[ad_1]

History in development

IBM acquired Red Hat, an open source cloud software company, for $ 34 billion in cash and debt. According to this agreement, IBM relies heavily on the cloud, especially cloud services, which combine on-premise and cloud architectures. Red Hat will be a separate unit of IBM's Hybrid Cloud team and will continue to focus on open source software. The acquisition is expected to be finalized in the second half of 2019.

IBM acquired Red Hat, an open source cloud software company, for $ 34 billion in cash and debt. According to this agreement, IBM relies heavily on the cloud, especially cloud services, which combine on-premise and cloud architectures. Red Hat will be a separate unit of IBM's Hybrid Cloud team and will continue to focus on open source software. The acquisition is expected to be finalized in the second half of 2019.

IBM bet firm on Red Hat – and it's better not to spoil

Who expects that a $ 34 billion contract involving two major companies will disappear on a Sunday afternoon, but IBM and Red Hat surprised us yesterday when they pulled the trigger of a historically important contract.

IBM has been the flagship of a rapidly changing company. As explained by Aaron Levie, CEO of Box (and IBM Business Partner), a company must sometimes be bold to advance this type of initiative:

Bright move by IBM. The transformation requires big bets, and this one is good.

– Aaron Levie (@levie) October 28, 2018

They believe they can use both their complex infrastructure / software / platform services and emerging technologies such as artificial intelligence, blockchain and analytic tools, and combine all this with the profitable merger of open source business tools, native cloud, hybrid cloud and business understanding.

As Jon Shieber pointed out yesterday, it was a tacit acknowledgment that the company would not achieve the desired results with emerging technologies such as artificial intelligence. Watson. It needed something that translated more directly into sales.

Red Hat can be this sales engine of business. It is already a company with a turnover of $ 3 billion and the goal is to reach $ 5 billion. Although it is a small potato for a company like IBM, which generates $ 19 billion per quarter, this is a crucial addition.

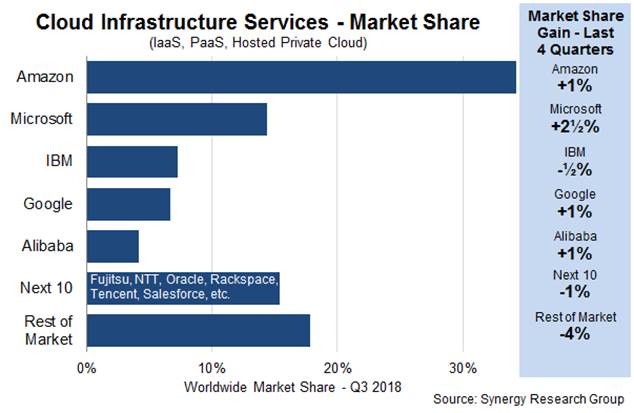

Indeed, despite its reports on uncertain earnings over the past five years, Synergy Research said that IBM held 7% of the cloud infrastructure market in its latest report, that's the only way it's going to work. it defines as infrastructure as a service, platform as a service and hosted private cloud. This is the last area in which IBM is particularly talented.

The company has the parts in place and a decent volume of market share, but Red Hat gives it a much stronger hybrid cloud story to tell. They can potentially bridge the gap between the hosted private cloud and their own public cloud (and presumably even those of their competitors) and use Red Hat as a native cloud and open source springboard, giving their sales teams a solid story to tell. .

Of course, IBM already has a lot of credibility. It sells on many of the same open source tools as Red Hat but has not benefited from the sales and revenue momentum enjoyed by Red Hat. If you combine the huge IBM sales engine and their service activities with Red Hat's, you have the potential to turn that into a huge company.

Photo: Ron Mller

It should be noted that the agreement must allow shareholders to sift through and eliminate global regulatory hurdles before they can bring the two organizations together. IBM predicted that it will at least wait until the second half of next year to conclude this deal, which could take even longer.

IBM must use its time wisely to ensure that these two companies integrate as much as possible between technology and culture. It's never easy to run these mega deals with so much money and pressure, but it's imperative that Big Blue does not spoil it. This could very well be his last chance to straighten the ship once and for all.

Forget Watson, the acquisition of Red Hat is perhaps what will save IBM

With the latest $ 34 billion acquisition from Red Hat, IBM may have found something more basic than "Watson" to save its flagship business.

While the acquisition of Red Hat is by no means a guaranteed victory for the Armonk, New York-based computer company, which has seen more failures than declines in the last five years, this seems to be a better bet for "Big Blue" than an artificial intelligence. program that has always been more hype than reality.

