[ad_1]

The sun sets in the second quarter, and not a moment too early for Deutsche Bank AG. In 90 days, the German lender replaced his CEO, promised thousands of job cuts, given his degraded credit rating, and watched the course of his action plunge into new depths. The testing of US Federal Reserve resistance tests was a final humiliation, albeit expected.

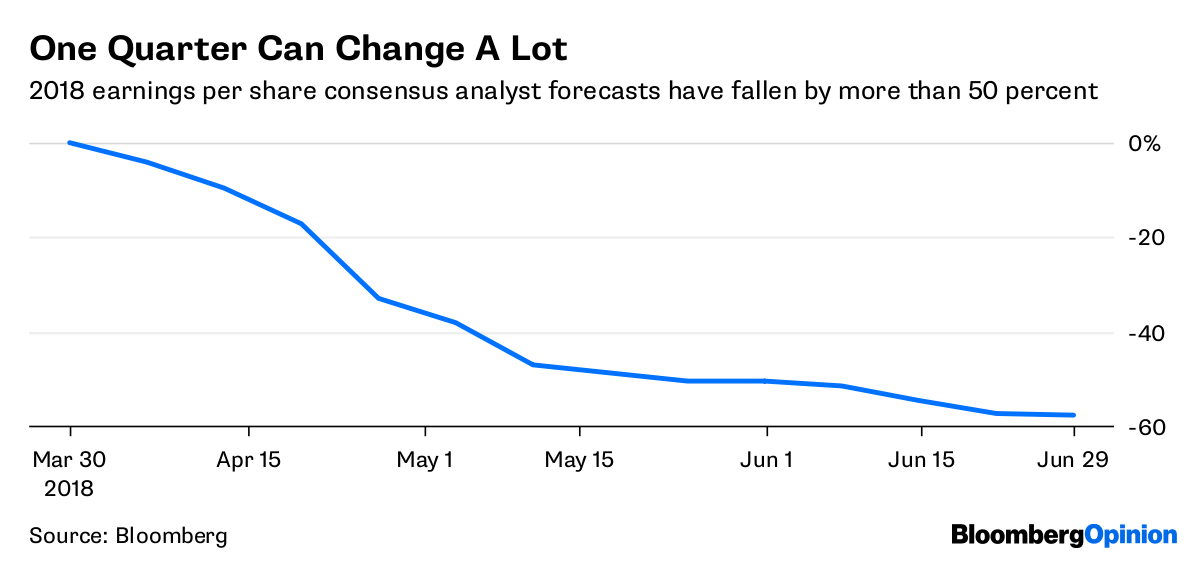

None of this is good news for the lender's underlying business, which has not been profitable for three years. Estimates of income and profits have plummeted since the end of March, not just because of lender-specific problems. Trying to fix a balance sheet of $ 1.8 trillion is hard enough without interest rates in the eurozone staying low until 2019, with limited volatility in stock markets and falling commercial rates. on economic growth

] Analysts consensus forecasts for earnings per share in 2018 fell by more than 50%

Source: Bloomberg

Investors seem ready to test the proposition that all these problems are now taken into account. Friday. It sounds bold.

Dead Cat Bounce?

Friday's jump in the course of action barely records the long-term picture

Much more could go wrong if the performance continues to decline and management is trying to fend for itself. In addition, there is a risk of credit rating downgrades. Deutsche Bank's debt insurance cost against default risk has jumped to levels never seen since the end of 2016. At the time, counterparties and customers were pondering twice at their exposure to the lender.

Deja Vu

The cost of insurance against a default of Deutsche Bank increases

Source: Bloomberg

We know that Deutsche Bank has plenty of options to try to turn things around, but none of them are free. Tinkering in the margins in the hope that things will improve with time may repeat previous mistakes. Conversely, a radical overhaul of the investment bank would hurt revenue and, by extension, profit, leading to a vicious circle.

But the current bad news and the risks of losing the confidence of stakeholders and counterparties should An encouraging recent scenario, developed by UBS analysts, is that Deutsche Bank could halve the size of its investment bank, bring back its turnover from some 27 billion euros to 22 billion euros a fair value of 21 euros per share – more than double the current market price of 9 euros. To get there, UBS makes some assumptions – such that costs will decrease with income. Still, he suggests at least that more can be done.

Deutsche Bank has lost market share and may lose more. His restructuring promises have fallen flat. The promises to reduce Wall Street in favor of its domestic market have been tempered with assurances that it will remain engaged in the US market. There is no quick fix, but it would be worthwhile to pull something in the air – rather than let the market force the bank.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP.

To contact the editor responsible for this story:

Edward Evans ] on eevans3 @ bloomberg.net

Source link