[ad_1]

Co-produced with the authors Long Player and Philip Mause for High Dividend Opportunities.

Intermediate partners of the Summit (SMLP) recently traded at a price of $ 14.77 and pays an annual distribution of $ 2.30 (on a quarterly basis) for 15.6% yield. Note that SMLP is an intermediate MLP that issues K-1 tax forms.

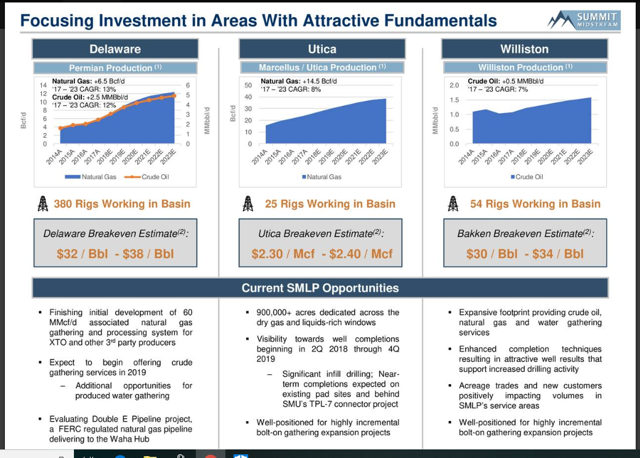

It is a medium-sized company with a market capitalization of $ 1.1 billion. It focuses on natural gas, crude oil and the collection and treatment of production water. SMLP operates in seven different resource pools in the United States, giving it a very diverse geographic footprint. Its cash flows are stable and recurring because its activities are based on fees. More than 95% of Q2 2018 gross margin was based on fees.

Source: Summit Midstream Citi One-on-One MLP / Midstream Conference on Infrastructure, August 2018

The distribution is getting closer to this magic cover 1.0. But this is about to change significantly. Mr. Market duly sanctioned the actions by increase the astronomical level. But while Market focuses on yield hedging, there are conservative debt ratios and projects underway to replenish this yield hedge in the future.

Distribution hedging would be a concern in this market without this low debt ratio. An additional $ 300 million of preferred shares is included in the calculation of leverage for ordinary unit holders. This may be a little less powerful than some investors would like. However, several projects will be online in the second half of the year.

Companies like this compensate for low debt by finding projects with above average profitability. Expansion in the midst of an industrial boom due to strong oil prices is expected to provide above average profitability for some time. Many of the contracts signed are long term. Management has just reiterated the guidelinesso the cover should climb new projects contribute to cash flow, EBITDA and, of course, profits.

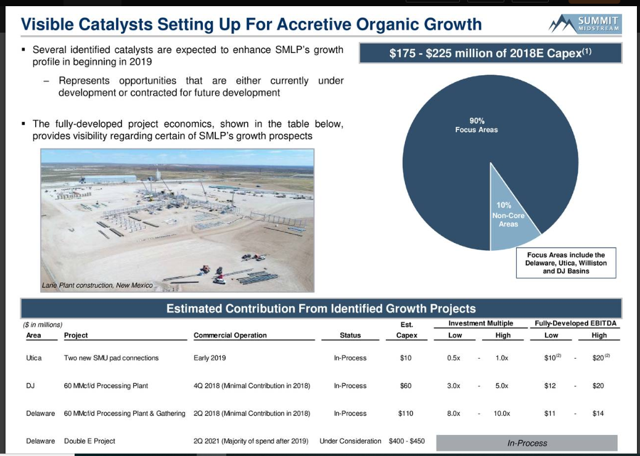

Source: Summit Midstream Citi One-on-One MLP / Midstream Conference on Infrastructure, August 2018

The current strength of oil prices makes additional investments of partnerships such as this one very attractive. Many investors focus on the returns of large projects. But the small projects presented above have extremely high returns that slowly improve the returns of the initial project.

This company extends its activities to the Permian. This is one of the the few places Additional capacities of all kinds are put online by a partnership. Pricing any unused capacity could be extremely valuable in the near future. While producers still need links with the final sellers of the product, any help in the Permian is welcome at this time.

