[ad_1]

If you follow crypto-currencies for a while, you begin to find strange and interesting patterns, scattered around various technical data. This may not seem like much, but it can sometimes give you a refreshing view of the market.

Bearish trends can tell us more about the future, one might think.

From the psychological trends to the hashing rate and the difficulty analysis, my goal today is to take stock of the shadows usually left behind.

If we really stop to think for a second about the functioning of the universe, we could realize that the essence of what is really happening, which directly affects our lives, is clear and simply unknown. Like dark energy and dark matter, which combine about 90% of all existing material, to learn more about price behavior, we probably want to look elsewhere.

Here's how I think about it: you know in "Law and Order", "CSI" or any other criminal show that you like to watch on Netflix, when the good guys catch the bad guy for the first 10 minutes and you're like "Hummm .. I'm pretty sure that's not the good guy?

That's precisely what I mean.

– This article should not be considered as financial advice because it represents my opinion and my personal opinions. I have savings invested in cryptocurrency, so take everything I write with a grain of salt. Do not invest what you can not afford to lose and always read as much as possible about a project before investing. Never forget: with great power, great responsibilities. Being your own bank means that you are still responsible for your own money–

The Kansas City Shuffle

You look left and they fall right

The Kansas City Shuffle is a type of scam that depends on the brand that realizes that it is scammed, but who guess wrong how it is done. When they try to thwart the scammers, they think they have discovered, they fall into the scam. This scam is more effective against brands "too smart for their own good" and will try to beat the scammer at his own game instead of backing off if they find out he's trying to scam them.

In my analogy, the conman is the price, because it disconcerts you with its virtues of volatility, while you could look elsewhere for direction.

Let's start with the feeling of the market: he dictates the market behavior. If you want a handy tool to understand the perfect time to sell, check out Google trends. People are looking for the most bitcoin when prices are at their highest. I would say that it is in our nature to buy when prices are high due to an excess of FOMO and a huge gain. That's why it's so important to be a contrarian when it comes to making decisions.

However, do not fall into the typical lie "A permanent bearish feeling will eventually drive up prices".

It can always get worse before you improve.

Always.

Anything that can go wrong will go wrong

Of course, when everyone is looking right, that's when you should look to the left.

My personal advice? Learn which enemies face. If you opt for the entire market, chances are you'll lose.

Wrong.

It's a much safer bet to follow smart money and not to upset it. At least, that's my own observation. If you do not know how to start, here are some tips:

First: buy when there is blood on the streets;

Second: buy the rumors, sell the news;

Third: buy when there is fear, sell when there is hype.

Simple things, right?

Setting the difficulty

One of the most interesting indicators I've found recently is the (possible) correlation between the difficulty adjustment of the hashing algorithm and price fluctuations.

According to Element, "historical cycles suggest that we may need 6 to 12 months of negative difficulty growth to flat for prices to go down to the lowest level."

If we take into account the fact that people generally seem to be on Bitcoin, as well as the miners leave the market, we could logically argue that the down cycle is coming to an end.

If this hypothesis is correct, only time will tell.

However, there are two hypotheses that we have more or less proved to be true:

(a) The more minors leave, the easier it is to exploit Bitcoinbecause it takes less energy to operate each block.

(B) The less energy it takes to operate each block, the lower the costs are.

Does this translate into huge price swings? It seems like. Do these price fluctuations go up each time? Absolutely not.

We need to carefully balance different variables to understand the overall status quo of the market. to clearly see the big picture.

Bitcoin whales

What you and I are dying to know is the cause of the next defeat. Will it finally be institutional investors?

Looking at other data, we could at least have a clue.

For example, I find interesting among the 20 richest Bitcoin addresses that we can find 4, which saw the very first UTXO created in 2016 or 2018. But wait, that's more. By comparing the numbers, we can quickly see that, on average, one transaction for each address was worth approximately $ 5,940,740.74.

Do you want to hear something really shocking? More than 50% of the 100 richest addresses have been created in the last 2 years.

Moreover, all these UTXOs are worth hundreds of times more than all the UTXOs of all the combined exchanges.

Whatever your conclusion, one thing is certain: Many people invest a lot of money in Bitcoin, which can potentially change gears and start a race at the top. This is one of the many possible conclusions.

On the other hand, the distribution of Bitcoin seems to be considerably more equitable than most global fiduciary currencies, although I do not personally see the two as comparable, as wealth is generally not measured in fiduciary money. but rather in physical assets (now also digital), such as real estate, precious metals or equities.

Hashing power

One of the most important metrics for the success of cryptocurrency is the growth in hashrate. This is the amount of mining power going to Bitcoin. By simply looking at the graph above, we can quickly see that hashrate has been steadily growing. It took about 10 years to reach nearly 100,000,000 TH / s; I wonder if we will reach 1 000 000 000 000 TH / s in less than 5 years.

I suggest that you look at the fundamentals in this market that affect production costs beyond what miners are likely to expect. Next, consider a potential reversal of this negative difference for the reduced selling pressure signals.

More interesting is what comes next.

If we take into account the halving events, which are the moments in time highlighted in navy blue, we can clearly see that the price seems to follow a fairly simple pattern: it is closely correlated to the amount of Bitcoin in circulation , as well as, the block reward.

By following these steps, we should reach a price of between $ 15,000 and $ 36,000 by the end of 2020.

In the mean time, volatility will play the usual game, because the less liquid a market, the easier the prices are to change as short-term trading.

