[ad_1]

Tesco Plc and Carrefour SA join forces in a "cordial agreement" grocery store against price pressure from Amazon.com Inc. and its domestic competitors. It's a sensible rather than radical solution to their problems, and it only serves to defend the margins rather than to stimulate them.

The logic is simple: Carrefour and Tesco partner to obtain better conditions from suppliers. According to Jefferies, their purchasing power, with combined net sales of about $ 180 billion, will be implemented in products not intended for resale and own brands. Both want to strengthen their offerings of the latter, which tend to have better margins. The three-year deal could eventually bring in about $ 520 million in total savings, although some analysts have pointed to the difficulties in achieving an important result here.

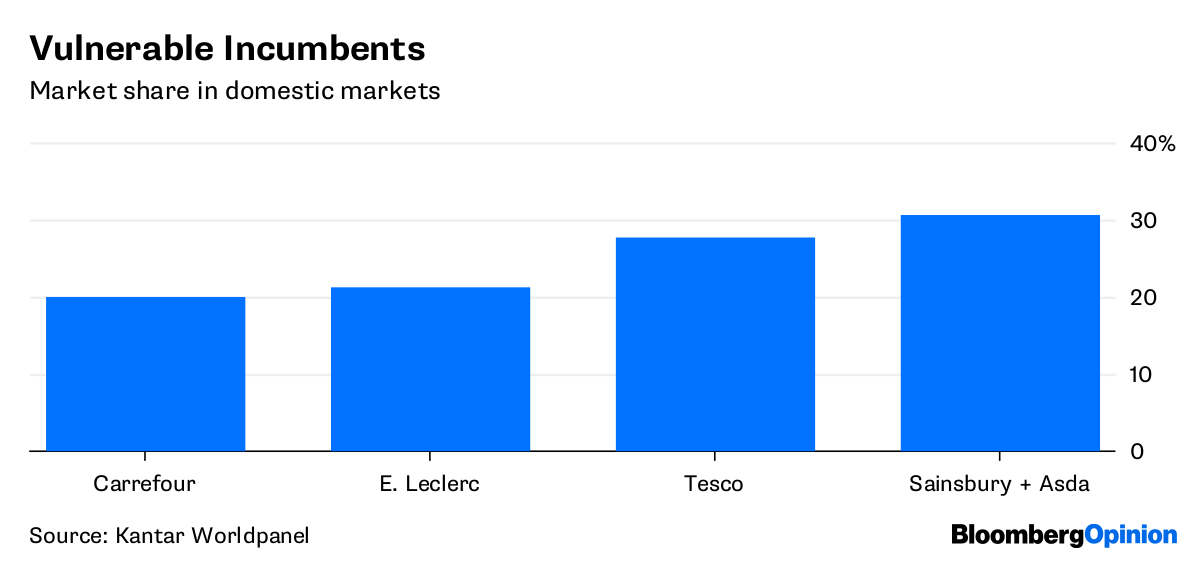

This type of cross – border buying alliance is not commonplace. But the broader message sent to investors is positive. Here are the bosses of two dominant dominant companies, in an industry with its fair share of challenges, ready to pull all the levers available to defend margins and improve valuations. Dave 1965 and Dave Bompard, CEO of Tesco, already promised thousands of job cuts, cost savings and store closures to fund price reductions in the face of fierce competition. Lewis knows that Tesco's market share may be jostled by the acquisition of J Sainsbury Plc by Asda; Carrefour, meanwhile, is under pressure from its rival Leclerc

Vulnerable Holders

Market Share on Domestic Markets

Source: Kantar Worldpanel

Considering that there is little geographical overlap between Tesco and Carrefour gather the supply chain is the obvious field for them to cooperate. Lewis warned that the Brexit's inflationary blow to the pound would require a supply chain "deeper and richer" – Booker's purchase is part of it. And, a few days ago, rivals Carrefour Auchan and Casino Guichard Perrachon SA announced a purchase partnership with Metro in Germany