The sale of preferred shares at the end of fiscal 2017 funded most of the projects listed above for the current fiscal year. The market clearly requires better distribution coverage. Therefore, the distribution can not increase. Instead, these additional cash flows will be reinvested in more capital projects to ensure future growth. The current vigor of oil prices ensures the long-term demand for many proposals for expansion projects in the intermediate sector.

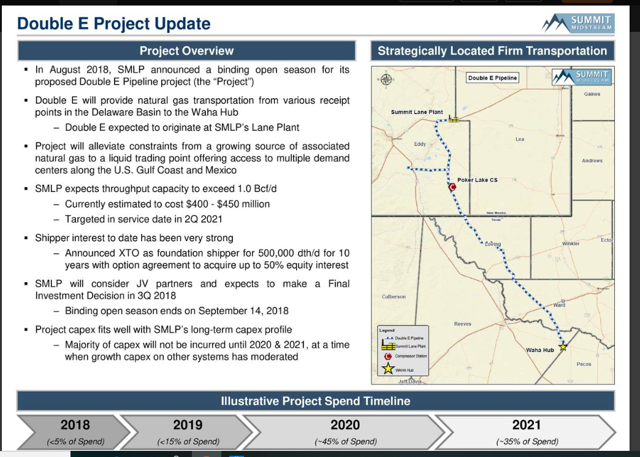

Source: Summit Midstream Citi One-on-One MLP / Midstream Conference on Infrastructure, August 2018

Even if oil prices decline in the future, it often takes years to reach the median level to meet the needs of the boom period. Production and "Wells drilled but incomplete"(CIC) often maintain the needs in a large pool after weakening commodity prices, and CICs in particular are often very profitable to be completed at very low prices.

As stated above, the company already has an anchor customer. The activity in this area should ensure a very warm welcome to this project. Management can minimize cash flow requirements (if necessary) by providing connections to ongoing projects as well as planning, developments and approvals. In fact, if the cash flow requirements were sufficient, management could waive any need for cash and maintain a low beneficial interest in the work already completed. This is very unlikely, as this partnership has a cash position of nearly $ 1 billion today. However, the need to diversify can make such a conservative strategy viable.

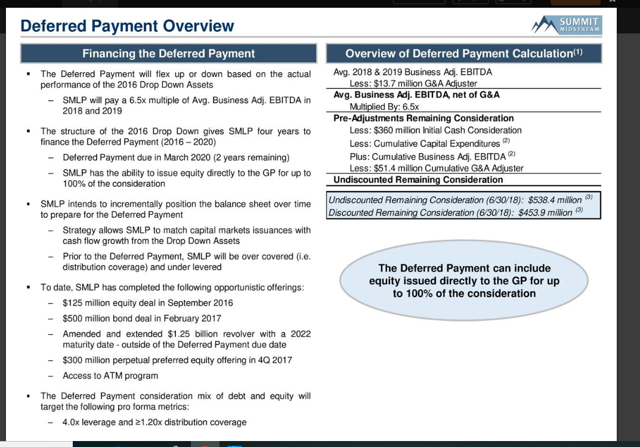

Source: Summit Midstream Citi One-on-One MLP / Midstream Conference on Infrastructure, August 2018

The main "elephant in the room" for these actions is the uncertainty regarding the funding of the "deferred purchase payment obligation(DPPO) See above By 2020, SMLP will need to receive a performance-based payment for certain declining assets acquired in 2016. The calculation of the amount due has good / bad news Plus EBITDA generated by assets in 2018 and 2019 is high, the higher the payment obligation will be high.

The bond that will be due in 2020 is currently estimated at $ 538.4 million, but this could change depending on the return on assets. SMLP has enough space in its revolver to cover this payment, but leverage considerations may prevent it from being fully funded with a debt. SMLP may also issue shares to the General Partner to the satisfaction of thedeferred purchase payment obligation"DPPO on the basis of the average market price over the 10 days before the issue.This could become difficult if the announcement of the share issue resulted in a massive sale of shares.In contrast, SMLP could raise Offers from ATMs (or a combination of both) well before the due date of payment.