Indeed, commentators have already noted that this may be a case in which IBM would eventually give up Watson's hat and return to the software and enterprise services sector that has always been its primary focus (although it has been much more focused on consulting services – to the detriment of the company's business).

Watson, the commercial division focused on artificial intelligence, whose public claims were still more focused on marketing than on the market, did not get the desired results and investors lost patience.

Critics – including investment bank analysts Jefferies (a year ago) – were skeptical about Watson's ability to free IBM from its woes.

As we wrote at the time:

Jefferies is inspired by a partnership audit between IBM Watson and MD Anderson as a case study for IBM's broader issues related to Watson's adaptation. MD Anderson cut ties with IBM after wasting $ 60 million on a Watson project ultimately deemed "not ready to be used for experimental or clinical purposes."

MD Anderson's nightmare is not autonomous. The founders of AI startups regularly inform that their own financial services and biotechnology customers have had similar experiences with IBM.

The narrative is not the product of a single malfunction, but rather the result of over-optimized marketing, failures in operation with deep learning and GPUs, and demands for intensive data preparation.

This is not the only problem IBM has had with Watson's health results. Earlier this year, the online medical journal stat According to Watson, Watson gave clinicians recommendations on "unsafe and incorrect" cancer treatments – based on training data from the company's engineers and doctors in Sloan-Kettering who worked with the technology.

All of these difficulties have been reflected in the Company's last earnings call, in which it experienced a decline in revenues derived primarily from Cognitive Solutions' business, which includes Watson's artificial intelligence and supercomputer services. Although IBM's chief financial officer pointed to the medium to high growth in Watson's health business revenue during the quarter, the transaction processing software business has dropped by 8% and the company's suite of hosted software services is essentially an afterthought for companies that interest Microsoft. , Alphabet and Amazon for cloud services.

Watson is certainly one of the segments that IBM hoped to exploit for its future growth; and while this is a broad area of investment for the company, it has always had its eyes set in part on cloud computing because it was looking for areas of growth.

It is this area of cloud computing where IBM hopes Red Hat can help it gain ground.

"The acquisition of Red Hat changes the game. This changes everything in the cloud market, "said Ginni Rometty, President of IBM, President and Chief Executive Officer, in a statement announcing the acquisition. "IBM will become the world's leading hybrid cloud provider, providing businesses with the only open cloud solution to fully leverage the value of the cloud for their businesses."

The acquisition also brings an incredible amount of marketing power to Red Hat's various open source service activities – giving all IBM project managers and consultants new projects and, perhaps, less costly open source software adoption. within the company.

As Red Hat General Manager Jim Whitehurst says The street in September, "the big secular Linux engine is that Big Data workloads run on Linux. The workloads of the AI run under Linux. DevOps and these platforms, almost exclusively Linux, "he said. "A lot of the new workloads on the net being created have an affinity for Linux."

Biggest Software Acquisition Ever: IBM Acquires Red Hat for $ 34 Billion

At a price typically reserved for semiconductor companies, telecoms and giants in the pharmaceutical industry, IBM announced today that it would pay out $ 34 billion in cash and debts to acquire the Red Hat open source business provider. With Microsoft's $ 26.2 billion acquisition of LinkedIn, it is the largest software acquisition in history. However, this is not the biggest technology acquisition ever since it is Dell's $ 67 billion buyout of EMC's data storage business.

Learn more about what IBM is buying from Red Hat to become a hybrid cloud company with TechCrunch Editor Ingrid Lunden's deep dive here:

How does the IBM-Red Hat contract (if it's closed) compare to other major acquisitions of all time?

Top Tech Acquisitions

- $ 67 Billion – Dell's Personal Computer Company Buys EMC Data Storage

- $ 37 billion – Semiconductor company Avago Technologies buys and renames Broadcom semiconductor giant

- $ 34 billion (pending) – IBM computers take over Red Hat open source software vendor

- $ 31.4 billion – Japanese conglomerate SoftBank buys semiconductor company ARM Holdings

- $ 26.2 billion – Microsoft software company buys a Linkedin professional social network in 2016

Main software acquisitions

- $ 34 billion (pending) – IBM computers take over Red Hat open source software provider in 2018

- $ 26.2 billion – Microsoft software company buys a LinkedIn professional social network in 2016

- $ 22 billion – The social network Facebook buys the WhatsApp email application in 2014

- $ 13.5 Billion – Security Software Vendor Symantec Purchased Veritas Storage Management Software Vendor in 2004 ($ 18 Billion Corrected for Inflation)

- $ 11 Billion – Oracle Database Company Acquires PeopleSoft Human Resources Management Software Company in 2004 ($ 14.7 Billion Corrected for Inflation)

