[ad_1]

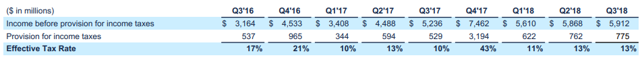

Facebook (FB) posted mixed results for third-quarter earnings. BPA was much higher than expected, but this was due to a one-time tax benefit.

Management has confirmed the deceleration of revenue growth. He also confirmed the pressure on margins to improve security and support growth initiatives. I am expecting further pressure on the tax rate in the next few years.

At $ 150 / share, the market gives the company a P / E ratio of about 20 for the 2018 fiscal year. With the confirmed growth profile and associated expenses, I believe the market values Facebook fairly.

Source of the image: Simon via Pixabay

Deceleration of user growth stabilized

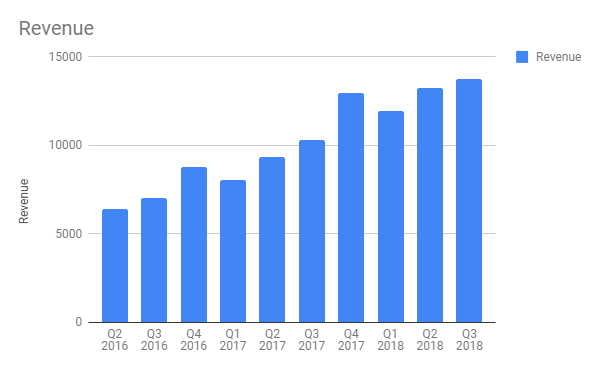

Facebook reported revenues of $ 13.727 billion and EPS of $ 1.76. Despite a 33% growth, the turnover is lower than the forecasts of 13.77 billion dollars analysts. The earnings per share is well above the $ 1.46 forecast, thanks to an exceptional tax benefit.

Source: author, based on business reports

Growth in SAD (Daily Active Users), MAU (Monthly Active Users) and Average User Income (ARPU) contributed to revenue growth.

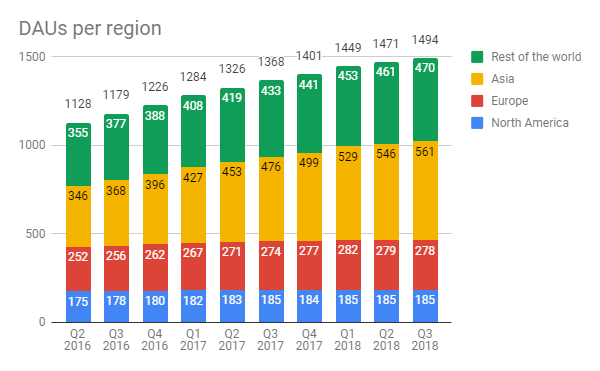

As usual, the figures presented below for the DAU and MAU do not include users of Instagram, WhatsApp or Oculus.

For the fifth consecutive quarter, SADs in North America remained stable. In Europe, the situation is a little more negative with a decrease in the number of ADU for the third consecutive quarter, due to the GDPR regulation. In Asia and the rest of the world, the growth of SADs continues. The chart below shows the evolution of the number of SADs by region in recent quarters.

Source: author, based on business reports

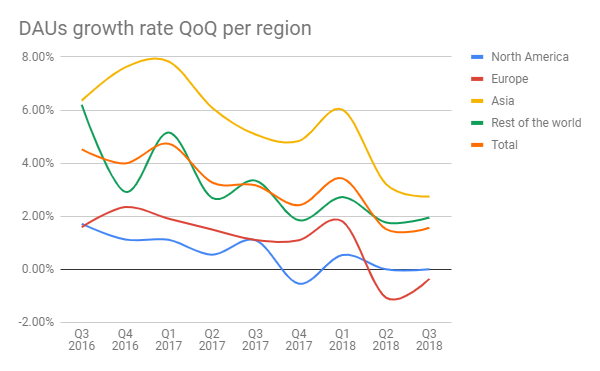

As shown below, the downward trend in SAD growth has stabilized in the third quarter in all regions.

Source: author, based on business reports

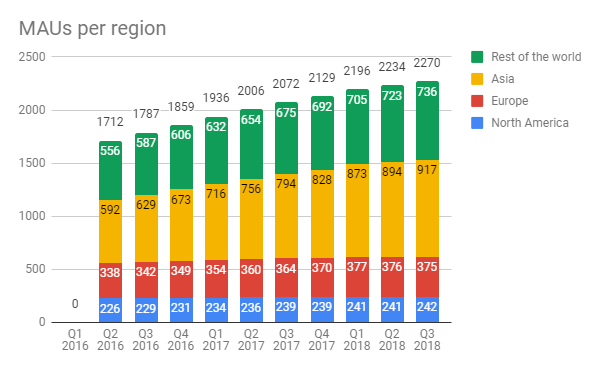

From the MAU's perspective, the results are similar except for the North America region, with a record MAU of 242 million.

Source: author, based on business reports

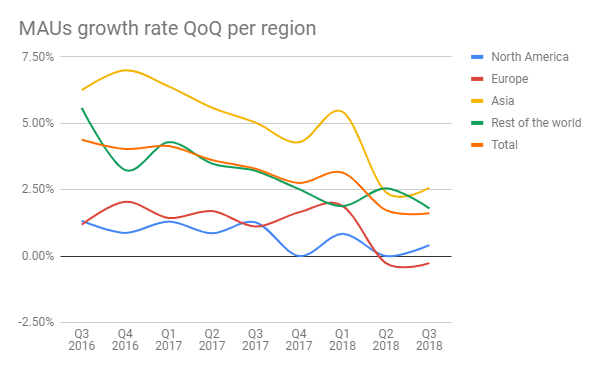

Following the same pattern as the SADs, the slowdown in UAM growth stabilized in the third quarter, as shown below.