Using the data currently available, we modeled only debt and equity satisfaction solely from OPD. Assuming an additional debt of $ 538.4 million is contracted, the debt would reach just over 5.5 times EBITDA, which is significantly higher than the long-term goal of society, which was four, but not on bled ground. Assuming interest rates of 6% on debt, interest expense would reduce the DCF by about $ 32 million a year.

A 100% equity approach would involve the issue of 35.6 million additional shares at the current price and bring the number of shares to 119.0 million. This would significantly reduce the DCF per share.

Potential investors may disagree with the idea of transferring the partner's performance risk to the partnership. These assets were sold to the partnership in 2016. Some investors would have liked the general partner to accept the lower prices in 2016. The idea that the general partner played with better conditions in the sector a few years later may not be agree with this notion. Nevertheless, the price of buying less than 7 times the EBITDA is attractiveand was at the time in the best interests of SMLP. To the extent that additional projects are available, the ratio of EBITDA could be further reduced in the future.

Evaluation

Based on $ 193.3 million of 12-month CDN, or $ 2.63 per unit, SMLP trades only 5.6 times DCF. This suggests that SMLP is a fabulous affair. It also provides a comfortable distribution coverage level of 114%. It is clear that DPPO's burden and the uncertainty surrounding its resolution weigh on the stock.

It is therefore necessary to take into account the imminent situation of DPPO in order to carry out a fair evaluation.

1- Use of the debt issue: If we assume that DPPO's 100% debt approach is used, the increase in interest expense would reduce the DCF to $ 161.3 million, or $ 2.20 per unit, which would imply an assessment of price / DCF ratio of 6.9 times.

2- Use of the issue of shares: On the other hand, if the all equity approach is used, the increase in the number of units would reduce the DCF per unit to $ 1.62 and the implication price / DCF valuation of 9.3 times.

Both approaches are conservative in that they do not take into account any cash flow growth due to pending projects.

3- Combination of debt and equity: The most likely outcome is a mixture of equity and debt. Assuming that SMLP uses leverage at 5.0 and generates the rest of the payment by issuing new units, the CDF per unit would be $ 2.02, which implies a price / DCF ratio of 7.5 times at the current price.

It should be noted that our three hypothetical CDF levels do not cover 100% of the current distribution of $ 2.30 per unit per year. SMLP is likely counting on growth to fill the gap and cover the current distribution of $ 2.30 per unit. While there is evidence to support this hypothesis, readers should be aware of the problem.

Recalling that:

- These calculations are cautious because they do not take into account the growth that is likely to materialize.

- That the post-DPPO SMLP raises a great deal of uncertainty, it would not be unreasonable for the "new" post-DPPO SMLP to trade at 9 times the DCF or at $ 18.18. This implies a potential gain of 23% without taking into account growth expectations and without taking into account the dividend yield of 15.6%.

IDR structure

SMLP has a very favorable IDR structure at its current price. 15% of IDRs come into play when distributions exceed 46 cents per quarter. At 50 cents, the rate rises to 25% and when distributions exceed 60 cents, the rate caps to 50%.

One way of thinking about this is to compare an investment in SMLP at the current price to a typical "private" limited partnership contract in private equity or real estate. Generally, the passive investor obtains limited partnership units with a "preferred shares" feature. The passive investor generally recovers his money and a preferential return before sharing the profits with the promoter or the general partner. This preferred yield is often 8% or 10%. Once the passive investor has recovered his preferred return, additional profits are often shared equally.

An investor in the SMLP at the current price gets a distribution of 46 cents per share or $ 1.84 per annum (about 12% on an initial cost of $ 15.11) before the IDRs come into effect and he must share the profits with the general partner. So his "favorite return" is actually a little over 12%. Even in this case, the profits are not shared half-and-half as long as the distribution does not exceed $ 2.40 a year (60 cents a quarter of the sum of 4), which allows a return of nearly 16.1% on the initial cost of $ 14.90. These conditions are much more favorable than a typical private transaction in which a passive investor must share the profits equally with the general partner as soon as his return exceeds 8% or 10%.