Top Acquisitions Never

- $ 202 billion – British Telecom Vodafone acquires the German telecom Mannesmann in 2000 ($ 296 billion corrected for inflation)

- 165 Billion Dollars – AOL ISOL Acquires Media Time Warner Conglomerate in 200 ($ 241 Billion Corrected for Inflation)

- $ 111.8 billion – In 1999, pharmaceutical giant Pfizer acquires pharmaceutical company Warner Lambert ($ 164 billion corrected for inflation)

- $ 130 billion – Telecom Verizon Communications buys Vodafone and Verizon Wireless from Bell Atlantic in 2013

- $ 130 billion – Dow Chemical buys DuPont chemical company in 2015

The Red Hat deal is proof that the scalability of software can massively focus wealth. Unlike industrial giants who shared their wealth with the physical resource providers who supplied and distributed their oil, chemical or packaged empires, the software required virtually no material cost to be created or distributed. The aggregation of value for the IT giants and their leaders offers both a great incentive to build a business that changes the world, but also a radical transfer of capital out of the hands of the work. While it is acceptable to celebrate Red Hat's accomplishments, society must inevitably tackle the poverty and populism fueled by the way the software channels money to a few.

IBM will buy Red Hat for $ 34 billion in cash and debt, making a bigger leap in the hybrid cloud

After rumors circulating this weekend, IBM announced today the acquisition of Red Hat, a cloud software company benefiting from open source software, at $ 190 per share, for a total value of 34 billions of dollars. IBM stated that the transaction had already been approved by IBM and Red Hat's board of directors, but that it was still subject to shareholder and shareholder approval. Regulatory Authorities of Red Hat. If all goes as planned, the acquisition is expected to be finalized in the second half of 2019.

The agreement concerns IBM, which has long leveraged its legacy server business, taking a bigger gamble on the cloud, and very specifically on cloud services combining on-premise and cloud architectures, which both companies have already working together since May of this year (which could now be considered a test drive). Red Hat will be a separate unit within IBM's Hybrid Cloud team – which is already a $ 19 billion business for IBM, said the company – and it will continue to focus on open source software.

"The acquisition of Red Hat changes the game. This changes everything in the cloud market, "said Ginni Rometty, President of IBM, President and CEO, in a statement. "IBM will become the world's leading hybrid cloud provider, providing businesses with the only open cloud solution to fully leverage the value of the cloud for their businesses."

Combined companies will be able to offer software in services covering Linux, containers, Kubernetes, multi-cloud management, cloud management and automation, said IBM. IBM also said that together, the two companies would continue to partner with several cloud providers, including AWS, Microsoft Azure, Google Cloud, Alibaba and others, alongside the IBM group. Cloud.

As Josh Constine notes here, this is one of the most important technology acquisitions ever made, and arguably the largest one dedicated primarily to software. (Dell acquired EMC for $ 67 billion to acquire software but also for a major hardware and storage company.)

Although companies like Amazon are fully integrated with the cloud, in many cases, many companies are operating gradually. IBM cites statistics that estimate that 80% of the workload of the company "has not yet been transferred to the cloud. the exclusive nature of the current cloud market. The purchase of Red Hat will help IBM better seize the opportunity.

"Today, most businesses use only 20 percent of their cloud computing, hiring computing power to reduce costs," she continued. "The next 80% is about unlocking real business value and boosting growth. This is the next chapter of the cloud. This requires moving from business applications to hybrid cloud, extracting more data and optimizing every aspect of the business, from supply chains to sales. "

On top of that, it will give IBM a much stronger foundation in open source software, the core of what Red Hat is building and deploying today.

"Open source is the default choice of modern computing solutions, and I am extremely proud of the role that Red Hat has played in making this a reality in the enterprise," he said. Jim Whitehurst, President and CEO, Red Hat, in a statement. "If we partner with IBM, we will have more scales, resources, and capabilities to accelerate the impact of open source as a foundation for digital transformation and bring Red Hat to the mainstream." even larger – while preserving our unique culture and unwavering commitment. open innovation at the source. "

While IBM is competing with Amazon, companies will remain partners with this acquisition. "IBM is committed to being a true multi-cloud provider and we will prioritize the use of Red Hat technology on multiple clouds," he said. Arvind Krishna, Vice President of IBM Hybrid Cloud, in a statement. "In doing so, IBM will support open source technology wherever it operates, which will enable it to significantly adapt to global business metrics."

IBM said Red Hat would increase revenue, gross margin and free cash flow within 12 months of closing.

[ad_2]

Source link