Number of transactions

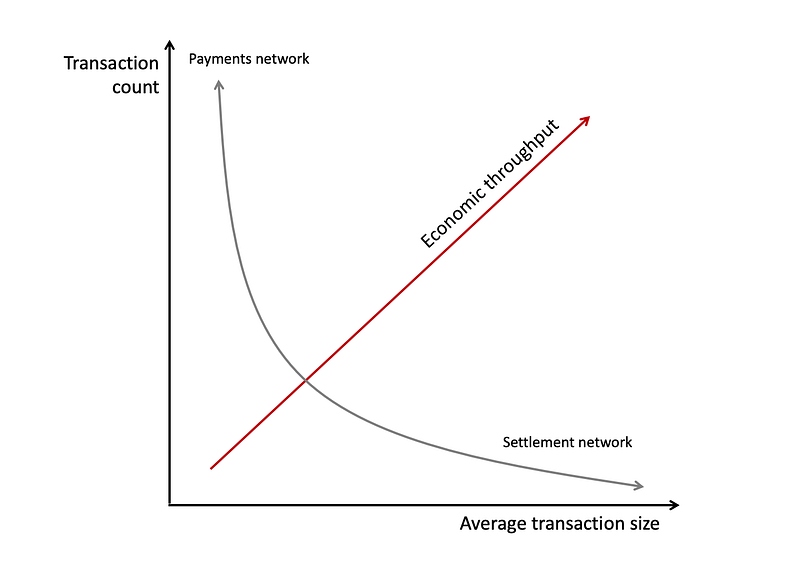

In the overall assessment of a value transfer system, there are at least three important variables to consider, including the transaction rate:

a) Transaction capacity (GST or transactions per second),

(b) typical characteristics of a transaction (size of the transaction),

c) Settlement insurance.

Together, the transaction rate and the average transaction size give you the economic flow of the system; a measure of its financial bandwidth per unit of time.

Even though Bitcoin is virtual, it is closer to a physical settlement system than a deferred settlement system such as credit cards. Bitcoins are bearer virtual instruments: if you have the private key that unlocks an unspent exit, you own these coins and you have the right to do whatever you want. This asset is not a liability for anyone. In this respect, it looks more like physical money or a commodity like gold.

So, how do you regularly compare dissimilar value transfer systems such as Bitcoin, Paypal, Visa, SWIFT and physical cash? I would recommend expanding your field of action beyond just the number of transactions. This is only one element of the economic flow.

What should really interest us is: average transaction size * number of transactions, which gives us the value that passes through the system per unit of time.

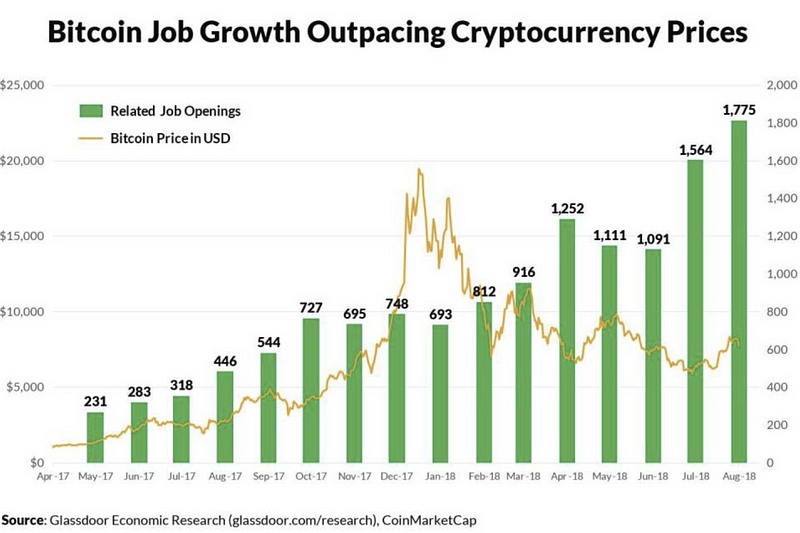

Another key measure is understanding how companies respond to Bitcoin and its blockchain technology. Do organizations develop the implementation of blockchain in their businesses? If so, is there a correlation between price and employment?

Price VS Jobs

The 1,775 job offers related to blockchain in the United States in August 2018, represent a 300% increase over the same period last year, highlighting the fact that employers remain confident in Cryptography market opportunities and continue to invest in their teams in the long term. , even if the market capitalization of crypto is down more than 70% from its peaks.

This proves that companies are targeting technically savvy people to join the blockchain development efforts, even though prices are falling steadily.

It is extremely important to see that there is little correlation between blockchain-related jobs and bitcoin prices.

Conclusion

Although prices continue to fall, we are still reaching new lows, their level becoming higher than the previous one. The same thing is happening at new heights. If we align a low volatility on the previous points and if we take into account all the arguments put forward, I perceive that the price of Bitcoin will sooner or later be on the Moon.

What I will continue to do is average losses and buy cryptocurrencies that I believe have a future.

Never forget: markets tend to stay at peak heights for short periods. Do not miss the best days of trading, otherwise you could seriously affect future earnings.

Disclaimer: The opinions expressed in the article only commit their author and represent neither those nor nor should be attributed to NCC.

Selected image of Shutterstock.

Follow us on Telegram or subscribe to our newsletter here.

[ad_2]

Source link