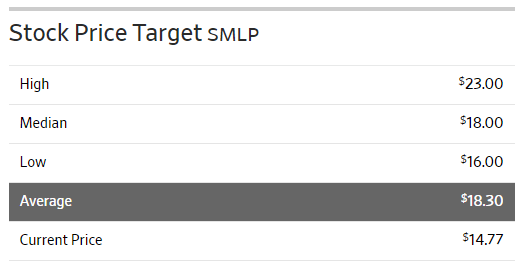

Our price target compared to analysts' ratings

We estimate that there is a + 23% upside potential for this stock over the next 12 to 24 months, in addition to the current yield.

It seems that our price target is consistent with that of other analysts. According to the latest Wall Street Journal data, nine analysts were covering the stock with an average price target per consensus of 18.30 USD / share, suggesting a ~ 24% upside potential from the current price (source: wsj.com).

This price target is actually very close to the goal generated by our $ 18.18 OPPD repayment model. We believe that a target price included in the interval of these two figures is very reasonable and that once the distribution will have more extensive coverage, we expect that the price will be higher. Analysts' price target increases even more.

Other risks

The major risks other than the deferred payment risk that we mentioned above, readers should take note of the following other major risks:

- SMLP's revenues and profitability depend on oil and gas production in the United States, which is booming today. If we witness a reduction in production, the benefits of SMLP may decrease.

- There is always the risk that SMLP will reduce its dividend in order to fund the deferred payment. In the event of a reduction in the dividend, this would produce price volatility.

Solid outlook confirmed by management

The outlook for SMLP is improving considerably. Based on the last call for management results (Q2-2018):

We are very happy to know where our balance sheet is with respect to the deferred payment and timing of some of the Permian projects we are talking about … We feel well positioned as we increase coverage and liquidity in 2019, and it's going to be pretty important. "

summary

Despite relatively stable comparisons to date, growth projects are poised to make a contribution and improve reporting results. The relatively conservative financial profile gives the company a lot of flexibility with respect to future projects and growth.

The main disadvantage is the remaining funding of the deferred payment resulting from the 2016 asset fall. As described above, this can be financed with all participating units (by further reducing the leverage and allowing the loan to finance greater growth) or, more likely, a combination of equity and debt. Mr. Market demanded better coverage of the distribution. This better coverage of the units seems to be at hand in the next six months. The continuous improvement of capacity and the utilization of unused capacity will continue to contribute to organic growth.

Investors should not expect an increase in distribution in the near future. But the appreciation of the unit price as distribution coverage increases would be a realistic expectation. Final financing of the deferred payment would also contribute to market clarity. Mr. Market just hates uncertainty.

Over the next 24 months, an appreciation of 23% combined with the continuation of the distribution of 15.1% is realistic, allowing a very attractive return. Once the market has recognized conservative funding for this partnership, the unit could increase further. The partnership has a leading position in some of the key basins. It could therefore become an attractive redemption target in the future for a large intermediate operator.

Most buyers want well-managed partnerships with few problems. This partnership clearly corresponds to this description. In the meantime, investors can benefit from a distribution that will not become secure in the future.

We value SMLP as a solid purchase at the current price. While we consider the stock price to be very attractive, investors should note that this is a higher risk / more profitable stock due to the deferred payment issue. Therefore, we recommend that you limit your exposure to no more than 1% of your overall portfolio.

A note on diversification: reach an overall yield of 9% to 10% and optimal level of diversification, High dividend opportunities, we recommend a maximum allocation of 2% to 3% of the portfolio for individual high-yielding stocks such as SMLP and a maximum allocation of 5% exchange-traded high-yield products (such as ETF, ETN and CEF). For income-dependent investors, diversification typically translates into more stable dividends, mitigates the risk of loss and reduces the overall volatility of your portfolio.

If you enjoyed this article and would like to receive updates on our latest searches, click "Follow" next to my name at the top of this article.

Disclosure: I am / we are long SMLP.

I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link