrowing in recent sessions, this is likely due to corrective price action in the crude oil market since higher from early October.

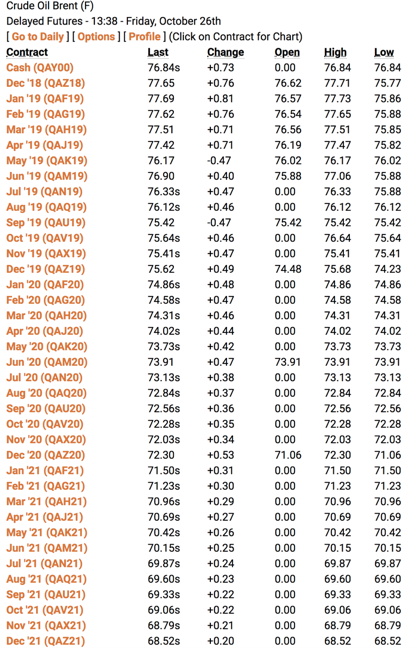

Source: NYMEX / RMB

The gap between December 2018 and December 2021 on Brent is even more important than in the WTI, at more than $ 8 per barrel on October 25. The problems facing the Middle East mean that the region is at the center of concerns over the supply of the crude oil market.

Backwardation favors holders of long positions in the energy sector. A lower deferred price means that the postponement of a position from one month to the next gives rise to a credit rather than a debit.

The crude oil market has corrected since the beginning of this month, but lower prices could be an opportunity for investors and traders. Crude oil, in the WTI and Brent markets, has been on record highs and lows since February 2016. Both have not exceeded their critical support levels, meaning that the bullish trade structure remains intact.

Given the challenges facing the Middle East, it is likely that Brent crude oil will continue to outperform WTI futures. In addition, if hostilities in the Middle East cause prices to rise, it is likely to have an impact on Brent futures because it is the benchmark for oil in the region. The ETF Brent Oil (BNO) product in the United States is doing a great job in replicating the price action in the Brent futures market. The fund summary states:

The investment looks for daily changes as a percentage of the net asset value per share of its shares to reflect the daily percentage changes in the Brent crude oil spot price. The reference futures contract is the Brent crude futures contract, as traded on the Ice Futures Europe Exchange, which expires next month, unless the contract next month is in both weeks of expiration, in which case it will be measured by the futures contract which is the contract of the next month to expire.

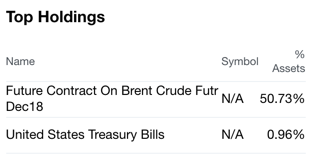

The main holdings on October 22nd were:

Source: Yahoo Finance

The December Brent crude futures contract price went from $ 70.83 on August 15th to $ 86.72 on October 3rd, then dropped to $ 75.13 on October 24th. Futures contracts increased by 22.4% and were adjusted by 13.4%.

Source: Barchart

As the graph shows, BNO went from $ 19.72 on August 15th to $ 24.41 on October 3rd, then dropped to $ 21.00 on October 18th. BNO rose 23.8% on the increase and was corrected by 14% over the current decline. is strongly correlated with the price of futures on Brent since it is the largest participation in the ETF product. BNO could be the ideal solution for investors and traders who wish to participate in price action on the Brent futures market but who do not trade in the highly indebted and volatile futures field.

I continue to believe that the structure of rising prices in the oil market will remain intact. At less than $ 63 on the WTI and $ 70 on the Brent, I will reconsider my current view of the oil market. However, I continue today to be a downward oil buyer in favor of Brent because of the unstable nature of the Middle East.

The Hecht Commodity Report is one of the most comprehensive commodities reports the author has ranked second in commodities and precious metals. My weekly report covers the market movements of 20 different products and provides bullish, bearish and neutral calls; directional trading recommendations and concrete ideas for traders. More than 120 subscribers derive real value from the Hecht Commodity Report.

Disclosure: I am / we are long BNO.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional disclosure: The author still holds commodity market positions in futures, options, ETFs / ETNs and commodity stocks. These long and short positions tend to change on an intraday basis.

[ad_2]

Source link