[ad_1]

Apple (AAPL) reported once again spectacular results. Q4 2018 revenue and EPS grew above expectations and across all regions.

But the company also announced a disappointing guidance for the next quarter. Management provided a mix of reasons to explain the weakness. But I have doubts the company can produce the same stellar results as the last few years.

The market did not appreciate the guidance. The stock price dropped by more than 6% at the after-market. The PE ratio of 13 is reasonable. But if Apple is back to low-single-digit revenue growth, the stock is not a buy.

Image source: FirmBee via Pixabay

Stellar Q4 results

The company reported revenue and EPS above expectations. Revenue increased by 20% YoY to $62.9 billion. This is the highest growth rate over the last three years. EPS amounted to $2.91, up 41%, against estimates at $2.78.

The growth was consistent across all geographies. But there were differences from the products perspective.

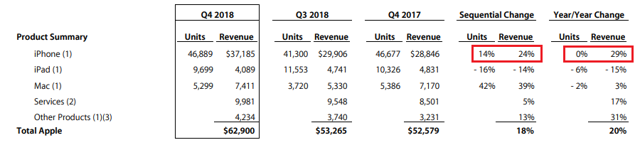

The table below presents the units reporting. This is the last quarter we will see this table. Management indicated during the earnings call that the units reporting would stop as from the next quarter.

Source: Q4 2018 data summary

As it was the case last quarter, the revenue from iPhones sales grew at an impressive pace while unit sales stagnated. This is due to the sales of high-end phones at a higher price. During the earnings call, Tim Cook highlighted the “very successful launch” of the iPhones Xs and Xs max.

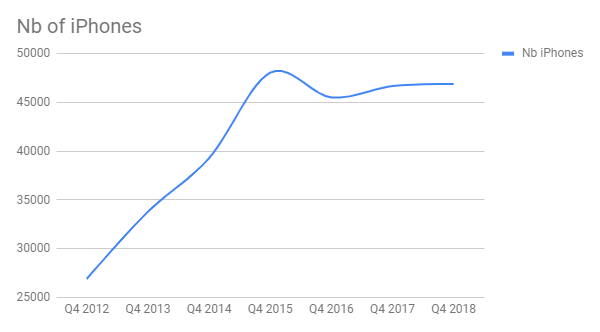

The graph below shows that the iPhone units sales have been stagnating since 2016.

Source: author, based on company reports

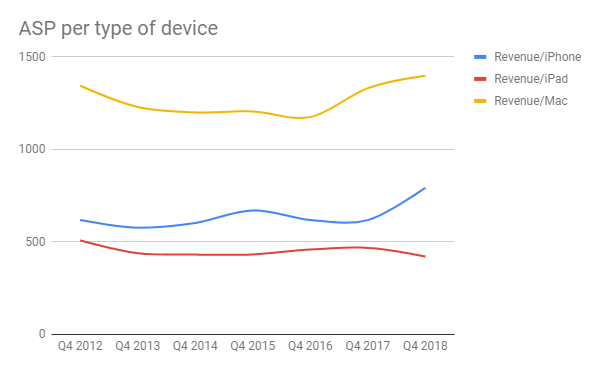

And the ASP per iPhone started increasing in 2017, as shown below.

Source: author, based on company reports

We can also see that the Mac follow the same trend as the iPhone: the higher ASP drives the revenue growth.

iPads units and revenue decreased. But management indicated the company is gaining market shares in the declining market of tablets.

The units table above also shows that services grew by 17%. But excluding a one-time accounting item last year, services actually grew by 27%. Management spoke about an “exceptional performance of Apple Pay”. And the previously announced goal to double the services revenue from 2016 to 2020 stays valid and on track.

Management also highlighted some successes in the “other products” segment with items such as the Apple Watch Series 4, headphones, etc.

Disappointing guidance

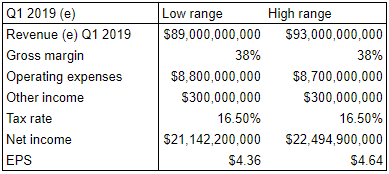

Following these exceptional results, especially considering the huge scale, management announced a disappointing Q1 2019 guidance.