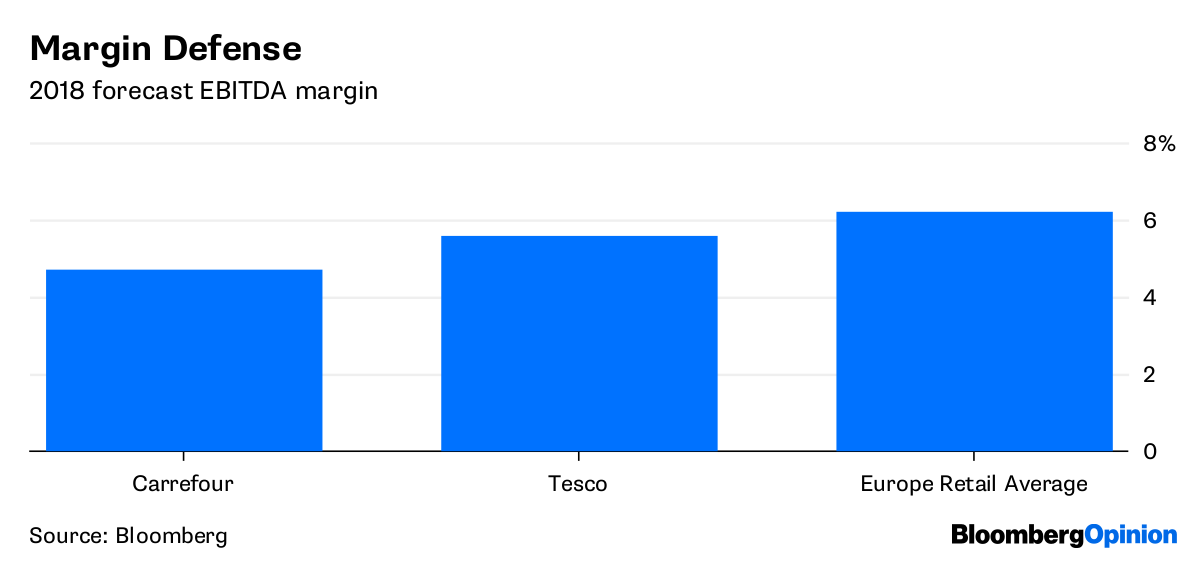

Margin Defense

Forecast EBITDA Margin 2018

Source : Bloomberg

It would be a mistake to consider this as the first step of a possible rapprochement with Tesco-Carrefour. This would bring unwanted baggage and less obvious savings.

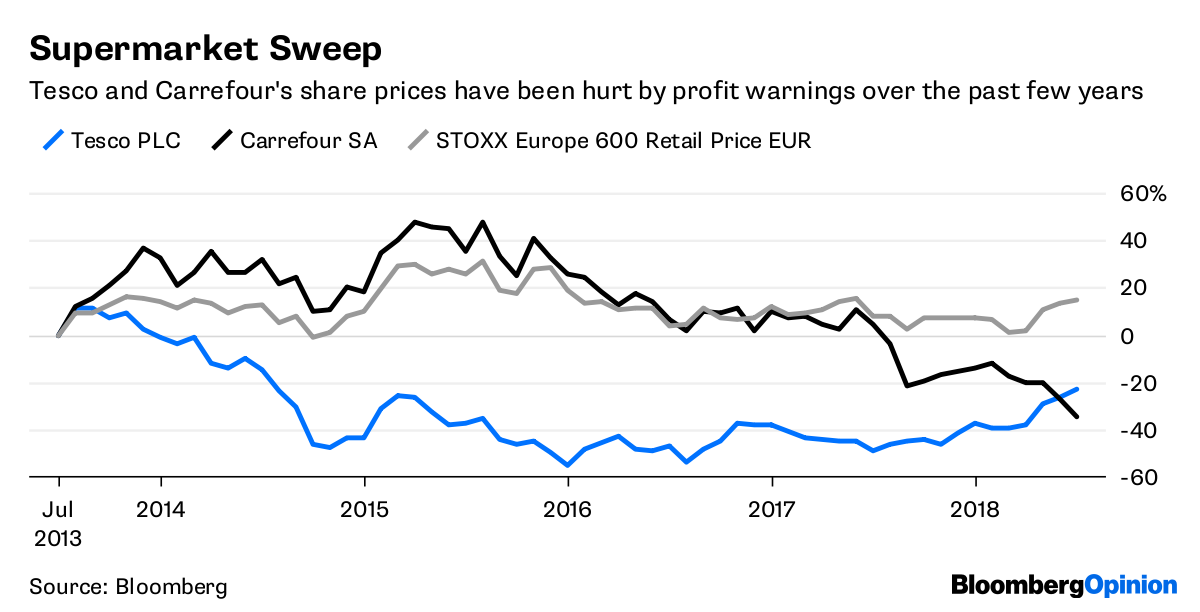

This purchase agreement will be a useful addition, rather than a solution, so it's just that the reaction on the stock market Monday was rather unobtrusive – on a day of risk. in European trade, shares in both fluctuated between small gains and losses.

Sweep Supermarket

Tesco and Carrefour stock prices have been hurt by profit warnings in recent years

Source: Bloomberg

Much more work ahead for both companies. Although Tesco's same-store sales and margins in its domestic market are beginning to recover, much remains to be done to reach the group's operating margin target of between 3.5% and 4%. here the year 2019-2020. Carrefour had a weaker start to the year, so its improved margins should benefit more than Tesco from this buying arrangement, analysts said Jefferies. A cordial agreement will not put a rocket under evaluation for one or the other, but should give them a safety net.

Every little help helps keep prices low in the face of fierce Brexit competition and risk.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the editor responsible for this story:

Jennifer Ryan [19659022] at [email protected]

Source link