Source: author, based on business reports

The weak footprint of the third quarter presentation suggests an accounting change that had an impact of $ 15 million and $ 9 million on the SAD and UAM.

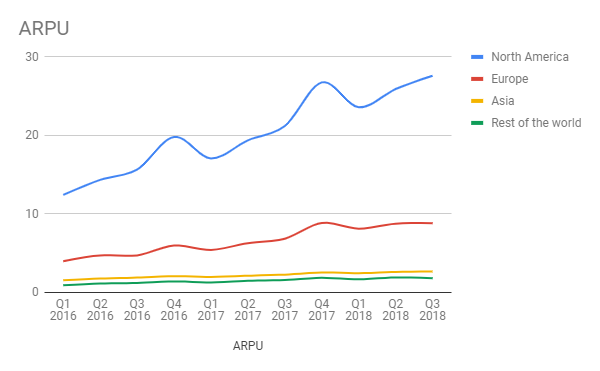

The ARPU has increased the QoQ in all regions except in the "rest of the world" with a drop from $ 1.91 to $ 1.82. The graph below highlights the impressive growth of ARPU in North America compared to other regions. This growth is even more impressive given the much higher base of comparison in North America.

Source: author, based on business reports

The chart above also shows the ARPU's growth potential for other regions, even taking into account lower GDP per capita.

During the teleconference, Mark Zuckerberg confirmed what we can see with the DAU and MAU charts above: Facebook is "almost saturated" in developed markets while there remains potential for growth in other markets ..

No more confirmed expenses

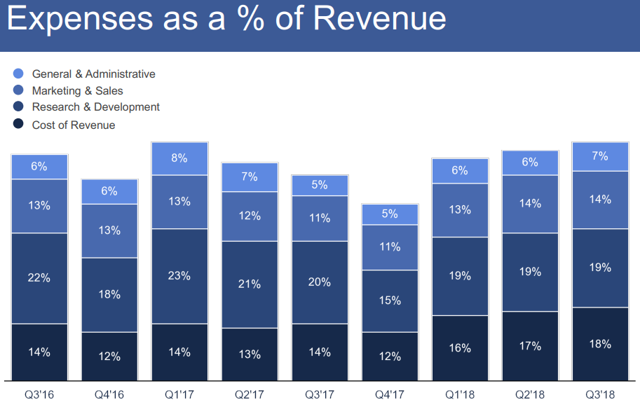

As announced during the second quarter teleconference, operating expenses continued to increase.

Source: Q3 2018 presentation

Research and development is the only expense that has not increased. This trend is not the most favorable outcome for the company. But given the additional costs of security and privacy, there is no surprise. As a result, the operating margin went from 50% last year to 42%. The operating margin remains impressive.

Despite higher expenses, operating income increased compared to the previous year but remained stable compared to the last two quarters.

Source: Q3 2018 presentation

Recently, many events have confirmed the need to increase security spending. For example, a security problem reached at least 30 million users. And fake news with WhatsApp developed during the elections in Brazil.

Of course, these expenses also affect free cash flow, as shown in the table below. Free cash flow does not include approximately $ 1 billion of quarterly stock-based compensation.

Source: Third Quarter 2018 Press Release

In addition to the pressure on the operating margin, the tax rate could increase. Facebook's effective tax rate has remained most less than 15% in recent quarters. And management is inspired by a tax rate of 15% for the fourth quarter of 2018 and the 2019 fiscal year.

Source: Q3 2018 presentation

For a company that generates operating margins greater than 40%, the low effective tax rate triggers a certain amount of challenge.. There is a increasing pressure of some countries change the tax regime of technology giants to bring the effective tax rate closer to a standard tax rate. This aspect was not addressed during the teleconference, but I would not exclude the possibility of a tax rate closer to 20% over the next few years..

Slightly improved orientation

Management now expects T4 sales growth to decline from mid-to-high (compared to the previous high number forecast). And he expects the expenses will increase from 50% to 55% (compared to the previous forecast of 50% to 60%).

For the long run, Mark Zuckerberg emphasized the importance of messaging and stories during the conference call.. In addition, the company has confirmed the development of payments, videos, stories, etc.

However, management still expects Facebook and Instagram feeds to generate the bulk of revenue growth over the next few years..

Evaluation

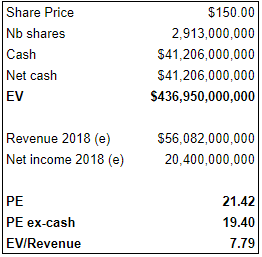

In my previous article, following the results of the second quarter, I estimated a P / E ratio of just 20, which corresponds to a stock price of $ 144. Given the confirmed growth profile and the associated risks, I still estimate the same P / E ratio of 20 for a fair valuation.

The revenues and net result shown in the table below are based on the updated forecasts. I assume revenue growth of 25%, operating income of 35% and income tax of 15% in Q4 2018.

Source: author

At $ 150 / share, the market values the company at a P / E non-cash ratio of 19.40, which is my estimate of fair value.

Conclusion

The third quarter results were not as surprising as the previous results. Revenues were below expectations. And the EPS was higher than expected due to a single tax element. Management has improved the fourth-quarter revenue growth forecast and reduced the fourth-quarter forecast at the lower end of the range..

Revenue growth will always come from Facebook and Instagram feeds. But management has confirmed efforts to monetize stories. In the meantime, the company is developing other long-term initiatives related to video, messaging, payments, and so on..

Given the growth, expense and risk associated with these long-term initiatives, I believe the market fairly values the company with a P / E ratio of around 20.

Note: To receive alerts in real time on my articles, click on the button "To follow"link at the top of this page next to my name.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link