- revenue between $89 billion and $93 billion

- gross margin between 38 percent and 38.5 percent

- operating expenses between $8.7 billion and $8.8 billion

- other income/(expense) of $300 million

- tax rate of approximately 16.5 percent before discrete items

Source: Press release Q4 2018

With revenue at $88.3 billion and 38.4% gross margin in Q1 2018, the company would grow Q1 2019 revenue by only 3%. Management explained the weak guidance by a mix of forex headwinds, timing with iPhone releases, and uncertainties in some emerging markets. But this slowing growth is worrying as it could translate into a new growth paradigm.

Also, the decision not to report on the units level anymore brings doubts. Management explained the units numbers were not relevant anymore due to the lack of correlation with the financial results. But the goal of this change could also be related to a potential decrease of iPhone sold units.

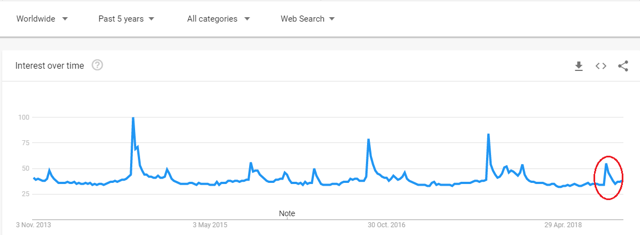

This quarter showed the company did not increase the iPhone sold units. And by looking for the term “iPhone” with Google Trends, there is a valid concern that the device may not be as popular as during the past years.

Source: Google Trends

The peak highlighted in red corresponds to the release of the iPhones Xs and Xs max. This peak is much lower than the peaks observed during the previous iPhone releases. This graph does not provide an accurate forecast for the success of the iPhone, but it is an information to take into account.

Also, some recent studies indicated that the iPhone was losing market share to Huawei and Xaomi.

In any case, the company will instead segment the reporting of revenue and gross margin between products and services.

A trillion market capitalization company?

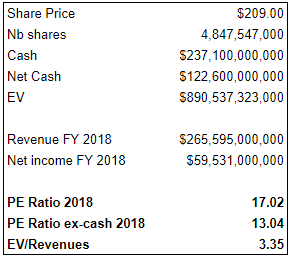

The table below summarizes the valuation after the earnings call, when the stock price dropped to $209.

Source: author, based on company reports

At this price, the market values the company at a PE ratio ex-cash of about 13.

Considering the deceleration of the growth announced with the weak guidance, the PE ratio is reasonable. But the ratio is not low enough to view the price as a bargain.

I provide in the table below the range of expected EPS for 2019 based on the guidance. I assume the number of shares as during Q4.

Source: author, based on company reports

The low range and the high range represent an EPS growth of about 12% and 19% YoY.

In my previous article, after the Q3 2018 earnings, I mentioned I did not want to buy shares despite the reasonable PE ratio at 12.28. The reason was related to the dependency on the iPhone for the financial results.

This quarter, the revenue part of the iPhone increased again. iPhone sales represented 59% of total sales against 56% last quarter and 55% the year before.

Also, the change of reporting and the other indications I have provided above don’t give me the confidence the stellar success of previous years will continue. The growth of other products will have to be spectacular for the company to keep on growing on such a huge revenue base.

Conclusion

Apple once again exceeded expectations with Q4 earnings. The higher ASP of iPhones and the growth in services are the biggest contributors to the growth.

But the Q1 2019 guidance is weak. And management announced the end of the units reporting. Despite the explanations provided during the phone call, I am skeptical. With the stagnating iPhone units sales and considering some market studies, I am concerned about a drop of iPhone units sales in the near future.

The market did not like the guidance either as the stock price dropped by more than 6% during the conference call. The current PE ratio of 13 is reasonable. But with my doubts about the capacity of Apple to replicate its previous stellar success, the stock price is not a buy.

Note: To receive real-time alerts about my articles, click on the “Follow” link at the top of this page next to my name.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link