[ad_1]

In all the Apple articles (AAPL) I have written in recent years, services have been either in the foreground or in the center. This quarter, Apple generated $ 10 billion in revenue from services. A growth rate of one year to the other of 27%. $ 10 billion represents 15.89% of total revenues. As a percentage of revenues, services only increased slightly compared to my July article. Disappointing The growth rate is lower than that of the iPhone itself, but it's probably only because of the timing of the product release.

In terms of results, I want to highlight four areas: services, shareholder returns, unit reporting and emerging markets (including China).

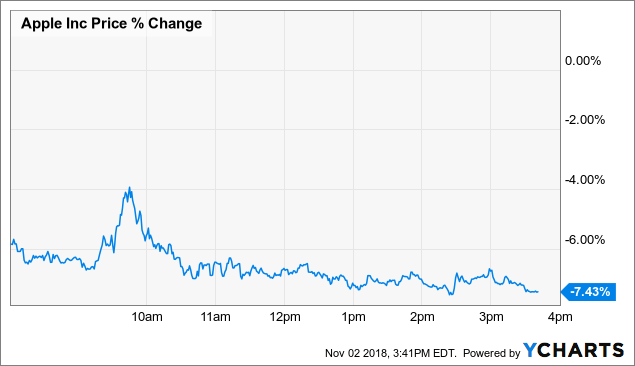

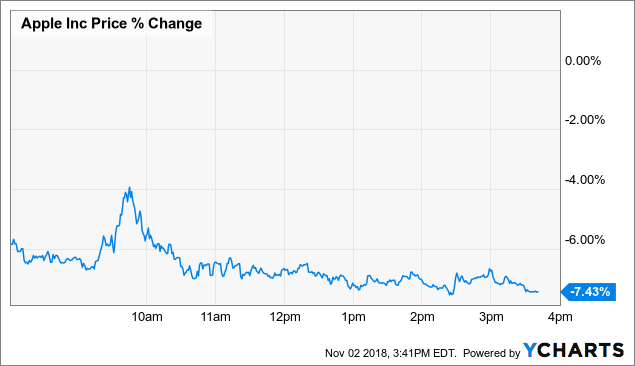

AAPL price data by YCharts

Services

Services are the key to Apple's future (to quote me):

I believe that services are so important because the peripherals sector is so vulnerable. The more users are attracted to all paid apps and cloud services, the harder it becomes to switch to Android during a recession. The growth, momentum, and size of the service industry are very encouraging and important to Apple and its assessment.

Third-party application developers are creating applications with better business models, and consumers may also be accustomed to paying for quality online services. Once they were reluctant (from the latest Apple earnings call):

We now have more than 330 million paid subscriptions on our platform, an increase of more than 50% compared to a year ago. We are very excited not only about the growth, but also the scale of our subscription activities. In fact, 30,000 third-party subscription apps are available on the App Store today, and the largest of them accounts for less than 0.3% of our sales figure. total business related to services.

I am already expecting the service line to be much more resilient compared to the hardware sector, but the number of subscriptions suggests that it could be even stronger than that.

Return to shareholders

Management indicated that it wished to obtain a neutral net cash position. That means restoring $ 122.6 billion in cash. At the current pace of share and dividend repurchases, it will take five quarters to do so. But Apple could also add something like $ 72 billion to its net cash balance over a period like this. This means that he has to speed up the pace if the goal is really serious. A return of about $ 45 billion per quarter would do it in 12 months. In the last quarter, the company reported $ 23 billion.

Unit data

This will get angry. Management has announced that it will no longer provide sales data for iPhone, iPad and Mac. The reason they give is that:

… the number of units sold during a 90-day period is not necessarily representative of the underlying strength of our business ….

… .In addition, a sales unit is less relevant to us today than in the past, given the extent of our portfolio and the greater dispersion of selling prices within the company. a range of products given …

I have mixed feelings. I guess the real goal is to make sure that Apple is considered a service company (that's also why they are going to declare their gross margins starting in December, which will be incredible for services).

Do not take these groups too seriously. I'm not saying that Apple can be simply associated with one or the other. But just for the sake of illustration: the iPhone continues to dominate the top line of Apple. Other smartphone makers are trading at well-priced multiples far below Apple's 18x:

Samsung (OTC: SSNLF) exchanges at 7.22x

HTC is trading at 9.93x

But companies considered as real services are trading at much richer multiples:

Microsoft (MSFT) at 43.94x, Adobe (NASDAQ: ADBE) at 49.33x and Salesforce (CRM) at 135.51x:

If Cook could finally get the market to consider Apple as a service company in the same way as Microsoft, it seems that his earnings exceed 100% in terms of multiple expansion.

It's very, very difficult to generate additional shareholder value through iPhones for the few who can afford it but have not bought it yet. The largest gains are in generating additional service revenue from the installed base and obtaining a multiple extension.

Let's go back to the original question of not reporting units – that sucks. The main vulnerability you want to monitor as an Apple shareholder continues to be related to the sales of your iPhone. Without the company clearly indicating sales figures, it will be harder to see coming. Of course, there will be less speculation on these numbers. But there will still be a lot of speculation on Apple's numbers, but with more surprises.

Emerging Markets

Cook admits the company is fighting in Turkey, India, Brazil and Russia. Currencies have something to do with this. Nobody with an economist subscription or a similar magazine will be surprised. In China, Apple has grown by 16%, which is very good. I'm delighted that Apple is doing so well in China, but I do not think Chinese profits are worth as much as US profits. Of course, a dollar is a dollar. But I've written quite a few articles here, here and here, about Apple's experiences with the PRC.

I was really happy to read that the company is in trouble in some areas. Apple is valued at one trillion dollars. If there were no economies as big as those in India and Brazil, where iPhone sales would expand services, that would be the only way out. These struggles mean that there is still a way to grow by simply putting computer equipment in the hands of people.

Conclusion

Apple is worth nearly a trillion dollars. Most developed countries are saturated with its products. It is trading at 18x earnings. But its high margin sticky business is growing rapidly. The Company may return to shareholders up to 15% of its current market capitalization through redemptions / dividends over the next 12 to 18 months. At the moment, I think there are better companies to own. Warning – in the past, I thought the same thing and it turned out to be a mistake, an error or an error.

See the investment report in a special situation if you want uncorrelated statements. We look at special situations such as spin-offs, share buybacks, rights offerings, mergers and acquisitions events, and so on. But we also have a keen interest in the commodities sector. Especially in the last stages of the economic cycle.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate position in the next 72 hours.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link